In the global digital asset market, Bitcoin, as the leading virtual currency, has long attracted significant attention from investors. This article examines the fundamental concepts of Bitcoin investment, key influencing factors, and investment strategies. By integrating authoritative data and real-world case studies, it aims to assist investors in making informed decisions within volatile markets, while also introducing how the Ultima Markets platform can elevate the trading experience.

1. Bitcoin Investment Primer: Basic Concepts and the Current Market Landscape

1.1 What is Bitcoin Investment?

Bitcoin investment involves buying, holding, and speculating on Bitcoin as an asset to capitalize on price fluctuations. Since its inception in 2009, Bitcoin has emerged as "digital gold" due to its decentralized architecture and censorship-resistant properties. According to CoinMarketCap data, as of April 2025, Bitcoin's market capitalization has surpassed $1 trillion, with the asset exhibiting intense volatility while maintaining a positive long-term trajectory.

1.2 Bitcoin's Current Market Landscape

Bitcoin's price is influenced by global economic conditions, regulatory policies, and market sentiment. For instance, in 2024, Bitcoin's annualized volatility exceeded 70%, while a Glassnode report revealed that approximately 65% of Bitcoin holders opt for long-term retention, underscoring investor confidence in its enduring value. Additionally, a growing number of financial institutions now incorporate Bitcoin into asset allocation strategies, further driving market maturation.

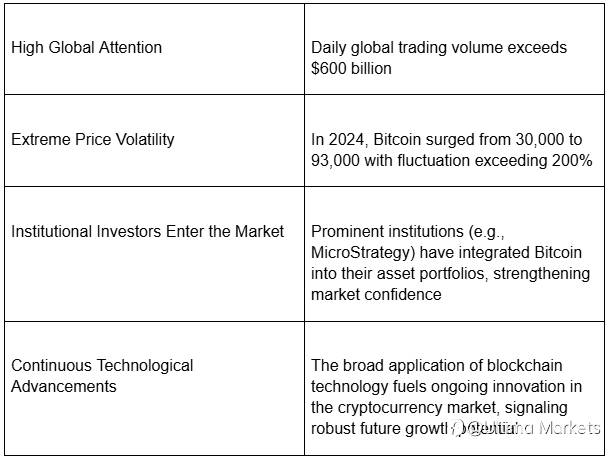

The following outlines key characteristics and relevant data in Bitcoin's current market:

2. Key Factors Influencing The Price of Bitcoin

2.1 Macroeconomic Conditions & Inflation Expectations

Global economic policies, inflation data, and central bank rate adjustments significantly impact Bitcoin's price. For example, sustained accommodative monetary policies in the U.S. may fuel inflation expectations, driving investors toward Bitcoin as an inflation-resistant asset. According to IMF forecasts, Bitcoin's role as "digital gold" becomes more prominent amid rising global economic instability.

2.2 Regulatory Policies & Market Sentiment

Shifts in regulatory stances toward cryptocurrencies across nations directly impact market confidence. Recently, clarified regulatory frameworks in regions like the U.S. and EU have facilitated increased participation from institutional investors. Enhanced regulatory clarity also helps mitigate market volatility risks, making Bitcoin investments more attractive.

2.3 Technological Advancements & Blockchain Applications

Blockchain technology, as Bitcoin's foundational infrastructure, directly influences its investment value through technical developments and application prospects. According to a World Economic Forum (WEF) report, the global blockchain application market is projected to reach $100 billion within the next five years, providing a robust technical basis for Bitcoin investment.

3. Bitcoin Investment Strategies and Risk Management

3.1 Long-Term Holding Strategy (HODL)

Long-term holding is a strategy adopted by many Bitcoin investors, appealing to those who believe in Bitcoin's enduring value. By implementing dollar-cost averaging (DCA) through scheduled Bitcoin purchases, investors can effectively mitigate market volatility risks. Institutions such as MicroStrategy have publicly endorsed long-term Bitcoin holding as a critical tool to hedge against inflation.

3.2 Technical Analysis & Market Trends

For short-term traders, leveraging technical analysis tools (e.g., MACD, RSI, Bollinger Bands) to track Bitcoin price fluctuations allows for strategic profit-taking. Common chart patterns and trendline analysis aid in identifying optimal entry and exit points in the market.

3.3 Risk Management Strategies

Effective risk management is critical to successful Bitcoin investment. Investors are advised to set strict stop-loss and take-profit levels for each trade and exercise prudent leverage usage. Experts recommend that beginners limit single-trade risk to 1% - 2% of their capital. Additionally, maintaining diversified asset allocations, avoiding overconcentration in Bitcoin and helps reduce overall portfolio risk.

4. How to Start Bitcoin Investment

4.1 Choosing a Suitable Trading Platform

Selecting a trusted and secure trading platform is the first step to successful investment. The Ultima Markets official website offers advanced trading tools and comprehensive market data, complies with international regulatory standards, and ensures fund security and transaction transparency for traders.

4.2 Opening an Account and Funding

On Ultima Markets, you can quickly open a live account and fund it after completing identity verification. This establishes a solid foundation for entering the Bitcoin investment market.

4.3 Practical Training with a Demo Account

If you are new to the market, it is recommended to first practice using a demo account. Through simulated trading, you can test investment strategies, master technical indicators, and progressively refine your live trading capabilities.

5. Frequently Asked Questions FAQ

Q: Is Bitcoin investment suitable for beginners?

A: Bitcoin investment carries a high-risk, high-reward profile. Beginners should start with small capital, gradually accumulate experience, and implement strict risk management strategies. Transition to live trading only after practicing with a demo account.

Q: How to manage leverage risks in Bitcoin investment?

A: Prudent leverage usage is critical. Beginners are advised to limit leverage ratios to 1:10–1:50, coupled with strict stop-loss orders to mitigate losses from short-term market fluctuations.

Q: How to predict Bitcoin price trends?

A: Bitcoin price forecasting requires combining technical analysis (e.g., historical price trends, trading volume) with fundamental data (e.g., global macroeconomic indicators, regulatory policies). This data supports more informed investment decisions.

6. Conclusion

Bitcoin investment offers significant opportunities but is accompanied by high volatility risks. Through effective technical analysis, rigorous risk management, and disciplined capital control, even beginners starting with small funds can gradually accumulate experience and achieve consistent profitability. The Ultima Markets platform provides advanced trading tools, transparent market data, and strict regulatory safeguards, creating a secure and reliable trading environment—making it the ideal choice for entering the Bitcoin investment market.

To learn more about Ultima Markets' Bitcoin leverage trading strategies and fund security measures, visit the live account page.

We hope this article has equipped you with a comprehensive understanding of Bitcoin investment’s critical aspects and risk control methodologies, empowering you to embark on a prudent trading journey on the Ultima Markets platform.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ