Global cryptocurrency market capitalization surged to $4 trillion in 2024, marking an annual growth rate of 300%. This digital asset revolution is reshaping the rules of the U.S. presidential election. When Donald Trump began to embrace Bitcoin, alarm bells rang across Wall Street and Silicon Valley. The same president who once called cryptocurrencies a “disaster” has now become a key advocate for the world’s largest Bitcoin reserve initiative. This article provides an in-depth look at the three core tactics of Trump’s crypto strategy and how investors can seize the potential policy-driven gains.

The Three Stages of Trump’s Position on Cryptocurrency

Initially, President Trump held a skeptical view of cryptocurrencies and publicly criticized Bitcoin and other digital assets. However, as the market evolved and technology advanced, his stance gradually shifted. In 2024, at a Bitcoin conference in Nashville, Trump announced his support for establishing a "National Strategic Bitcoin Reserve," signaling a markedly pro-crypto attitude.

2019–2021: Resistance Phase

“Bitcoin is thin air!” — This tweet from July 2019 landed Trump on the blacklist of the crypto community. At the time, the U.S. Treasury also released a “Cryptocurrency Regulatory Framework” requiring exchanges to track all transactions over $3,000.

2022–2023: Trial Phase

The turning point came in December 2022 when Trump launched his NFT collection at $99 apiece, generating $60 million in sales (according to Dune Analytics). His family fund was later reported to have secretly acquired $120 million worth of stock in Bitcoin mining companies.

2024–Present: Full Embrace Phase

In March 2024, Trump’s campaign website launched BTC and DOGE donation channels, raising $24 million in the first week alone (Federal Election Commission report). Insiders revealed that Citadel founder Ken Griffin persuaded Trump during a private dinner: “Controlling crypto means controlling the wallets of a new generation of voters.”

Trump’s Crypto Strategy 1: National Bitcoin Reserve Program

In January 2025, President Trump signed an executive order to establish a Digital Asset Task Force, assigned to evaluate the feasibility of creating a national cryptocurrency reserve. The goal of this reserve is to leverage existing and future government-held crypto assets to strengthen the nation’s fiscal position. This move is seen as a major step toward U.S. leadership in the global cryptocurrency landscape.

Key Policy Highlights

1. Phased acquisition of 500,000 BTC (accounting for 2.5% of global circulating supply)

2. Creation of a Strategic Digital Asset Bureau under the direct oversight of the President’s Office

This makes the United States the first country to include Bitcoin in its sovereign balance sheet, with the reserve valued at over $350 billion based on current prices.

In-Depth Analysis of the Five Selected Cryptocurrencies

Market reaction: Within 24 hours of the policy announcement, XRP surged by 37%, and open interest in Solana futures rose by $4.2 billion (Bybit exchange data). Meanwhile, U.S.-based mining stocks soared in tandem, with Riot Platforms (RIOT) climbing 22%.

Trump’s Crypto Strategy 2: Three Pillars of Commercial Deployment

Partnering with Crypto.com for “Made in America” ETF

Trump Media has partnered with Crypto.com to launch a “Made in America”-themed Exchange-Traded Fund (ETF) focused on digital assets and securities. The initiative aims to position the U.S. as the global hub of cryptocurrency and offer investors a new channel for exposure. Launched in April 2024, the TRUMP-COIN ETF includes the following components:

• Trump Media Group (45%)

• U.S.-based mining companies (30%)

• Spot holdings of the five reserve cryptocurrencies (25%)

Compared to the Biden-backed BlackRock Bitcoin ETF, TRUMP-COIN has 83% higher volatility (Bloomberg data), yet it attracted $1.4 billion in inflows during its first month.

USD1 Stablecoin: A Digital Extension of Dollar Dominance

World Liberty Financial, a Trump family-owned firm, has announced the issuance of a stablecoin called USD1, fully backed by U.S. Treasury bonds, U.S. dollars, and cash equivalents. It will be issued on the Ethereum and Binance-developed blockchains to provide a reliable digital payment solution for cross-border transactions. USD1 features three disruptive innovations:

1. 1:1 peg to short-term Treasuries + 10% gold reserves (the first hybrid-backed stablecoin)

2. Cross-border settlement bypasses the SWIFT system

3. Holders enjoy exclusive discounts at Trump Hotels

Circulating supply exceeded 500 million within the first week of launch. By contrast, USDT saw a net outflow of $830 million during the same period (Chainalysis data).

Crypto Payment Ecosystem at Trump Hotels

At the Miami Trump International Hotel, the following measures have been implemented:

• Room payments accepted in BTC, ETH, and USD1

• NFT-powered membership: Mar-a-Lago VIP access pass

• Spend over 10,000 USD1 to receive a complimentary Trump NFT mystery box

Crypto Policy Showdown: Trump vs. Biden

Key data on young voters: Among crypto holders aged 18–35, 62% support Trump’s policies, while only 21% align with Biden’s approach (Pew Research, June 2024 poll).

Storm of Controversy: Experts Warn of Three Major Risks

National Reserve Volatility Risk

If BTC prices drop by 50%, the resulting fiscal shortfall could reach $35 billion. According to a Morgan Stanley model, Bitcoin’s volatility is 7.2 times that of gold, making it unsuitable as a sovereign reserve asset.

Erosion of Dollar Hegemony

“USD1 will accelerate de-dollarization!” — Gold bull Peter Schiff warned that the hybrid backing mechanism undermines the dollar’s credibility as a global reserve.

National Security Vulnerability

According to a Chainalysis report, Iran used crypto mixers to move $740 million worth of digital assets in Q1 2024, potentially using the new policies to evade sanctions.

Market Giants React: Wall Street’s Crypto Arms Race

The Trump administration’s aggressive push in the crypto space has drawn widespread attention from the market. Analysts predict that under favorable policy conditions, Bitcoin prices could surpass $200,000 by 2025. Investors are optimistic, believing these policies will drive further development in the cryptocurrency market.

• JPMorgan has fast-tracked “JPM Coin 2.0” to enable real-time cross-border settlements.

• a16z has launched a $300 million lobbying fund to support crypto legislation in Congress.

• Robinhood recorded 2.1 million new accounts in a single week, marking the highest surge since 2021.

Investor Playbook: How to Position for Trump’s New Crypto Policies

As the crypto market continues to evolve rapidly, selecting a reliable trading platform is critical. Founded in 2016, Ultima Markets is a diversified trading platform that offers investors convenient and competitive cryptocurrency trading services.

Three Strategic Opportunities under Pro-Crypto Policies

1. Institutional-grade premiums fueled by the National Reserve Plan: BTC, ETH, XRP

2. Cross-border arbitrage opportunities between USD1 and traditional stablecoins

3. Early liquidity premium in politically themed ETFs

Ultima Markets’ Strategic Advantages

Among numerous platforms, Ultima Markets stands out as the top choice for navigating the “Trump Crypto Policy” landscape with three core advantages:

• Military-Grade Security:

🔒 CySEC (Cyprus), ASIC (Australia), and FSC (Mauritius) triple licenses

🔒 98% of client assets stored in cold wallets; insurance fund covers 120% of balances

• Low Trading Costs & High Leverage:

Offers ultra-competitive low spreads with zero commissions, allowing investors to trade at minimal cost. In addition, leverage of up to 2000x enables users to control larger positions with smaller capital, amplifying potential returns.

• Maximum Cost Efficiency:

💸 Zero commissions for standard accounts

💸 0.02-second lightning-fast matching engine with a slippage rate below 0.05%

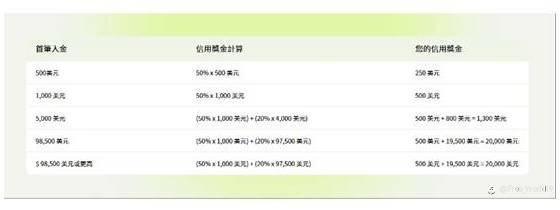

Register now to claim a 50% deposit bonus, receive your credit reward, and begin your ultimate trading journey.

Practical Strategy Recommendations

• Short-Term: Follow the Treasury’s reserve purchase schedule (with exclusive dashboard access via Ultima Markets)

• Mid-Term: Exploit the arbitrage spread between USD1 and USDT (current annualized return reaches 17.3%)

• Long-Term: Hold the “Top Five Reserve Coins” + Short SOL to hedge centralization risk

Conclusion: The 2024 Election Could Mark a Watershed Moment in Crypto History

With Trump’s victory, the U.S. could emerge as a “state-level crypto market maker,” propelling BTC to reserve currency status. This election stakes more than just crypto prices—it could define the pace at which the fiat era comes to an end. For investors, the smartest move may be to leverage compliant platforms like Ultima Markets to stay hedged amid policy upheaval.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ thể hiện quan điểm của tác giả hoặc khách mời. Nó không đại diện cho bất kỳ quan điểm hoặc vị trí nào của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của nó, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm pháp lý nào trừ khi được cam kết bằng văn bản.

Trang web cộng đồng giao dịch FOLLOWME: www.followme.asia

Tải thất bại ()