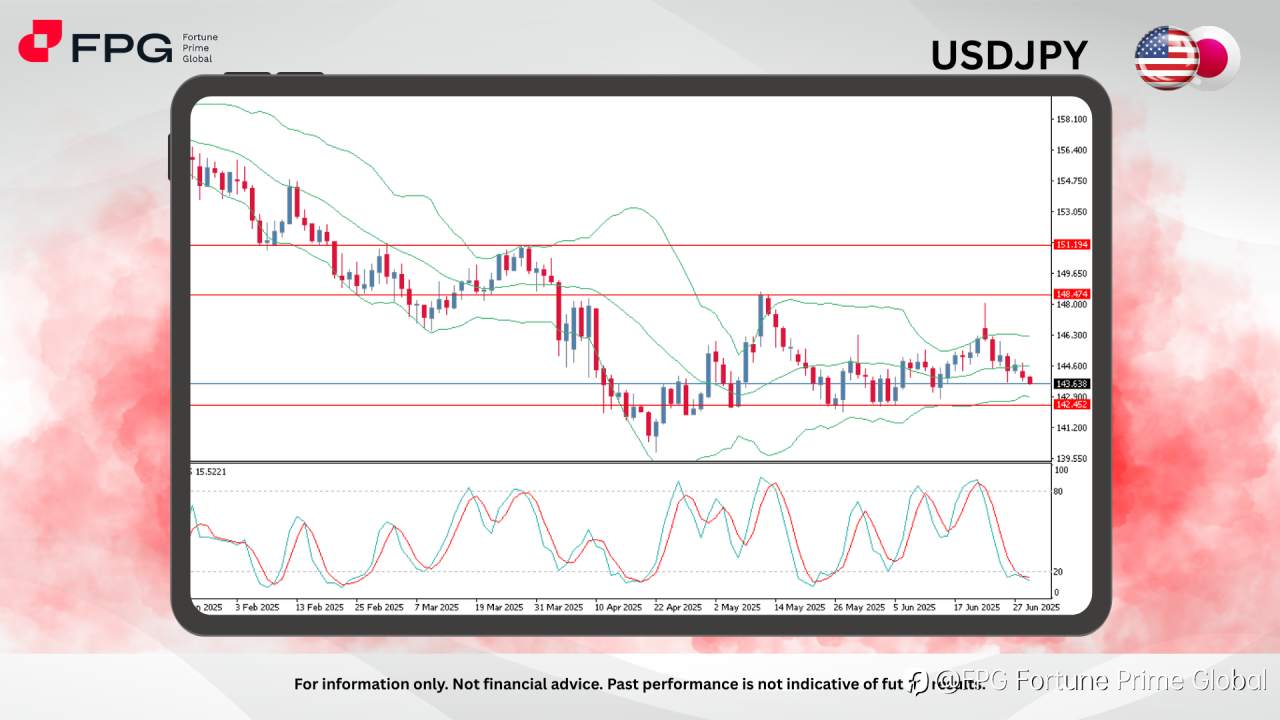

USDJPY remains in a consolidative range after a multi-week rebound from April lows, with price action capped below 148.474 resistance and supported above the 142.452 zone. Recent candles show weakening bullish momentum as price approaches key support, testing the lower boundary of the sideways channel.

The most recent daily candle closed bearish at 143.638, just above the 142.452 support line and hugging the lower Bollinger Band. This proximity to the lower band suggests oversold conditions, though the trend remains neutral within the broader range. The price is also trading below the Bollinger midline and 20-day moving average, reinforcing short-term bearish bias.

The Stochastic Oscillator (5,3,3) is in the oversold zone (~12.87), with a potential bullish crossover forming. This may signal a short-term rebound, though confirmation is still needed. Volatility remains compressed, and the Bollinger Bands are narrowing — indicative of a potential breakout in coming sessions.

Market Observation & Strategy Advice

1. Current Position: Around 143.638, testing lower Bollinger Band support within a sideways channel.

2. Resistance: 148.474, recent range high and structural ceiling.

3. Support: 142.452, lower channel boundary and psychological support.

4. Stochastic Oscillator: Oversold with a possible bullish crossover, watch for reversal signals.

5. Trading Strategy Suggestions:

- Bullish defence: Look for bullish candlestick formations near 142.45 support. Rebound toward 146–148 is possible if buyers reclaim momentum.

- Bearish breakdown: A decisive daily close below 142.45 could trigger a deeper drop toward 140.50 or even 139.50.

- Range setup: Continue range trading between 142.45–148.47 until a clear breakout direction is confirmed.

Market Performance:

Forex Last Price % Change

EUR/USD 1.1783 -0.03%

GBP/USD 1.3729 -0.03%

Today’s Key Economic Calendar

JP: Tankan Large Manufacturers Index

JP: Consumer Confidence

EU: Inflation Rate YoY Flash

US: ISM Manufacturing PMI

US: JOLTs Job Openings

Risk Disclaimer:

This report is for informational purposes only and does not constitute financial advice. Investments involve risks, and past performance does not guarantee future results. Consult your financial advisor for personalized investment strategies.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()