General Outlook

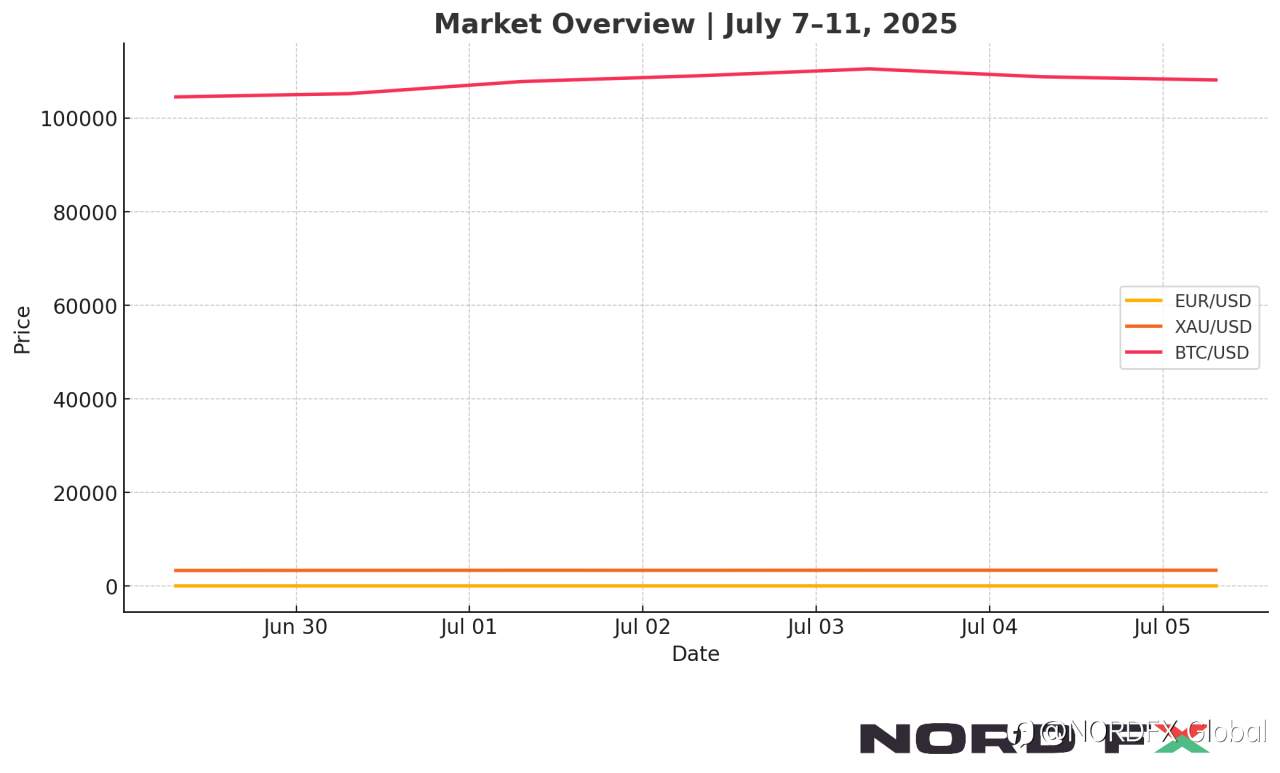

Last week ended with mixed movements: EUR/USD closed around 1.1779, reflecting modest euro strength. Gold eased slightly to approximately $3,330.44 per ounce, and bitcoin dipped just below $110,000, settling around $108,125. Markets now await fresh catalysts, with technical corrections likely in play before any sustained momentum emerges.

EUR/USD

EUR/USD closed the week at roughly 1.1779, consistent with the ECB reference rate. Bullish indicators remain present, yet momentum appears to be slowing. In the coming week, we may see a move toward resistance near 1.1895. If that level proves firm, a reversal toward support around 1.1750 is possible. Only a clear breakout above 1.1985 would negate the bearish lean and open a path toward ~1.2275. Conversely, a drop below ~1.1475 would indicate a deeper downtrend.

XAU/USD (Gold)

Gold closed Friday at approximately $3,330.44, down modestly from recent peaks. Price action continues within a bullish triangle on the charts. Expect an initial pullback toward the $3,295–3,260 range next week. A rebound from there could resume the bullish drive toward $3,745. However, dropping below $3,145 would invalidate the bullish pattern, pushing prices potentially toward $2,965. A clean breakout above $3,505 would confirm renewed upside momentum.

BTC/USD

Bitcoin ended last Friday near $108,125, having slipped from just under $110,500. It remains confined within a bullish channel. A likely next move is a correction toward $102,265–105,000. If that support holds, a fresh rally may drive prices toward $127,505. A drop below $92,205 would challenge the bullish structure, opening a path toward $82,605. Meanwhile, a rally above $115,605 would reinforce bullish expectations.

Conclusion

From July 7–11, EUR/USD may test resistance near 1.1895 before correcting toward 1.1750–1.1475. Gold looks poised for a dip to $3,260–3,295 before another upward push toward $3,745, barring a break below $3,145. Bitcoin still aims higher, but a correction to $102k–105k is likely; holding that zone could set it up for a move toward $127,505. These forecasts reflect current technical setups and preserved bullish trends, albeit with expected near-term consolidations.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()