"Want to buy a condo in Taipei for 300,000 TWD? It’s possible." Just like real estate investment uses a "down payment" to leverage assets, leverage tools in forex trading enable small investors to participate in the international market.

In the fast-changing financial market, "leverage" is undoubtedly a powerful tool that multiplies capital efficiency. Especially in the low-volatility forex market, leverage allows investors to use smaller funds to engage in larger-scale trades. However, leverage can amplify profits as well as risks. This article will fully explain the principles, advantages and disadvantages, and practical strategies of leverage, helping you take the key step toward efficient leverage use.

What is leverage? Why is leverage indispensable in forex trading?

Simply put, leverage is a financial tool that amplifies capital, acting as a "capital multiplier." Leverage trading means brokers lend funds to investors, allowing them to hold larger positions with less principal. For example, if you have $1,000 capital and use 1:100 leverage, you can operate a position worth up to $100,000. This enables small capital to enter the global forex market for strategic asset allocation.

In Taiwan’s investment environment, due to low interest rates and limited stock volatility, more investors are turning to the forex and CFD markets, where leverage is the core mechanism. Leverage trading allows you to effectively participate in short-term market fluctuations and seize more opportunities, even with just a few hundred dollars.

Leverage Principle: How Does It Work? Practical Example Explanation

What is Margin?

The operation of leverage is not difficult to understand; the key lies in the "margin system." The so-called "margin system" means that in financial trading (such as forex, stocks, futures, etc.), investors do not need to pay the full transaction amount upfront, but only a portion as margin, allowing participation in larger-scale trades.

Although leverage trading and margin trading have different names, their core is the same—amplifying positions by borrowing funds. Some brokers indicate leverage as a multiple of usable funds (e.g., 1:100), while others show the required margin ratio (e.g., 1%), which are two expressions of the same mechanism.

Basic Calculation Method for Leverage Trading

● 1. Leverage Ratio Calculation Formula:

Leverage Ratio = Total Transaction Value ÷ Required Margin

- Step-by-Step Analysis:

- Confirm Total Transaction Value

This is the actual position size you operate (e.g., 1 lot EUR/USD = 100,000 euros).

- Calculate Required Margin

Margin = Total Transaction Value ÷ Leverage Ratio

Example:

In 2025, USD/TWD exchange rate = 30.5. Assuming using 1:100 leverage to trade 1 lot (100,000 USD) USD/JPY:

○ Margin Calculation: 100,000 USD ÷ 100 = 1,000 USD

○ Converted to TWD: 1,000 USD × 30.5 = 30,500 TWD

● 2. Calculation Formula for Tradable Position:

Tradable Position = Own Capital × Leverage Ratio

If you have $1,000 capital and use 1:100 leverage, it means you can hold a position worth $100,000 (i.e., 1 lot EUR/USD).

Example:

○ EUR/USD rate = 1.1000, 1 lot = 100,000 units

○ Leverage 1:100 → actual margin required is only $1,000

○ If the rate rises to 1.1050, you can profit $500 (excluding fees)

However, if the market moves against you, losses will be magnified proportionally. Therefore, understanding how leverage affects profit and loss is the first step to successful trading.

Advantages of Leverage: Amplify Opportunities, Improve Capital Efficiency

Small Investors Can Participate in Big Markets

The most attractive feature of leverage is that it allows small capital to have a big impact, breaking through capital barriers. Especially in the forex market, common leverage ranges from 1:50 to 1:2000, offering great flexibility.

Enhance Short-term Trading Efficiency

With leverage, you can profit from small exchange rate movements, particularly suitable for intraday trading and scalping strategies.

Flexible Long and Short Positions

Forex CFD products support two-way trading, combined with leverage to amplify profit potential, providing opportunities regardless of market rising or falling.

Risks of Leverage: Amplifies Profits but Can Also Amplify Losses

Leverage is powerful, but improper use can lead to margin calls. This happens when the account equity falls below a certain margin level, triggering forced liquidation to protect the account from going negative.

What Causes Margin Calls?

● Sharp market reversals

● Using excessive leverage without stop-loss

● Losing control of multiple positions in a short time

For example, at Ultima Markets, the margin call level is 50%, with negative balance protection. When account equity falls below this threshold, positions are automatically closed.

How to Reduce Leverage Risks?

● Set stop-loss for every trade

● Strictly control single trade risk (recommended 1-3%)

● Avoid “all-in” trading, especially under high leverage conditions

Which Financial Products Allow Leverage Trading?

Leverage trading is widely applied across various financial products. Below are common types that support leverage:

1. Forex

● Features: UM leverage up to 1:2000, making it one of the most flexible markets for leverage application.

● Suitable for: Traders skilled in short-term or swing trading, profiting from small price fluctuations.

2. Contracts for Difference (CFD)

● Wide range of products, including:

○ Precious metals (e.g., gold, silver)

○ Energy commodities (e.g., crude oil, natural gas)

○ Index CFDs (e.g., Dow Jones, DAX, Taiwan Index))

○ Stock CFDs (e.g., Apple, Tesla)

○ Cryptocurrency CFDs (e.g., Bitcoin, Ethereum)

● Features: Supports both long and short positions, ideal for leveraging to capture two-way market moves.

3. Futures

● Includes stock index futures, commodity futures, forex futures, etc.

● Features: Standardized contracts allowing trading of large contracts with less capital via leverage, but have fixed expiration dates.

4. Options

● Although not direct leverage, options inherently have leverage characteristics.

● Features: Small capital can participate in high-priced assets; risk and reward are asymmetric.

5. Cryptocurrency Leverage Contracts

● Features: Highly volatile and risky; platforms usually offer leverage from 1:2 to 1:100.

● Note: Cryptocurrency markets are less regulated, so risk management mechanisms require special attention.

How to Use Leverage Correctly? Practical Tips for New Traders

1. How to Choose the Right Leverage Ratio?

Leverage ratio should be chosen based on your risk tolerance and trading experience:

Tip: Practice with a demo account under different leverage levels to find the style that fits you best.

2. Leverage Risk Management Tips

● Always set stop loss and take profit: Avoid emotional decisions

● Diversify multiple positions: Reduce impact of single trade mistakes

● Use technical analysis and indicators: Combine MACD, RSI to improve entry accuracy

● Predefined maximum loss limit: Set a daily maximum loss threshold in advance

Why Choose Ultima Markets for Leverage Trading?

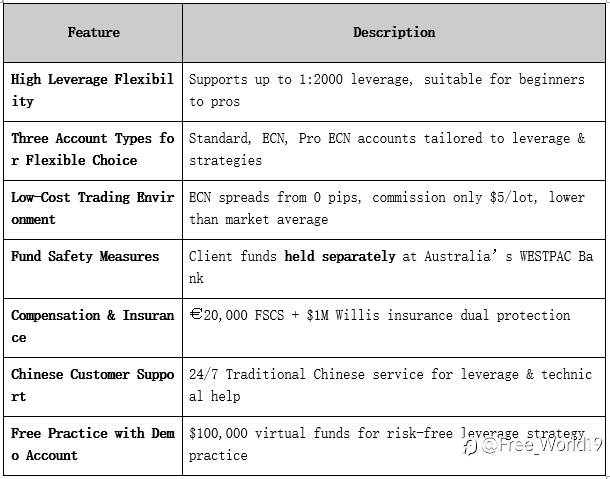

Among many forex platforms, Ultima Markets is favored by Taiwanese users for its flexible leverage, security, and low trading costs.

Ultima Markets Core Advantages:

Master leverage and amplify your power the right way

In a fast-changing market, leverage is not just risk but a key tool for efficient capital use. The key is understanding its mechanics, risks, and using the right trading platform.

Choosing a compliant, transparent platform with high leverage options and strong risk controls will greatly boost your success. Ultima Markets is your best choice to master leverage and amplify your investment power.

📢 Open a free Ultima Markets Demo Account now, practice leverage strategies, and seize global trading opportunities in 2025!

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ