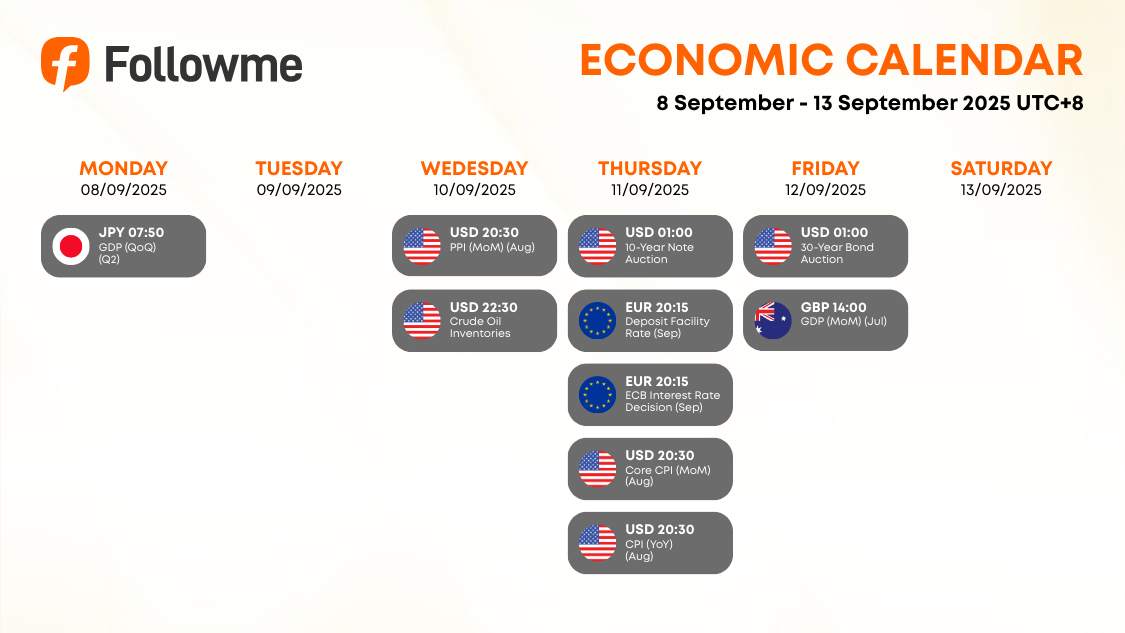

Weekly Economic Calendar: Week of September 8 - 13, 2025 (GMT+8)

This week's macro calendar is stacked with high-impact data and central bank decisions that could shake up FX, bond yields, and risk sentiment. From Japan’s Q2 GDP kicking off the week to Thursday’s CPI showdown in the U.S. and the ECB’s rate decision, traders should brace for volatility across G10 pairs.| Time | Cur. | Events | Fcst | Prev |

|

Monday, September 8, 2025

|

||||

| 7:50 | JPY |

GDP (QoQ) (Q2)

|

0.30% | 0.30% |

| Tuesday, September 9, 2025 | ||||

| Wednesday, September 10, 2025 | ||||

| 20:30 | USD | PPI (MoM) (Aug) | 0.30% | 0.90% |

| 22:30 | USD | Crude Oil Inventories | 2.415MM | |

| Thursday, September 11, 2025 | ||||

| 1:00 | USD | 10-Year Note Auction | 4.26% | |

| 20:15 | EUR | Deposit Facility Rate (Sep) | 2.00% | 2.00% |

| 20:15 | EUR | ECB Interest Rate Decision (Sep) | 2.15% | 2.15% |

| 20:30 | USD | Core CPI (MoM) (Aug) | 0.30% | 0.30% |

| 20:30 | USD | CPI (YoY) (Aug) | 2.90% | 2.70% |

| 20:30 | USD | CPI (MoM) (Aug) | 0.30% | 0.20% |

| 20:30 | USD | Initial Jobless Claims | 234K | 237K |

| 20:45 | EUR | ECB Press Conference | ||

| Friday, September 12, 2025 | ||||

| 1:00 | USD | 30-Year Bond Auction | 4.81% | |

| 14:00 | GBP | GDP (MoM) (Jul) | 0.00% | 0.40% |

| Key highlights: |

🇯🇵 Japan GDP (QoQ) – Monday

🇺🇸 U.S. PPI, CPI, Jobless Claims – Wednesday & Thursday

🇪🇺 ECB Rate Decision & Press Conference – Thursday

🇬🇧 UK GDP (MoM) – Frida

Macro Analysis

Japan GDP (Q2)

Released early Monday, Japan’s Q2 GDP offers insight into regional growth momentum. A weak print could reinforce dovish BoJ expectations and weigh on JPY, especially against USD and EUR.

U.S. Inflation & Labor

PPI (Wed 20:30): A precursor to CPI, this will hint at upstream price pressures. A surprise uptick could front-run hawkish sentiment.

CPI (Thu 20:30): The main event. July’s YoY CPI came in at 2.7%. Markets are pricing in a modest rise to 2.8–2.9%. Anything above 3% could reignite Fed rate hike chatter.

Jobless Claims: Still a key labor market gauge. A spike could soften USD if paired with tame inflation.

ECB Decision (Thu 20:15)

Markets expect the ECB to hold rates steady as Eurozone inflation hovers near 2.1%. The press conference (20:45) will be closely watched for forward guidance. EUR/USD could swing sharply depending on Lagarde’s tone.

UK GDP (Fri 14:00)

July’s GDP print will test the resilience of the UK economy amid sticky inflation and rate fatigue. GBP/USD may react more to USD flows unless the data surprises.

Speculative Outlook for USD Traders

This week is a CPI-driven minefield for dollar bulls and bears alike. Here’s how it could play out:

🟢Bullish USD Scenario

CPI prints hot (>3% YoY)

PPI shows upstream inflation

Jobless Claims remain low

Fed rate cut expectations fade

Trade ideas: Long USD/JPY, short EUR/USD, fade gold rallies

🔴 Bearish USD Scenario

CPI disappoints (<2.7%)

Jobless Claims spike

Fed dovish pivot gains traction

Trade ideas: Long EUR/USD, long gold, short USD/CHF

🟡 Wild Card: ECB Surprise

If Lagarde signals hawkish intent or upgrades inflation forecasts, EUR/USD could rally regardless of U.S. data. Watch for divergence trades.

Watch full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ