General Outlook

With the Fed cutting the funds rate by 25 bps on 17 September to 4.00–4.25% (11–1 vote; Miran dissented for a 50 bps cut) and the BoE on 18 September holding Bank Rate at 4% while slowing QT to £70bn over the next 12 months (target £488bn stock), the dollar stays soft into a data-heavy week. The ECB left policy unchanged on 11 September (DFR 2.00%, MRO 2.15%, MLF 2.40%). Flash PMIs arrive Tuesday, 23 September, followed by the US Q2 GDP (third estimate) and August durable goods on Thursday, 25 September.

EUR/USD

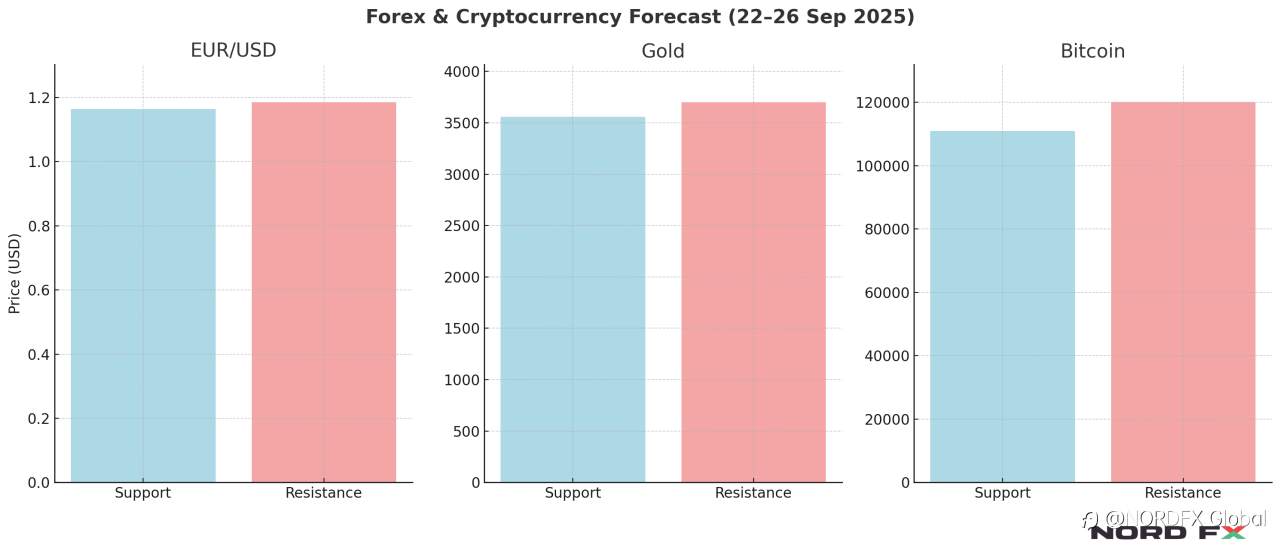

The pair ended last week near 1.1745 (Friday close), having traded in a 1.173–1.192 band around the FOMC and BoE headlines. A benign PMI round and in-line GDP should keep the near-term bias modestly EUR-positive; stronger-than-expected US data risks a pullback. Resistance is at 1.1760–1.1800, then 1.1850–1.1900. Support is at 1.1680–1.1640, then 1.1600. Trading view: prefer buying shallow dips while above 1.1640, targeting 1.1800/1.1850; a hot US data surprise could drag price back towards 1.1640–1.1600.

XAU/USD (Gold)

Spot gold closed Friday around $3,680/oz (day range roughly $3,632–3,686). With real yields contained and the dollar soft post-FOMC, dips remain shallow ahead of Tuesday PMIs and Thursday’s GDP and durable goods. Positioning is rich, so the metal is sensitive to upside US surprises. Resistance is at $3,650–3,675, then $3,700. Support is at $3,590–3,560, then $3,500–3,450. Trading view: maintain buy-the-dip bias above $3,560–3,590 for a re-test of $3,675–3,700; a hotter data run risks a correction towards $3,500–3,450.

BTC/USD

Bitcoin is consolidating above $115k–$116k after briefly touching around $117.9k on 18 September; macro remains a tailwind if US data don’t push yields decisively higher. A clean break above $118k opens $120k and potentially $123k. Resistance is at $116.5k, then $118–120k ($123k beyond). Support is at $114k–$111k, then $108k–$105k. Trading view: mildly bullish while above $111k–$114k, aiming for $118–$120k; watch Tuesday’s PMI risk and Thursday’s GDP and durable goods for directional cues.

Key Dates

Tuesday, 23 September: Flash PMIs (Eurozone, UK, US)

Thursday, 25 September: US Q2 GDP (third estimate) and US Durable Goods Orders (August, advance)

Conclusion

For 22–25 September, EUR/USD retains a slight upside tilt with the dollar soft; gold stays underpinned near highs; bitcoin remains constructive above $111k–$114k. A notably stronger US data pulse would favour a dollar bounce and shallow corrections in bullion and crypto; benign prints keep the current trend intact.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()