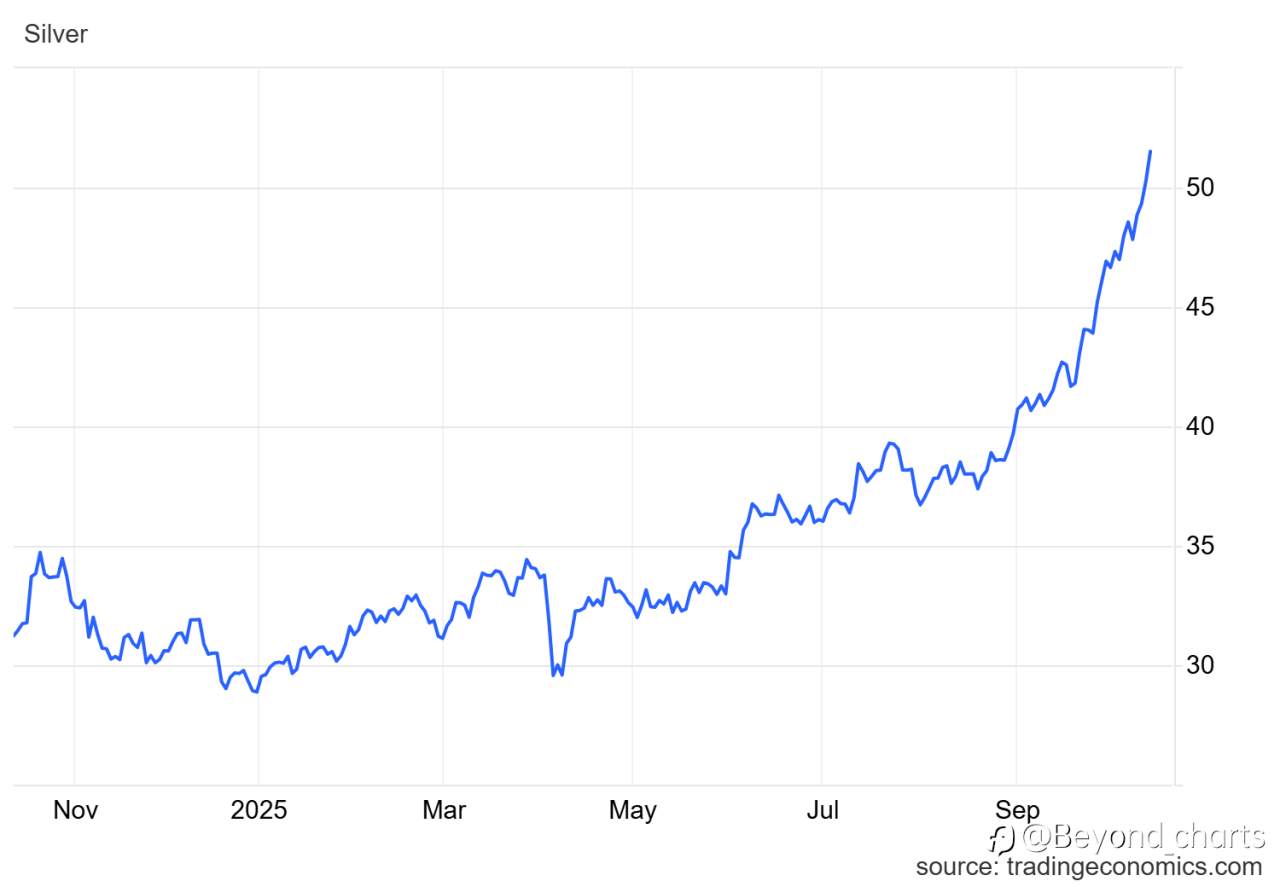

#Silver# is once again making headlines - crossing above $51 per ounce and setting a new all-time high. But what’s catching traders’ attention now isn’t just the breakout… it’s the growing belief that this could be the early phase of something much bigger.

Many analysts are now floating a bold projection: $100 silver may not be as far-fetched as it sounds. Let’s break down why.

⚙️ The #fundamentalsanalysis# Are Shifting

Unlike the speculative runs of the past, this current rally is underpinned by strong macro and industrial fundamentals.

On the macro side, we’re seeing a confluence of factors that traditionally favor precious metals:

- Falling U.S. yields and the rising odds of back-to-back #Fed# rate cuts.

- Safe-haven demand fueled by renewed #ChinaUSTariffDeal# trade tensions, a U.S. government shutdown, and ongoing political uncertainty in Europe and Japan.

- A #USDollarWeakness# , which historically acts as a tailwind for silver and #gold#.

These themes have pushed investors back toward metals, but what separates silver this time is its industrial relevance.

🔋 The #IndustryReport# Catalyst

Silver isn’t just a hedge anymore , it’s becoming an essential industrial material.

With the global transition toward renewable energy, EVs, and advanced electronics, demand for silver in solar panels and electric components is exploding.

The Silver Institute recently reported that industrial demand is expected to hit record levels, outpacing mine supply for the third consecutive year. Meanwhile, inventories in London’s metal vaults have dropped sharply, signaling a tightening physical market.

That’s a recipe for long-term price pressure and potentially, an extended bull phase.

📈 The #technicalanalysis# Setup

From a technical perspective, silver’s breakout above $50 confirmed a major resistance breach that had capped prices for over a decade.

Momentum indicators continue to favor the bulls, and any corrective dips toward $48–$49 are being seen as accumulation zones by smart money.

Short-term, we could see consolidation, but as long as silver holds above the breakout zone, the path of least resistance remains higher.

💬 Final Take

At this point, silver’s rally is no longer just reactionary, it’s structural.

Macro tailwinds, industrial demand, and tightening supply are all aligning in a way we haven’t seen in years.

Could silver actually touch $100? Possibly not overnight but given the current setup, that target no longer looks unrealistic.

For traders, this is the phase to stay alert, not skeptical. Volatility is opportunity and silver may just be gearing up for its next big leg higher.

#FOLLOWME众测# for more such Articles , Insights , Signals and Analysis.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ