📈 Wall Street Rebounds Slightly

US indices recovered part of Friday’s losses after Donald Trump’s conciliatory weekend message and signals from Beijing suggesting readiness to resume trade talks.

💬 Talks Still On the Table

Scott Bessent confirmed that the Trump–Xi meeting remains scheduled, though he warned the prolonged government shutdown is starting to weigh on economic activity. Meanwhile, China’s Ministry of Commerce said discussions with the US continue, even as Beijing launched an investigation into US tariffs affecting its transport sector.

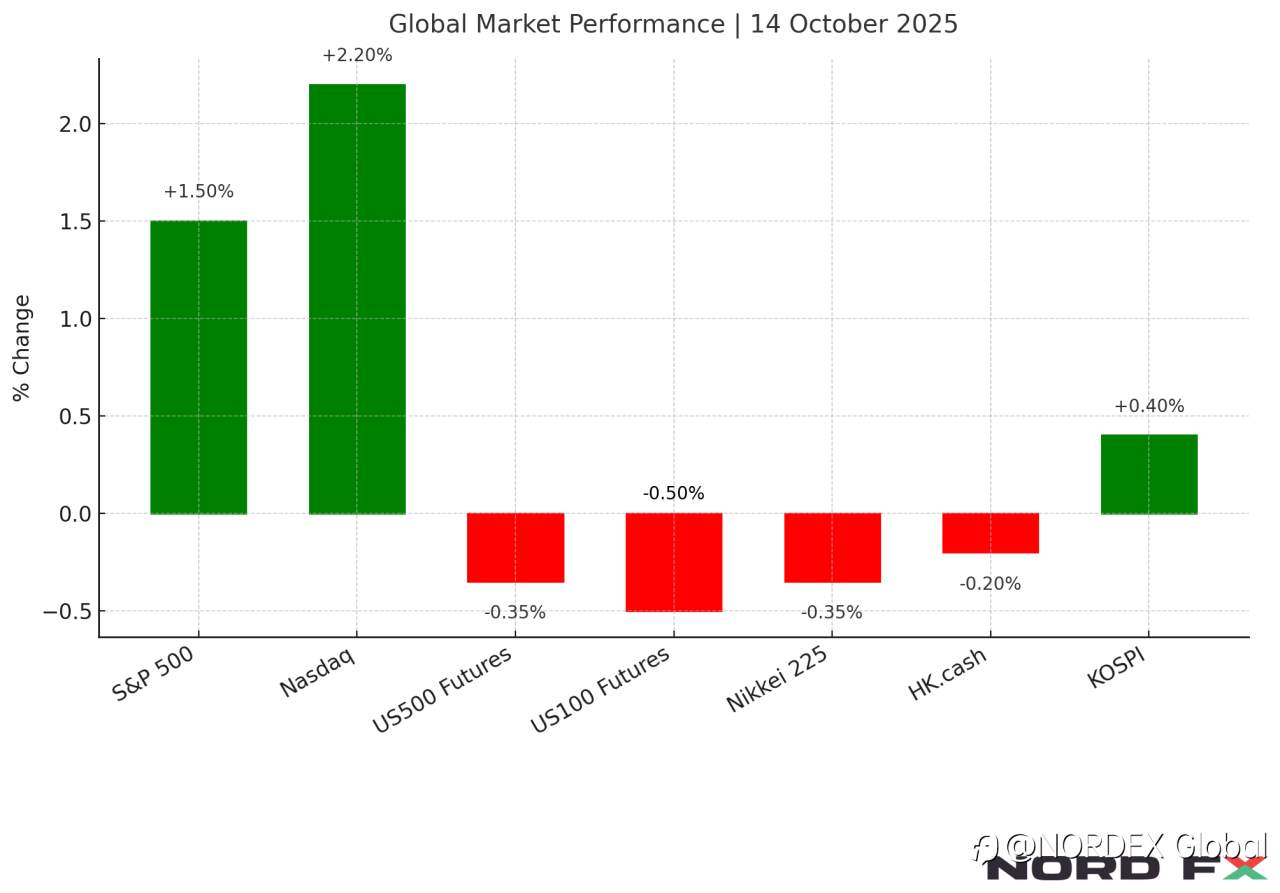

🇺🇸 Market Overview

S&P 500 gained 1.5%, Nasdaq +2.2%, but futures opened weaker today (US500 -0.35%, US100 -0.5%). In Asia, markets are mostly lower: Nikkei 225 -0.35%, HK.cash -0.2%, while South Korea’s 🇰🇷 KOSPI hit a record high thanks to Samsung’s strong outlook.

🇦🇺 Australia in Focus

NAB Business Confidence rose to 7 points in September (vs 4 in August). The RBA minutes revealed patience regarding rate cuts, noting strong property activity despite restrictive rates. The bank considers AUD’s strength consistent with fundamentals, signalling no further tightening ahead.

🏦 Global Outlook

Goldman Sachs warns the US shutdown could become the longest ever, trimming 0.11% off Q4 growth weekly. Yet GS expects a rebound once the government reopens and anticipates a Fed rate cut in October. Rabobank sees AUD/USD rising from 0.65 short term to 0.68 within a year.

💰 Commodities

Gold surged to $4,167/oz, Silver above $53/oz with borrowing costs hitting 30% per month on the London exchange — forcing shorts to cover. Oil slipped below $60/barrel (WTI), and natural gas nears $3/MMBTU.

🗓 Today’s Highlights

- 🇺🇸 No macro data due to shutdown

- 🗣 Fed Chair Powell speaks at 18:20 CET

- 🧾 Earnings season begins: JP Morgan, Goldman Sachs, Citi, Wells Fargo, BlackRock, and J&J report today.

🚀 Stay tuned with NordFX for all the latest market updates — trade smart and stay ahead of the curve! 💹

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()