General Outlook

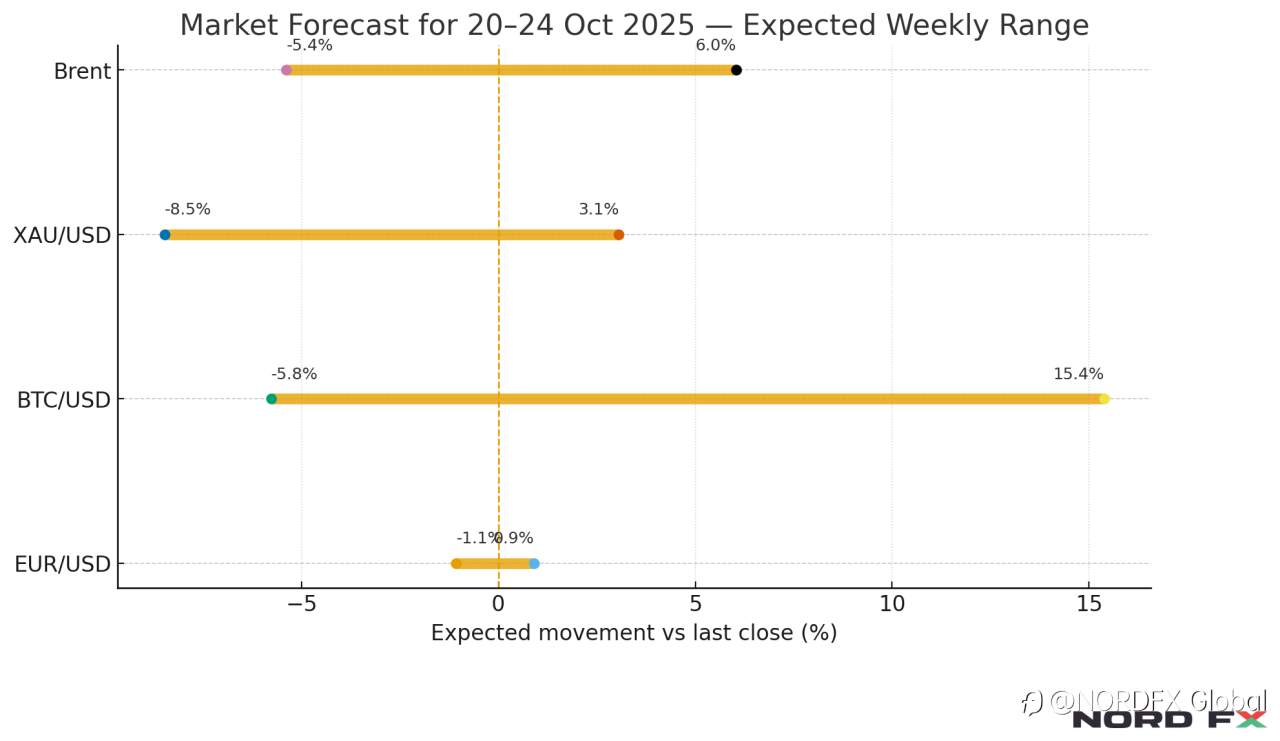

Markets head into the week still digesting President Trump’s tariff threats and a sharp repricing in safe havens and risk assets. Gold set a new record near $4,380 before a volatile pullback late on Friday, while Brent extended its downtrend to the low $60s and bitcoin slid toward $104,000 amid heavy liquidations. The euro held its recent rebound as the dollar eased, but direction will hinge on incoming U.S. rhetoric and any follow-through in energy and crypto. Volatility risks remain elevated across majors and commodities during 20–24 October.

EUR/USD

The pair finished last week near 1.1650 after rebounding from the mid-1.15s (ECB reference rate on 17 Oct: 1.1681). The 1.1630–1.1660 area is first support to watch early in the week. A sustained move higher would target 1.1710–1.1755, then 1.1810. A break back below 1.1600 could reopen 1.1550–1.1525, with risk to 1.1400 on a clean downside extension. Price action into 1.1630 is pivotal for the bullish structure that formed in mid-October.

BTC/USD

Bitcoin whipsawed after the tariff headlines, with a flush toward $104,000 on Friday as leveraged longs were forced out. Lows were recorded around $ 103.5k on Friday. Immediate resistance is layered at 112,000–116,000, then 120,000. Supports sit at 110,000, 107,000 and 104,000, with 100,000–98,000 the next demand band if pressure resumes. Despite the pullback, year-to-date ETF inflows and high dominance keep the longer-term uptrend intact, although near-term flows remain sensitive to risk sentiment and U.S. policy signals.

Brent

Brent closed the week around $61.2/bbl and retains a bearish bias while below the 64.80–65.00 supply zone that flipped from support earlier in October. Bulls need to reclaim that band to stabilise the outlook. A daily close under 61.00 would expose 58.00 and potentially 53.50 in extension. Any easing in tariff rhetoric or signs of improving demand could spark short-covering, yet the trend stays fragile at the start of Q4’s penultimate stretch.

XAU/USD (Gold)

Spot gold set an all-time high near $4,380 last week before fading to the low $4,200s into the close. The uptrend remains intact while above 4,000–4,080, with resistance back at 4,240–4,300 and the record area near 4,380. Overbought readings argue for periods of consolidation or a dip to 3,890–3,900 if the dollar bounces, yet macro drivers and central-bank demand continue to underpin the medium-term bullish case.

Conclusion

The new week opens with gold consolidating after record highs, Brent struggling to base, bitcoin attempting to rebuild above the 104,000–110,000 area, and EUR/USD defending the mid-1.16s. Traders should expect headline-driven swings and respect nearby technical levels, particularly around 1.1630 in EUR/USD, 61.00 in Brent, 4,000 in gold, and 110,000 in bitcoin.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()