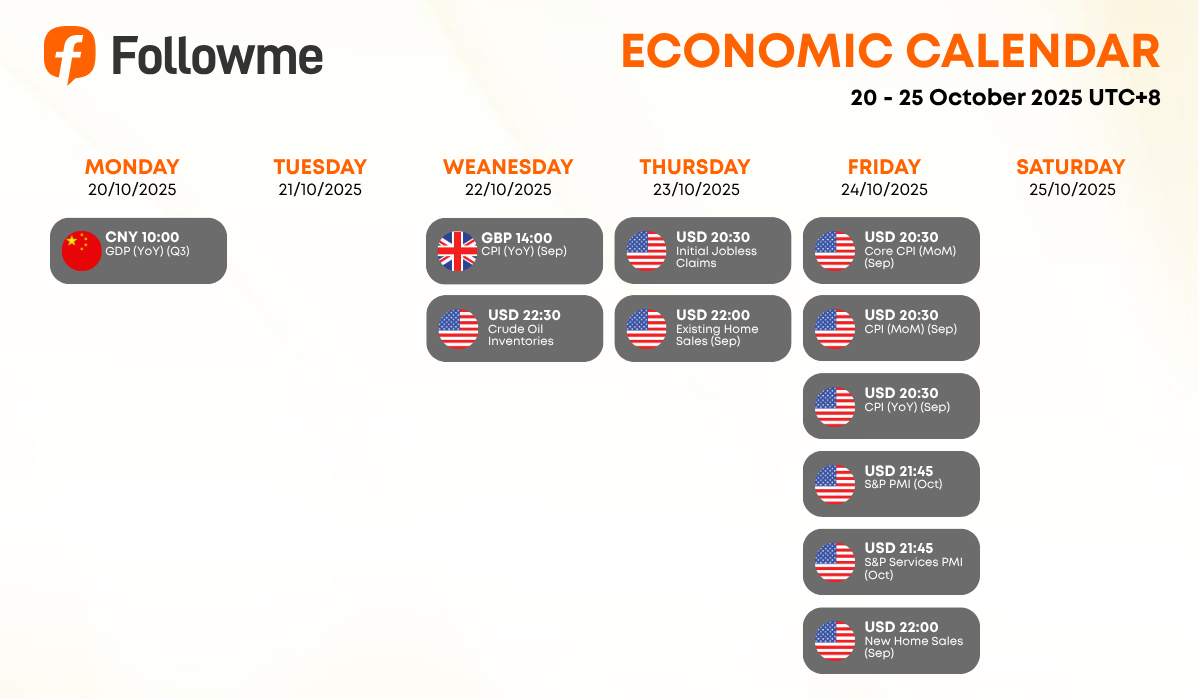

Weekly Economic Calendar: Week of October 20 -25, 2025 (GMT+8)

This week features major economic data from the U.S., U.K., and China, setting the tone for global markets. Investors will keep an eye on U.S. inflation figures, job data, and PMI releases, while China’s GDP could give a clearer signal on Asia’s economic momentum.| Time | Cur. | Events | Fcst | Prev |

|

Monday, October 20, 2025

|

||||

| 10:00 | CNY | (YoY) (Q3) | 4.70% | 5.20% |

| Wednesday, October 22, 2025 | ||||

| 14:00 | GBP | CPI (YoY) (Sep) | 3.80% | |

| 22:30 | USD | Crude Oil Inventories | 3.524M | |

| Thursday, October 23, 2025 | ||||

| 20:30 | USD | Initial Jobless Claims | 223K | 218K |

| 22:00 | USD | Existing Home Sales (Sep) | 4.00M | |

| Friday, October 24, 2025 | ||||

| 20:30 | USD | Core CPI (MoM) (Sep) | 0.30% | 0.30% |

| 20:30 | USD | CPI (MoM) (Sep) | 0.30% | 0.40% |

| 20:30 | USD | CPI (YoY) (Sep) | 2.90% | |

| 21:45 | USD | S&P Global Manufacturing PMI (Oct) | 52 | |

| 21:45 | USD | S&P Global Services PMI (Oct) | 54.2 | |

| 22:00 | USD | New Home Sales (Sep) | 800K | |

| Key highlights: |

- 🇨🇳 China GDP (YoY) (Q3) — Monday, Oct 20 (10:00)

Forecast: 4.70% | Previous: 5.20%- China’s growth is expected to slow further, reflecting weaker domestic demand and continued property-sector drag. A miss here could pressure Asian equities and commodities.

- 🇬🇧 UK CPI (YoY) (Sep) — Wednesday, Oct 22 (14:00)

Forecast: — | Previous: 3.80%- Traders will watch for inflation stickiness. Any upside surprise could strengthen GBP and add pressure on the Bank of England to maintain a hawkish tone.

- 🛢️ U.S. Crude Oil Inventories — Wednesday, Oct 22 (22:30)

Previous: +3.524M- Oil traders will monitor whether supply builds continue, especially amid concerns about slowing demand and Middle East tensions.

- 🇺🇸 U.S. Initial Jobless Claims — Thursday, Oct 23 (20:30)

Forecast: 223K | Previous: 218K- A slight rise is expected. Persistent job market resilience could keep the Fed cautious about near-term rate cuts.

- 🇺🇸 Existing Home Sales (Sep) — Thursday, Oct 23 (22:00)

Previous: 4.00M- Housing market activity remains under pressure from high mortgage rates, a key signal for overall consumer strength.

- 🇺🇸 U.S. CPI & Core CPI (MoM) (Sep) — Friday, Oct 24 (20:30)

Forecast: +0.30% | Previous: +0.30% (Core), +0.40% (Headline)- Inflation data remains the main market mover. A higher reading could push back expectations of Fed rate cuts, boosting USD and yields.

- 🇺🇸 U.S. CPI (YoY) (Sep)

Forecast: 2.90% | Previous: —- Annual inflation cooling would confirm gradual disinflation, but stickiness could reignite volatility across risk assets.

- 🇺🇸 S&P Global PMI (Oct) — Friday, Oct 24 (21:45)

- Manufacturing PMI: Forecast 52 | Previous 52

- Services PMI: Forecast 54.2 | Previous 54.2 PMI figures above 50 indicate continued economic expansion; any downside could fuel recession concerns.

- 🇺🇸 New Home Sales (Sep) — Friday, Oct 24 (22:00)

Previous: 800K- Housing remains a key barometer of consumer confidence; sharp declines may signal cracks in U.S. domestic demand.

Macro Analysis

🇺🇸 United States — Inflation & Housing Under Spotlight

With multiple CPI releases and PMI updates, the U.S. data flow could heavily shape Fed expectations.

A strong inflation print would reinforce USD strength, while soft housing or job data could hint at cooling momentum.

🇨🇳 China — Slowing Growth Concerns

Weak GDP may highlight structural challenges in consumption and property sectors, pressuring Asian risk sentiment.

🇬🇧 United Kingdom — Inflation Revisited

Stubborn inflation would keep the BoE in a tough position between supporting growth and fighting price pressures.

💡 Speculative Outlook for USD Traders

🟢 Bullish USD Setup

- CPI beats forecast

- Jobless claims stay low

- PMI shows strong activity

- → Possible trades: Long USD/JPY, Short Gold, Short EUR/USD

🔴 Bearish USD Setup

- CPI cools below expectations

- Rising jobless claims

- Weak PMI readings

- → Possible trades: Long Gold, Long EUR/USD, Long GBP/USD

🟡 Neutral / Range Setup

-

Inflation matches forecast, but PMIs signal slowdown — expect sideways USD moves with short-term volatility.

Watch full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Bạn thích bài viết này? Hãy thể hiện sự cảm kích của bạn bằng cách gửi tiền boa cho tác giả.

Tải thất bại ()