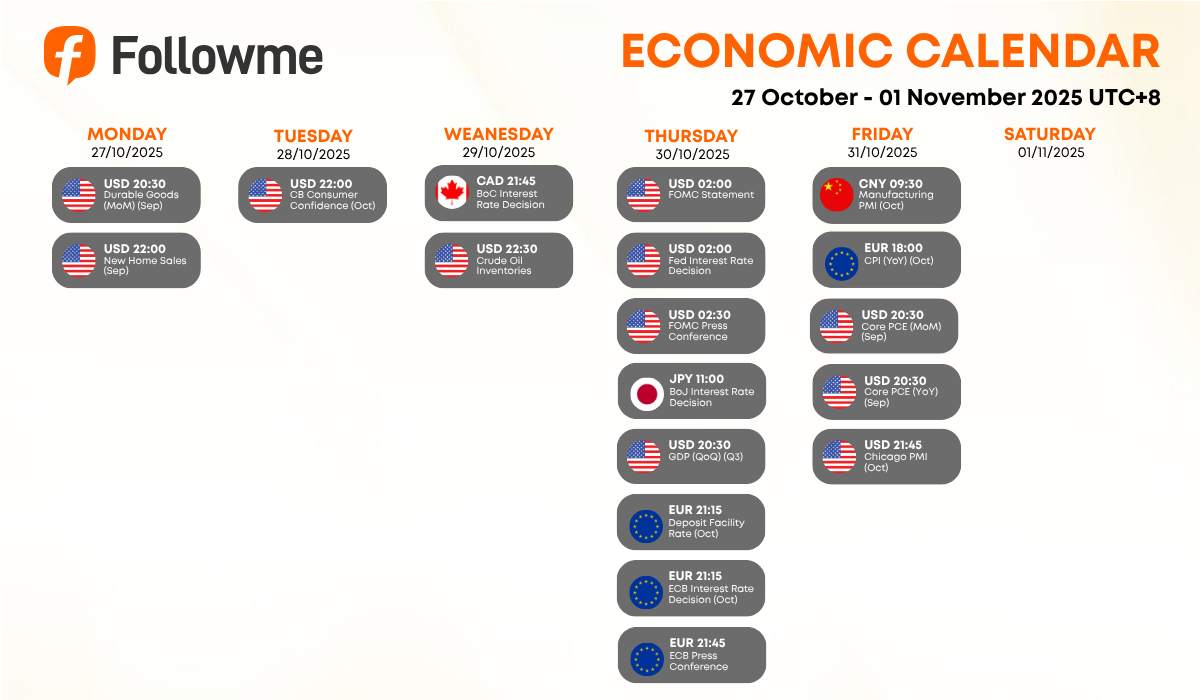

Weekly Economic Calendar: Week of October 27– November 01, 2025 (GMT+8)

A highly eventful week lies ahead — packed with central bank meetings (Fed, BoJ, ECB, BoC) and top-tier U.S. inflation and GDP data that could reshape global monetary outlooks. Traders should brace for heightened volatility across USD, JPY, and EUR pairs.

|

Time |

Cur. |

Events |

Fcst |

Prev |

|

Monday, October 27, 2025

|

||||

|

20:30 |

USD |

Durable Goods Orders (MoM) (Sep) |

2.70% |

|

|

22:00 |

USD |

New Home Sales (Sep)

|

710K |

800K |

|

Tuesday, October 28, 2025 |

||||

|

22:00 |

USD |

CB Consumer Confidence (Oct) |

93.9 |

94.2 |

|

Wednesday, October 29, 2025 |

||||

|

21:45 |

CAD |

BoC Interest Rate Decision |

2.25% |

2.50% |

|

22:30 |

USD |

Crude Oil Inventories |

-0.961M |

|

|

Thursday, October 30, 2025 |

||||

|

02:00 |

USD |

FOMC Statement |

|

|

|

02:00 |

USD |

Fed Interest Rate Decision |

4.00% |

4.25% |

|

02:30 |

USD |

FOMC Press Conference |

||

|

11:00 |

JPY |

BoJ Interest Rate Decision |

0.50% |

0.50% |

|

20:30 |

USD |

GDP (QoQ) (Q3) |

3.0% |

3.8% |

|

21:15 |

EUR |

Deposit Facility Rate (Oct) |

2.00% |

2.00% |

|

21:15 |

EUR |

ECB Interest Rate Decision (Oct) |

2.15% |

2.15% |

|

21:45 |

EUR |

ECB Press Conference |

||

|

Friday, October 31, 2025 |

||||

|

09:30 |

CNY |

Manufacturing PMI (Oct) |

49.7 |

49.8 |

|

18:00 |

EUR |

CPI (YoY) (Oct) |

2.10% |

2.20% |

|

20:30 |

USD |

Core PCE Price Index (MoM) (Sep) |

0.20% |

0.20% |

|

20:30 |

USD |

Core PCE Price Index (YoY) (Sep) |

2.90% |

|

|

21:45 |

USD |

Chicago PMI (Oct) |

42.0 |

40.6 |

|

Key highlights: |

🇺🇸 U.S. Durable Goods Orders (MoM) — Monday, Oct 27 (20:30)

Forecast: — | Previous: -2.70%

A rebound in durable goods would indicate stronger manufacturing momentum. Another drop could reinforce signs of weakening U.S. business investment.

🇺🇸 New Home Sales (Sep) — Monday, Oct 27 (22:00)

Forecast: 710K | Previous: 800K

The housing sector remains under pressure amid high borrowing costs. A sharper-than-expected decline could weigh on market confidence and the USD.

🇺🇸 CB Consumer Confidence (Oct) — Tuesday, Oct 28 (22:00)

Forecast: 93.9 | Previous: 94.2

Confidence is expected to remain soft. Weak consumer sentiment could hint at slower spending heading into Q4.

🇨🇦 BoC Interest Rate Decision — Wednesday, Oct 29 (21:45)

Forecast: 2.25% | Previous: 2.50%

Markets expect a rate cut, signaling the Bank of Canada may shift toward easing as growth slows. CAD volatility likely.

🛢️ U.S. Crude Oil Inventories — Wednesday, Oct 29 (22:30)

Previous: -0.961M

Oil traders will monitor whether supply draws continue; tightening inventories could support crude prices.

🇺🇸 FOMC Statement & Fed Rate Decision — Thursday, Oct 30 (02:00)

Forecast: 4.00% | Previous: 4.25%

The Fed is widely expected to cut rates by 25bps, marking a policy pivot as inflation moderates.

🇺🇸 FOMC Press Conference — Thursday, Oct 30 (02:30)

Chair Powell’s tone will be critical — dovish guidance could pressure the dollar and lift gold.

🇯🇵 BoJ Interest Rate Decision — Thursday, Oct 30 (11:00)

Forecast: 0.50% | Previous: 0.50%

No change expected, but traders will watch for commentary on inflation and possible yield curve tweaks.

🇺🇸 GDP (QoQ) (Q3) — Thursday, Oct 30 (20:30)

Forecast: 3.00% | Previous: 3.80%

Growth expected to slow; a sharp miss may intensify expectations for further Fed easing.

🇪🇺 ECB Interest Rate Decision — Thursday, Oct 30 (21:15)

Forecast: 2.15% | Previous: 2.15%

No change expected. Focus on Lagarde’s remarks at the 21:45 press conference for clues on 2026 rate path.

🇨🇳 Manufacturing PMI (Oct) — Friday, Oct 31 (09:30)

Forecast: 49.7 | Previous: 49.8

A reading below 50 signals contraction. China’s manufacturing pulse remains fragile amid weak external demand.

🇪🇺 CPI (YoY) (Oct) — Friday, Oct 31 (18:00)

Forecast: 2.10% | Previous: 2.20%

Eurozone inflation cooling could reinforce the ECB’s dovish stance and weigh on EUR.

🇺🇸 Core PCE Price Index (MoM) — Friday, Oct 31 (20:30)

Forecast: 0.20% | Previous: 0.20%

🇺🇸 Core PCE Price Index (YoY) — Friday, Oct 31 (20:30)

Forecast: 2.90% | Previous: 2.90%

The Fed’s preferred inflation gauge — any surprise higher could delay rate-cut expectations.

🇺🇸 Chicago PMI (Oct) — Friday, Oct 31 (21:45)

Forecast: 42.0 | Previous: 40.6

Manufacturing sentiment remains weak; a rebound could ease U.S. recession worries.

Macro Analysis

🇺🇸 United States — Central Focus Week

With both Fed and GDP data, the U.S. dominates market direction. A dovish rate cut may weigh on USD initially, but resilient GDP or inflation could limit downside.

🇪🇺 Eurozone — Inflation Cooling

Soft CPI and steady rates could add downward pressure on EUR unless Lagarde surprises with a hawkish tone.

🇯🇵 Japan — Steady Policy, Watch Yen

BoJ stability contrasts with global easing; any hint of tightening could lift JPY sharply.

🇨🇳 China — Weak Manufacturing Pulse

Sub-50 PMI readings highlight persistent weakness in industrial activity, weighing on Asian risk sentiment.

💡 Speculative Outlook for USD Traders

🟢 Bullish USD Setup

GDP beats expectations

Core PCE remains elevated

Powell signals cautious tone

→ Possible trades: Long USD/JPY, Short Gold, Short EUR/USD

🔴 Bearish USD Setup

GDP misses, CPI softens

Fed signals multiple rate cuts

→ Possible trades: Long Gold, Long EUR/USD, Long GBP/USD

🟡 Neutral / Range Setup

Data mixed; markets await clarity post-Fed

→ Sideways USD moves with short-term spikes in volatility.

Watch full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()