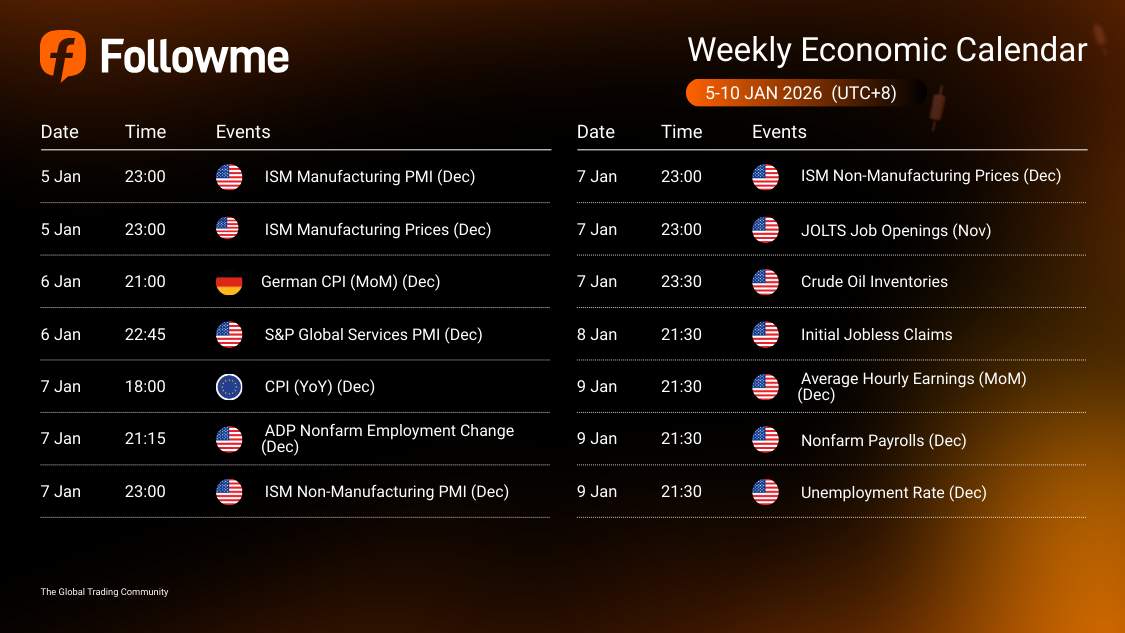

Weekly Economic Calendar: Week of January 5 - 10, 2026 (GMT+8)

This week’s macro calendar is driven by U.S. growth + labour risk and Europe’s inflation prints, with key releases that can swing USD pairs, EUR crosses, rates, and broad risk sentiment. Expect the sharpest moves around the U.S. ISM (manufacturing & services) midweek and Friday’s U.S. jobs report (NFP), while German CPI and Eurozone CPI can shift EUR pricing and ripple into DXY.

| Time | Cur. | Events | Fcst | Prev |

| USD | ||||

| CPI (YoY) (Dec) | ||||

| ADP Nonfarm Employment Change (Dec) | ||||

| USD | ISM Non-Manufacturing PMI (Dec) | |||

| ISM Non-Manufacturing Prices (Dec) | ||||

| JOLTS Job Openings (Nov) | ||||

| USD | Crude Oil Inventories | |||

| Average Hourly Earnings (MoM) (Dec) | ||||

| Nonfarm Payrolls (Dec) | ||||

| Unemployment Rate (Dec) |

| Key highlights: |

🇩🇪 German CPI (MoM, Dec) – Tuesday

🇺🇸 S&P Global Services PMI (Dec) – Tuesday

🇪🇺 Eurozone CPI (YoY, Dec) – Wednesday

🇺🇸 ADP Nonfarm Employment Change (Dec) – Wednesday

🇺🇸 ISM Non-Manufacturing PMI (Dec) – Wednesday

🇺🇸 ISM Non-Manufacturing Prices (Dec) – Wednesday

🇺🇸 JOLTS Job Openings (Nov) – Wednesday

🇺🇸 Crude Oil Inventories – Wednesday

🇺🇸 Initial Jobless Claims – Thursday

🇺🇸 Average Hourly Earnings (MoM, Dec); Nonfarm Payrolls (Dec); Unemployment Rate (Dec) – Friday

Macro Analysis

The ISM Manufacturing PMI sets the tone for early-week USD and rates. A stronger PMI with firmer prices supports a “sticky inflation / resilient activity” narrative (USD-supportive), while a soft PMI and cooling prices lean risk-off growth concerns and can cap yields and weigh on USD.

Germany & Eurozone Inflation – Tuesday/Wednesday

The German CPI (MoM) and Eurozone CPI (YoY) are key for EUR rate expectations. Hotter inflation can lift EUR via higher-for-longer pricing, while softer inflation reinforces disinflation and can pressure EUR—especially if U.S. data stays firm.

U.S. Labour Stack – Tue to Fri (PMI → ADP → JOLTS → Claims → NFP)

This is a classic build-up into Friday:

1. Services PMI (Tue) hints at demand momentum.

2. ADP + JOLTS (Wed) shape expectations for hiring strength and labour tightness.

3. Jobless Claims (Thu) is the final temperature check for near-term labour cooling.

4. NFP + Wages + Unemployment (Fri) is the main volatility trigger, especially for USD, yields, and equity index futures.

Crude Oil Inventories – Wednesday

Inventory surprises can move oil sharply, impacting inflation expectations and oil-sensitive FX. A large draw can lift crude and inflation hedges; a big build can pressure crude and cool inflation fears.

Speculative Outlook for USD Traders

This is an ISM + NFP week, expecting positioning to shift fast as the data chain confirms (or contradicts) the labour and growth narrative.

Watch the full calendar at Followme Economic Calendar Tool

Don’t forget to follow Followme and stay in sync with the latest updates.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ