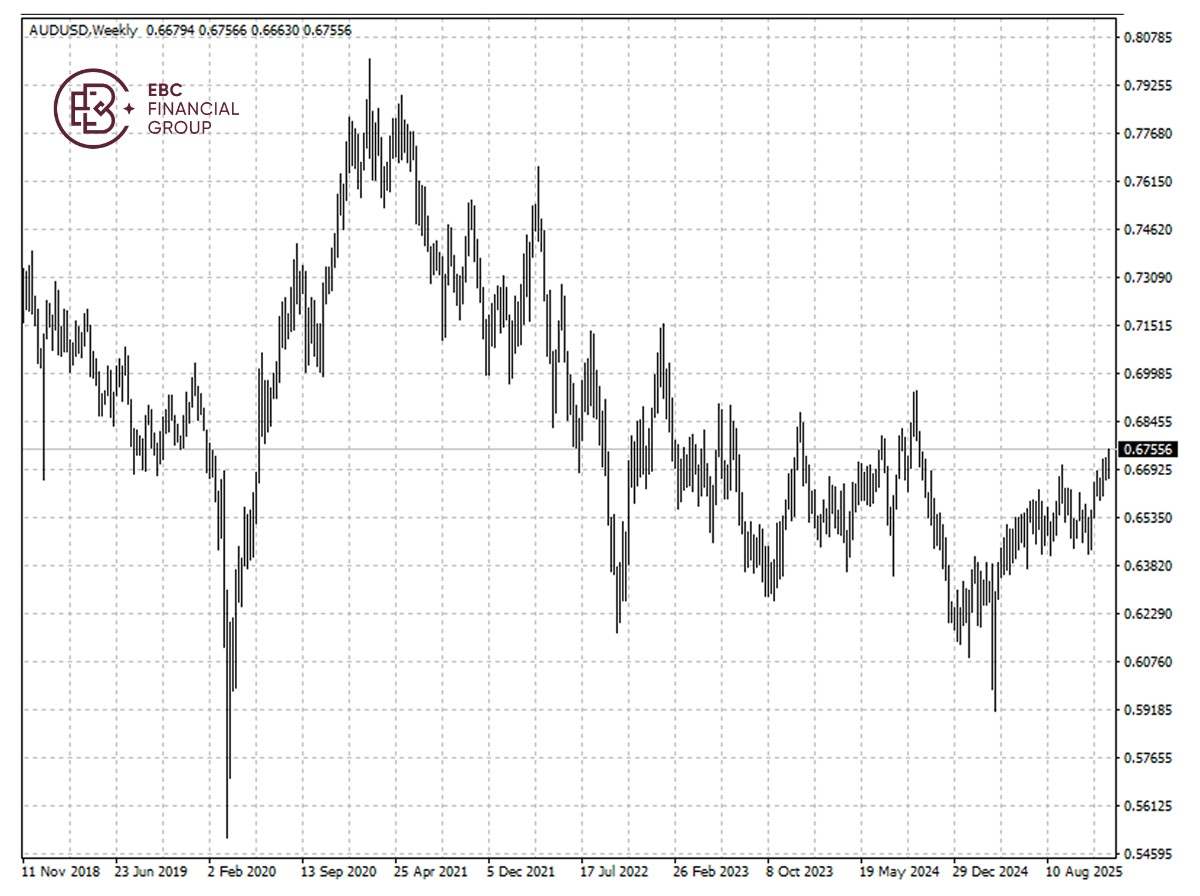

The Australian dollar fell on Wednesday following a weak inflation report, though markets had largely brushed off deepening geopolitical fractures around the world.

Australian consumer prices rose by less than forecast in November, but core inflation showed enough stickiness which speaks to an interest rate hike as early as next month.

Traders see a 33% risk that the RBA will act again in February. The central bank cut interest rates three times last year to 3.6% while warning the next move could be up given the pick-up in inflation.

The country's December exports showed strong performance, particularly in resources like gold and LNG, with high export volumes and increased earnings forecasts for the 2025-26 year.

Asia's factory powerhouses closed 2025 on a firmer footing, with activity swinging back to growth in several key economies as export orders picked up, helped by new product launches.

While it is too early to say whether Asia's largest exporters are adjusting to higher tariffs, the recovery may spur optimism on demand for Australia's resources heading into the new year.

The Aussie held its uptrend that began in late November, with few signs of easing momentum. We see the initial resistance around $0.6800, a push above which would expose $0.6870.

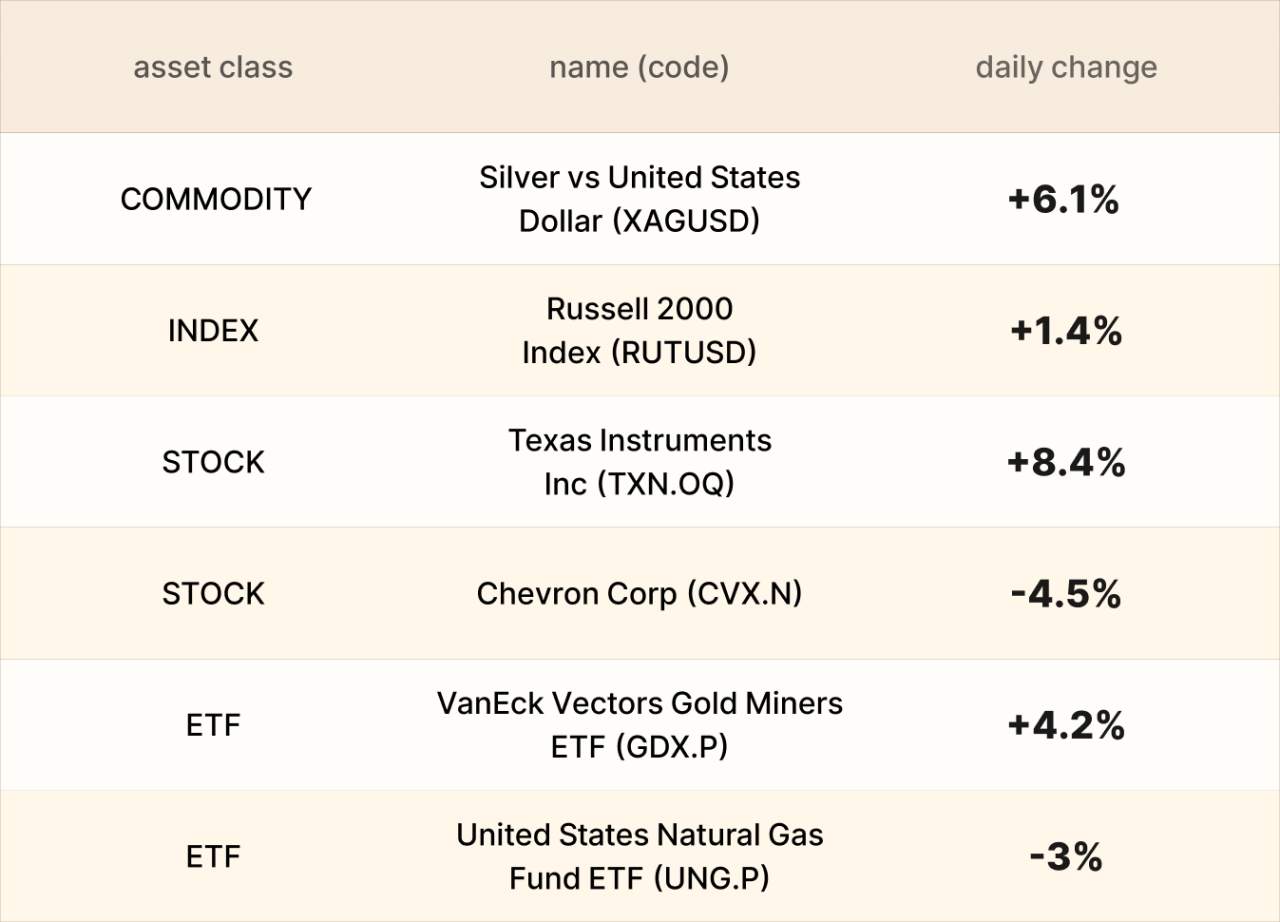

Asset recap

As of market close on 6 January, among EBC products, Texas Instruments shares led gains. The company is closely watched to assess demand for chips that go into factories and cars.

Chevron suffered its worst loss in months as the market got a reality check. More voices joined those cautioning that the road ahead for US oil companies in Venezuela could be difficult.

Gold is drawing bullish calls from major banks as conditions line up for fresh record highs. Morgan Stanley said in a note that prices could hit new heights this year and rise to $4,800 by Q4.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ