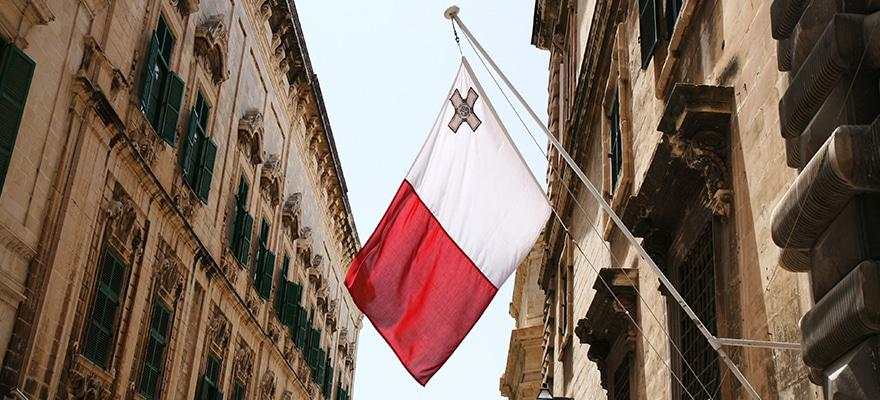

Nukkleus Inc, which controls FXDD Trading and FXMarkets brands, said its MFSA-regulated entity FXDD Malta Limited rebranded as Triton Capital Markets Ltd. (TCM). The listed company has also reported its financials for the fiscal year ending September 30, 2020.

Over this period, Nukkleus saw its trading revenue unchanged from a year ago, coming in at $19.2 million in the FY 2020, which came from support services rendered to Triton Capital, formerly known as FXDD Malta.

In terms of its net income, Nukkleus managed to mitigate its losses for the reported period to $100,562, compared to a net loss of $730,113 for the year ended September 30, 2019.

Though the company had incurred a 25 percent decrease in revenues due to the amendment of its agreement with FXDD Malta, the retail broker reduced services fees it currently pays to its controlled entity Forexware, which fell from $1.9 million per month to $1.57 million.

Nukkleus booked profit for the first time in several years in the three months ending June 30, 2020, albeit at a very modest level. During the same quarter, the company’s CEO, Emil Assentato has injected $1 million to maintain the ongoing operations of the business.

The transaction was made through the sale of 15 million common shares and 100,000 Series A preferred stocks to Currency Mountain Holdings Bermuda Limited (CMH), which is wholly-owned by Nukkleus, with the majority percentage owned by Mr. Assentato.

The operating costs were pointedly lower on a yearly basis, according to the company’s latest filing with the US Securities and Exchange Commission. The primary culprit for this has been the decrease in the number of Nukkleus’ employees.

On August 27, 2020, Nukkleus renamed Nukkleus Exchange Malta Ltd. to Markets Direct Technology Group Ltd (MDTG), which will manage the technology, software licenses and IP addresses behind the Markets Direct brand, operated by TCM. MDTG, which is expected to become operational in the Q1 2021 (Q2 of FY21), will then lease out the rights to use these names/brands licenses.

Looking at the rest of the filing, Nukkleus highlighted that it is currently seeking additional capital through private placements or public offerings of its securities. In addition, it may seek to secure funding through public or private debts to finance its business or any mergers or acquisitions in the future.

Để lại tin nhắn của bạn ngay bây giờ