USDINR 78.23 ▼0.15%.

EUR/USD 1.0555 ▲ 0.01%.

GBP/USD 1.2273 ▲ 0.09%.

India 10-Year Bond Yield 7.465 ▲ 0.28%.

US 10-Year Bond Yield 3.156 ▲ 1.04%.

ADXY 102.84 ▲0.07%.

Brent Oil 109.11 ▲ 0.01%.

Gold 1,836.85 ▲ 0.36%.

NIFTY 50 15,882.15 ▲ 1.17%.

Global developments

Leaders of G7 countries met in Germany yesterday to explore measures to stifle Russia by choking off its revenue from energy exports. Measures on the table included putting a cap on which countries can purchase crude from Russia, a ban on insuring ships that carry Russian crude, and putting sanctions on countries such as India and China that are purchasing discounted Russian crude.

Any of the above measures would further exacerbate inflation woes globally by pushing up energy prices and are therefore politically difficult to execute.

Russian missiles are targeting Kiev. This is a fresh attack on the Ukrainian capital.

With most global central banks tightening policy to rein in inflation, recessionary fears are taking hold. Copper prices have hit a 16-month low. Copper prices are considered to be a bellwether of global economic sentiment. In the US the Michigan consumer sentiment is at an all-time low. Average 30y fixed-year mortgage rates are at 5.81%, the highest since 2008. Eurozone PMIs that came out last week too was disappointing.

Price action across assets

Shorter-term bond yields have cooled off as recessionary concerns have become more pronounced. US 2y yield is down to 3.06%. The Dollar is steady. 1.0480 on the Euro and 1.2170 on the Sterling are critical supports. Asian currencies are stronger against the US Dollar. Asian equities are trading with gains of 0.5%-1.5%. Crude prices have inched higher with Brent now at USD 113 per barrel. Gold is hovering around USD 1834 per ounce.

German business sentiment clouds over but no sign of recession – Ifo.

Domestic developments

USD/INR

The rupee continues to remain under pressure as there is a cash Dollar shortage. While there is persistent cash Dollar demand from custodian banks and oil companies, the RBI is selling Dollars forward. We believe the RBI may have to change its intervention strategy at some point.

Month-end exporter selling may cap upside in USD/INR.

Tomorrow is the June exchange-traded currency derivative expiry. We are likely to see significant Dollar demand at RBI fix tomorrow.

Bonds and rates

G-sec auction on Friday had gone through smoothly with a cutoff on the 10y benchmark coming in at 7.43%. Bonds are likely to open flat.

Equities

Domestic equities had ended last week on a solid note with the Nifty gaining 0.9% to end at 15699 on Friday. IT stocks underperformed. Auto stocks continued to outperform on the decline in raw material prices.

Strategy

Exporters are advised to cover on upticks towards 78.50. Importers are suggested to cover through options. The 3M range for USDINR is 77.20-79.20 and the 6M range is 76.75–80.00.

BOJ focused on wages, yen at June meeting, no debate on tweaking yield cap.

FX outlook of the day

USD/INR (Spot: 78.23)

The Indian rupee continues to remain under pressure as there is a cash Dollar shortage. While there is persistent cash Dollar demand from custodian banks and oil companies, the RBI is selling Dollars forward. We believe the RBI may have to change its intervention strategy at some point. Month-end exporter selling may cap upside in USD/INR. Tomorrow is the June exchange-traded currency derivative expiry. We are likely to see significant Dollar demand at RBI fix tomorrow. Shorter-term bond yields have cooled off as recessionary concerns have become more pronounced. US 2y yield is down to 3.06%. The Dollar is steady. The USDINR is likely to open around 78.25 and trade in a 78.15-78.40 range with sideways price action. The focus will be on the US Core Durable Goods Orders data due later today.

EUR/USD (Spot: 1.0554)

EURUSD extends the weekly recovery towards 1.0600, trading around 1.0570 during Monday’s initial Asian session. The US New Home Sales for May jumped to10.7% whereas Michigan's Consumer Sentiment Index for June came in lower than expected. On the Euro side, Germany's Ifo data also came a tad soft against expectations and ECB Vice President Luis de Guindos said that it is possible to see negative growth in the euro area in 2023. With a focus on inflation from both the U.S. and EU. The EU is expected to remain at 3.8% but anything higher could trigger hawkish ECB bets and potentially push the euro higher. Until then, more of a rangebound consolidation type move from the EURUSD currency pair. The pair is expected to trade in the range of 1.0520 to 1.0620.

GBP/USD (Spot: 1.2273)

GBPUSD manages to begin the week’s trading on a positive side around 1.2280. Cable's latest gains have more to do with the US dollar weakness and the risk-on mood than the improved fundamentals relating to the UK. British Prime Minister Boris Johnson's government will press ahead with legislation to scrap rules on post-Brexit trade with Northern Ireland, setting up further clashes with the European Union. The Conservatives lost two parliamentary by-elections and the same exerted more pressure on UK PM Johnson to leave the position after the party gate scandal. “The by-election defeats suggest the broad voter appeal which helped Johnson win a large parliamentary majority in December 2019 may be fracturing after a scandal over illegal parties held at Downing Street during coronavirus lockdowns. On the data front, UK's retail sales data came in better than expected. The pair is expected to trade in the range of 1.2220 to 1.2320.

USD/JPY (Spot: 134.85)

USDJPY has witnessed selling pressure around 135.20 on weak DXY after Friday's mixed economic data from the US. Last week, the pair witnessed a downside move after failing to sustain near all-time-highs at 136.70. Despite the intentions of the Bank of Japan (BOJ) policymakers to support the ultra-loose monetary policy, the yen gained strength. IMF has revised down US 2022 GDP forecast to 2.9% against 3.7% earlier. On macro data, Today's US Durable Goods Orders will be watched out. The preliminary estimate of 0.1%, is significantly lower than the prior print of 0.5%. The pair is expected to trade in the range of 134.20 to 135.30.

NATO to pledge aid to Baltics and Ukraine, urge Turkey to let in Nordics.

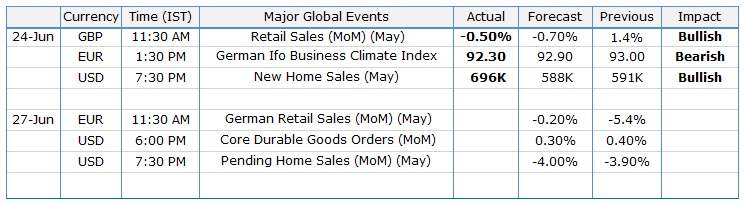

Economic calendar

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ