就职典礼日与特朗普交易

当选总统唐纳德·特朗普将于周一正式开始第二个任期。他的首次就职典礼标志着美元显著下跌的开始,此前特朗普第一次当选后美元曾经历过一轮强劲反弹。

与特朗普1.0时期类似,美元的特朗普交易吸引力主要源于以下几点:

(1) 作为避险货币,在投资者担忧关税政策时的避险需求;

(2) 由于关税和宽松财政政策引发对美国通胀和收益率上升的担忧,美元的收益吸引力;

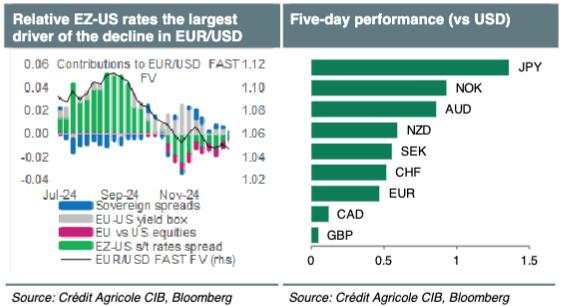

(3) 由于投资者预计监管放松和美国经济表现优异,美元资产的吸引力。我们的FAST FX模型显示,自11月以来,最显著的驱动因素是相对利率,其次是相对股市表现,特别是涉及EUR/USD。这些估值模型以及我们的仓位模型也表明,目前美元被高估并且过度买入。

特朗普似乎比首次就职时更具准备开始他的第二任期,他可能在第一天就准备好签署多达100项行政命令,涵盖移民、关税和能源政策。

本周,特朗普的关税策略引起了更多关注,有报道称他经济团队建议逐步提高关税,以减轻通胀负面影响,同时对贸易伙伴施加压力。这与特朗普提名的财政部长和经济顾问委员会主席,斯科特·贝森特(Scott Bessent)和斯蒂芬·米兰(Stephen Miran)的观点一致。实施这一政策可能会增强投资者的乐观情绪,提升美国以外的资产价值,并减少美国国债收益率上升的风险,可能导致长期美元特朗普交易的逆转。

尽管日本央行的再次加息可能会进一步削弱美元的收益吸引力,但日元的风险在于央行可能采取鸽派加息。加拿大元(CAD)将密切关注就职典礼日的额外关税威胁,以及加拿大的通胀和零售销售数据,以评估鸽派的加拿大央行是否继续对加元施加压力。

我们预计,1月挪威银行(Norges Bank)会议的结果将巩固其作为G10央行中较为鹰派的立场,并结合高能源价格,将支撑挪威克朗(NOK)对欧元(EUR)和瑞典克朗(SEK)的表现。

下周,焦点将集中在欧洲的初步1月PMI数据和最新的英国劳动市场数据。

We have revised our outlook for the EUR/USD following the US election, but we believe that many negative factors are already reflected in the price, and the pair appears to be oversold and undervalued. Our economists do not foresee a recession in the Eurozone and anticipate a terminal ECB rate of 2.25%, which is significantly higher than current expectations in the European rate market. Additionally, while recent political events in France and Germany have unsettled EUR investors, our rate strategists are not positioned for a repeat of the sovereign debt crisis from a decade ago and believe that many negatives are already accounted for. Moreover, we think that a potential reduction or even withdrawal of US support for Ukraine under President-elect Donald Trump could ultimately lead to the end of the war by 2025. This development could ease geopolitical risks in Europe, potentially enhancing domestic demand in the Eurozone. Furthermore, the conclusion of the Ukraine conflict could trigger a reconstruction boom in the country, serving as a tailwind for recovery in the Eurozone as well.

The USD strengthened following Donald Trump’s victory in the US presidential elections and the ‘red wave’ in Congress. The second Trump administration is expected to introduce additional fiscal stimulus and more aggressive trade policies, which could enhance the US growth outlook compared to its trading partners and make US inflation more persistent. We also anticipate that the Trump policy mix could shorten the Fed's easing cycle, but we believe this has already been factored into the rates markets, boosting the USD's appeal across the board.

More generally, we think that many positive factors are already priced into the USD, and we expect it to remain near recent highs but not surpass them on a sustained basis through 2025. While we cannot rule out further USD gains due to US tariffs, their timing and aggressiveness remain uncertain. In the long run, we also believe that a return to President Trump’s ‘Weak USD Doctrine’ and market concerns about the Fed’s independence could once again weigh on the USD as we approach 2026.

Increasing struggles in the Eurozone have driven safe-haven demand for the CHF, which may remain sought after until uncertainties are largely resolved. Assuming no lingering shocks, the CHF could then regain its status as a favored funding currency due to the potential return of near-zero interest rates and a high CHF valuation, while the SNB will closely monitor FX developments and Swiss disinflation.

Among the G10 currencies, the JPY was one of the least affected by tariffs during Trump’s first term. We expect the US-Japan rates spread to continue to narrow as the Fed cuts rates and the BoJ raises them further. This compression of the US-Japan spread will diminish the carry appeal of holding long USD/JPY positions, while the exchange rate’s volatility is likely to remain high due to uncertainty surrounding the Fed and BoJ rate paths, as well as Trump’s policy agenda, particularly regarding trade. Japan’s Ministry of Finance will also be prepared to intervene to support the JPY.

The recent decline of the GBP seems to reflect renewed concerns about the UK economic outlook, which, combined with rising government borrowing costs, could lead the Labour government to exceed its current fiscal deficit target, necessitating new austerity measures as early as March. However, we would not go so far as to say that FX investors no longer see the GBP as a higher-yielding, safe-haven alternative to the EUR.

We continue to expect that the political stability and relative economic performance of the UK compared to the Eurozone will sustain market expectations that the BoE will require a less aggressive easing cycle than the ECB to support growth. This ongoing dynamic makes us optimistic about the GBP versus the EUR for 2025 and 2026.

GBP/USD may continue to trade near its lows following the US election, but we anticipate a more robust recovery for this pair compared to EUR/USD in 2026.

Trump’s tariff threats have pushed USD/CAD to new highs above 1.40, but regardless of the incoming US administration's policy stance, risks to the CAD appear to be skewed to the downside in early 2025 due to a potentially widening BoC-Fed gap. However, the prospects of Canada outperforming the US in terms of growth could facilitate a gradual recovery for the CAD.

AUD/USD was weaker during Trump’s first term due to his tariffs on China and a declining Australian-US rates differential. We expect Trump to be open to negotiations regarding his China tariffs, which may end up being less than the 60% he promised during his campaign, thereby supporting AUD/USD. Additionally, AUD/USD will benefit from the RBA refraining from cutting rates while the Fed continues to lower its policy rate, with the RBA potentially missing this rate-cutting cycle altogether.

A declining NZ-US rate differential, China tariffs, and several periods of dry weather in New Zealand negatively impacted NZD/USD during Trump’s first term. We believe Trump’s China tariffs could be lower than the 60% he pledged during his election campaign, which will support NZD/USD, along with a stable NZ-US rate differential as the RBNZ matches Fed rate cuts in the coming year. La Nina and a rebound in New Zealand's growth will also support NZD/USD.

We adjust our XAU predictions based on current market conditions but maintain a downward trend in our forecasts for the majority of 2025. We anticipate a possible resurgence in gold prices in 2026 due to increasing market concerns regarding the independence of the Federal Reserve and the risk of fiscal dominance in the US.

Tải thất bại ()