China and the United States have agreed to a three-month pause in their trade conflict, providing markets with a dose of relief after a volatile stretch. As part of the deal, the U.S. has reduced tariffs on Chinese goods from 145% to 30%, while China has lowered its retaliatory tariffs to 10%. While either side made no long-term concessions, the agreement to resume negotiations was enough to spark a broad-based market rally.

The news helped extend an already powerful rebound in equities. The S&P 500 rose more than 3% on the day, capping a 22-day surge that now ranks among the largest post-1990 rallies. The move builds on momentum that began April 9, when President Trump first introduced a 90-day tariff reprieve for U.S. allies—excluding China at the time.

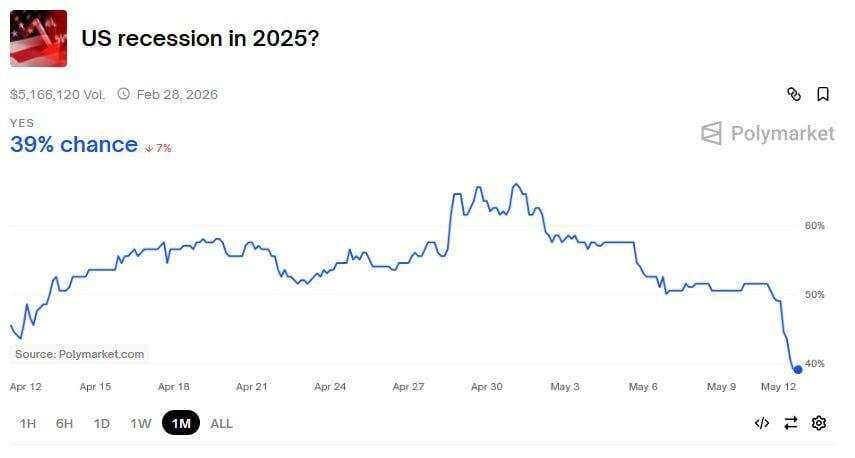

For investors, the rapid escalation in tariffs last month had triggered fears of a near-term U.S. recession. Many assumed that sustained tariffs at 145% would cause significant economic damage. However, sentiment has shifted sharply, with tariffs now significantly scaled back, and trade talks are back on the table. According to prediction markets like Polymarket, the odds of a U.S. recession in 2025 have fallen since the beginning of April.

While the current deal remains a temporary reprieve with no structural resolution in place, the market has interpreted the move as a signal that both sides are willing to de-escalate, at least in the short term. The focus now turns to the tone and progress of upcoming negotiations, with investors closely watching for signs of a more durable trade framework.

Forex

Today’s CPI print lands in a very different world than the one markets were bracing for just a week ago. The sharp de-escalation in U.S.-China tariffs over the weekend doesn’t just ease headline risk—it changes how the market processes inflation data. With tariff-related price pressures now seen as backward-looking, any CPI surprise—upside or downside—is likely to generate a more muted response.

In short, the CPI tape is running behind the policy narrative.

The upshot is that the bar for inflation data to influence rates has risen meaningfully. Even if today’s print shows signs of tariff pass-through, markets may look through it, knowing those pressures are already in retreat. Meanwhile, softer inflation may simply reinforce that tariffs didn’t hit as hard—or haven’t hit yet—making it harder to draw conclusions from a single data point.

Against this backdrop, most economic baselines have shifted. The rationale for Fed rate cuts is evolving from “insurance” against downside risks to a slower, more measured “normalization” path. Growth has shown modest improvement, the labor market is loosening only gradually, and overall macro conditions no longer scream urgency.

As a result, the timing and cadence of expected Fed cuts are sliding. July is likely off the table. December looks more plausible, with rate cuts coming at every other meeting rather than in a rapid-fire sequence.

The bottom line is that CPI still matters, but the policy gears have moved. The tariff unwind has dulled the market’s sensitivity to near-term inflation noise, while the Fed’s calculus is increasingly anchored in a world of stabilization, not rescue.

With trade tensions easing and CPI coming in under the glare of a shifting policy backdrop, all eyes now turn to the next pivot: the U.S. dollar. The question is whether it remains hostage to political dysfunction in Washington—or finds new legs via a resurgence in U.S. exceptionalism, powered once again by tech market dominance.

The landscape is changing fast. The tariff rollback has taken one major bearish tail risk off the table. And now, the market is watching whether the dollar can break out of its odd negative correlation with volatility and risk aversion—and instead ride the coattails of a rebound in U.S. equity leadership.

The reawakening of the “Magnificent Seven” tech stocks could be the key. Bloomberg’s index tracking these megacaps has reclaimed its 200-day moving average, both outright and relative to the broader U.S. market. That’s not just a technical win—it’s a narrative shift. These names were pummeled during the tariff selloff, but with trade fears dialed down and real yields ticking higher, they’re now leading again, potentially rekindling the U.S. growth premium story that drove the dollar higher in previous cycles.

But there’s a twist: for the dollar to stay bid, the move needs to come with stable yields and controlled inflation. A tech-led rally with cooling price pressure and a patient Fed is the sweet spot. Too much rate compression, and the dollar fades. Too much inflation, and we’re back to fearing Fed hawkishness that could choke the rebound.

For now, DXY is caught in a push-pull. On one hand, the Fed is leaning toward normalization—not panic easing—which keeps rate differentials mildly dollar-supportive. On the other, the political baggage out of Washington—from budget uncertainty to God knows what’s next —still casts a shadow.

If the Magnificent Seven holds the line and macro data stabilizes, the dollar could decouple from the political noise and reassert itself as a growth-adjusted safe haven. But it's walking a fine line. The market is no longer chasing dollar strength—but it isn’t ready to short U.S. exceptionalism at this point either. The next leg will be defined not by fear, but by leadership, and right now, that’s quietly shifting back toward the U.S. again.

The view

I'm now considering tactical trades rather than committing to any big-picture USD position. It’s way too early to make a full meal out of the dollar losing a chunk of its self-induced, tariff-driven negative risk premium. Sure, the rollback helps, but I think a smarter play is to take a breath, trade what’s in front of me, and hopefully back into a trade.

Heading into today’s CPI print, the macro mood has thawed. Risk sentiment has firmed, real yields are ticking higher, and the doom loop around the U.S. economy has been interrupted by better-than-feared growth data and a trade policy pivot—namely, tariff rollbacks with China and a UK deal that’s removed some geopolitical weight off the dollar’s shoulders.

The dollar has benefitted from this recalibration, and there’s still some room for further upside if the CPI delivers a hot-enough surprise. But zoom out, and the risk-reward on staying overweight USD isn’t what it used to be. Yields may be holding up for now, but the bias remains for lower rates down the road. Plus, the positive correlation between the S&P and the dollar—particularly in G10 FX—has diluted the dollar’s role as a portfolio hedge. That dynamic reduces its appeal in multi-asset positioning.

Today’s CPI is a tricky one. There are two key questions:

- How much of the recent tariffs passed through in April?

- Will markets look through an upside surprise given that tariffs have since been rolled back?

The policy backdrop has shifted enough that markets are no longer primed to panic over a hot number. A week ago, an upside surprise would have been interpreted as evidence of front-loaded inflation. But now, a hotter CPI might be seen as rearview mirror noise—reflecting policies that are already being reversed. In that sense, downside surprises could be even more discounted. The bar for CPI to actually change market direction has moved higher.

Tactically, long JPY remains a smart hedge against any CPI-induced risk-off wobble. For traders looking to lean defensive without going fully bearish on USD, short AUD/JPY offers a cleaner way to express caution—less painful in a dollar rally, more sensitive to equity downside. With the Fed now expected to wait until December to start cutting, expressions that price out near-term easing still make sense, especially if inflation doesn’t roll over cleanly.

In short: The Dollar still has a near-term glide path, but it’s narrowing. If it surprises, CPI might extend that path, but the structural setup now favours selective FX positioning over broad USD overweight for the next few days.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()