As President Trump softens his approach to tariffs, markets should start paying more attention to the supply pressures in Bund markets. Our analysis suggests that foreign investors can play an important role in absorbing the hike in Bund issuance on the back of German spending plans. This should limit the upward pressure on 10Y Bund yields versus swaps.

Germany's spending plans could result in an additional €1tr in Bund issuance

With Trump’s tariff threats softening, markets can look at the bigger picture again, bringing us back to Germany’s ambition to spend, spend, spend. The supply of Bunds in the market should continue to increase, building on the significant increase seen in recent years. Germany’s spending plans may lead to an additional €1tr of issuance over the next decade, which represents an increase of 50% on top of the current outstanding amount of around €1.9tr in Bunds.

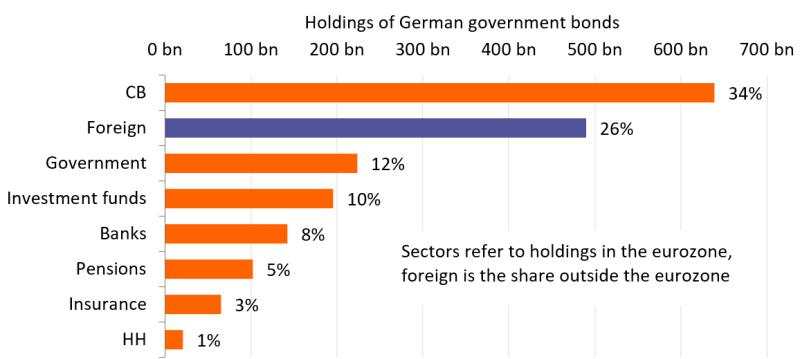

These are big numbers, but our analysis suggests that strong demand for Bunds from foreign investors can mitigate the upward pressure on yields. Foreign investors, those outside the eurozone, accounted for 26% of Bund holdings at the end of 2024, about the same share as the holdings of the entire financial sector in the eurozone. Compared to many other countries, Germany does not rely on domestic demand to absorb the increased supply. Italy, for example, is strongly dependent on the domestic banking sector and retail investors for buying its government debt.

Foreign investors play an important role in Bund markets

Source: ING, ECB

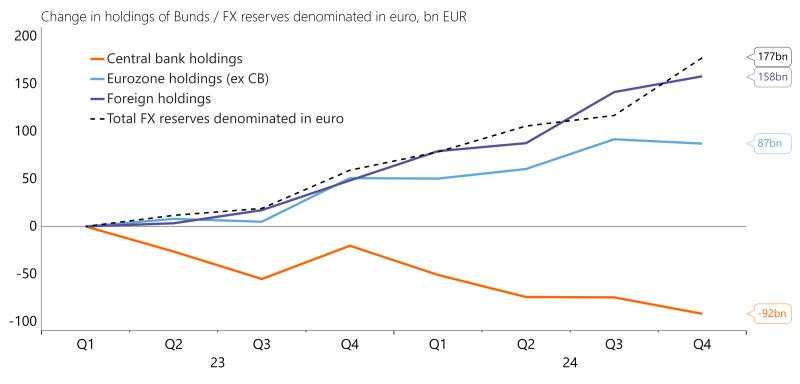

More importantly, the role played by foreign investors is growing. Since the start of quantitative tightening by the European Central Bank, foreign investors have increased their holdings by around €240bn. A rise in Bund issuance of €100bn per year on the back of increased infrastructure and defence spending may therefore meet sufficient demand from outside the eurozone.

Foreign investors have easily absorbed the increased Bund supply since QT

Source: ING, ECB, IMF, Macrobond

An important factor in the Bund’s popularity among foreign investors relates to its safe asset characteristics. FX reserve managers, for instance, are often guided by mandates that limit the investible universe to the highest credit quality. As the chart above shows, the holdings of euro-denominated assets by global FX reserves rose by around €180bn over the same period, which is similar in magnitude to the change in the foreign holdings of Bunds. In an earlier note, we indicated that by historical standards, EUR-denominated assets are still underallocated by up to €450bn. The de-dollarisation theme could help swing the balance in favour of the euro.

A review of foreign ownership of eurozone government bonds confirms that those with high credit ratings are particularly popular. Greece, Italy, and Spain have around half the foreign interest compared to the AAA-rated countries. France is an outlier here, but this can be explained by the size of the market and the high liquidity it provides on the back of an OAT futures market. A healthy futures market makes risk management around the holding of OATs easier.

Foreign investors are particularly interested in higher-rated government bonds

Source: ING, ECB, S&P

We anticipate strong demand for Bunds from the foreign private sector, particularly as the dominant role of US Treasuries as a safe asset has recently become more fragile.

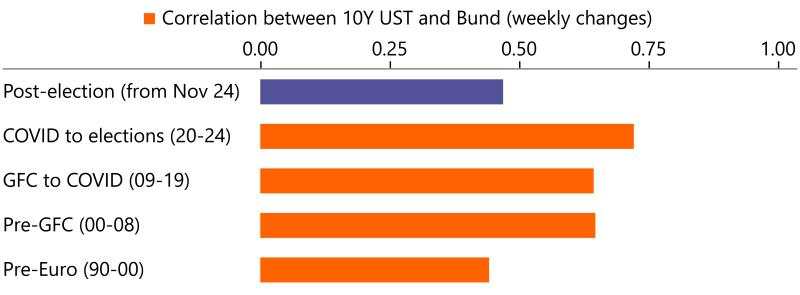

In the aftermath of Liberation Day, USTs and equities sold off together, which defeats the purpose of holding government bonds in a diversified portfolio. Bunds, on the other hand, saw yields dropping and strongly outperformed swaps. On top of that, the correlation between USTs and Bunds has declined since Trump’s election, falling back to the pre-euro era, adding to the diversification benefits of holding Bunds in an international portfolio.

The breakdown of US correlations enhances the Bund as a portfolio diversifier

Source: ING, Macrobond

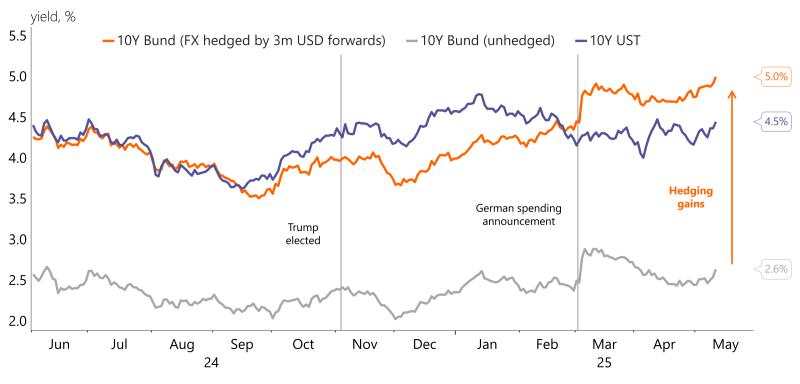

Whilst the 10Y Bund yield seems low at face value compared to USTs, Bunds can look more attractive when accounting for FX hedging costs. For USD-denominated investors, rolling over 3-month hedges adds around 2.4% to the carry on an annualised basis. Even though this benefit is expected to reduce as the Federal Reserve continues cutting rates later this summer, the 50bp in excess above USTs provides a decent buffer.

On an FX-hedged basis, Bunds offer attractive yields to USD-denominated investors

Source: ING, Macrobond

Read the original analysis: Foreign investors key to absorbing Bund supply

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Để lại tin nhắn của bạn ngay bây giờ