Outlook

We get a ton of data today and tomorrow but little of it will move any needles—jobless claims, three regional Fed surveys, import prices, and perhaps interesting, the Michigan U preliminary consumer survey for May. Retail sales later today are important but again, the numbers may be distorted by buying-to-hoard and beat the tariffs. We also get a late-day speech by Fed chief Powell, but it’s silly to expect anything fresh.

Everyone is as confused as all get out. A big distraction is the budget and it will take a few more weeks before we see it. That doesn’t stop the fretting that it will be a huge deficit and that means the Treasury will have to fund it with more issuance at a time it’s not clear the usual buyers are in the mood. To be fair, the auctions last week were well-attended and foreigners did buy, but analysts still suspect big selling is on its way.

The core of the plan is to renew the tax cuts from Trump One that expire soon. The “cost is $3.72 trillion over the next decade on top of the nation's already record $36.2 trillion debt,” Reuters reports. Then there’s the massive cuts to welfare and if Musk got his way, the /defense department. It’s a mess. Even the bipartisan budget office sees the deficit at over 100% of GDP this year (for the first time since WW II). It will be 120% in ten years. Historically, this marks the downfall of an economy (and a reserve currency).

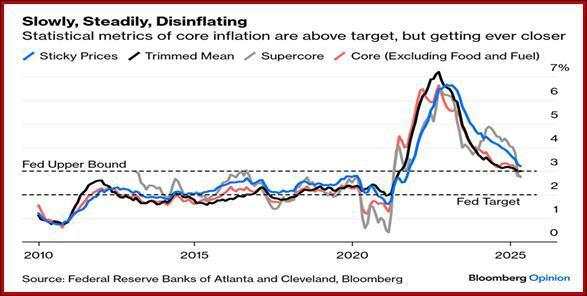

Inflation data was as expected but got a favorable report card anyway, indicating people see what they want to see even if it’s fairies in the garden. See the riff on inflation below in Tidbits. Implications include slowdown rather than recession and Fed cutting earlier than Sept-Oct, although it may not because it’s waiting for that post-tariff inflation that may not come.

The big problem is not the macro data and whether we should project any of it, but rather the uncertainty being driven into our heads like railroad spikes by Trump.

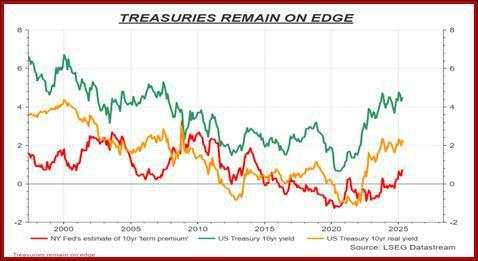

If we should expect a more stable set of conditions—less inflation, slowing but no recession—shouldn’t yields fall? Falling yields vis-à-vis other big issuers (the UK comes to mind) favors those currencies. See below. We are getting higher yields, not lower ones.

Ah, but wait, there’s more. The global strategist for BCA Research told an analyst that “celebrating eased levies on China could unfold like Jaws ‘where the inhabitants of Amity Island sigh in relief after they catch a great white shark, only to realize that a much bigger one is still stalking beachgoers. Tariffs are the small shark; a fiscal crisis is the bigger one.’”

We have to keep saying that for decades, since Gingrich closed the government over the budget during the Clinton years, scaredy-cats say “This is it! Too much debt! The dollar has to fall!” But then it never does, or not for that reason. Will it be different this time? We won’t have the actual budget and deficit for weeks. What if it’s not that bad? It would be an irony for the ages if a not-bad budget/deficit drove the dollar up.

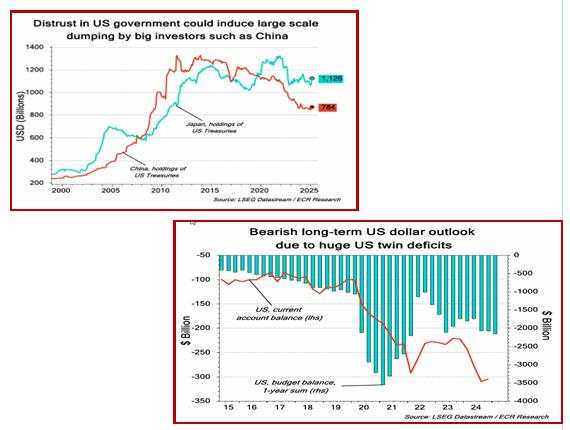

Still, foreign trust in the US and confidence in management is falling. It’s taken as a given now that foreigners will continue to remove their investment in Treasuries. See the chart. This is due not just to Trump’s bad behavior but to the real and growing current and federal deficits. A less-bad increase on the fiscal side, even if we were to get such an unlikely outcome, will not change enough to change sentiment.

A final chart, this time from the BoA managers survey. It shows “Exposure to the US dollar fell to a 19-year low in May…net 17% of FMS investors are underweight the US dollar.” Another chart, not copied here, shows “… investors are the most overweight Eurozone vs US equities since Oct ’17.”

Kind of fun but not necessarily relevant: they are exceptionally long gold (now the most “crowded” trade), the Big Seven, Tech, and the Nasdaq, among others.

Forecast

Yields keep rising. See the chart from Reuters. This reflects the rising risk premium required by investors in the face of probably rising inflation, a rising deficit, and general dislike of everything the US government is doing these days. We expect the correlation to be higher yields, higher dollar, but not this time.

Apparently, the round number 5% in the 10-year is some kind of tipping point in the collective bond market mind. The dollar “should” retreat some more unless Trump has another big ace in his hand like the 90-day tariff pause. What could it be? And as long as the dollar is soft, which he likes, why would he show the card?

Tidbit: Is it remotely possible that the disinflation already in progress is robust enough to overcome the tariff-induced inflation that everyone says is sure to come? Some speak of a soft landing after all. See the chart from Bloomberg.

We keep pointing out that “We are going to get inflation and everyone knows it.” Well, everyone can be wrong, as every economist knows to his rue. Let’s say shelter and food keep falling and the inflation that would normally be inherent in imported prices is less than imagined—and plenty of stats folks have been pumping out estimates for everything from rubber bands to jet planes.

They are using the full face-amount of the tariffs to project future inflation. But it's not nuts to imagine that foreign suppliers and US importers will eat some of the tariffs in order to maintain relationships and market share.

Shelter rent is little affected by tariffs, even if new construction may be, down the road (cement from Mexico and lumber from Canada). The US is self-sufficient in food, although we do like fruit *and veggies from overseas, not to mention Irish butter, real Parm from Italy and French wine. But we can live without them—for a while. Coffee is a different matter—it’s an imperative. Even so, while the price of coffee rose from $206.42 a year ago on May 24 to $449.75 in Feb, it’s down to $373.68 as of yesterday and likely to fall further on good harvest news from Brazil--but not all the way to the price last year.

And eggs are down, finally, if still about $5-6/dozen from under $3 pre-pandemic. We think it’s funny that the St. Louis Fed tracks the price of eggs.

Not that imported food is a big part of anyone’s spending, but it almost doesn’t matter—people see the price of eggs and coffee, and project that inflation onto everything. This means, probably, that the next sentiment surveys are not going to show relaxation of inflation fear, meaning we will still have bingeing and hoarding for some time to come.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()