The pickup in repo versus fall-off in bills is likely to persist as the debt ceiling remains unresolved, and market repo remains attractive relative to the Federal Reserve's reverse rate. We like terming out here ahead of cuts.

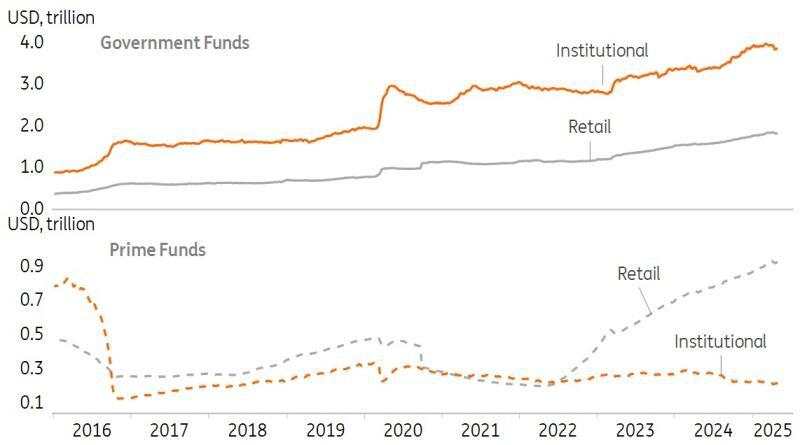

Inflows into money market funds have stalled since 'Liberation Day', particularly for institutions, which have seen moderate falls. Liquidation here likely reflected a dash to cash out for some players, especially as material angst played out as a theme in the risk asset space. There's been some stabilisation since. As a percentage of GDP, they remain comfortably over 23%, not far off the prior high of 27% in 2009.

Money market funds - Institututional vs Retail

Government Funds compared with Prime Funds

Source: Macrobond, ING estimates

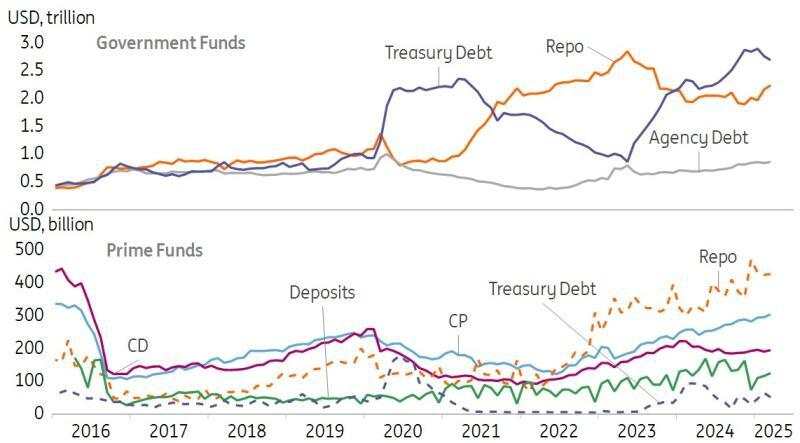

In terms of portfolio breakdown - take a look at the chart below - Government Funds had been seeing an ongoing rise in holdings of Treasury Debt (effectively bills). In the wider market setting, bills represent some 22% of overall government debt financing, up from the 15% area in 2022/23, implying that extra bill issuance is being employed to take pressure off coupon issuance.

For now, the high net bills issuance environment remains in play. However, as we get deeper into debt ceiling control measures, there will be more pressure to reduce net bill issuance, which can add a premium to prices. That can result in more cash moving back into repo. That, in fact, has been the play in recent months, with repo exposure rising at the expense of bill holdings. Expect this theme to continue in the months ahead.

In Prime Funds, repo (reflecting equity repo) exposures have come off prior highs. Exposure to commercial paper (CP) has been gradually rising, while certificates of deposit (CD) and ordinary deposits have been steadier to a tad lower.

Money market funds – Breakout of investments

Government Funds compared with Prime Funds

Source: Macrobond, ING estimates

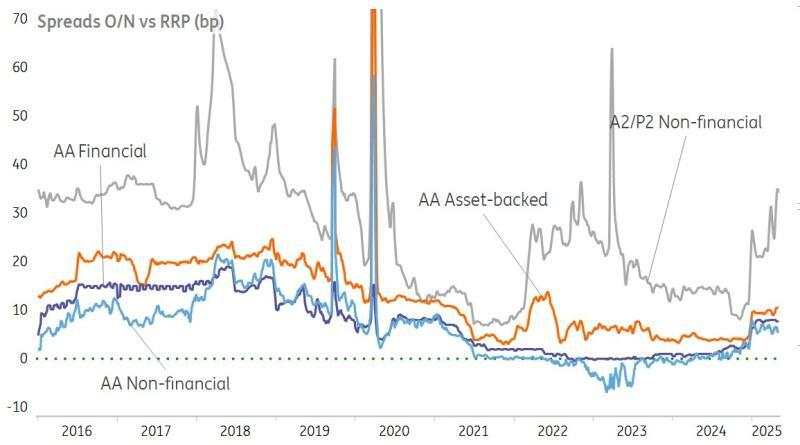

Commercial paper rates still elevated versus the Fed's reverse repo rate

In terms of attainable rates, the entire spectrum of overnight commercial paper rates remains comfortably above the Fed’s reverse repo rate, following the move down 5bp to the funds rate floor since the December FOMC meeting. This reduces the attractiveness of the Fed’s reverse repo facility, and should continue to increase the relative attractiveness of market repo.

At the same time, CP spreads are not yet quite as wide as they were during the pre-pandemic years, but they are edging towards these types of levels, as shown in the chart below. A larger concession has been built into A2/P2 rates, as we show in the chart above.

Commercial paper versus the Fed's reverse repo rate

Source: Macrobond, ING estimates

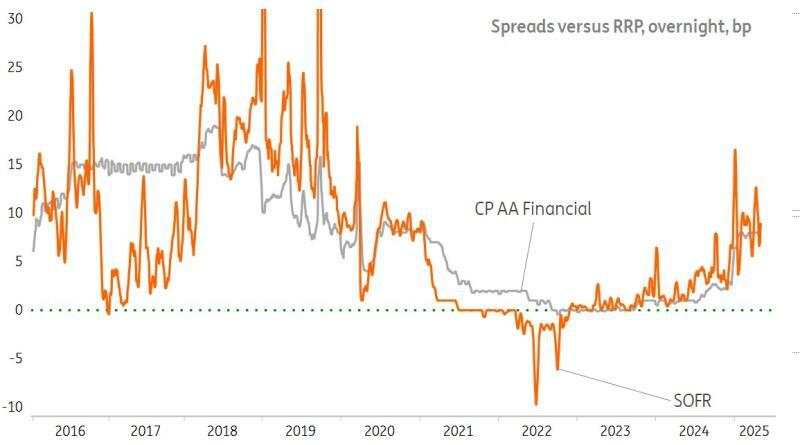

Repo is likely to continue to prove more attractive in the future. The relevance of the Fed’s reverse repo facility has been downsized significantly from a relative value perspective, as better repo terms are now typically attainable on the private market (chart above).

The reverse repo window will continue to be accessed primarily around quarter (and month) ends, as counterparties turn to the Fed’s facility to bridge liquidity gaps driven by regulatory window dressing requirements.

General collateral versus the Fed reverse repo facility, and financial commercial paper

Source: Macrobond, ING estimates

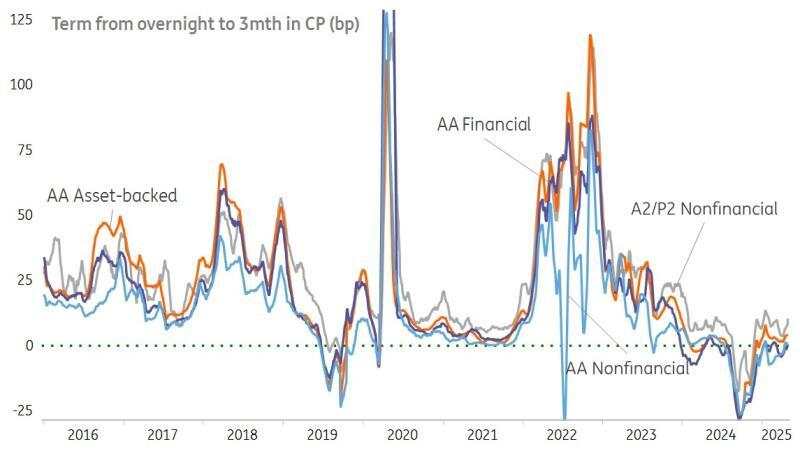

Term in commercial paper – still quite tame

With the Fed still technically in cutting mode, terms will tend to be contained. While we'll need to get to the end of the rate-cutting cycle with some degree of certainty before terms can really open up, there is still value in terming out as a means of locking in current rate levels. This will prove to be a good play should the Fed cut rates later in the year.

Three-month AA financial commercial paper is trading broadly flat to a few basis points above overnight rates. In the A2/P2 non-financial and AA-asset backed, the evolution of some terms is a tad wider.

Overnight to 3-month term in commercial paper

Source: Macrobond, ING estimates

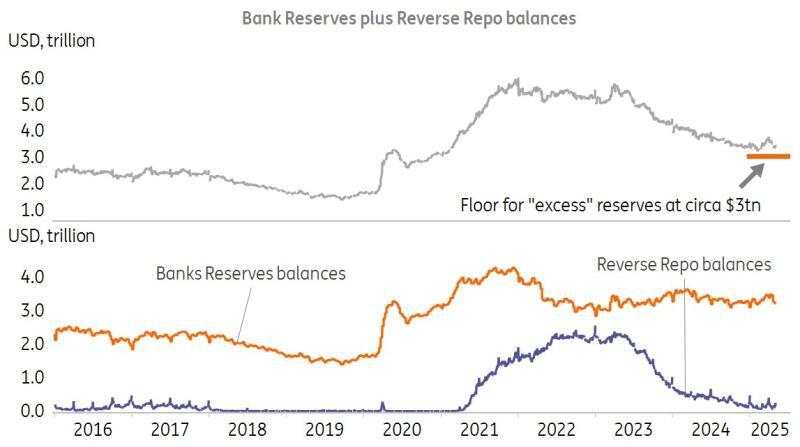

Bank reserves are ample, party on debt ceiling complications

From here, reductions in excess liquidity due to quantitative tightening (QT) are more likely to be felt through falls in bank reserves. The Fed needs to be careful here, as in 2019, the QT process pushed bank reserves down to the US$1.5 trillion area, which caused some severe tightness. Back then, the value of US GDP was around $20tr. So, bank reserves hit around 7.5% of GDP. The thinking ahead is that this needs to be closer to 10% of GDP. With the value of US GDP running at around $30tr, that implies a floor for bank reserves at around $3tr.

Currently, bank reserves are running at some $3.3tr. Adding the cushion of almost $100bn at the Fed’s reverse repo facility, there is an overall "excess" liquidity balance of some $3.4tr. Meanwhile, QT is running at around $60bn per month and acts to reduce excess liquidity at that pace. Based on this, within the coming half year, the $3tr bank reserves floor will be hit. Consequently, the Fed will likely bring its QT programme to a halt by the middle of the year.

Bank reserves still ample, but will ultimately slip to $3tn this year

Source: Macrobond, ING estimates

Read the original analysis: US Money Markets: Terming out looks sensible here

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()