Currency fundamental strength snapshot (week 21, 2025)

Here's a quick guide to the anticipated fundamental strength and influences for major currencies in the upcoming week:

- Japanese Yen (JPY): Moderately Strong Strength / Moderately Bullish Influence.

- Swiss Franc (CHF): Moderately Strong Strength / Moderately Bullish Influence.

- Euro (EUR): Neutral Strength / Neutral Influence.

- Australian Dollar (AUD): Neutral Strength / Neutral Influence.

- US Dollar (USD): Neutral Strength / Moderately Bearish Influence.

- New Zealand Dollar (NZD): Moderately Weak Strength / Moderately Bearish Influence.

- British Pound (GBP): Moderately Weak Strength / Moderately Bearish Influence.

- Canadian Dollar (CAD): Moderately Weak Strength / Moderately Bearish Influence.

Japanese Yen (JPY)

The Japanese Yen looks pretty good for this week. Further out, by June 2025, its basic prospects aren't as strong, but it could still go up, especially if the Bank of Japan hints at stricter policies than expected.

Recently, the Yen has often been a safe bet. It got stronger when US-China trade tensions peaked in April and early May, despite Japan's own mixed economic news. The Bank of Japan has been cautious all along due to global trade risks, alongside worries about rising prices at home.

In just the last week, the Yen gained ground even though Japan's economy shrank in the first quarter. This highlights its appeal when new US economic concerns pop up. The Bank of Japan is being careful about rate hikes due to possible US tariffs, and people are waiting for details in June on how they'll reduce bond buying.

Swiss Franc (CHF)

The Swiss Franc is looking quite strong for the week ahead, with a good chance of rising. Looking further out to June 2025, its outlook is more neutral. However, its usual safe-haven appeal could be put to the test if the global scene stays calm for a good stretch.

Over the past seven weeks, the Franc has really been a safe bet, getting stronger when global trade tensions and US policy worries peaked in April and early May. The Swiss National Bank's rate cut back in March was pretty much offset by all the money pouring in. In the last week, the Franc got another boost from increased global jitters after the US credit downgrade. Switzerland also reported solid Q1 numbers for its industry and economic growth. Still, falling gold prices, which often move with the Franc, might hold it back a bit.

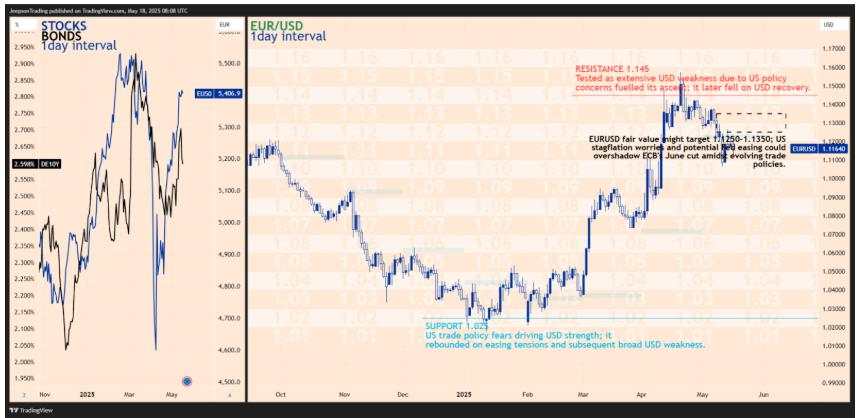

Euro (EUR)

The Euro looks like it'll be pretty neutral this week. Looking ahead to June 2025, though, it could get a bit stronger. That's mostly because the European Central Bank (ECB) might not be so quick to lower interest rates again after the expected June cut, especially if core inflation really sticks around.

Over the last seven weeks, the Euro's price has been a bit of a seesaw. On one hand, there was good economic news from the region, like solid growth in the first quarter and strong trade figures. On the other, the ECB has been pretty clear about planning to make borrowing cheaper. They cut rates back in April, and another one is pretty much expected for June. But, that sticky core inflation is making people wonder what comes next. The US-China trade situation has also played a part.

Just last week, the Eurozone announced a record trade surplus for March, and overall inflation in April was stable. However, core inflation did nudge up. ECB folks are saying a June rate cut is probably on the cards, but they've also hinted they might take a break from cutting after that.

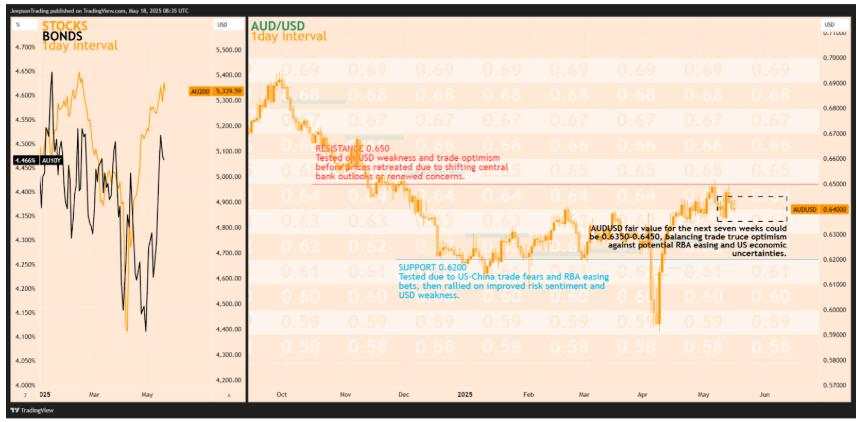

Australian Dollar (AUD)

Looks like the Aussie Dollar is set to be pretty steady this coming week, and that's expected to carry on through June 2025. It probably won't make any big leaps because even though Australia's job numbers are strong, there are still worries about China buying fewer resources and the chance the Reserve Bank of Australia (RBA) might cut interest rates.

Over the last seven weeks, the Australian Dollar has been on a bit of a rollercoaster. This was mostly down to changing global moods, news on US-China trade, guesses about Australian interest rates, and how China's economy was doing. Good iron ore prices gave it a lift in April, but concerns about Chinese demand and RBA rate cuts often stopped it from going too high. Just last week, the AUD initially went up with some good trade news from China but then fell back as the US Dollar got stronger. Also, a solid Aussie jobs report for April means people are now thinking the RBA won't cut rates as sharply as they first thought.

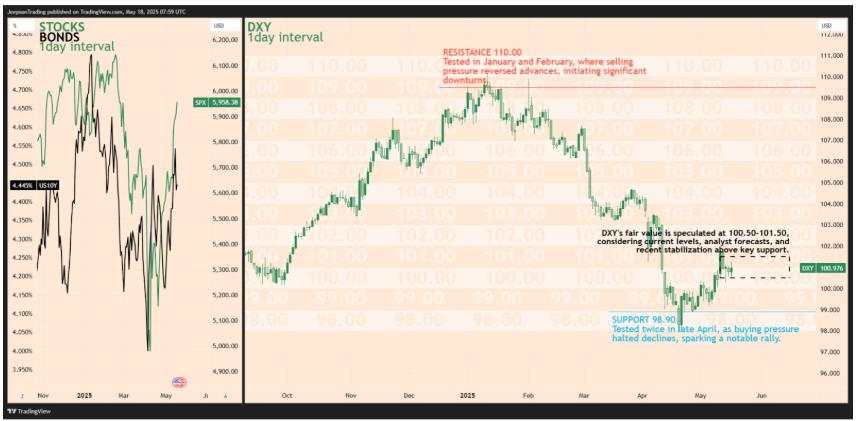

US Dollar (USD)

The US Dollar's looking a bit neutral heading into the week, but there's a definite downward nudge. This bearish sentiment could last well into June 2025, mostly thanks to worries about stagflation (slow growth, high prices) after Moody's cut the US credit rating, plus expectations the Fed will lower interest rates.

It's been a bumpy seven weeks for the Dollar. April was a rollercoaster, with bad US economic news like a shrinking Q1 GDP sparking recession fears and big bets on Fed rate cuts, which really hit the Dollar at times. Some good news on US-China trade and strong April job numbers helped it recover a bit. But this past week, that recovery stalled. A US-China trade truce offered a quick boost, but economic anxieties returned fast, especially with Moody's downgrade and much lower consumer confidence in May. So now, most expect the Fed to step in again.

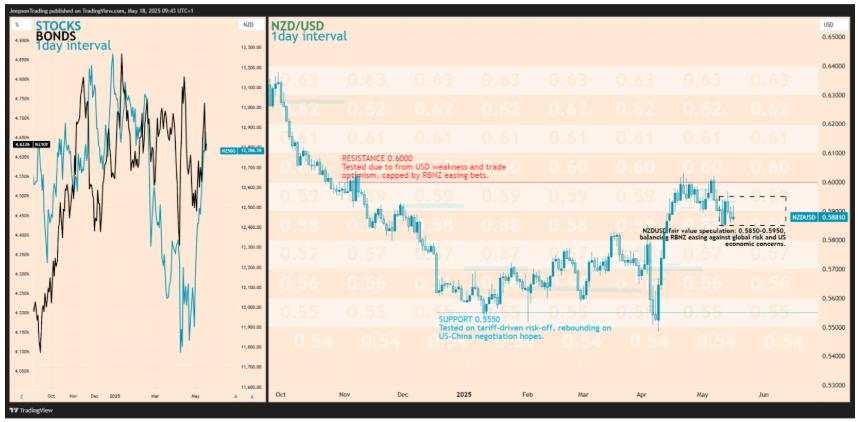

New Zealand Dollar (NZD)

The New Zealand Dollar (NZD) will likely face some downward pressure this week and into June 2025. This is mainly due to the RBNZ's expected low-interest-rate policy and a weak domestic economy, despite its own surveys showing rising inflation expectations.

Lately, the NZD has been swayed by global market mood, RBNZ rate forecasts, and dairy price changes. It saw gains in April with a weaker US dollar, but RBNZ rate cut expectations often capped it. US tariff worries also held it back.

Last week, the Kiwi first rose on US-China trade optimism, then fell as the US Dollar gained. While April's Business NZ PMI showed growth, many still expect an RBNZ rate cut because the wider economy remains soft.

British Pound (GBP)

The British Pound looks set to be a bit weak, with a bearish tilt heading into next week. This downward trend could stick around until June 2025, depending on how the Bank of England manages slowing wage growth and if any US trade concerns pop up again.

The Pound's had a pretty bumpy ride over the last seven weeks. It held up well in April, partly thanks to a weaker US Dollar. But then things shifted: expectations that the Bank of England might ease its policy, driven by worries about UK trade weaknesses, pulled the Pound down later that month. And while March brought strong retail sales, consumer confidence really took a dive.

Last week, the Pound still fell despite good Q1 GDP numbers. It seems wider market forces, like a stronger US Dollar, were pushing it down. So now, all eyes are on the upcoming UK inflation and retail sales figures.

Canadian Dollar (CAD)

The Canadian Dollar isn't looking too strong for the week ahead and will likely be under some downward pressure. This trend will probably stick around until June 2025. That's mainly because the Bank of Canada might ease up on interest rates, and people are still worried about manufacturing. Higher oil prices might offer a bit of help, though.

Over the last seven weeks, the Canadian Dollar has had a tough time. A lot of this was due to US trade policy, economic news from Canada, and oil prices bouncing around. Canada did get some breaks from US tariffs, but worries about important areas like the car industry made people nervous. Then, bad economic news in April, like terrible business surveys and job losses in March, made it even more likely the Bank of Canada would cut rates.

Just in the past week, the Canadian Dollar lost ground against a strong US Dollar, even though oil prices went up. Weak Canadian job numbers and the growing gap between Canadian and US interest rates kept pushing it down.

Conclusion and key upcoming events

This week, what's happening with the US economy will be a big deal for currency markets, especially after that Moody's downgrade. Keep an eye on US numbers like business activity (PMIs) and housing stats – they’ll really set the mood.

At the same time, central banks around the world are doing different things with interest rates, which will open up trading chances. The Australian central bank's rate decision, plus inflation numbers from the UK, Canada, and Japan, are likely to make those currencies move.

So, if you're trading forex, make sure to stay on top of this data and anything new central banks say. It's all about what these things mean for economic growth and where interest rates might be headed.

Top five events to watch (May 19 - May 23, 2025):

May 20: Reserve Bank of Australia Interest Rate Decision & Meeting Minutes. This event is pivotal for the Australian Dollar. Any deviation from the market's current expectations for the RBA's policy stance or a significant change in its forward guidance could trigger substantial volatility in AUD pairs.

May 21: United Kingdom Consumer Price Index (CPI) for April. A critical release for the British Pound. A higher-than-expected inflation reading could temper expectations for Bank of England rate cuts, thereby supporting Sterling. Conversely, a softer figure could intensify bearish sentiment.

May 22: Flash S&P Global PMIs for US, Eurozone, UK, Japan, Australia. These Purchasing Managers' Indexes are timely indicators of economic health and momentum across major economies. The US PMI figures will be particularly scrutinized for any signs of economic slowdown following the recent credit downgrade, which would impact the US Dollar and broader risk sentiment. The EUR, GBP, JPY, and AUD will also react to their respective regional PMI data.

May 22: New Zealand Budget 2025. This is a major domestic event for the New Zealand Dollar. The government's fiscal policy announcements, economic growth forecasts, and spending plans will heavily influence the currency's direction.

May 23: Japan National Consumer Price Index (CPI) for April. Crucial for the Japanese Yen and the Bank of Japan's policy assessment. Persistently high inflation could increase pressure on the BoJ to adjust its stance despite ongoing concerns about economic growth, while a softer reading might reinforce the central bank's cautious approach.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ thể hiện quan điểm của tác giả hoặc khách mời. Nó không đại diện cho bất kỳ quan điểm hoặc vị trí nào của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của nó, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm pháp lý nào trừ khi được cam kết bằng văn bản.

Trang web cộng đồng giao dịch FOLLOWME: www.followme.asia

Tải thất bại ()