滞胀对冲

美国总统唐纳德·特朗普在关税问题上的前后矛盾立场加剧了第二季度外汇波动,促使我们进一步下调了对美元的预测。我们已将欧元/美元汇率预测调整至第二季度的1.12,到2025年底的1.14。同样,我们也将美元/日元汇率预测下调至第二季度的144,到2025年底的142。虽然投资者正在分散美元的投资组合,但他们并未完全放弃美元。我们认为,有关美元失去全球储备货币地位的猜测被严重夸大了。旨在削弱美元的海湖庄园协议将对美国产生反作用,因为它将推高美国国债收益率并提高借贷成本,从而加剧人们对财政可持续性的担忧。

预计多元化资金流出美元的趋势将持续,但速度将有所放缓,因为美元的主要损失已经发生。投资者对特朗普能否在国会获得财政刺激方案的质疑日益加深,尤其是在近期美国主权评级被下调之后。此类法案的通过可能会加剧人们对财政可持续性的担忧。然而,声称美国正面临“利兹·特拉斯时刻”的说法言过其实。在90天内完成100多项贸易协议的雄心勃勃的目标蕴含着巨大的风险,而互惠关税的再次出现则加剧了滞胀的隐患。此外,美国经济增长正在恢复正常,在经历了一段时间的优异表现后,已回落至与其他十国集团经济体的水平。

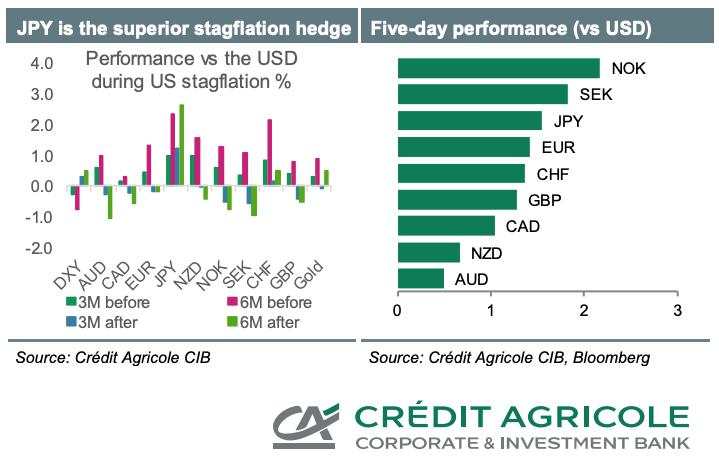

日元仍然是对冲美国贸易协议失败风险和潜在滞胀的有力工具。自1983年以来(不包括疫情时期)十国集团外汇的历史表现表明,美国滞胀持续导致日元表现优异。与其他在滞胀时期及之后表现参差不齐的G10货币不同,日元持续走强,甚至跑赢了瑞士法郎和黄金等传统避险货币。

美国经济指标,例如世界大型企业联合会和密歇根大学消费者信心数据,以及GDP数据,不太可能缓解投资者的担忧。个人消费支出数据目前还无法完全反映关税的影响。与此同时,美联储近期的谨慎言论未能为美元提供支撑,即将发布的联邦公开市场委员会会议纪要中的类似措辞也不太可能改变这一趋势。

在欧元区,通胀数据可能强化人们对6月份“鸽派欧洲央行降息”的预期,从而可能削弱欧元的相对利率吸引力。然而,欧元可能继续受益于投资组合和外汇储备多元化资金从美元流出。此外,我们预计新西兰联储将下调官方现金利率(OCR)25个基点,并下调其官方现金利率预测。

FX & Gold Outlook

The euro (EUR) has recently strengthened across the board due to market expectations that it could become a key beneficiary of diversification away from the U.S. dollar (USD). Additionally, hopes for aggressive fiscal stimulus supporting the Eurozone’s economic outlook and attracting capital inflows have bolstered the EUR. As a result, EUR/USD may remain supported for the rest of the year and into early 2026. However, many positives appear to be priced into the EUR already, potentially limiting future gains. Upside risks to this forecast include earlier-than-expected revival of economic sentiment from fiscal stimulus and a potential resolution to the war in Ukraine, which could lead to a positive commodity terms-of-trade shock for the Eurozone.

The USD outlook for 2025 remains subdued as foreign exchange investors express concerns over: (1) long-term damage to the U.S. economy and USD-denominated assets from Trump-era policies, which could drive portfolio rebalancing away from the U.S. and increase short-USD positions; and (2) uncertainties surrounding fiscal stimulus approval in Congress following the recent U.S. sovereign downgrade and the need to raise the debt ceiling in the summer. While a USD collapse is unlikely, the economic impact of Trump’s policies is expected to be significant but temporary. The U.S. economy could begin recovering in the second half of 2025 and rebound in 2026 as fiscal stimulus gains traction. This recovery could allow the Federal Reserve to avoid aggressive policy easing, especially if inflation remains persistent, supporting a USD recovery within 6-12 months.

Safe-haven demand amid tariff uncertainties has strengthened the Swiss franc (CHF), even against the resurgent EUR. EUR/CHF may edge higher throughout the year as Switzerland’s return to zero interest rate policy (ZIRP) makes CHF an attractive funding currency. However, lower inflation differentials and balanced growth could temper real CHF valuations and limit large nominal losses.

The Japanese yen (JPY) remains a reliable hedge against potential stagflation in the U.S., as asset managers diversify away from U.S. and Japanese assets. While the Federal Reserve’s rate cuts and the Bank of Japan’s anticipated rate hikes (not expected until 2026) exert downward pressure on USD/JPY, the JPY stands to benefit from these dynamics.

The British pound (GBP) is likely to outperform both the EUR and USD in 2025 and beyond, partly due to improving trade relations with the U.S. and EU. Persistently high UK inflation could delay aggressive Bank of England rate cuts, maintaining the GBP’s rate advantage over the EUR. Additionally, the UK government’s reputation for fiscal conservatism could shield the GBP amid global bond market volatility. The GBP’s recent underperformance has pushed it into undervalued territory versus the EUR, according to short-term FX fair value models.

USD/CAD has recently dipped below the 1.44 pivot due to broad USD weakness. Despite a decline in oil prices, the Canadian dollar (CAD) has remained resilient. However, heightened global uncertainties may delay a sustained recovery, as domestic economic activity continues to grapple with trade turmoil.

Investor concerns over U.S. tariffs and a global trade war appear to have peaked, with the conflict narrowing to primarily U.S.-China tensions. While this scenario is less detrimental to the Australian dollar (AUD) compared to a broader trade war, China’s ongoing economic stimulus efforts to counteract U.S. tariffs could support the AUD. The AUD remains strongly correlated with the Chinese yuan (CNY). Australia’s labor market remains tight, contributing to underlying inflation, which is further bolstered by increased government spending post-election. This suggests that rate cuts in Australia may be overestimated by the market.

New Zealand’s economy is recovering well from a deep recession, supported by strong agricultural export prices and production. While the absence of major U.S. trade deals could negatively impact the New Zealand dollar (NZD), diversification away from U.S. assets will likely benefit NZD/USD, which is positively correlated with Asia-U.S. equity market performance.

The Norwegian krone (NOK) has seen its rebound cut short by global market turmoil following U.S. tariff announcements. Its high-beta nature and the decline in energy prices have raised concerns about Norway’s otherwise-solid fundamentals. A return to risk-on sentiment is needed for the NOK to regain ground.

The Swedish krona (SEK) has been the surprising year-to-date outperformer among G10 currencies, benefiting from its role as a high-beta proxy for the EUR. However, near-term challenges such as dividend season and the Riksbank’s decision to absorb large selling flows could limit further gains. More evidence of sustainable economic recovery in Sweden will be required for the SEK to achieve long-term appreciation.

Gold’s recent aggressive gains may deter buyers in the short term, but its strength could resume in the next 3-6 months due to central bank purchases and a potential Fed easing cycle, which could lower U.S

Để lại tin nhắn của bạn ngay bây giờ