Markets are a confidence game wrapped in a narrative machine. Traders don’t move on facts—they move on stories they believe. And right now, Wall Street is being spun in opposite directions.

Start with bonds. Long-end yields didn’t just drift—they thudded lower after Tokyo grabbed a wrench and began fiddling with JGB issuance, signaling a clear attempt to cauterize a bleeding yield curve. That sent ripple waves through U.S. Treasuries. A solid 30-year auction stateside gave the bond bulls another jolt of oxygen, and suddenly the bond vigilantes—last week’s headline villains—seem to have vanished into the fog.

But here’s where the plot gets murky.

Equities ripped Tuesday. The S&P 500 tacked on a broad advance, pushing the rally from the April 8 low to +19%. That sounds impressive—until you zoom out and realize the index is still treading water versus levels from six months ago. It’s a rally, sure, but one that's barely escaped the gravitational pull of stagnation.

Meanwhile, consumers—supposedly paralyzed by tariff shock therapy—are back in the game. Confidence just posted its biggest monthly gain since 2009, spurred not by peace treaties or stimulus checks, but by one leader’s tariff threat followed swiftly by his walk-back. It was enough to yank inflation expectations back from the ledge.

That’s where the TACO trade has returned in force: “Trump Always Chickens Out”. Traders don’t even wait for the tariffs to bite anymore. They front-run the reversal. Threat, panic, rally—rinse and repeat. The 50% EU tariff feint was the clearest case yet. The market skipped the selloff and went straight to the repricing.

But this is where the plotlines clash.

If bond vigilantes have been pacified, yields are falling. Yet the TACO narrative assumes Trump 2.0 will serve up another banquet of tax cuts and deregulation. These stories can’t coexist for long—either the market gets fiscal fireworks or it experiences debt discipline.

And the risks are compounding. If Trump’s threats are now seen as empty negotiation theater, the act loses power. Traders may be front-running the retreat, but foreign negotiators aren’t guaranteed to flinch. Plus, tariffs—despite their PR walkbacks—are still sitting at decade-highs. Eventually, the market will stop rewarding the bluff if the underlying pain continues to spread.

Throw in softening housing data—quietly rolling over in the background—and you’ve got a stew of conflicting signals. Rates are falling, stocks are rallying, consumers are happy, but beneath the surface, there’s a narrative pile-up at the intersection of macro uncertainty and political theatre.

Markets are no longer trading fundamentals. They’re pricing assumptions about the next plot twist. And the more people believe a particular story, the more fragile that belief becomes. When everyone’s reading from the same script, all it takes is one surprise page turn to flip the entire scene.

Right now, the tape says relief. But the script is overloaded. And the curtain’s still up.

Oh yeah—remember that alternate universe theory we floated last week? The one where tariff inflation was never real to begin with, just a glorified VAT shock dressed up as monetary apocalypse?

Everyone’s racing to slap the "inflationary" label on Trump’s tariff revival like it’s 1979 all over again—but that’s lazy analysis, not market thinking. If you actually crack open the mechanics, this is more deflationary drag than reflationary risk. Tariffs don’t create sustained inflation—they’re just a one-time price pop, like a VAT hike. They push prices up once, then fade into the baseline.

This isn’t Econ 101. This is macro price calculus. Sustained inflation needs demand strength chasing limited supply. Tariffs are the opposite. They’re a tax on consumption, not a booster shot. They crimp margins, discourage imports, and ultimately hit the consumer in the wallet—demand down, not up. It’s fiscal tightening in disguise.

Well, guess who just stepped through the portal?

Goldman

After months of breathless right-tail inflation chatter, they’ve finally joined the sane side of the multiverse. Tariffs? Just a one-time price level bump, not the beginning of an inflationary death spiral. No wage-price loop, no consumer blowout, no 1970s rerun. Just demand drag with a side of political drama.

Welcome to the timeline. Took you long enough.

Goldman blinks: Right-tail inflation dies a quiet death

Well, well—looks like even Goldman Sachs finally brought a calculator to a tariff fight. After months of treating Trump’s trade artillery as a gateway drug to runaway inflation, Jan Hatzius & Co. have quietly walked back the doom loop. The latest house view? Tariffs will deliver a one-time pop, not a rerun of the 2021-22 inflation bonanza. In trader terms: they just killed the right tail.

Let’s be clear—this isn’t some high-conviction shift grounded in fresh insight. It’s a capitulation, a reluctant nod to second-order effects that should’ve been obvious to anyone not trapped inside a linear DSGE model. Tariffs, as we’ve said all along, don’t unleash inflation on their own. Without matching fiscal stimulus or a monetary flood, they tend to sap demand, not amplify it. You can’t tax consumption and expect the consumer to keep spending like nothing’s changed.

Now even the Fed’s own researchers are catching up—Javier Bianchi flags the disinflationary nature of tariffs, and Harvard’s Alberto Cavallo points out prices are quietly falling at major retailers. The smoke-and-mirrors narrative that tariffs = instant price spikes is collapsing under the weight of actual data. The market might be slow to admit it, but Goldman just did.

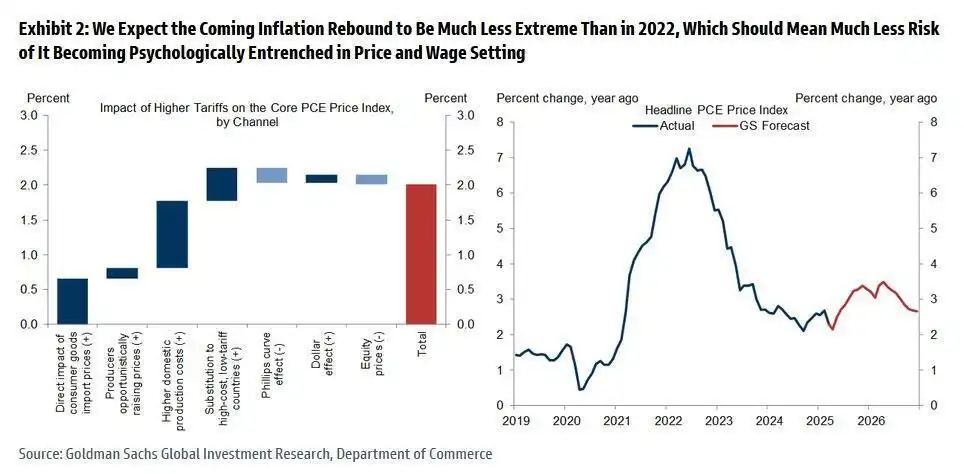

In their latest note, Hatzius & team walk back months of breathless inflation anxiety, now saying tariffs may push core PCE to 3.6% in the short term, but fade thereafter. He hangs the revision on a weaker economy, a cooling labor market, and the disappearance of post-pandemic fiscal steroids. No more helicopter money, no more wage-price spiral—just a soft, overextended cycle playing itself out with a muted inflation pulse.

The pivot is especially rich given Hatzius’ whiplash-inducing record—he’s flip-flopped between stagflation and soft landing faster than Trump revises a tariff deadline. Now he’s hedging harder than a convexity desk in an illiquid tape, warning that a persistent inflation rebound could still happen “if tariffs escalate into 2026.” Translation: we’re wrong... unless we're not.

And the cherry on top? Even Goldman is now dragging the University of Michigan’s inflation survey, long a favorite for armchair macro takes, into the mud—calling it exaggerated, distorted, and technically unreliable. When even Wall Street’s front office is throwing shade at Ann Arbor, you know the academic models are out of sync with the market.

So here we are: the once-feared “right-tail inflation risk” has been gently laid to rest by the same firm that helped birth it. The fear that Trump’s trade moves would light an unstoppable inflationary fuse now looks like a case of mistaken identity. Tariffs aren’t fire—they’re fog. And Goldman just joined the growing camp of those who’ve realized that without stimulus to fuel the blaze, all they really do is smother demand and kill momentum.

The tail risk is gone. The panic has passed.

The narrative is shifting.

And Goldman, at last, is reading the second page of the playbook.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia