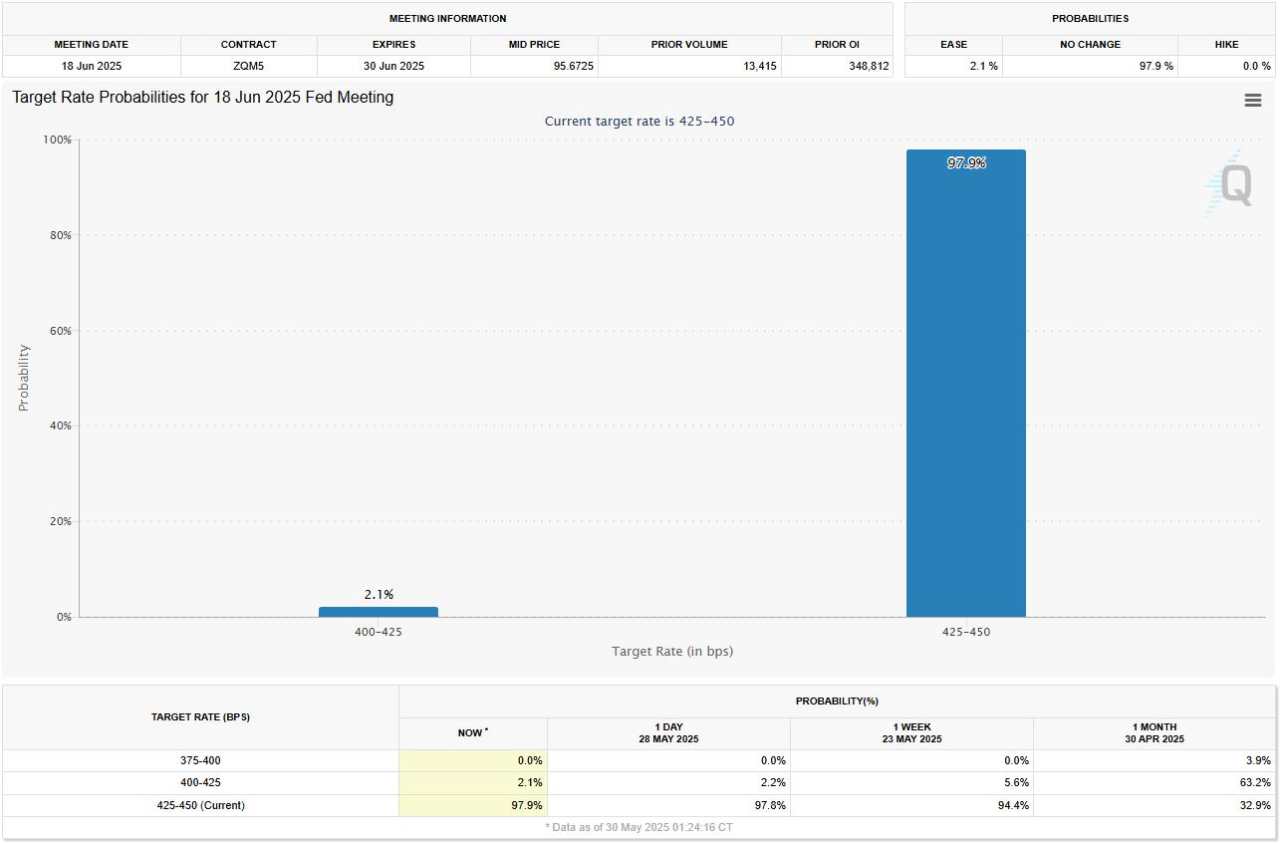

- Federal reserve holds at 4.50% rates on the next monetary policy decision.

- Thursday's opening gap failed to hold as Dollar slides back to 100.

- Continued All-Time Low imminent as 99.129 - 98.694 increases risk of testing.

Federal Reserve prices in a rate pause on June

While rates remained unchanged, this Federal Reserve pause is beginning to look more like a bridge to the next phase of policy rather than a hard stop. Core inflation has been drifting lower, and economic growth, while resilient, is showing signs of slowing. That gives the Fed room to start shifting its posture without sending shockwaves through markets.

From a trader's perspective, the absence of hawkish language combined with the Fed’s readiness to “adjust policy as appropriate” is being interpreted as a green light to start positioning for a dovish turn.

Dollar Thursday gap failed to hold, downside move resumes

U.S. Dollar gapped up at Thursday's open but was quickly invalidated and slide down as the pause is turning more dovish for the Dollar especially with looming rate cuts for 2025.

If the Dollar fails to hold this line, below 100 level, we might see further downside until 2025's All-Time Low.

Key levels to watch

A breakdown below 99.129 - 98.694 level could send the Dollar for renewed downside until we reach the 97.921 level. As of now, the 4-Hour Bearish Fair Value Gap is holding as a resistance. Unless we trade pass through it to the upside, Dollar still has a risk for a downside continuation.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()