Since Donald Trump returned to the White House in January, he has revived a very aggressive economic policy toward his trading partners, imposing high tariffs on a long list of countries – including China, Mexico, and Canada – that trade with the United States (US).

But since their announcement on April 2, during an event Trump himself called “Liberation Day,” these tariffs have been constantly modified, plunging economic players and stock markets into total uncertainty.

With all these twists and turns, many questions arise in terms of what Trump can do about tariffs and the impact of his decisions on the global economy.

What are customs tariffs?

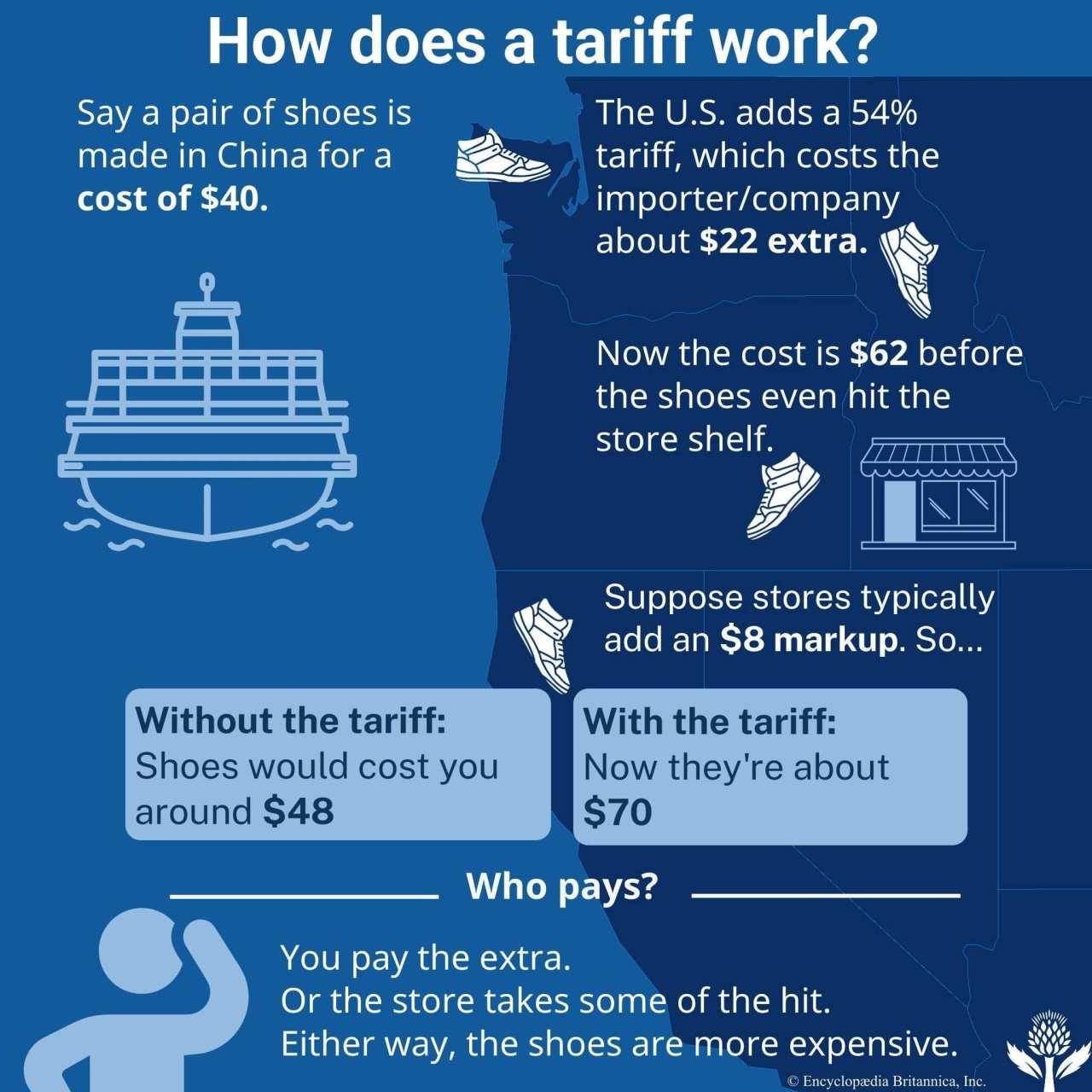

A customs tariff is a tax imposed by a government on goods imported from another country. In practical terms, when a company imports a product, it must pay a tax, usually expressed as a percentage of the value of the imports. Thus, when a company exports its products to that country, the final price of its products is increased by the value of the tax, making them more expensive and less attractive to the end consumer.

For example, if a shoe produced in China costs $15, and its transportation cost to the United States is $5, its final price should be $20 when it enters the US market. But if a 10% customs tariff applies, the importer must pay $22 to purchase these shoes.

While customs tariffs have an important fiscal dimension, bringing money into the state, their role can go far beyond that:

- Protecting local industry by making foreign products more expensive and therefore less competitive.

- Reducing the trade deficit by slowing down imports.

- A tool for negotiation with trading partners.

Why are tariffs bad?

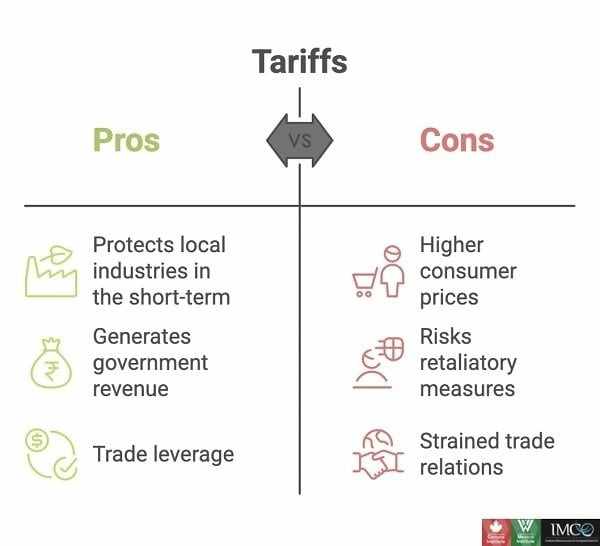

Customs tariffs are far from neutral, often producing both positive and negative effects. They are often introduced for good reasons, at least according to the country introducing them, but they can also have negative repercussions on the economy and financial markets.

The first harmful effect of customs tariffs is inflation, a rise in prices for local consumers. When importers pay an additional tax, they must pass it on, either partially or in full, to the final price of the product, i.e., to consumers.

Ultimately, it is not the importer who bears the additional cost of importation, but the local consumer.

In addition to the extra cost of imported products, their diversity may also be affected. Importers may simply decide to stop importing certain products, which reduces consumer choice.

For local producers, tariffs can cause significant disruptions to supply chains. In today's globalized world, components can cross several borders before reaching the final producer. Imposing tariffs at each stage can therefore increase the cost of the finished product and complicate production.

Tariffs can also lead to an escalation of retaliation and countermeasures, resulting in a trade war. This creates a deeply unstable and uncertain environment for businesses, which often choose to slow down or even cancel investments, affecting economic growth.

Customs tariffs can therefore have a negative impact on consumers and producers, and ultimately affect a country's entire economy.

What are the advantages of customs tariffs?

If a country introduces customs tariffs, it is because it expects to gain certain advantages.

Although this is often not the main reason for their implementation, customs tariffs represent a source of revenue for the state, which can then be used in accordance with the government's budgetary policy.

However, the overall fiscal effectiveness of customs tariffs is widely disputed, particularly because of the negative effects mentioned above.

Another reason that may prompt a country to introduce customs tariffs is to protect industries in difficulty. Tariffs can act as a shield for certain strategic industries that are considered vulnerable and weakened by imports, such as steel and aluminum in the United States. By making foreign competition more expensive, they enable local players to regain market share and grow.

Making products more expensive, particularly imported raw materials and components used by local industries, can encourage them to relocate some or all of their production, source supplies from local rather than foreign players, and invest in the domestic market.

Are tariffs good or bad? Ultimately, the answer can be very complex because while their objective is to protect the local economy, they can have the opposite effect.

If tariffs are designed to protect the US steel industry, for example, steel manufacturers may indeed benefit. But if these manufacturers cannot meet the steel needs of local car factories, the latter will have to pay even more for imported steel, which creates inflation and reduces export competitiveness.

Source: Wilsoncenter

Are tariffs good or bad for stock markets?

An immutable law of financial markets is that they hate uncertainty, regardless of its source. Tariff policies introduce significant instability because they can change quickly.

So even beyond the question of whether tariffs will ultimately be beneficial or harmful to the economy, the uncertainty they create is often enough to send stock markets tumbling as they wait for a clearer picture to emerge.

During periods of uncertainty, high volatility can also be observed as negotiations between countries unfold.

Why is Donald Trump using tariffs?

Since his first term in office, the US president has made tariffs one of the pillars of his economic and diplomatic vision. Trump sees international trade as a bilateral power struggle, in which he must protect the US against “unfair” or “anti-American” trade practices by its trading partners.

For him, a country that imports more than it exports is “getting screwed.” He therefore opposes free trade rules and adopts an approach of negotiating “win-win” bilateral agreements to rebalance trade flows, using tariffs as a bargaining chip to his advantage.

The primary countries contributing to the US trade deficit are China, Mexico, and Vietnam, according to data from the US Census Bureau. However, many other countries – from Canada to Japan and several EU member states such as Germany – also contribute to the gap.

"Foreign leaders have stolen our jobs, foreign cheaters have ransacked our factories, and foreign scavengers have torn apart our once-beautiful American Dream. But it is not going to happen anymore," Trump warned in his speech on April 2.

The main objectives of his trade policy are:

- To reduce the US trade deficit

- To bring industrial production back to the US

- To put pressure on countries deemed unfair

- To ensure national security

- To create a source of revenue to offset tax cuts

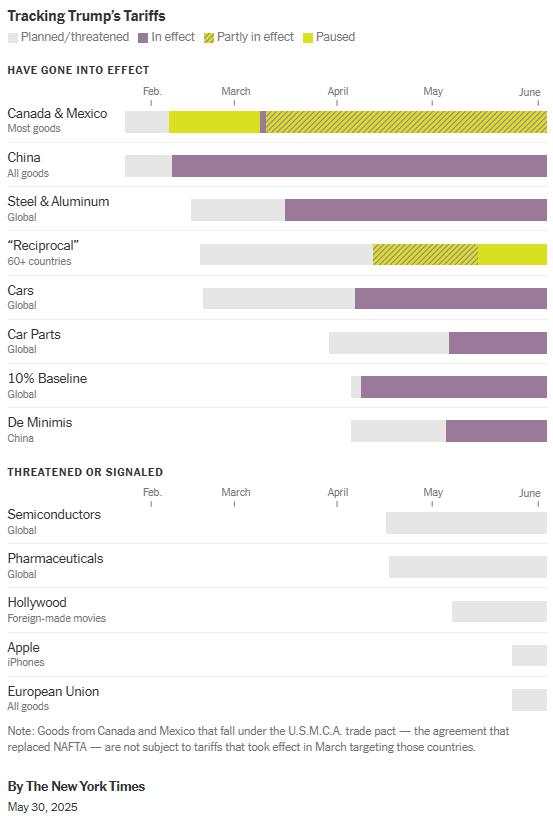

What tariffs has Trump imposed?

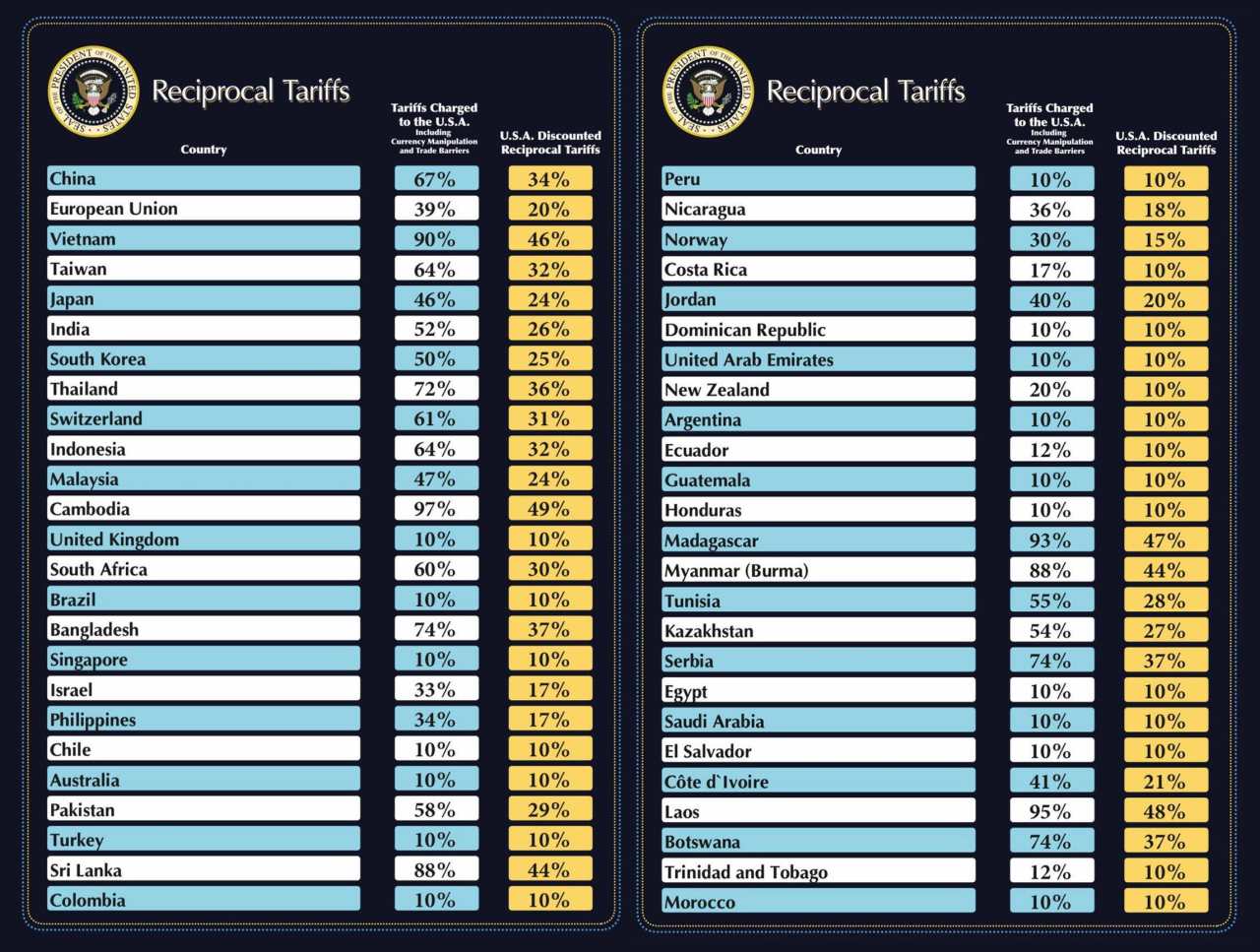

Trump declared April 2 “Liberation Day,” when he imposed a universal 10% tariff on all products from countries with a trade surplus with the United States, in addition to reciprocal tariffs on more than 60 countries based on the size of their trade imbalance with the United States.

Source: Wikipedia

Following multiple political pressures from major economic players and, above all, the financial markets, with falling stock market indices and rising US debt costs, Donald Trump announced a three-month pause on some of the tariffs to give countries time to negotiate trade agreements with the United States.

China: The central adversary of the Trump doctrine

China is largely the main target of Donald Trump's tariff sanctions. Since 2018, hundreds of billions of dollars worth of Chinese products have been taxed, up to 145% in some cases, while China has systematically increased its tariffs on US products in response.

In May, a fragile compromise was reached, temporarily reducing US tariffs on China to 30% for 90 days, while China reduced its tariffs to 10% and undertook to resume US agricultural purchases.

But the truce remains precarious. Trump is accusing Beijing of failing to honour its commitments, and China is threatening to suspend its exports of rare earths, which are essential to American technology industries.

Canada and Mexico: Persistent tensions between allies

Despite the USMCA agreement designed to boost trade, trade relations between the United States, Canada, and Mexico remain tense.

Tariffs of 25% are still in force on steel and aluminium, and Trump has threatened to double them from 4 June, in the name of national security, according to the US President. Both countries consider this unjustified.

Canada, while avoiding escalation, has challenged some of the tariffs at the WTO and taken retaliatory measures against certain American products, such as whisky and agricultural products.

What tariffs are currently in force?

Between dramatic announcements, temporary truces, and legal challenges, the current situation is marked by great uncertainty.

Trump's tariff policy is legally flawed. Indeed, Trump's strategy relies heavily on the use of emergency laws, in particular:

- The International Emergency Economic Powers Act (IEEPA) of 1977, which allows the president to impose economic sanctions in the event of an “unusual and extraordinary threat.”

- Section 232 of the Trade Expansion Act of 1962, which justifies tariffs on national security grounds.

But in May, the US Court of International Trade (CIT) ruled that Trump's use of the IEEPA to justify a universal 10% tariff on imports violated the separation of powers by bypassing Congress. This decision jeopardized the administration's entire tariff architecture.

The next day, a federal appeals court temporarily suspended the ruling, allowing the tariffs to remain in place while the appeal is reviewed.

The case could go before the Supreme Court this summer, setting a major precedent on the limits of executive power in trade matters.

Today, despite legal challenges, the tariffs remain largely in effect, with:

- Universal tariff of 10%: Still applied to most products imported from countries with a trade surplus with the United States.

- Steel and aluminum: Tariff doubled to 50% as of June 4.

- Chinese products: After reaching peak levels (up to 145%), duties were reduced to 30% as part of a 90-day truce.

- European products: Some planned tariff increases have been temporarily suspended until July 9, pending an agreement.

Certain specific tariffs (on toys, electronic equipment, cars) continue to be subject to exemptions or bilateral renegotiations, but the general intention remains to maintain high trade pressure.

Source: The New York Times, as of May 30, 2025.

Can Trump's tariffs last?

While Trump's tariffs are still partially in place, their future is uncertain.

One of the major factors determining the future of Trump's tariffs is pending court decisions. The legal battle is far from over, and several scenarios are possible:

1. The Supreme Court upholds the use of the IEEPA:

The tariffs would be fully reinstated and legally consolidated, and Trump would gain considerable leeway to impose future levies. He could even intensify his tariff policy without congressional intervention.

2. The IEEPA is ruled inapplicable to tariffs:

The tariffs imposed since April would be declared illegal, and the administration would be forced to lift them or reinstate them on another legal basis. This would pave the way for a complete overhaul of the current tariff system.

But even if he loses in court, Donald Trump could resort to other legislation to impose tariffs. Commerce Secretary Howard Lutnick said on June 1: “If they take away the IEEPA, we will use another section. The tariffs will not go away.”

Some options the administration could consider include:

- Section 232 (Trade Expansion Act of 1962): on national security grounds (already used for steel and aluminum).

- Section 301 (Trade Act of 1974): to respond to unfair trade practices, particularly those of China.

- Section 122 (Trade Act of 1974): allows tariffs of 15% to be imposed for 150 days without congressional approval.

These alternatives are more legally constrained, but show that the president still has significant room for maneuver, even in the face of a legal setback.

What are the longer-term consequences of Trump's tariffs?

If the courts uphold Donald Trump's tariffs, they would become more permanent pending announcements of future trade agreements, such as the one recently reached with the United Kingdom (UK), which has led to lower tariffs.

This uncertainty and the risk of further changes to Trump's policy would generate lasting instability and fuel inflation. This could lead to increased stock market volatility.

Conversely, if the courts invalidate Trump's tariffs, we could see a period of relief on the markets. Still, longer-term uncertainty would remain high, as the administration is already considering this possibility and preparing workarounds. The lull could therefore be short-lived.

Finally, aside from the current legal issue, there is also the political question of the 2026 midterm elections to consider, when Congress could become more hostile to the presidency, weakening Donald Trump's current strategy.

Conclusion: Tariff strategy under pressure

The tariffs imposed by Donald Trump represent a significant departure from decades of trade liberalization. Presented as a tool for economic sovereignty and industrial protection, they have nevertheless led to diplomatic tensions, inflation, and legal uncertainty.

While their future remains in the hands of the courts and the evolving US political landscape, one thing is clear: the tariff war initiated by Trump has redefined the rules of global trade. The challenge now is whether this strategy can be sustained over time without weakening the economy it claims to protect.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()