Jamie Dimon, CEO of JPMorgan Chase, has once again sounded the alarm that the US Bond market is in danger of cracking if the United States does not regain control of its public finances.

It's a shock warning that could give rise to serious concerns among investors, but also to criticism. What are we to make of it, and what would be the consequences if Jamie Dimon's scenario of a fall in US Bonds materialises?

Jamie Dimon's warning: "It's going to happen, and you're going to panic"

At the Reagan National Economic Forum in California last Friday, Jamie Dimon issued a stern warning:

"You are going to see a crack in the Bond market, OK? It is going to happen”, reported Reuters.

The reason for the warning? The US budget deficit and total amount of debt, which has exploded in recent years to more than 36,000 billion dollars.

Without substantial changes, the US is headed for a reckoning, Dimon said.

"And I tell this to my regulators...it's going to happen, and you're going to panic," he said.

The JPMorgan CEO accused the US of "disastrous" fiscal management, uncontrolled debt and massive deficits caused by "completely unrealistic" tax and spending policies.

Dimon points in particular to the excessive stimulus plans after the COVID pandemic and the post-2008 crisis regulations that limit the ability of banks to absorb Bonds during periods of stress.

The comments from Dimon come after the US House of Representatives recently passed a tax bill that is likely to add another $2.7 trillion to the deficit over the next decade. The bill heads now to the Senate, with at least a dozen Republican senators suggesting they’d like to see some changes to it before they give the green light.

Dimon fears that confidence in US Treasuries – still considered to be the safest asset in the world – will gradually erode.

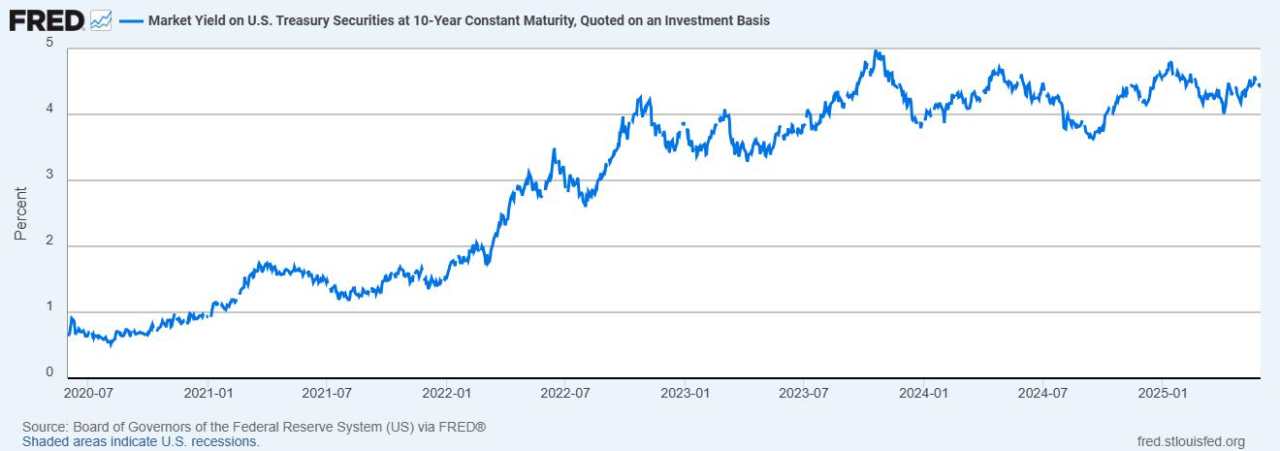

This fear is already visible in the markets, according to Jamie Dimon, who points to "lukewarm" demand at recent auctions and a rise in long-term Bond yields (the 10-year at 4.4% and the 30-year at 5%).

"I just don't know if it's going to be a crisis in six months or six years", warned Dimon.

He added:

"It's not like a business. If we lose our financial credibility, we risk losing our status as a reserve currency. And then rates will no longer be manageable."

In fact, Moody's has withdrawn the USA's triple-A rating, citing "an unsustainable debt trajectory".

Bond crash: lucid prediction or doom and gloom?

The JPMorgan CEO's alarmist comments have caught the attention of markets and investors, but it is worth taking a step back.

First of all, Jamie Dimon has often predicted crises that have never happened, at least not yet!

US Treasury Secretary Scott Bessent reacted to Dimon's comments:

"I've known Jamie for a long time. And throughout his career, he's made predictions like this. Fortunately, none of them have come true.", he said on CBS News on June 1.

Bessent tried to reassure on the trajectory of the US deficit:

"We're going to reduce the deficit gradually. We didn't get here in a year, and we're going to get it down to a sustainable level by 2028."

According to Bessent, revenue from customs duties and savings on drugs will help to balance the books."The situation is serious, but not critical. Jamie is an excellent banker, but he always sees the glass as half empty," he said

Moreover, Dimon's critics point out that he also has a strategic purpose in his multiple crisis calls. Through these messages, he seeks to keep his teams on constant alert and reinforce prudence in his risk management, while also considering image considerations to establish JPMorgan's dominance in the markets.

So, is this a lucid prediction or a catastrophic one? The reality could lie somewhere in between.

The pressure on interest rates, the loss of appeal of US Bonds, and the rise in the cost of debt are a reality.

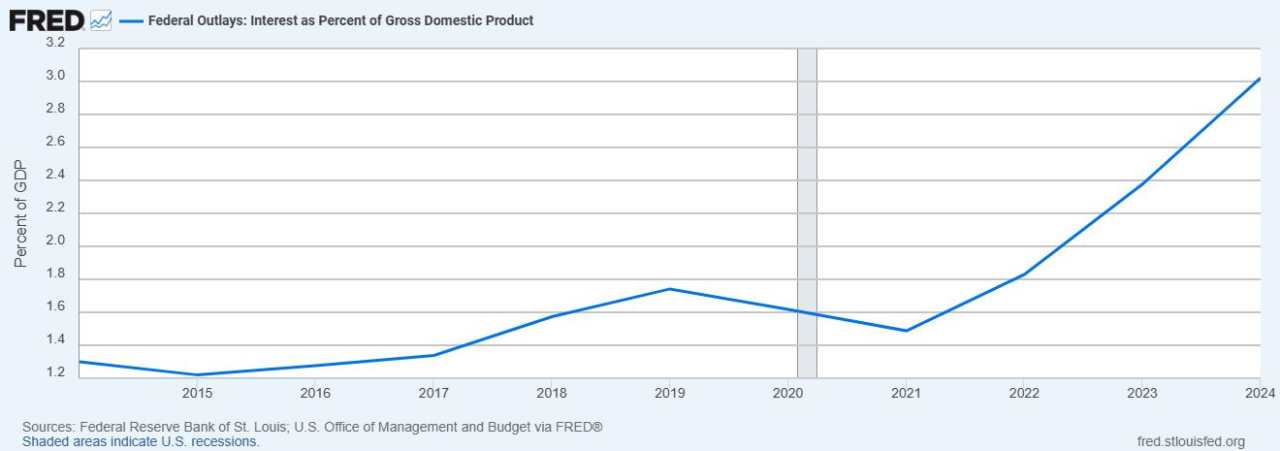

The interest burden on US debt already exceeds $1,000 billion a year, already representing more than 3% of its Gross Domestic Product (GDP), and could reach $2,000 billion by 2028 if interest rates remain high. This would represent almost 10% of GDP in financial costs alone, a level that is unheard of in peacetime.

According to some economists, a brutal collapse of the Bond market remains unlikely in the short term.

"Investors are still buying Treasurys on a massive scale," points out Peter Azzinaro, manager at Agile Investment Management, as reported by MarketWatch.

He adds:

"The risk premium is rising, but there is no panic."

Derek Tang, economist at Monetary Policy Analytics, also moderates:

"The US Bond market remains the deepest and most liquid in the world. But it is true that international investors are increasingly diversifying into Europe and Asia."

The real threat, according to these experts, is not an immediate explosion, but rather a gradual erosion of confidence, which would result in a structural rise in rates and constant pressure on public finances.

What would be the consequences of a US Bond crash?

A US Bond market crash would have major repercussions for investors:

Bonds

A sharp rise in interest rates would drive down the value of Bonds, particularly long-term Bonds. Investors holding Bond funds, which are often heavily represented in life insurance and retirement savings plans, would suffer major losses, particularly in defensive or balanced portfolios.

Currencies

The US Dollar (USD) could depreciate sharply if mistrust takes hold, prompting some investors to turn to the Euro (EUR) or safe havens such as the Japenese Yen (JPY), the Swiss Franc (CHF) and Gold.

Stocks

If long-term interest rates soar, equity markets will suffer, especially growth and technology stocks, which are highly sensitive to the cost of capital.

Lending

Rates on mortgages, car loans and consumer credit would rise, making access to credit more difficult and increasing the risk of default. This would weigh on the real economy and consumption.

How to operate?

Exiting the US Bond market altogether may not be the best solution for investors. Instead, they could reduce duration (favouring short-term Bonds), explore inflation-linked Bonds and diversify geographically into Europe, Asia and emerging markets.

Conclusion: Vigilance, not panic

Jamie Dimon has a talent for doom and gloom, but he raises some legitimate questions. The level of US debt is worrying, and the markets are starting to take a closer look. But there is no indication that a Bond crisis is imminent or inevitable.

Investors should therefore monitor the situation and be prepared to adjust their portfolios if necessary. As is often the case in finance, anticipation and diversification remain the best weapons in the face of uncertainty.

Finally, apart from stock market considerations, Dimon declared:

"What I really fear is that we will no longer be able to manage our own country".

And this fear deserves at least some thought.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()