The latest UK employment report is unequivocal: the labor market is deteriorating rapidly. Employment data indicate a marked slowdown in hiring activity, with companies becoming increasingly reluctant to recruit or replace departing employees.

The downturn comes shortly after the government's new tax measures, which significantly increase the cost of labor, took effect. At a time when wage pressures are finally beginning to ease, this deterioration in the labor market is rekindling debate on the country's economic strategy and reinforcing expectations of interest-rate cuts by the Bank of England (BoE).

A general deterioration in the labor market

In May, 109,000 jobs were lost according to the Office for National Statistics (ONS), bringing the total to 276,000 since Chancellor of the Exchequer Rachel Reeves' first budget, according to Bloomberg. The unemployment rate climbs to 4.6% in the three months to April, its highest level for almost four years.

The figures are worrying on all fronts. The number of people on payrolls is falling sharply, job vacancies are down for the 35th consecutive quarter, and unemployment benefit claims are rising, according to the ONS data.

"The cooling in the UK jobs market is gathering pace," noted ING in a report.

Wages, while still buoyant, are also showing signs of slowing. Annual pay growth excluding bonuses fell to 5.2% in the three months to April, compared with 5.5% in the first quarter.

"Wage growth is slowing, too", added ING.

However, this wage growth remains too high in the eyes of the Bank of England, which considers that growth close to 3% is compatible with its inflation target of 2%. In addition, the minimum wage was raised by 6.7% in April, a factor that supports wages, but also puts pressure on companies.

"The jobs market is not collapsing... But most indicators show labour demand is clearly weakening," said Ruth Gregory, at the consultancy Capital Economics, in comments reported by the Financial Times.

The growing weight of employers' taxes

For many analysts, the link between these poor figures and the Reeves government's tax choices is not in doubt. Since April, employers have had to bear a significant increase in social security contributions, a measure valued at around 0.6% of GDP by the National Institute of Economic and Social Research.

"UK employment plunged by the most in five years and wage growth slowed more than forecast, as the labor market deteriorated after Chancellor of the Exchequer Rachel Reeves ramped up the cost of hiring," noted the Financial Post.

At the same time, raising the minimum wage mechanically increases the cost of labor, particularly in low-margin sectors such as hotels, restaurants, and retail.

As a result, some companies are refusing to hire or are even reducing their workforce. The ONS reports that many employers are reluctant to replace departures, a worrying sign of a wait-and-see attitude.

"Feedback from our vacancies survey suggests some firms may be holding back from recruiting new workers or replacing people when they move on.", said ONS Director of Economic Statistics Liz McKeown, according to Bloomberg.

The decline in employment is mainly in the private sector, while public sector employment continues to grow, a trend fuelled by forthcoming increases in public spending.

A double-edged sword for the Bank of England

For the Bank of England, this easing of the labor market is a double-edged sword. On the one hand, slowing wages and rising unemployment provide welcome relief in the fight against inflation.

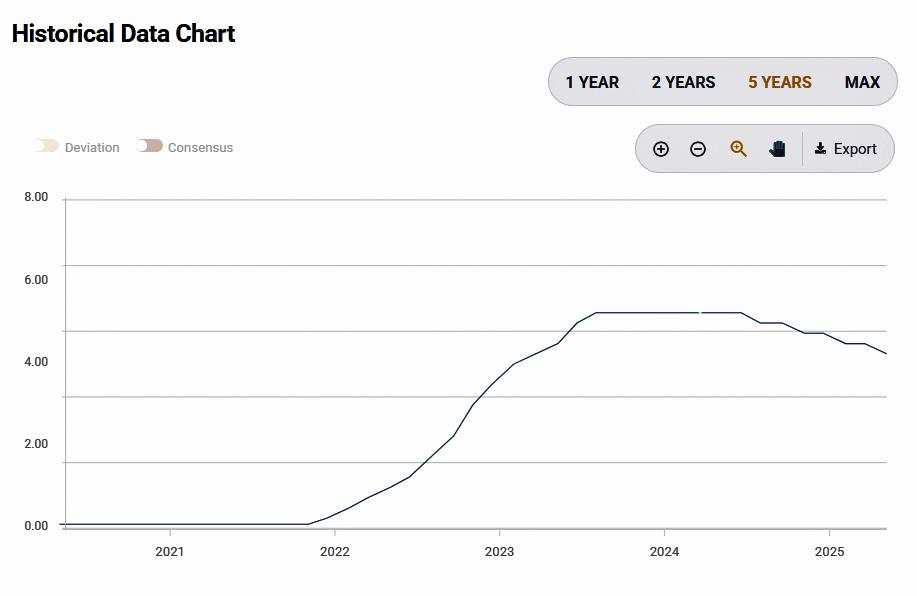

Indeed, markets are now anticipating two rate cuts by the BoE between now and the end of the year, with one likely as early as August.

Source: FXStreet, BoE rate history chart

"The larger-than-expected drop in pay growth and a cooling jobs market give the Bank of England all the cover it needs to continue lowering rates this year. With headline inflation running high and signs of sticky price expectations, we're sticking to our call that the central bank will move in quarterly steps, with the next move likely in August. Ongoing signs of weakness in the jobs market would put sequential cuts on the table in the second half of the year", noted Ana Andrade and Dan Hanson, economists, in a report from Bloomberg Economics.

But on the other hand, these figures reveal an economy under pressure, which could struggle to cope with further fiscal tightening.

The slowdown in hiring, the drop in job vacancies, and the deteriorating outlook in several key sectors point to a weakening in overall demand.

"It is likely that businesses will look to offset some of the rise in employment costs through a combination of reducing headcount and slowing hiring activity," said Yael Selfin, chief economist at KPMG UK, according to the BBC.

A policy in need of rebalancing?

As the Chancellor Rachel Reeves prepares to present new budgetary arbitrages, more and more voices are calling for a change of course. Employers' organizations are denouncing a tax environment that is increasingly dissuasive to hiring.

"It is disappointing but no surprise that unemployment is up again. Businesses are still absorbing a £25bn jobs tax but things are about to get even worse as Labour's £5bn unemployment bill hits businesses with higher regulation," said Andrew Griffith, shadow business secretary, according to The Telegraph.

"There is so much nervousness with employers right now.", said Petra Tagg from Manpower UK to Bloomberg.

The contrast is all the more striking given that, on the other side of the Atlantic, the United States may have imposed new tariffs, but retains a more resilient labor market, underpinned by more robust growth and productivity.

British economic policy is therefore at a turning point. While the Bank of England now seems ready to accompany the slowdown with gradual interest-rate cuts, the fiscal question remains unanswered.

In an economic climate already weakened by global uncertainties, budgetary choices will now have to incorporate a major risk: that of further slowing down an economy that is just beginning to catch its breath.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()