Headline US CPI rose only 0.1% in May, marking a deceleration from April’s 0.2% uptick and supporting the Fed’s cautious policy stance.

On a year-on-year basis, headline inflation rose from 2.3% to 2.4% – well above the Fed’s 2% target – but still fell short of the 2.5% estimate. The core version of the report also posted a 0.1% increase, lower than the earlier 0.2% increase and the expected 0.3% gain.

Key Takeaways:

- Headline CPI rose 0.1% month-over-month in May, down from 0.2% in April

- Annual inflation remained at 2.4%, unchanged from April’s reading

- Core CPI (excluding food and energy) increased 0.1% monthly, moderating from April’s 0.2% rise

- Annual core inflation stood at 2.8%, slightly above the previous month’s 2.7%

- Energy prices declined 1.0% monthly, providing significant downward pressure on headline inflation

- Shelter costs rose 0.3% monthly, continuing to be the largest contributor to inflation pressures

- Food prices increased 0.3% monthly, with both food at home and away from home rising

Components of the report revealed that the softer monthly reading was primarily driven by a 1.0% decline in energy costs, with gasoline prices falling significantly during the month. However, shelter costs continued their upward trajectory, rising 0.3% and serving as the primary contributor to the overall monthly increase.

Link to U.S. Consumer Price Index (May 2025)

While the monthly deceleration in both headline and core inflation provided some relief, the persistent strength in shelter costs—which comprise over 40% of the core CPI basket—suggests underlying price pressures remain elevated.

In addition, food inflation showed renewed strength in May, with both grocery and restaurant prices rising 0.3% monthly. This broad-based increase across food categories suggests underlying demand pressures remain intact despite some moderation in other sectors.

Market Reaction

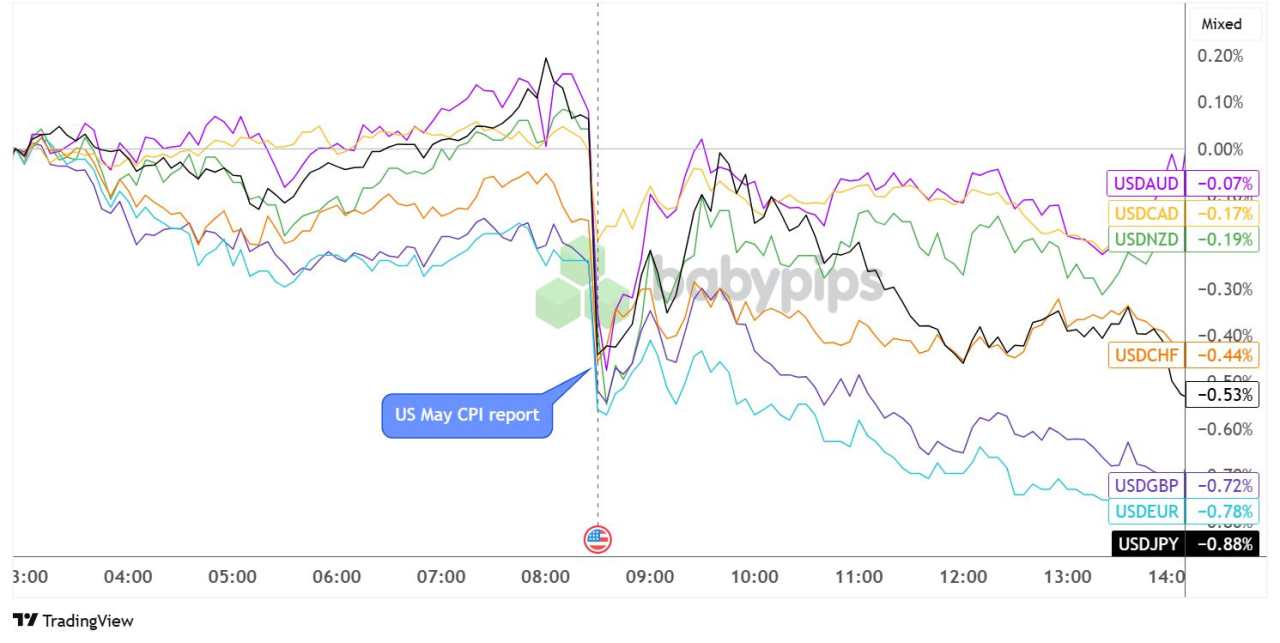

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The USD weakened across the board following the CPI release, with currency markets interpreting the data as potentially dovish for Federal Reserve policy. Markets appear to be pricing in stronger odds of Fed rate cuts later in the year, particularly given the deceleration in monthly core inflation readings.

The dollar declined against all major trading partners, with the most significant moves seen against the Japanese yen (-0.88%) and the euro (-0.78%). The British pound also gained ground against the dollar (-0.72%), while commodity currencies showed mixed performance. The Canadian dollar (-0.17%) and New Zealand dollar (-0.19%) posted modest gains, though the Australian dollar (-0.07%) remained relatively stable.

Tải thất bại ()