In the shadow of Israel’s attack on Iran and we are adding a comment for that at the end of the current report, we have a look at what’s in next week’s calendar. On Monday we get China’s Urban investment, industrial output and retail sales growth rates, Japan’s chain store sales and Canada’s number of House Starts all being for May, while the G7 meeting is taking place in Alberta Canada. On Tuesday we get from Japan BoJ’s interest rates decision, Germany’s ZEW indicators for June and from the US the retail sales and industrial output growth rates both being for May, while it’s the last day of the G7 meeting in Canada. On Wednesday we get Japan’s machinery orders for April and trade data for May, UK’s and the Euro Zone’s inflation metrics for May, from Sweden Riksbank’s interest rate decision, the US weekly initial jobless claims figure while BoC Governor Macklem is scheduled to speak and the Fed is to release its interest rate decision. On Thursday we get New Zealand’s GDP rate for Q1 and Australia’s employment data for May and on a monetary level, we note the interest rate decisions of Switzerland’s SNB, Norway’s Norgesbank and the UK’s BoE. On Friday on a monetary level, we note the release of the interest rate decision of China’s PBOC, BoJ Governor Kazuo Ueda’s speech and the release of the BoJ’s May meeting minutes, while as for financial data we get Japan’s CPI rates for May, UK’s retail sales for May, the US Philly Fed Business index for June, Canada’s retail sales for April, and Euro Zone’s preliminary consumer confidence for June.

USD – Fed’s interest rate decision front and center

On a fundamental level a number of issues are tantalizing the greenback. The uncertainty created by the unrest in LA, the threats of US President Trump for new tariffs being applied and US President Trump’s budget and tax bill, tend to intensify uncertainty, thus weighing on the USD. On the flip side the US-Sino negotiations seem to be making progress which could allow for tensions in the US-Sino trade relationships to ease thus supporting the USD.

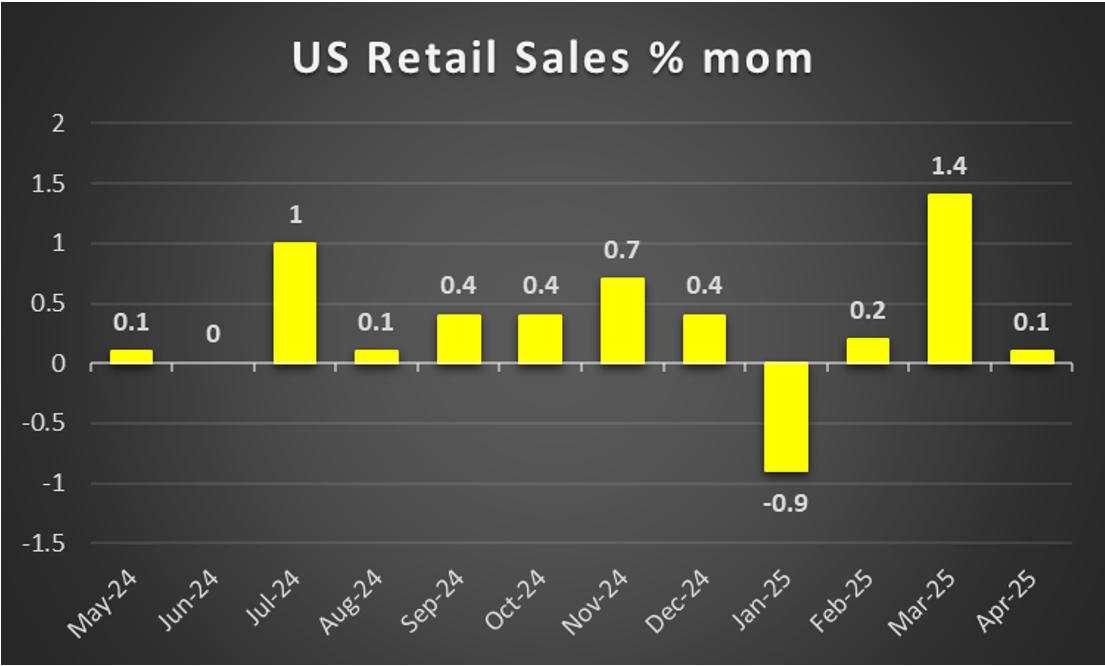

On a macroeconomic level, we make a start by noting that the US employment report for May released last Friday showed a tighter US employment market than expected. Furthermore we also note that the release of the US CPI rates for May showed a slowdown of the rates yet they tended to remain at relatively high levels. Implying a relative persistence of inflationary pressures in the US economy.

Such employment and inflation data may be easing the pressure on the Fed to ease its monetary policy, an issue that gains on importance given the bank’s interest rate decision. The market for the time being expects the bank to remain on hold on Wednesday, and Fed Fund Futures imply a probability of 98.8% for such a scenario to materialise. But the market also seems to be currently pricing in two more rate cuts until the end of the year, which implies a dovish inclination of the market for the bank’s intentions. Should the bank remain on hold as expected, we may see market attention shifting towards the bank’s forward guidance, which is to be included in the accompanying statement, Fed Chairman Powell’s press conference and the new dot plot. Should the bank signal strong hesitation towards easing its monetary policy further, the Fed may force the market to reposition its expectations, thus providing support for the USD and vice versa.

Analyst’s opinion (USD)

Overall we see the case for the USD to remain supported in the coming week, primarily due to a more hawkish tone that may prevail in the Fed’s interest rate decision. On a more fundamental level, though, we may see the uncertainty as described above weighing on the USD, unless there is some progress and more clarity

GBP – BoE’s interest rate decision and UK’s May CPI rates in focus

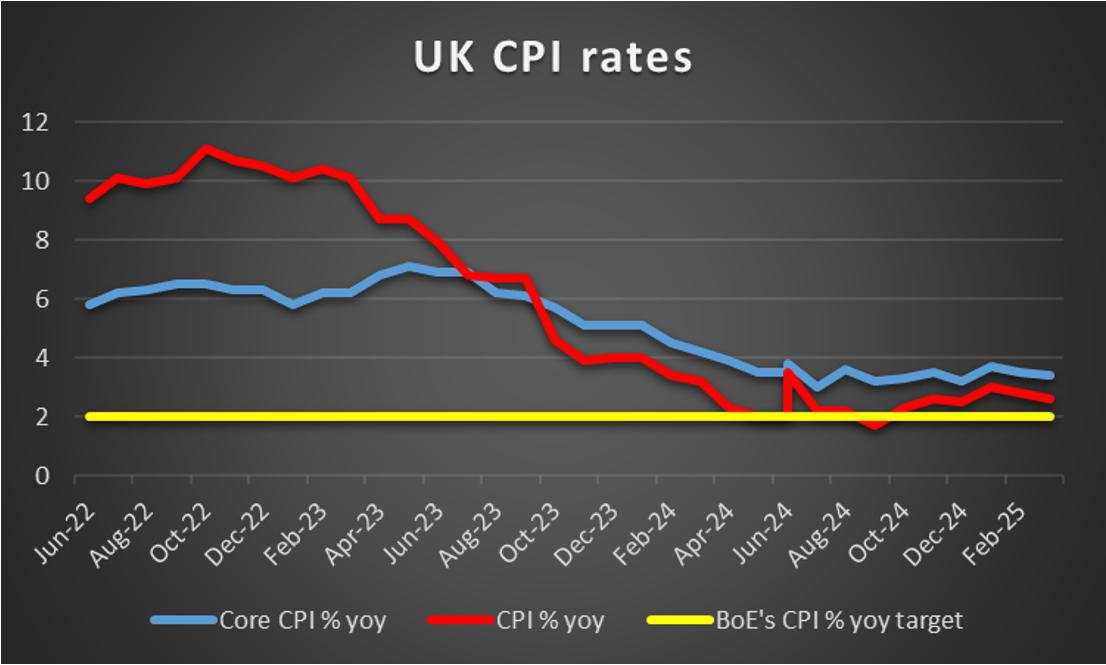

On a macro level we note the release of UK’s soft April employment data but also the wider-than-expected contraction of the GDP rate for April which weighed on the pound and tended to darken the economic outlook of the UK. In the coming week we highlight the release of UK’s CPI rates for May on Wednesday. The release may get additional traction given that it’s to be followed by BoE’s interest rate decision the following day. Should the CPI rates show a persistence or even an intensification of inflationary pressures in the UK economy we may see the pound getting some support as it could enhance market expectations for the bank to ease on its dovishness and vice versa.

On a monetary level, BoE’s interest rate decision is expected to dominate the interest of pound traders next Thursday. The bank is currently expected to remain on hold at 4.25% and GBP OIS imply a probability of 89% for such a scenario to materialise. It should be noted though that GBP OIS also currently imply that the market expects the bank to proceed with two more rate cuts until the end of the year, one in September and one in December, which in turn showcases a dovish inclination of the market’s expectations for the bank’s future intentions. Should the bank remain on hold as expected and imply that there are more rate cuts down the line, we may see the GBP slipping as the market’s expectations could be enhanced. On the flip side, should the bank fail to provide any dovish signals or sound more hawkish than the market expects, we may see the pound getting asymmetric support.

On a fundamental level, we note UK Chancellor of the Exchequer Reeves’s spending plans. A lot could be commented upon, starting from setting out over 2 trillion GBP in an effort to revive the UK economy through spending plans. Main economic areas of interest seem to be health, defence and infrastructure projects. On the other hand, though Ms. Reeves did not rule out the possibility of additional taxation in order to finance the spending plans. Overall in our ears, the announcement tended to underscore the difficult fiscal position of the UK Government rather than the possibility of a possible boost in the UK economy. Should we see further signals of fiscal tightness we may see this fundamental issue weighing on the GBP.

Analyst’s opinion (GBP)

The GBP is expected to be influenced primarily from the release of BoE’s interest rate decision as well as the UK CPI rates for May. Possible market expectations for a more hawkish BoE could provide some support for the GBP and the contrary.

JPY – BoJ expected to remain on hold

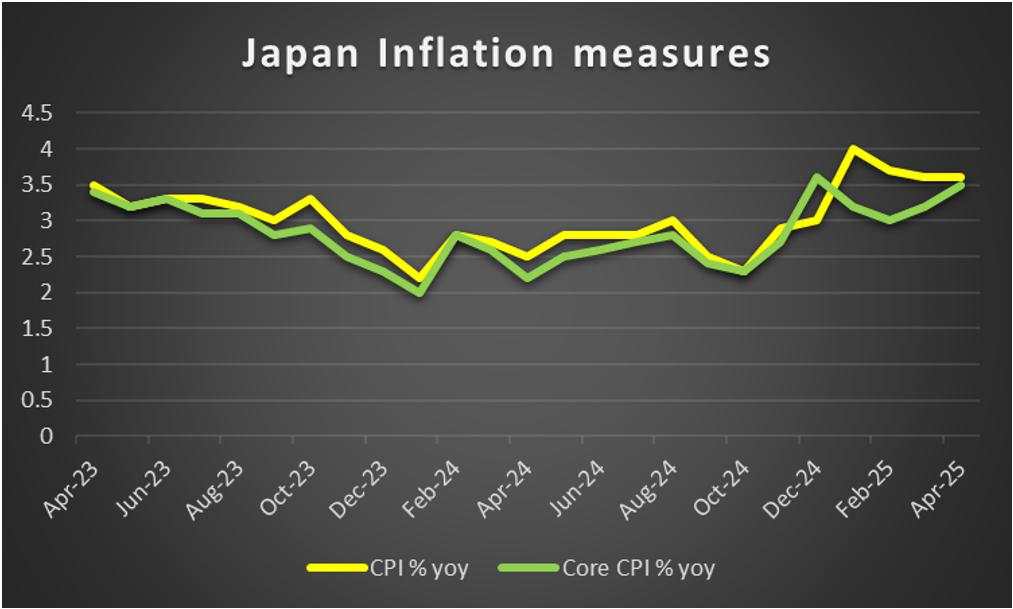

On a macroeconomic level, we highlight the release of Japan’s revised GDP rates for Q1. The rates showed a shallower contraction than the one estimated in the preliminary release. Despite the relatively positive signal, in our opinion the outlook of the Japanese economy remains a substantial worry for JPY traders. In the coming week, we highlight the release of Japan’s CPI rates for May on Friday and should the rates accelerate or even remain at high levels we may see the Yen getting some support as it may add pressure on BoJ to hike rates.

The release of Japan’s revised GDP rates for Q1 in our opinion besides the macroeconomic aspect also highlighted the peculiar position of BoJ as on the one hand the bank has to tighten its monetary policy in order to combat inflationary pressures, on the other hand, the bank may have difficulties in abandoning its supportive role for the boosting of the Japanese economy. Hence we highlight the release of BoJ’s interest rate decision in Tuesday’s Asian session. The bank is widely expected to remain on hold at 0.50% and JPY OIS currently imply that the market has almost fully priced in such a scenario and the market is expecting the bank to remain on hold until the end of the year. Hence should BoJ allow for hawkish signals to be included in its forward guidance, we may see the Yen getting some support as the market may shift towards a more hawkish anticipation for BoJ’s intentions. Please note that BoJ Governor Ueda besides Tuesday is scheduled to speak also on Friday in a second chance to affect the market’s mood.

On a fundamental level, given the high uncertainty surrounding the market, we note JPY’s dual nature as a national currency and a safe haven investing instrument for the international markets. Hence should we see the market’s worries intensify further we may see the Yen getting some support in the coming week.

Analyst’s opinion (JPY)

The main issue for JPY in the coming week is expected to be BoJ’s interest rate decision and a possible hawkish tone could provide support for the JPY. Yet the release is early in the week, hence we may see JPY traders also placing some interest on the release of Japan’s May CPI rates. Throughout the week, we may also see safe haven inflows and outflows also affecting the Japanese currency’s direction.

EUR – Fundamentals to lead the common currency

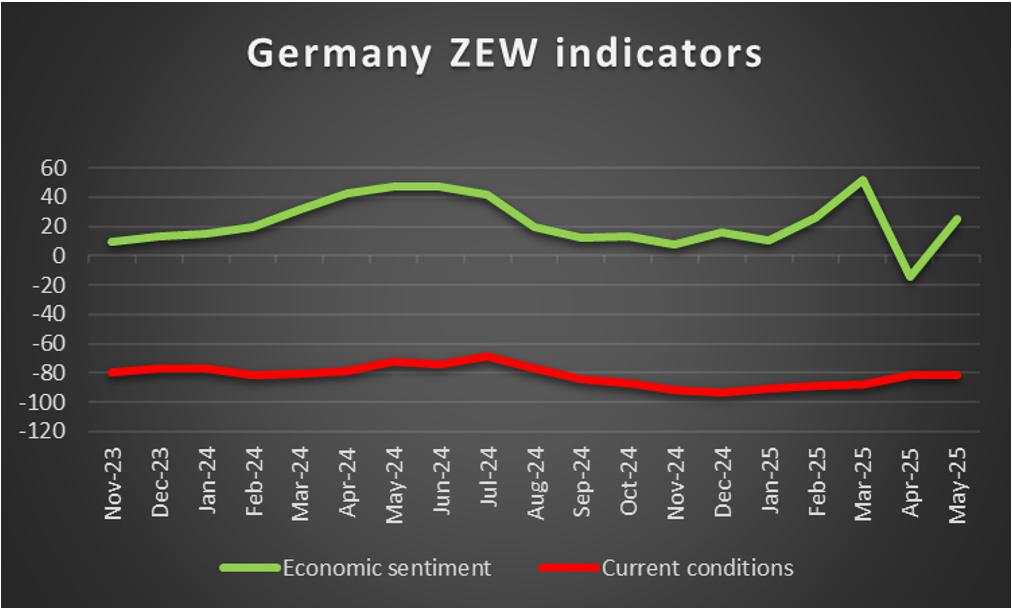

On a macro level with few exceptions the calendar for EUR traders is relatively empty of high impact financial releases. We note the release of Germany’s ZEW indicators for June and Euro Zone’s final HICP rate for May and a possible acceleration of the HICP rate or a rise of the readings of Germany’s ZEW metrics could aid the EUR, yet we expect fundamentals and the market’s expectations for the ECB’s intentions to be the main factors behind EUR’s direction.

On a monetary level, we note the market’s expectations for the bank to proceed with only one more rate cut, possibly in the September meeting. The common currency got some support on Wednesday as ECB Policymaker and Germany’s Bundesbank President Nagel suggested that there is no hurry for the bank to continue easing its monetary policy. We view the comment as characteristic of the bank’s stance and should we see additional such comments emerging in the coming week, we may see the EUR getting additional support. Another minor issue which may come up on the ECB’s radar is the fact that the EUR is at the highest level since 2021 and given Trump’s tariff intentions the bank may start considering operations of verbal market intervention to weaken the common currency in order for it to be more competitive and allow for EU products be sold cheaper abroad.

On a fundamental level for EUR traders we note efforts for a possible US-EU trade agreement. On a more pessimistic tone, US Commerce Secretary Lutnick expressed his optimism for a possible deal of the US with the EU, yet also highlighted that such a possible deal will be probably at the “very, very end”. On the other hand the meeting of US President Trump with Germany’s Chancellor Merz went relatively well as the German Chancellor was spared from Trump’s roasting, something suffered by other leaders which met the US President. Any signals of a thawing of the tensions in the US-EU relationships could provide some support for the EUR and the contrary.

Analyst’s opinion (EUR)

In the coming week we expect fundamentals to lead the EUR. Any signals from ECB that it intends to ease further on its rate cutting path could provide support for the common currency as could also any signs of thawing of the tensions in the US-EU trade relationship

AUD – Australia’s May employment data the main event for Aussie traders

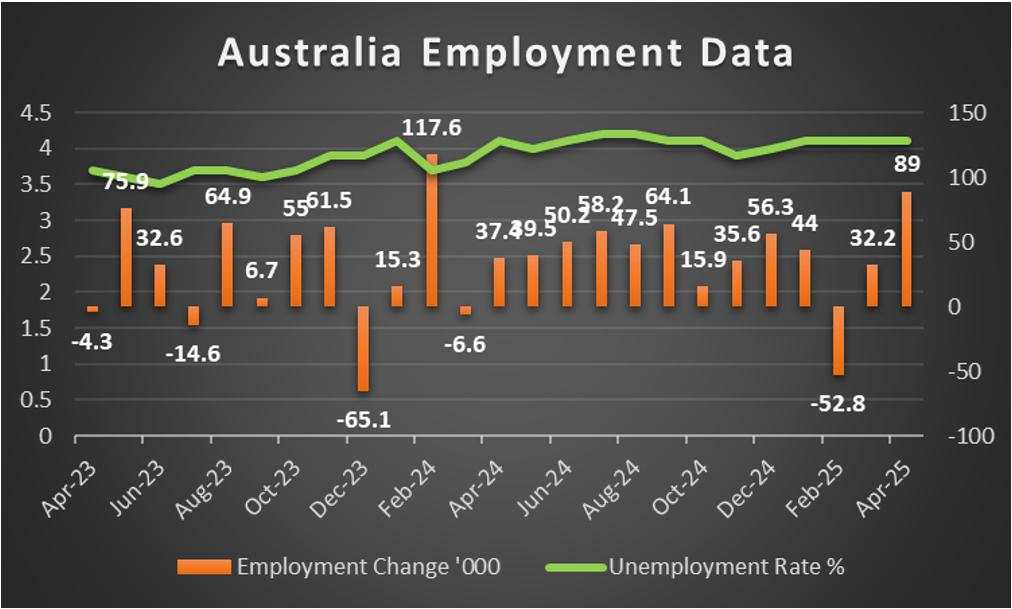

On a macro level, it’s been an easy going week for Aussie traders yet in the coming week, we highlight the release of Australia’s employment data for May next Thursday. Should the data show an easing of the Australian employment market, we may see the release weighing on the Aussie as it could add more pressure on the RBA to cut rates. On the flip side, a possible tightening of the Australian employment market in the past month could provide some support for the AUD.

On a monetary level, we note the market’s expectations for the RBA to proceed with three more rate cuts until the end of the year. Overall the market seems to have locked in this path at the current stage, with some analysts highlighting the risk of the bank being late in easing in its monetary policy. Thus any dovish signals deriving from RBA policymakers in the coming week could weigh on the AUD, while any more hawkish than expected comments could provide substantial support for the Aussie as they may include a surprise element and force the market to readjust its expectations.

On a fundamental level, we expect that a potential US-Sino trade deal, given also Trump’s comments on the issue, could provide support for AUD given the close Sino-Australian trade relationships. We also note the release of China’s industrial output growth rate for May among other indicators, and a possible slow down of the rate could weigh on the AUD as it could imply less Australian exports of raw materials to China. On a more generic level, we note the market’s perception of the Aussie as a riskier asset in the FX market, thus any improvement of the market sentiment could provide support for AUD and on the contrary should the market sentiment turn more cautious we may see it weighing on the Aussie.

Analyst’s opinion (AUD)

The crown for Aussie traders in the coming week is expected to be the release of Australia’s employment data for May and a possible easing of the Australian employment market could weigh on AUD. In a more generic level, a possible trade deal between the US and China and an improvement of the market sentiment could provide some support for the AUD.

CAD – Easy going week ahead for Loonie traders

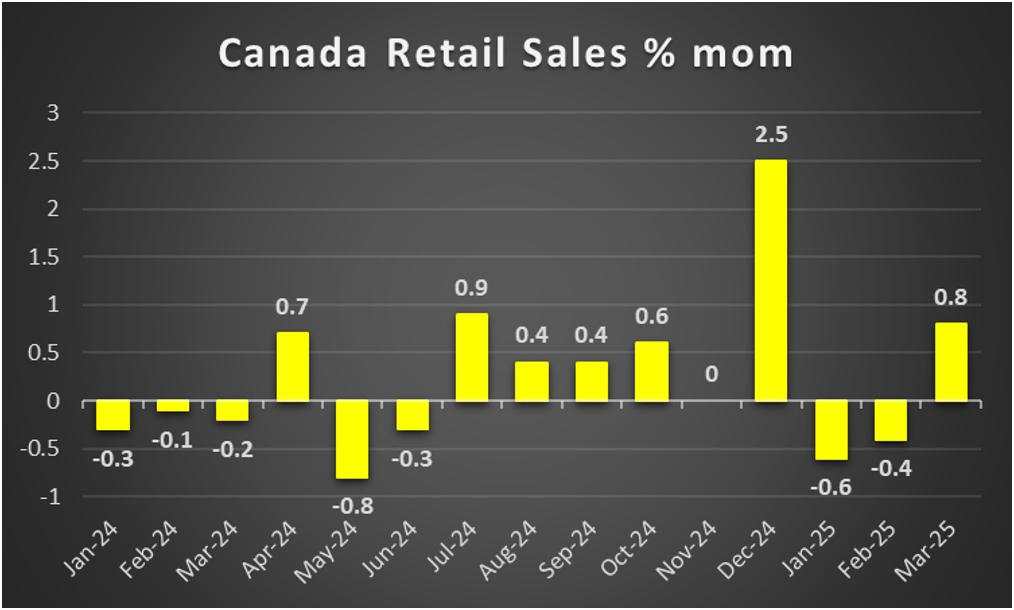

On a macro economic level, we note the release of the Canadian employment data for May, which sent out mixed signals. On the one hand the unemployment rate ticked up as expected, yet on the other hand the employment change figure instead of dropping into the negatives as expected, rose causing some short lived support for the Loonie. In any case the tick up of the unemployment rate tends to add more pressure on the BoC to proceed with further easing of its monetary policy. In the coming week we note the release of Canada’s April retail sales on Friday. Should the rates accelerate, the release could provide some support for the Loonie as it would show case a resilience of the demand side of the Canadian economy.

On a monetary level, we note the market’s expectations for the BoC to deliver one more rate cut by the end of the year possibly in September, as per CAD OIS. Such expectations tend to imply a slightly dovish inclination of the market for the bank’s intentions. Also BoC’s and the Fed’s monetary outlook differentials tend to be in favour of the Loonie as the market expects fewer rate cuts by the Canadian central bank at the current stage. In the coming week BoC’s summary of monetary policy deliberations for its last meeting are to be released on Tuesday, and should they show some dovish intentions from BoC policymakers, we may see the release weighing on the CAD. Furthermore we also note the planned speech of BoC Governor Macklem which is expected to be offering "valuable insights into Canada's economic outlook, inflation trends, interest rates, and the factors shaping the financial landscape for businesses".

On a more fundamental level, we note that Canada is hosting the G7 meeting, yet more interesting for Loonie traders would be the path of oil prices for CAD traders. Oil prices have been on the rise since the start of the month given the flare up of the tensions in the Middle East. Should we see oil prices getting additional support in the coming week, we may see the positive correlation between the CAD and oil prices coming into effect allowing the Loonie to benefit from the rise of oil prices. Other than that, we also note an easing of the tensions in the US Canadian trade relationship. Expectations for Canada to hit NATO's military spending target of 2% of GDP this fiscal year, five years earlier than promised, seems to be pleasing the US. Any improvement of the US-Canadian trade relationships could provide some support for the Loonie.

Analyst’s opinion (CAD)

In the coming week we expect Loonie traders to focus on the release of Canada’s April retail sales and a possible acceleration could provide some support for the CAD. On a fundamental level, we note the path of oil prices and the market sentiment as key factors for the CAD’s direction, while any dovish signals from BoC could weigh on the Loonie on a monetary level

General comment

As an epilogue we add a comment for Israel’s attack on Iran. Israel hit Iranian targets in today’s Asian session causing wide uncertainty in the markets as the possibility of a regional war has appeared on the horizon. The Israeli army stated 200 jets struck more than 100 sites across Iran in a large-scale attack. The Israeli strikes, targeted Iranian nuclear facilities, missile factories, but also high-profile individuals such as the Revolutionary Guards commander and nuclear scientists. It should be noted that the US had distanced itself in the past few days from any military action, and thus it may be that Israel acted on its own accord and without prior approval from the US. Specifically the US State Secretary Marco Rubio stated that the US is not involved and that the Israeli air strikes were a unilateral action. Furthermore, the US State Secretary also stated that “our top priority is protecting American forces in the region”, highlighting the possibility of US bases being targeted by Iran. Also, media report that the airstrikes are the first of other actions to follow on behalf of Israel, which implies a continuance of the uncertainty. Other possible targets of the Israeli Airforce may include Iranian oil facilities, as Israel may try to neutralise Iran’s main sources of income. Such a development obviously could boost oil prices further, yet the repercussions could be wider as it could also weigh on economic activity on a wider level, considering that China is one of the main importers of Iranian oil. Iranian counterstrikes are expected and it’s characteristic that the Israeli official state plane, Wing of Zion, similar to US Airforce One, took off from the airport of Tel Aviv, with no further details being announced. Given the high uncertainty and high stakes involved in the issue, markets have turned substantially nervous, which could lead to unexpected moves in the markets or overreactions to the developments as they unfold. For the time being we note that safe haven instruments such JPY and CHF remain flat against the USD, gold’s price received some safe-haven inflows as did US bonds, while oil prices have skyrocketed given the market concerns for the supply chains of the international oil market.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()