S2N spotlight

I am not sure if you have ever thought about whether the stock market drives the economy or the economy drives the stock market.

Naturally the traditionalists or fundamentalists will say that, of course, the economy drives the stock market. The stock market essentially derives its value by discounting the future cash flows of businesses that are a proxy for the economy. Within this approach there is allowance for bullishness and bearishness as an expression of the uncertainty around the discounting rate of the cash flows.

There is another school of thought, one that I am a student of, that is a more deterministic approach. We believe that there is a more endogenous influence on the stock market. That means we believe that the mood from the collective psyche of the society forming the economy with its oscillating “animal spirits,” the term Keynes coined, acts as the primary driver of the stock market. Based on the bullishness and bearishness of the mood of the day, a cycle of positive or negative feedback loops unfolds in a pattern of sorts. This energy transfers into the way consumers and other actors making up the economy interact. This drives the stock markets, and the economy follows suit.

Ray Dalio describes 6 stages in the long cycle of economic history. Dalio’s description of the six stages of the long-term debt cycle provides a compelling framework for reconciling these views. Dalio’s framework is deterministic in the sense that the broad contours—borrowing booms, bubbles, deleveraging, and eventual recovery—repeat throughout history. But within each stage, the endogenous dynamics of markets and human psychology introduce vast variability. Each cycle manifests with its own peculiarities because collective mood, policy responses, and social attitudes evolve in unpredictable ways. In this sense, the stock market becomes a living barometer of where society imagines itself to be within Dalio’s stages—not always grounded in objective fundamentals, but deeply entwined with them nonetheless.

The reason I share this often ignored way of thinking is that trying to understand why a market moves up with bad news and down with good news is like driving while looking at the road through your rearview mirror.

S2N observations

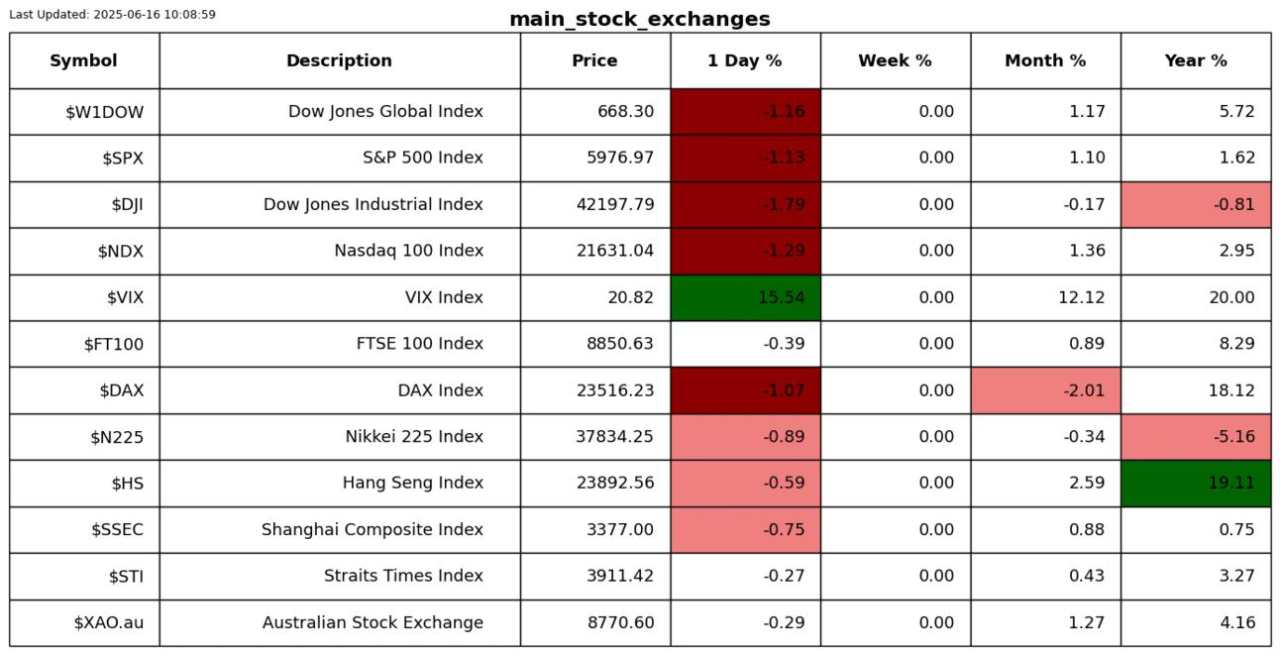

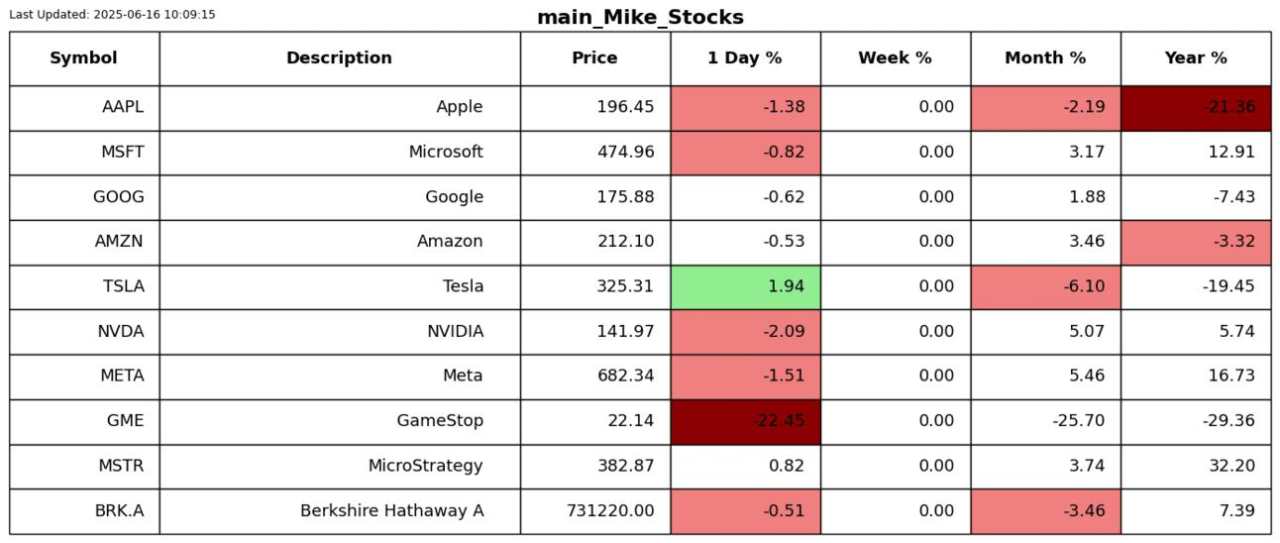

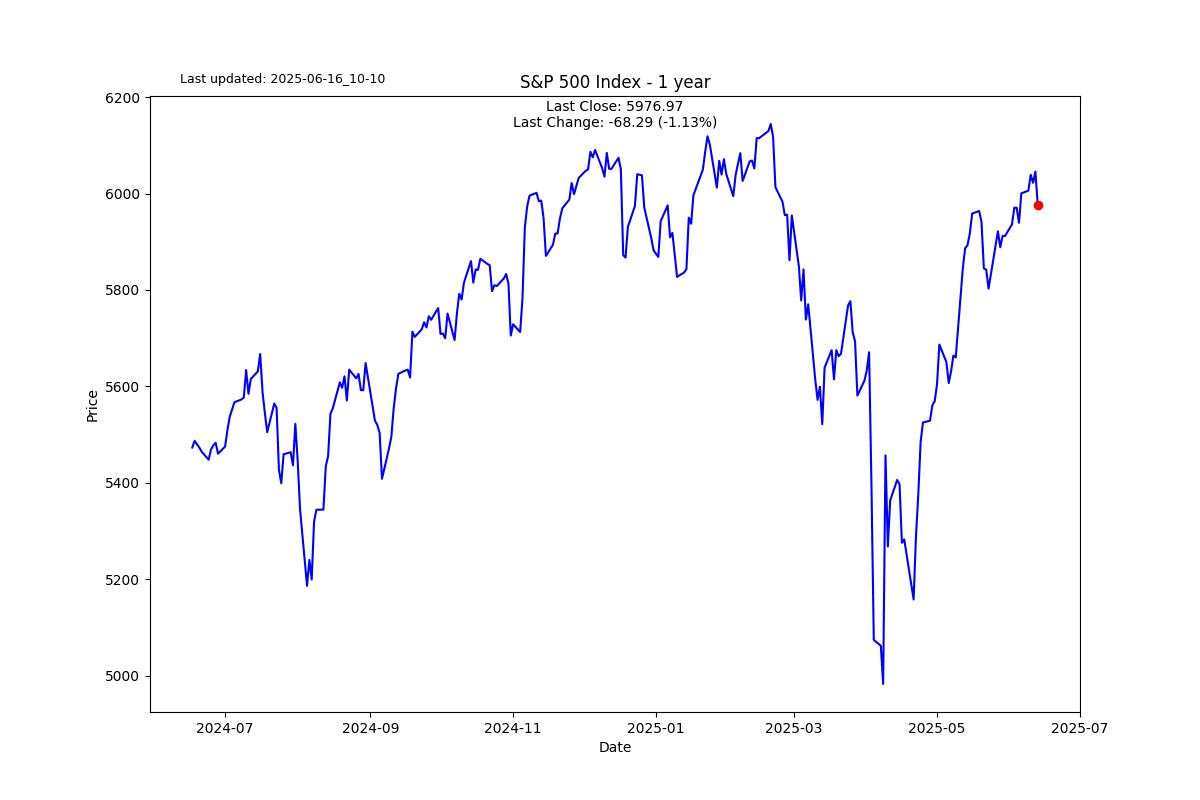

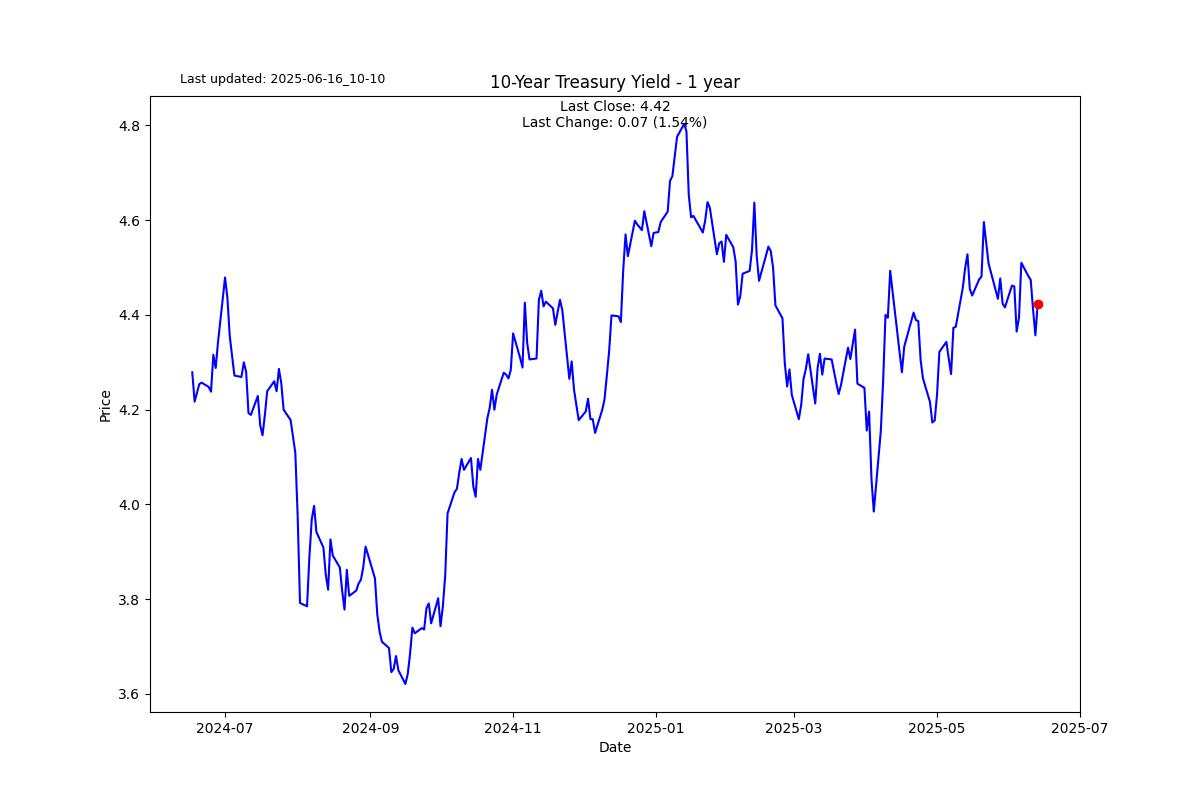

Naturally the last few days have been dominated by the wars in the Middle East. I have written at length over the last few weeks in particular that the markets are priced for endless days of glory. If one steps back for a moment and focuses on the next 10 years of return when the forward P/E of the S&P 500 is at 22 or above, it tells us that we should expect zero or negative returns.

We cannot know when the animal spirits will leave; all we can know is that with the current setup, they have booked their tickets.

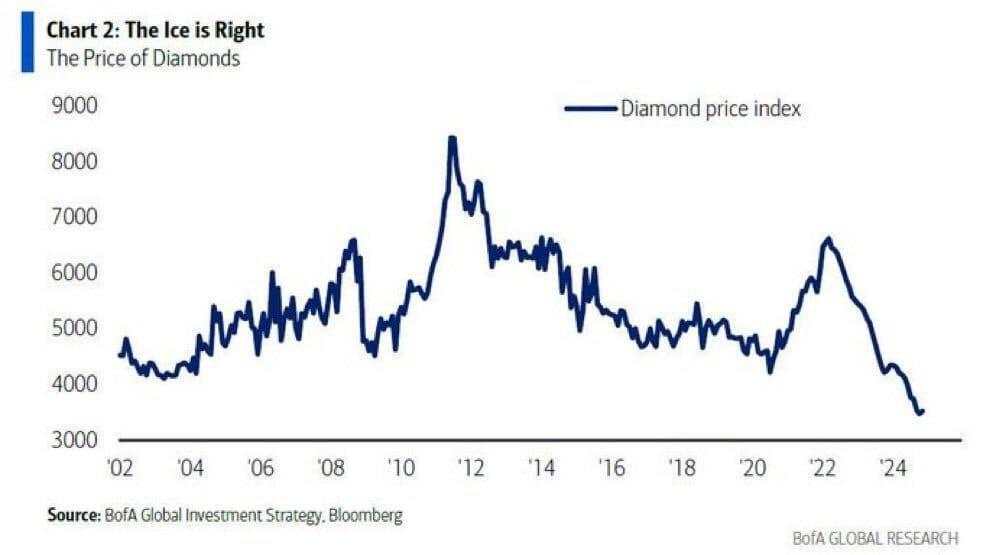

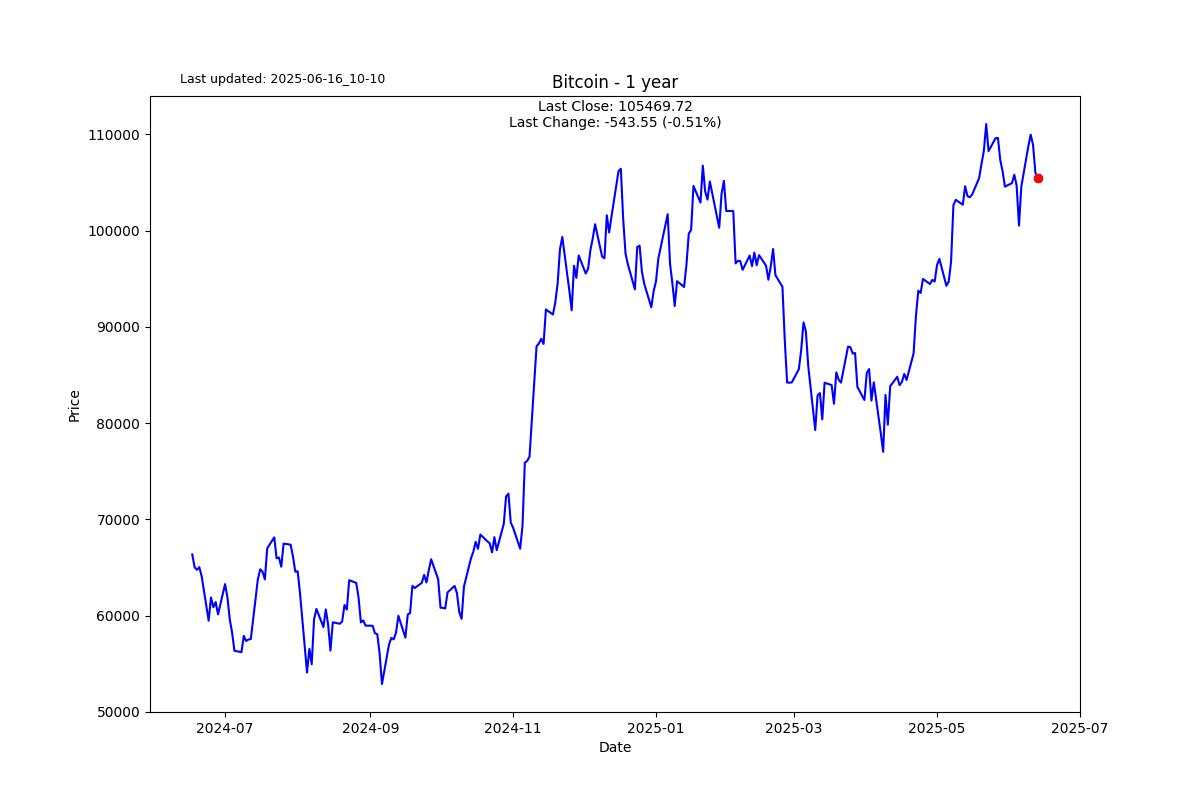

Something that caught my eye, and it wasn’t their sparkle, is the way diamonds have performed over the last few decades. I cannot explain it; perhaps it is all those diamond hands holding crypto?

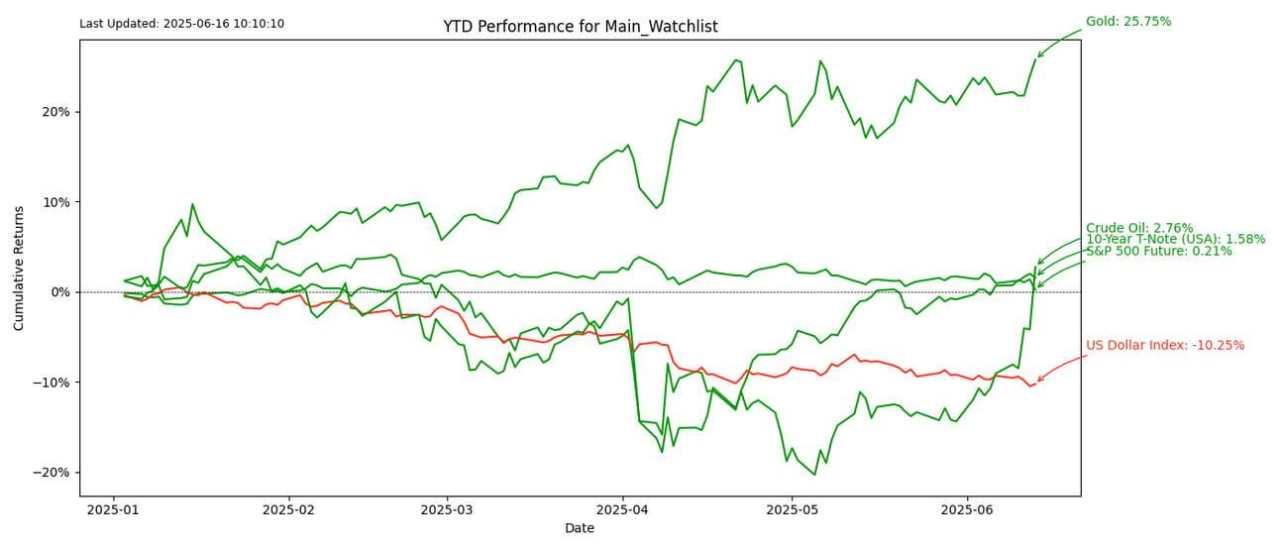

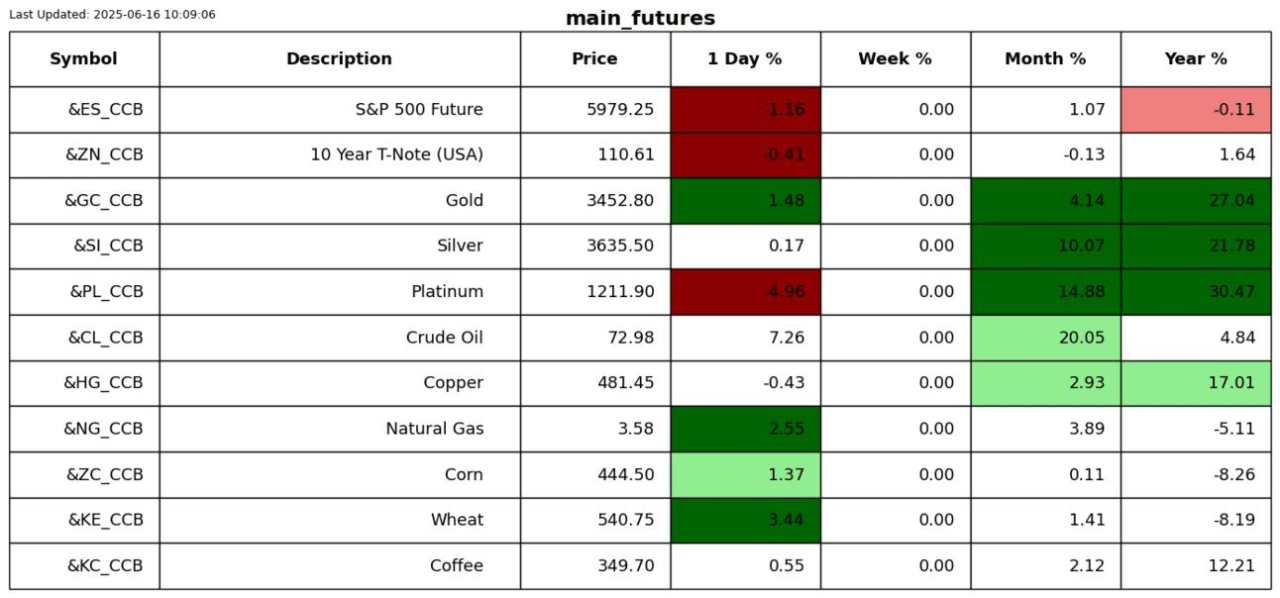

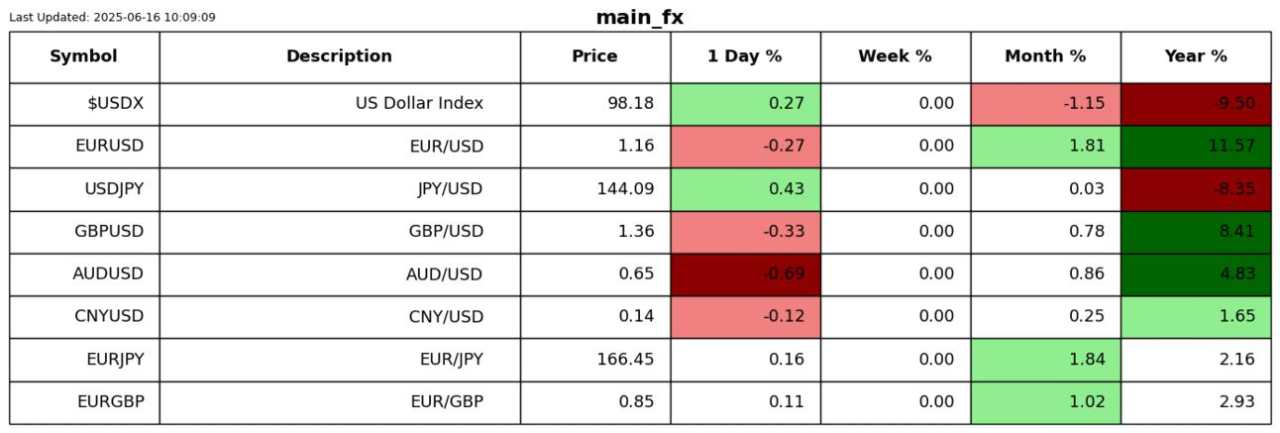

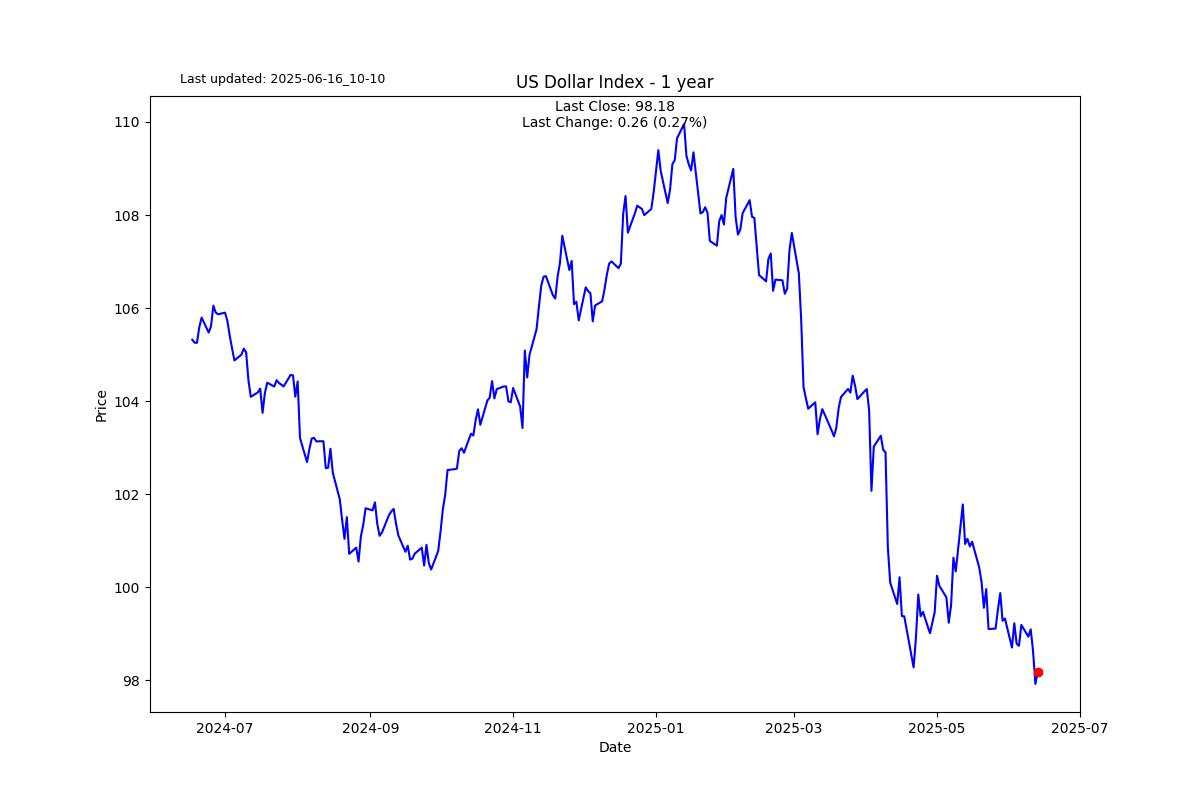

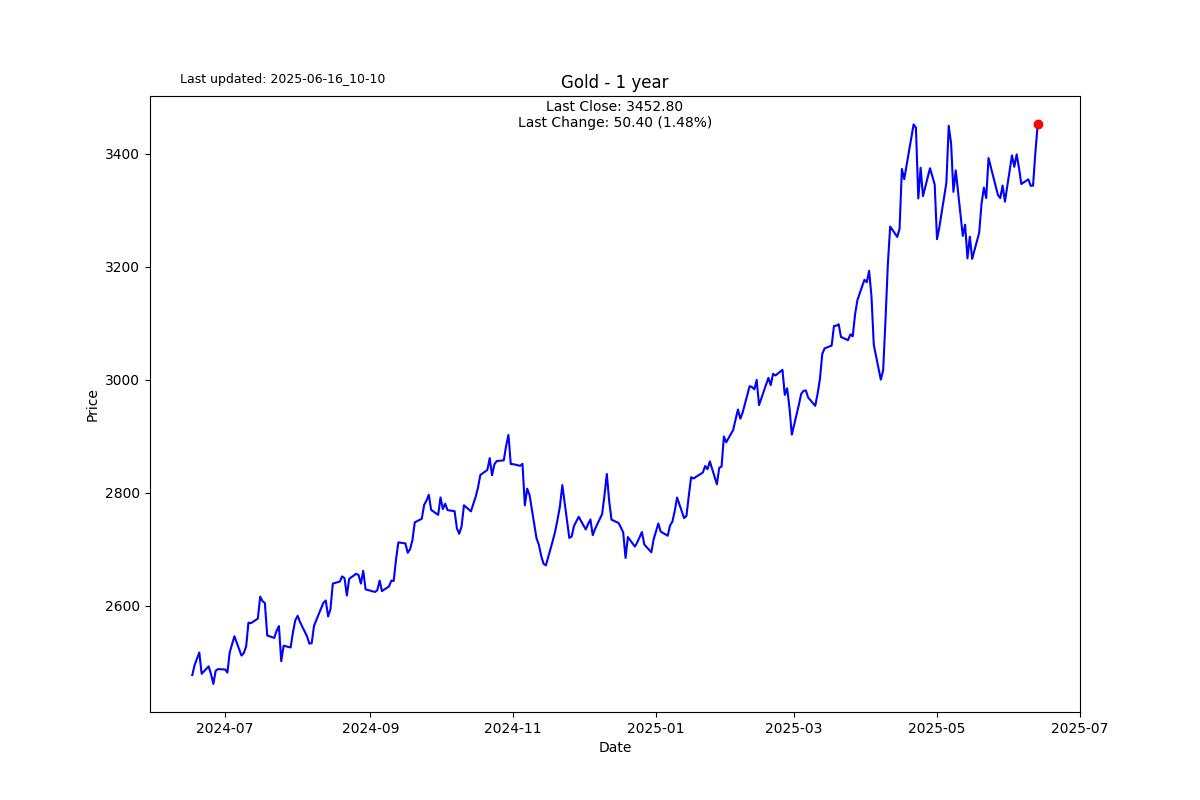

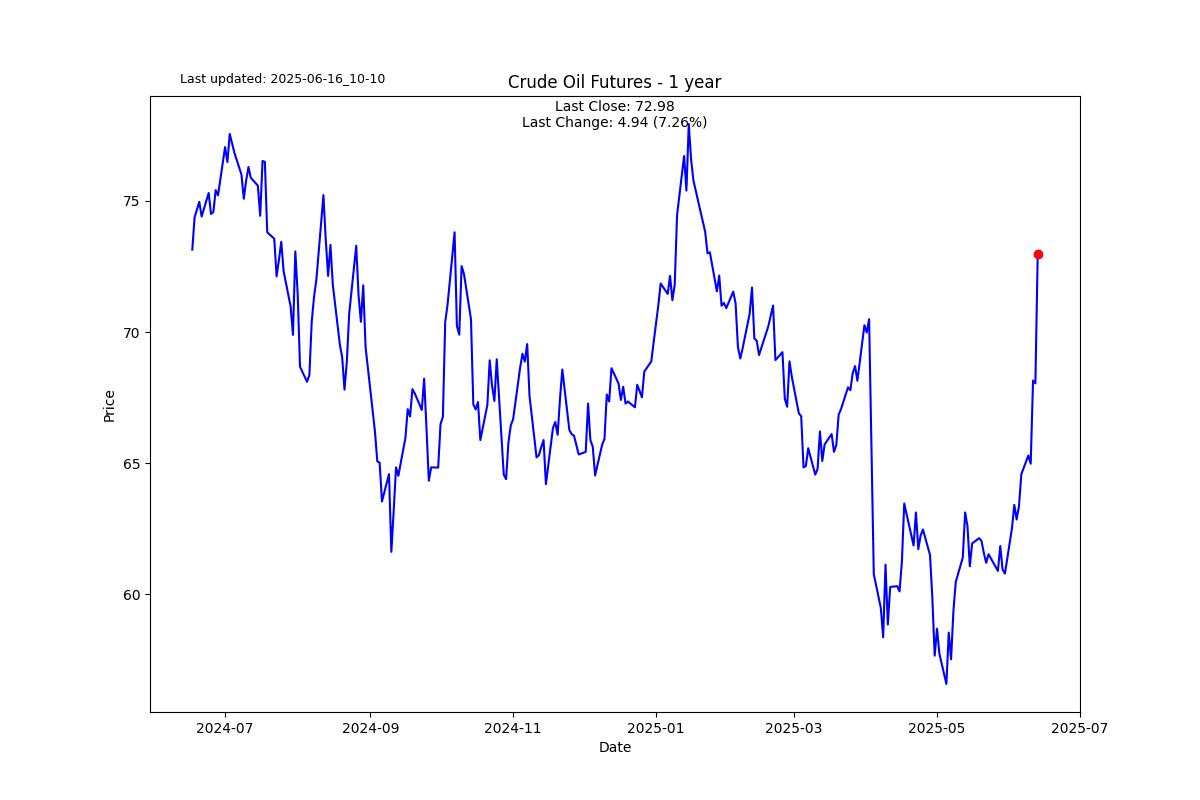

Gold is continuing to do its job as a safe haven against inflation and global currency uncertainty. Oil has abruptly entered positive territory. The US dollar continues to weaken.

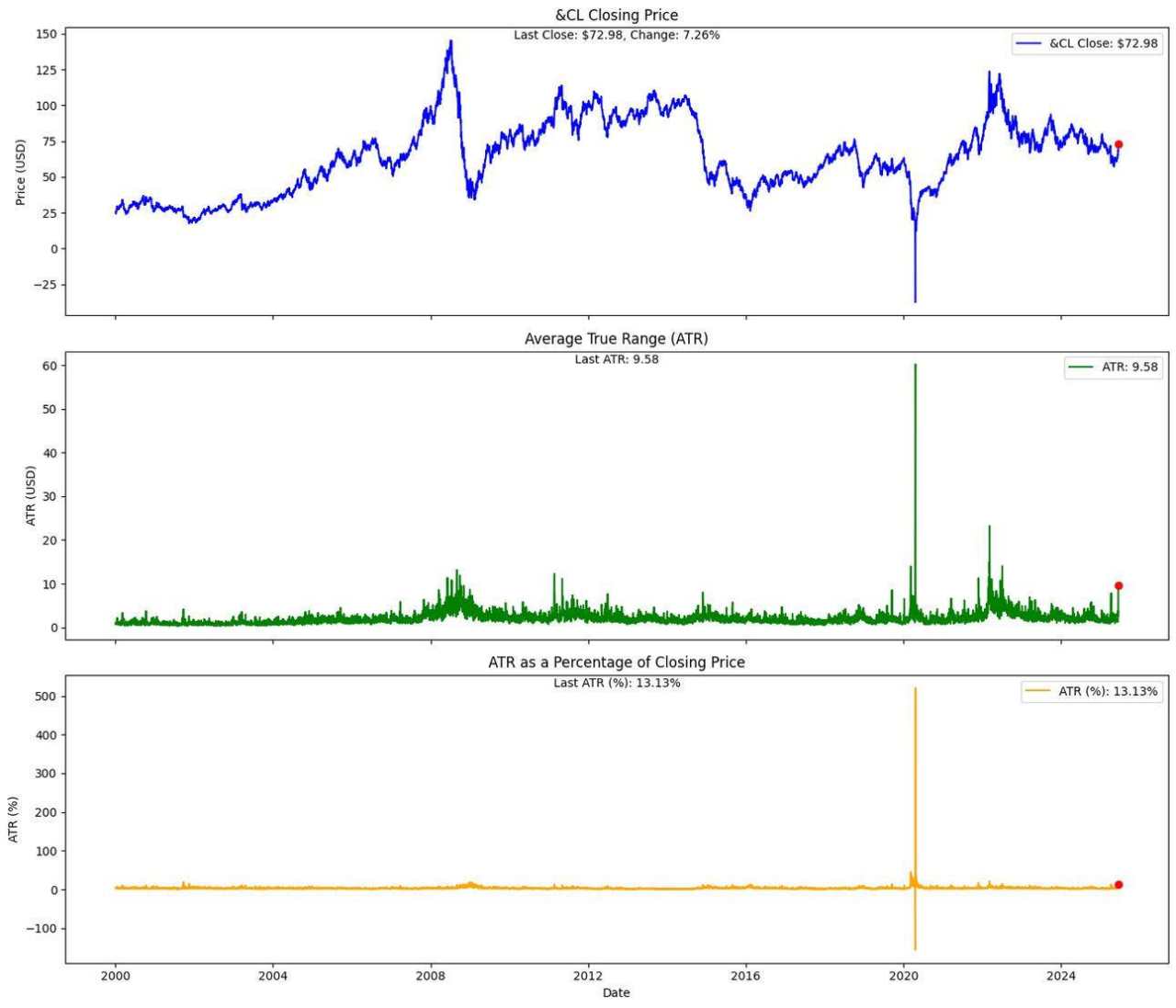

What I found interesting is that crude oil’s average true range was high but not nearly as dramatic as some of oil’s previous moves this century.

S2N screener alert

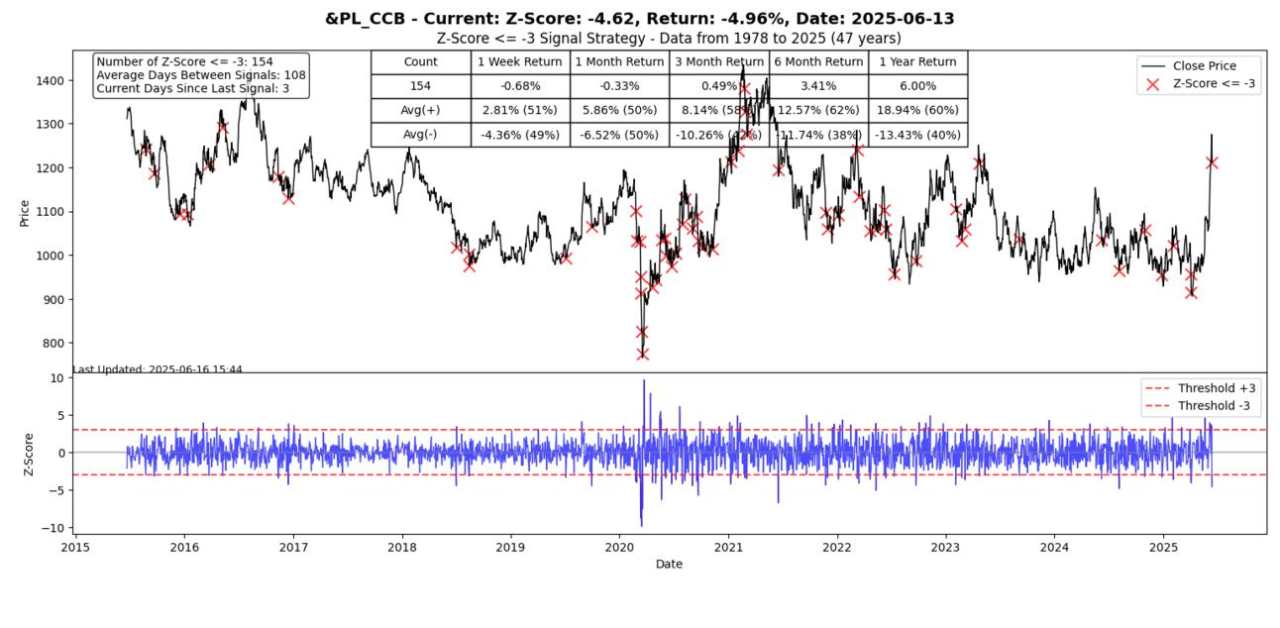

Platinum had a pretty big move down on Friday.

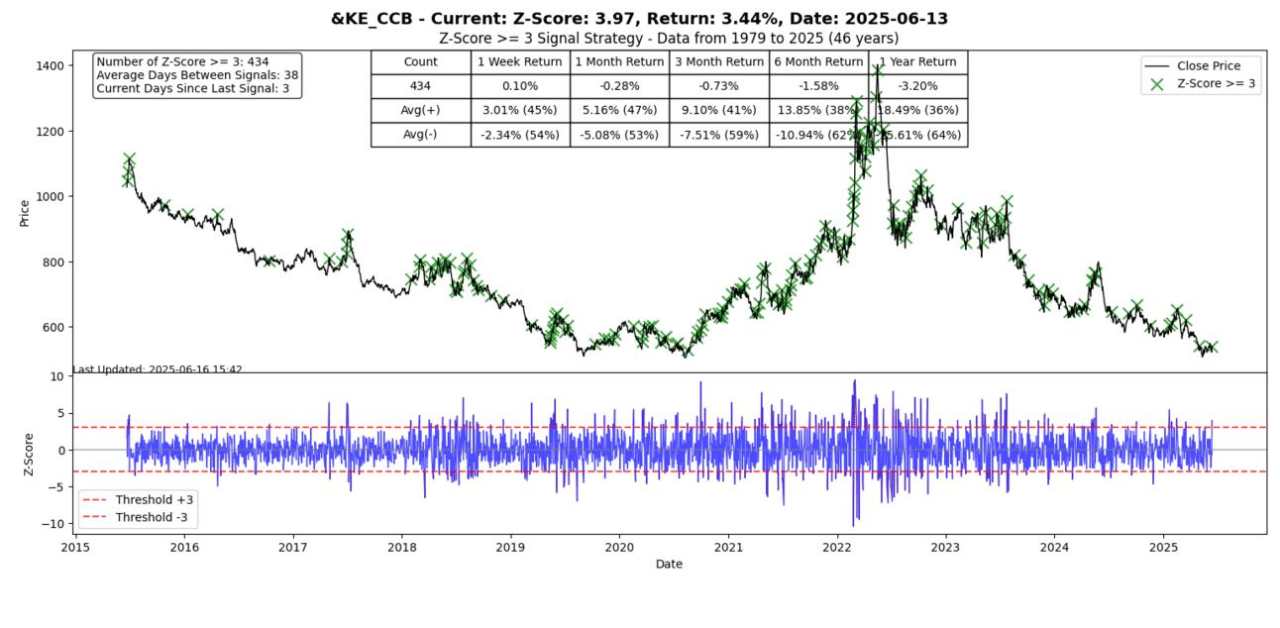

Wheat had a sizeable move up.

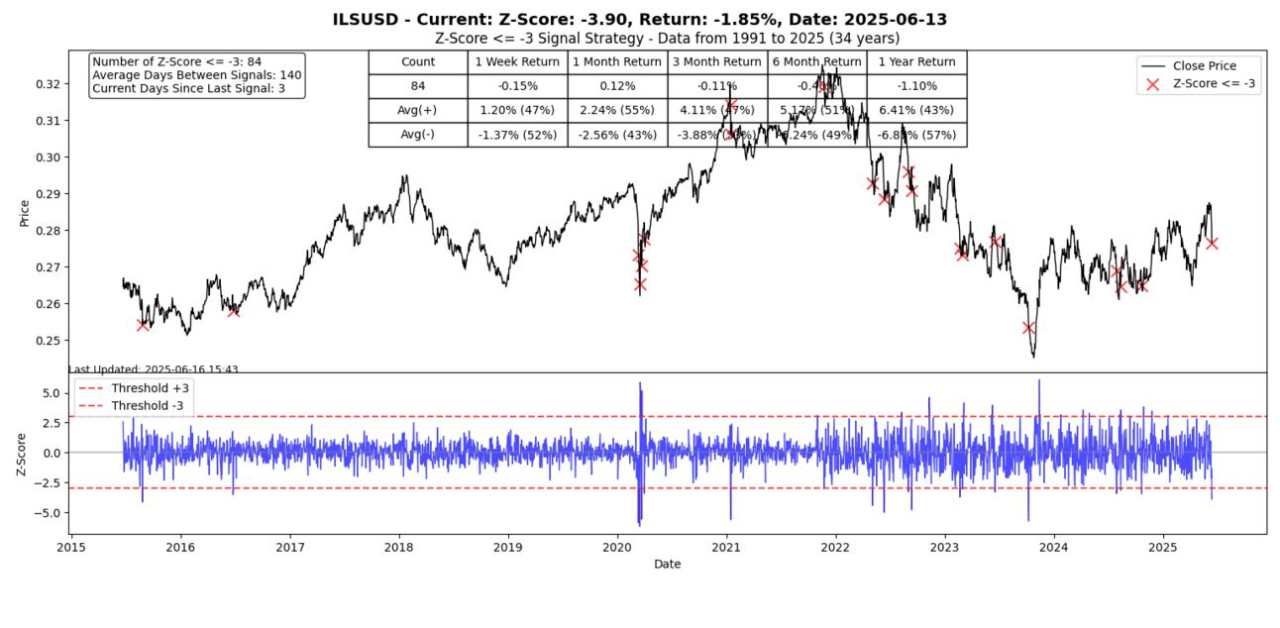

The Israeli Shekel dropped steeply.

S2N performance review

S2N chart gallery

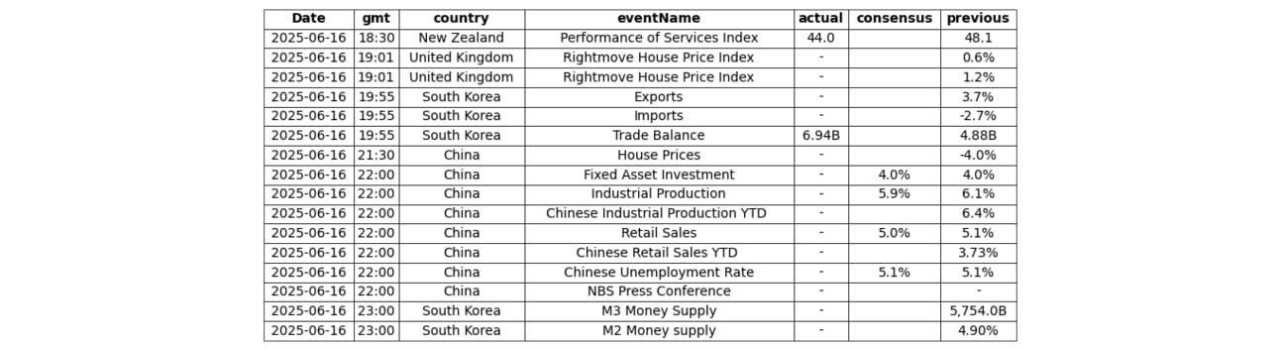

S2N news today

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()