The Bank of Japan kept its policy rate unchanged at 0.5% today while announcing a more gradual approach to reducing its massive bond-buying program, signaling caution amid trade policy uncertainties and persistent inflation pressures. The decisions were largely in line with market expectations, though the slower pace of quantitative tightening provided a mildly dovish surprise.

Key points from the BOJ statement:

- Policy rate held steady: The Board voted unanimously to maintain the uncollateralized overnight call rate target at 0.5%, keeping borrowing costs at their highest level in 17 years

- Slower bond purchase tapering: Starting April 2026, the central bank will reduce JGB purchases by 200 billion yen per quarter, down from the current 400 billion yen pace, aiming to reach about 2 trillion yen monthly by March 2027

- Inflation concerns persist: Consumer prices excluding fresh food have been running at around 3.5% recently, well above the 2% target, driven by wage pass-through effects and higher import costs

- Economic outlook cautious: Growth is expected to moderate due to trade policy impacts and overseas economic slowdown, though accommodative financial conditions should provide some support

- Trade policy risks highlighted: The Board emphasized “extreme uncertainty” around evolving global trade policies and their potential impact on economic activity and prices

Link to BOJ Official Statements

In his post-meeting press conference, Governor Kazuo Ueda stressed that future rate decisions would remain data-dependent, particularly focused on wage growth and inflation sustainability. He noted that while the central bank expects inflation to remain near its 2% target, global trade policy headwinds could complicate the economic outlook.The decision to slow the pace of bond purchase reductions from 2026 onwards reflects the BOJ’s desire to avoid unnecessary market volatility while maintaining its gradual normalization path. One Board member (Naoki Tamura) dissented, preferring to maintain the faster 400 billion yen quarterly reduction pace through 2027.

Market Reactions

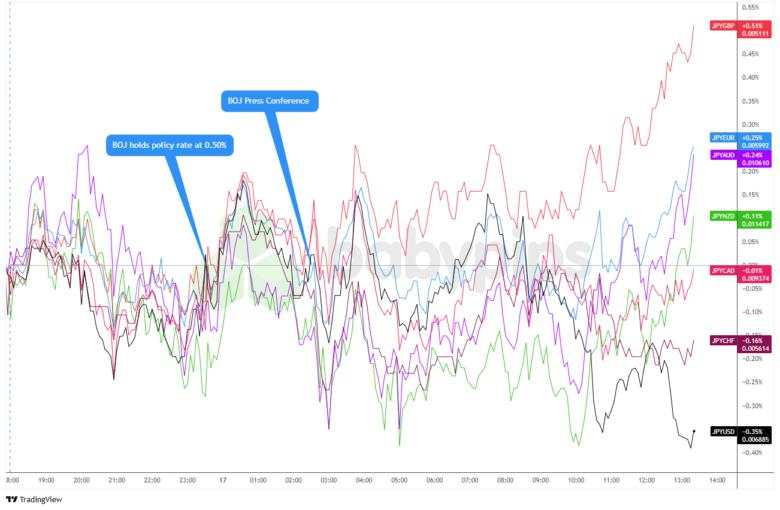

Japanese yen vs. Major Currencies: 5-min

Overlay of JPY vs. Major Currencies Chart by TradingView

The yen’s initial reaction was uniformly net positive in the first couple of hours after the statement release, but the moves were capped as expected as traders likely awaited more details from the following press conference.

After the press conference, the yen saw increased volatility once again, initially to the downside before rebounding just as quickly during the London session, and chopping around through the U.S. session.

This sideways action did lean net bearish for the rest of the session, likely due to traders possibly interpreting the slower JGB tapering pace as marginally dovish. The relatively muted reaction overall also likely reflected that most elements of the decision had been well-telegraphed by the central bank in recent communications.

An argument can also be made that the lack of directional bias on the session was due to the combination of the absence of explicit guidance on future rate hikes, ongoing global trade policy uncertainties, a slower JGB tapering pace, and no major changes to policy. Also, the central bank’s emphasis on data-dependency and external risks may have reinforced expectations that any future tightening would be gradual and cautious.

Tải thất bại ()