- Cooling U.S. inflation has revived bets for a possible Fed rate cut as early as September.

- The Fed’s rate hold is priced in, but all eyes are on forward guidance and the dot plot.

- EUR/USD hinges on the 1.14890 level, hold it for a rebound, break it for deeper downside.

Cooling inflation aligns with Fed’s goals: But what’s next?

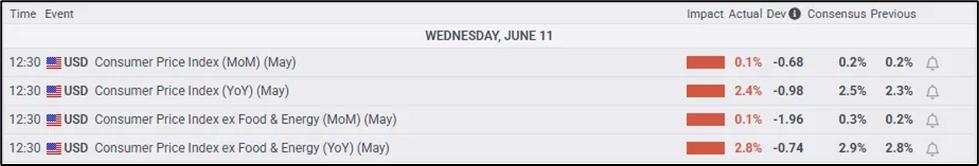

With last week’s CPI print coming in cooler than expected, inflation is gradually aligning with the Federal Reserve’s long-term targets.

This has reignited speculation around possible rate cuts later this year, with markets now pricing in a higher probability of a September cut. Depending on upcoming data, we could see one rate cut in 2025 or even two, as initially projected earlier this year.

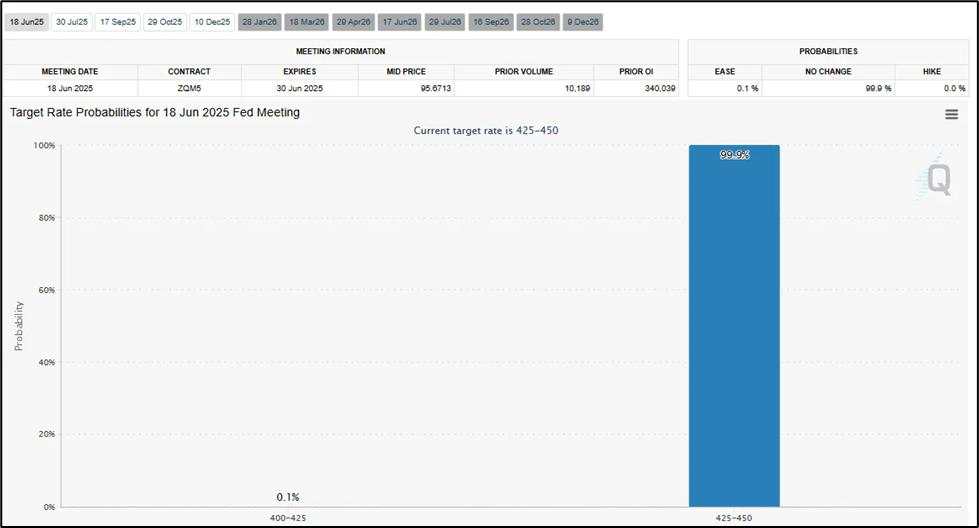

Fed expected to hold steady

Federal Reserve holding rates later today is already priced in, expecting a dovish rate policy. However, the real impact lies in the forward guidance and dot plot. While the hold was priced in, any shift in tone, whether dovish or hawkish, can ripple across markets.

What this means for the Dollar and EUR

Previous Analysis on Dollar: Dollar struggles near three-year lows ahead of FOMC: What It means for the majors

Current Dollar price action

The dollar sits at a critical point, with inflation cooling and the Fed showing restraint. If the Fed signals patience, it could cap further dollar strength, giving EUR/USD room to recover. But if the Fed leans hawkish, especially with stronger inflation or labor data, USD could reassert its dominance.

Technical outlook

EUR/USD: Euro pushes lower as dollar higher

Before

After

Based on the scenario I have plotted yesterday, EUR/USD technical setup before the break, bearish setup has now played out, as price broke below the prior structure and the Fair Value Gaps failed to hold, flipping into resistance. With the downside now in motion, all eyes turn to the Federal Reserve’s rate decision. The key level to watch is 1.14890—a bounce here could trigger a short-term recovery, but a clean break below it opens the door for further downside continuation.

EUR/USD bullish case: Bounce from 1.14890, reclaim of structure

If the Fed takes a dovish tone or signals a possible September rate cut, EUR/USD may bounce off 1.14890 and start forming a bullish leg back toward previous imbalance zones.

- Price holds and confirms demand at 1.14890.

- Breakout of the 4-hour FVG at 1.15087 - 1.15479.

- Break above short-term lower highs with bullish engulfing or breaker structure.

- Fed guides toward easing or confirms inflation progress.

Targets:

- 1.15300 short-term resistance.

- Potential retest of 1.15800.

- Extended upside to 1.16314.

Bearish case: Retest of FVG at, rejection from resistance

If the Fed delivers a hawkish hold, reiterates inflation concerns, or signals no cut in 2025, EUR/USD may bounce slightly to fill inefficiencies before continuing lower.

- Price retraces back to the FVG or 1.153 - 1.156 zone but fails to reclaim

- 4-Hour FVG holds at 1.15087 - 1.15479

- Break and close below 1.14890

- Momentum follow-through post-Fed statement

Targets:

- Break below 1.14890 opens space toward 1.14200 - 1.13900

- Deeper liquidity resting near 1.13500 and below

Key Level to Watch: 1.14890

This level acts as the short-term line in the sand:

- Hold = potential recovery

- Break = further sell-off

With the Fed rate decision imminent, volatility is expected. This level may act as the springboard or breakdown point depending on how market participants interpret the Fed’s tone and projections.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()