- Inflation cools and the Fed is expected to hold, but forward guidance will steer the market’s next move.

- Dollar hovers below critical resistance, with 98.60 and the Daily FVG acting as a potential ceiling or breakout level.

- GBP/USD retests a bearish fair value gap, with the Fed decision likely to dictate whether price rebounds or extends lower.

Inflation slows, Fed expected to hold

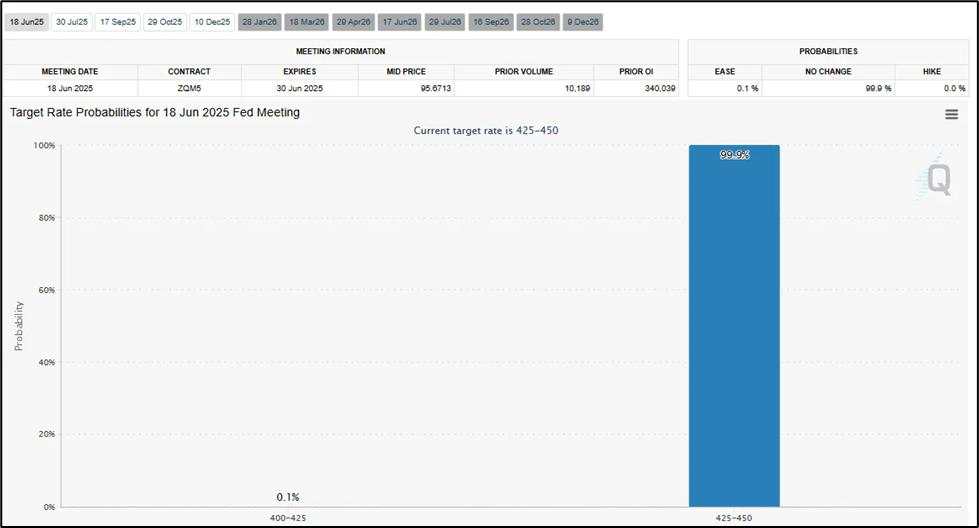

Recent U.S. CPI data confirmed that inflation is softening, inching closer to the Fed’s long-term goal. This reinforces expectations that the central bank may begin easing later this year, with the September meeting now a key event for markets.

While the Fed is widely expected to leave interest rates unchanged, the real market mover will be the updated dot plot and guidance. Traders are closely watching whether officials hint at upcoming rate cuts—or push back against market expectations.

Dollar implications for GBP

Daily

With the dollar on a rebound, the greenback is still not out of the woods from a continued downside as price have not yet broken through the daily FVG as a potential sign of recovery, but not likely.

Four-hour

The dollar has been hovering around a key resistance level in the 4-hour. As the markets await the incoming Federal Reserve Rate Decision Policy release, either dollar pushes above the Daily FVG and breakout of the resistance at 98.60 or this level will be a propeller for more downside.

If the Fed acknowledges cooling inflation and leans dovish, the greenback may weaken and the resistance may hold, allowing GBP/USD to rebound. But if the Fed signals no rush to ease, the dollar could regain strength—pressuring the pound further.

Technical outlook

The pair broke down from a recent consolidation zone and failed to hold support around 1.3470. This move invalidated the previous fair value gap and formed new downside inefficiencies, now acting as resistance.

Bullish case: Recovery from reclaimed support

If GBP/USD holds above the recent bearish FVG at 1.34378 - 1.34655 and manages to reclaim the level above it, we could see a gradual grind higher especially if the Fed opens the door to future rate cuts.

- A break above and close above the FVG.

- Price holds above the FVG resting at 1.34378 - 1.34655.

- Fed leans dovish or weakens the dollar via guidance.

Targets:

- Minor previous support turned resistance at 1.3520.

- Previous equilibrium at 1.3535.

Bearish case: FVG rejection and continuation lower

If the pair fails to reclaim the fair value gap and stalls at the 1.34378 - 1.34655 FVG level, sellers may regain control, particularly if the Fed remains hawkish or the dollar firms up on yield differentials.

- Weak reaction at the FVG or rejection wick at 1.3470.

- Failure to close above prior bearish FVG or imbalance range at 1.34378 - 1.34655.

- Fed downplays rate cuts or projects fewer 2025 cuts.

Targets:

- Retest of 1.3420 - 1.3400.

- Continuation toward 1.3360, with deeper liquidity resting below.

Extended decline toward 1.3280 in risk-off or dollar strength scenario.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()