This week, Jerome Powell, Chair of the US Federal Reserve (Fed), engages in an exercise as formal as it is strategic: his semi-annual testimony before Congress. A fixture of the institutional calendar, it is often seen as a mere "must-see", but takes on particular importance whenever the American economy or politics enter a period of turbulence. This is precisely the case this year, with geopolitical tensions, inflation uncertainties and growing political pressure from US President Donald Trump.

An exercise required by law... and scrutinized by the markets

Twice a year, the Fed Chair is required by the Humphrey-Hawkins Act of 1978 to appear before the US Congress to set out his vision of the economy and the direction of monetary policy. The aim is to defend the decisions taken by the Fed, explain the evolution of the macroeconomic context, and above all, answer the sometimes tense questions from elected officials.

Testimony takes place in two stages: a prepared statement (often highly calibrated) is first read before the two committees concerned: the House Financial Services Committee (Tuesday) and the Senate Banking Committee (Wednesday), before being followed by a question-and-answer session that can last several hours and reveal precious clues as to the Fed Chair's real thinking.

This second, much more spontaneous phase is closely scrutinized by the financial markets, as it is often in these exchanges that new language, revealing hesitations or signals anticipating a future change of course can emerge.

A tense economic and political context

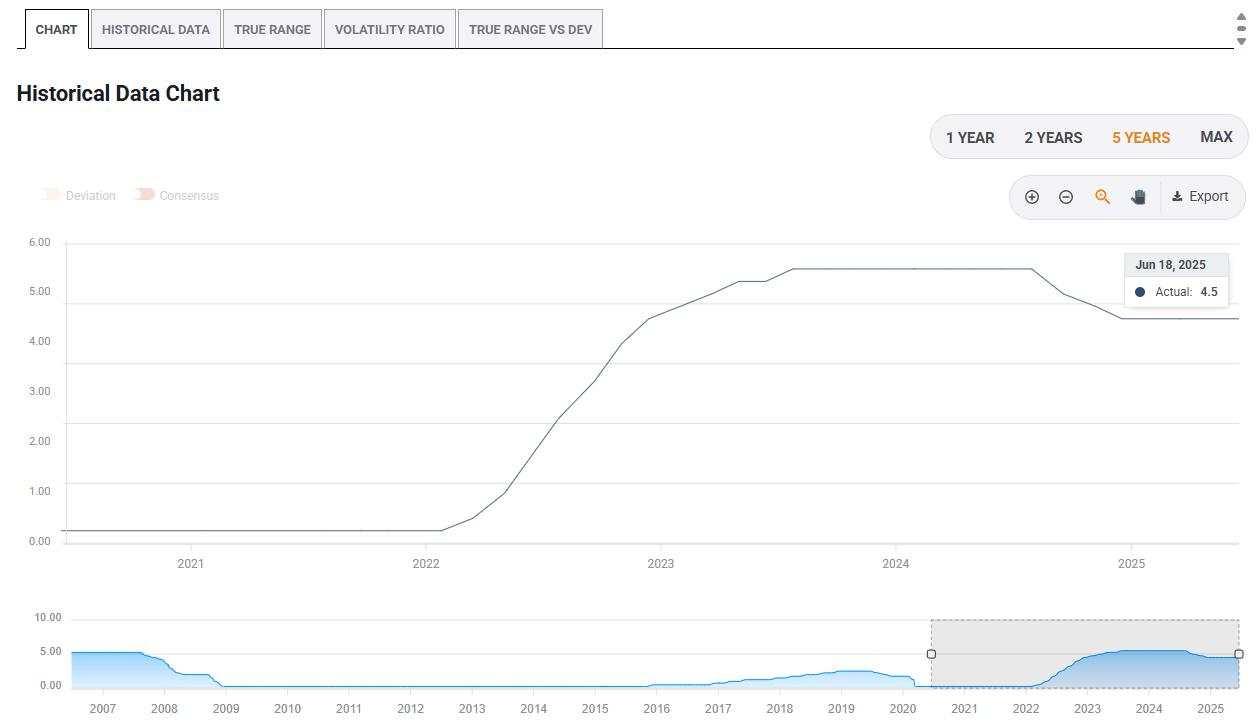

This June testimonial is not a routine exercise. It comes just a few days after a widely-anticipated but unsurprising monetary policy decision: the Fed kept its key rates unchanged, confirming a "wait-and-see" posture against a backdrop of slowing inflation but persistent uncertainties about the global economy.

Fed interest rates. Source: FXStreet

Several hot topics could provoke lively exchanges between Powell and parliamentarians:

Tariffs imposed by the Trump administration are accused of rekindling inflationary pressure. Powell will probably have to defend the idea that tariffs always end up being borne by consumers, a thesis that could displease some pro-tariff elected officials.

The war in the Middle East, particularly the recent strikes on Iranian nuclear sites, which could push up energy prices. Powell could be questioned about the "second-round effects" of this type of geopolitical shock.

Political pressure from Donald Trump, who continues to call for rate cuts to support growth in the run-up to the election. Powell will once again have to reiterate the importance of the Fed's independence, the pillar of its credibility.

A meticulous communications strategy

In his opening remarks, Powell is expected to adopt a measured tone, stressing that the economy remains "solid but vulnerable", that the job market is "in balance", and that inflation, although better oriented, remains above the 2% target.

He also reminds us that any future decisions will depend on the economic data to come, notably the Personal Consumption Expenditures (PCE) index expected this Friday, the main inflation indicator monitored by the Fed.

This positioning seeks to keep all options open: reassuring those who fear a rate hike too soon, while showing that the Fed is ready to act if growth slows or the labor market weakens.

Why this testimony is crucial for investors

For the markets, this type of intervention is a moment when monetary policy lays itself bare. Investors are looking for the slightest hint of a change of course. In an environment where global rates are beginning to fall, as in Switzerland where BNS lowered rates to zero, a Fed that delays the move could strengthen the US Dollar, unless it yields to political pressure, which would raise the question of its credibility.

This testimony is also an opportunity for the Fed to re-establish its authority in a climate where its neutrality is regularly called into question. How Powell responds to criticism, notably about the role of the Consumer Finance Protection Bureau (CFPB), or attacks on his independence, could weigh on market perceptions in the medium term.

An institutional signal in an uncertain world

Finally, beyond the immediate stakes, this testimony is an essential exercise in democratic transparency: it shows that the world's leading central bank is accountable to the elected representatives of the American people.

It is a reminder that despite the scale of its economic power, the Fed is not a player independent of political institutions but an instrument at the service of the public good.

In these times of geopolitical recomposition, trade tensions and aggressive fiscal intervention, Powell's ability to preserve the Fed's credibility and independence will be decisive for market stability, and undoubtedly also for the economic trajectory of the coming months.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()