Paradoxically, as financial uncertainty grows, the dollar figure that Americans feel they need for a comfortable retirement is falling. What's behind this apparent contradiction?

They don't sleep well. They worry about their children, their homes, their future. And above all, their retirement. According to the 2025 edition of Northwestern Mutual's Planning & Progress Study, a record 69% of Americans report feeling anxious or depressed about financial uncertainty. And yet, despite this growing tension around money, the famous "magic number", i.e. the estimated amount for a comfortable retirement, fell in 2025. A drop of $200,000 really raises questions.

The "magic number" declines, but anxiety persists

Since 2022, this figure had hardly changed. This drop in 2025 might suggest that Americans are becoming more realistic or adjusting their expectations. But the reality seems more worrying: it's more a question of a downward adjustment of their ambitions, forced by stagnating incomes, persistent inflation, and eroded confidence in public schemes such as Social Security.

The study reveals that 51% of Americans consider it likely that they will outlive their savings, and only 16% consider this risk highly unlikely. Even more worrying, 1 in 4 Americans with retirement savings say they have accumulated the equivalent of one year's salary or less. And among Generation Xers approaching retirement age, more than half (52%) have less than three times their annual income in savings.

Young people start early, but remain fragile

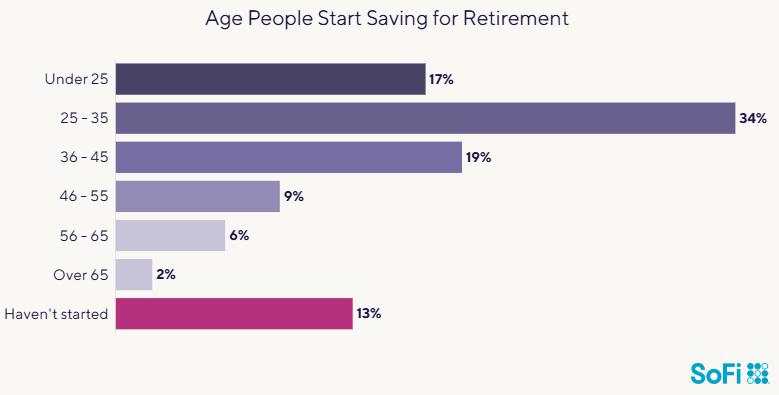

Despite this, there are signs of positive change. Younger generations, particularly Generation Z, are starting to save earlier (at an average age of 24). They are consulting financial advisors at a younger age and are looking to retire earlier (at an average age of 61, compared with 72 for baby-boomers).

However, these same young people are also the most vulnerable: 53% of Millennials and 56% of Gen Z say that money makes them physically ill. A growing proportion rank finances as their greatest weakness, ahead of physical or mental health.

And while many would like to save more, only 17% of Americans overall are devoting more than 15% of their income to retirement, the threshold recommended by experts.

The mirage of Social Security

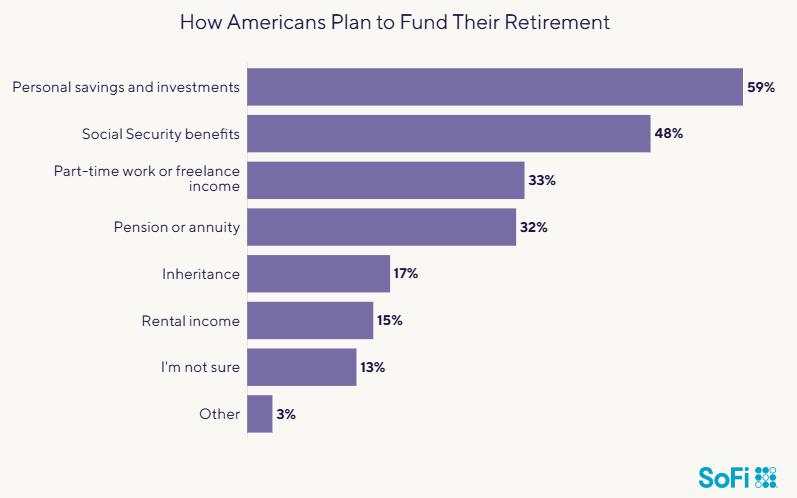

Another source of confusion: Social Security. Nearly a third of Americans still rely on it as their main source of retirement income, even though it only replaces an average of 40% of pre-retirement salary.

Worse still, a majority of Gen Xers and Boomers+ plan to start collecting their benefits as soon as they are eligible, at the risk of cutting their monthly payments for life.

Concern about the future of the program is growing: 47% of Gen Xers consider the viability of Social Security to be one of their main concerns. Among younger people, confidence is so low that they are increasingly excluding it from their plans.

Working in retirement: By choice or necessity?

Faced with this landscape, post-retirement work is becoming the norm rather than the exception. Four out of ten Americans plan to continue working after retirement, a proportion that rises to almost half among Millennials and Gen Xers. While some cite the need to stay active, others — especially Gen Xers — admit that they will have to work to survive.

The image of a peaceful retirement of leisure, travel and grandchildren now seems out of reach for a large proportion of the population. Almost 75% of adults admit that their vision of retirement differs from that of their parents — often less stable, longer and more uncertain.

The true price of retirement: much more than $1.26 million?

So, is the "magic number" of $1.26 million really enough? In theory, at a withdrawal rate of 4% per year, this amount could generate around $50,000 in annual income.

But that presupposes a retirement free of unforeseen events, galloping inflation and health or economic crises. It also means starting early. A person who starts at age 20 will need to invest around $330 a month to reach this amount at age 65 (at an annual return of 7%). By age 40, you'd already need more than $1,500 a month.

Yet nearly half of Americans say they don't know how much they'll need to retire. And 35% say they have taken no steps to avoid outliving their savings.

Between renunciation and illusions

The decline of the "magic number" in 2025 to $1.26 million is not a sign of optimism, but of forced adaptation. Faced with an uncertain economy, a fragile social safety net and ever-rising living costs, Americans are reviewing their ambitions. Retirement is becoming a grey area, a stage to be redefined.

Working longer, saving earlier, diversifying income, rethinking priorities: never before have personal choices weighed so heavily in everyone's financial destiny. The American dream of a golden retirement has not evaporated, but now more than ever it needs to be actively built, early and with discipline.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()