Welcome to the carnival of contradictions—where the economy looks like it just rolled out of bed after a bender, but the S&P 500 and Nasdaq are strutting down the catwalk like it’s fashion week. Forget the fundamentals; this market is trading on vibes, Botox, and the fear of missing yet another AI-fueled face ripper.

This week served up a sampler platter of soggy data: limp income, undercooked spending, and housing slippage. Yet somehow, sentiment bounced like a cat on a trampoline, launching stocks to fresh record highs—thanks to easing inflation that gave the “bad news is good news” regime fresh legs. It’s not quite a bull market of yesteryears—more like a mechanical bull: wild, and powered by artificial adrenaline.

The SPX is now more stretched than a pair of decade-old Lululemons, with RSI deep in nosebleed territory at 72. But the problem isn’t that it’s overbought—it’s that everyone knows it’s overbought and still can’t stop buying. The crowd that puked risk in April is now stuck playing musical chairs, praying the music doesn’t stop after they're forced to get back in.

And oh, the Nasdaq. Call it Et Tu, Tech—sliced, diced, and still surging like it drank a case of Celsius. Options desks are busy as traders pile into upside calls. It's the kind of move that screams positioning scramble, not fundamental conviction.

But let’s not pretend this is broad-based euphoria. Only 22 SPX stocks are hitting all-time highs. Compare that to the 97 in March 2013 or the 82 in the pre-Lehman peak. This is a narrow mania wearing index lipstick. Meanwhile, fund managers are still hugging the sidelines like scared chaperones at a high school dance, underweight and underwhelmed.

Fundamentals? Please. The Bloomberg US Econ Surprise Index just hit a clean sweep—every subcomponent in the red. But in this new regime, bad news is like a backstage pass to the rally. The worse the data, the louder the rate-cut drumbeat, and the hotter the chase gets. It’s 2020 logic rewrapped in 2025 packaging—cheap money dreams with trillion-dollar AI tape over the cracks.

Bonds rallied, the curve bull-flattened, and the dollar got tossed like last season’s sneakers—until Trump blew up trade talks with Canada and sent the Loonie into a Toronto Maple Leaf playoff-style collapse. Gold cracked under the weight of unwinding geopolitical risk, but palladium did its best impersonation of a meme stock. Crude? Straight off a cliff as the Israel-Iran risk premium got priced out faster than an IPO on day two. Meanwhile, Bitcoin moonwalked back above $108K, just in time for macro tourists to flex on crypto X again.

And somewhere in the madness, cattle futures were... mooving. Because, of course, they were.

Looking ahead, we’ve got fireworks queued up: NFP on Thursday, a long weekend for punters to stew over open risk, and then it’s go-time with the FOMC, tariff deadlines, and that pesky debt ceiling X-date. Vol-sellers may be loving life now, but Cupid has a nasty habit of yanking the rug. Let’s see who’s still smiling when the music shifts from bubblegum pop to funeral dirge.

In this market, disbelief isn’t a contrarian signal—it’s the primary fuel source.

In summation, Equity markets ripped higher again this week, with the S&P 500 flirting with a record close—now up over 20% from the April lows, like a fighter shaking off an early-round knockdown and coming back swinging in the championship rounds. The tailwind? A Fed that’s quietly swapped its hawk feathers for dove wings, gliding toward a soft landing that investors had all but written off just months ago.

Back then, the fear was simple: if tariffs returned with a vengeance, inflation would re-ignite and the Fed would be stuck in a monetary straitjacket—unable to ease as growth stumbled. But that straitjacket’s coming loose. This week’s core PCE print was mild enough to feed the doves: 2.7% year-on-year, sure, but just 2.2% annualized in May and an even cooler 1.7% pace over the last three months. That’s not inflation roaring back—it’s inflation dozing off.

And so, the rate cut drumbeat grows louder. Futures markets are now pricing in about 65bps of easing by December. July’s still a no-fly zone, but September and December are on the runway. For equities, this is the kind of backdrop that smooths the runway for further upside: yields are backing down, multiples have more breathing room, and the valuation story—while still stretched—no longer looks like it's held together with duct tape and denial.

In short, the market’s riding a fresh wave of monetary optimism, paddling out on calm inflation seas with rate-cut winds at its back. It’s not a broad-based risk rally yet, but in this environment, all it takes is the right breeze—and the bears are the ones getting seasick.

However, the softness in the U.S. dollar has made unhedged U.S. equity exposure a relative sore spot for foreign buyers.

Speaking of FX… the Dollar’s Slippery Slope Looks Far From Over

The greenback’s grip continues to loosen, with the DXY sliding to its lowest since March 2022 on Thursday. Momentum? Still soggy. Even with Trump’s team floating the possibility of ten trade deals before the July 9 tariff suspension deadline, the FX market isn’t biting. The narrative has shifted decisively back to macro—rate expectations, data risk, and central bank signals—not headlines.

Fed speakers are now openly teeing up the chance of a July cut, though that still hinges on next week’s jobs print and the CPI on July 15. It’ll take clear, unambiguous softness across both to pull the trigger that soon—but the bar is no longer sky-high. What’s already weighing on the dollar is the broader recalibration: 2026 rate cut expectations have been yanked lower, dragging Fed funds down across the curve and keeping USD bulls on the back foot.

If we get a soft jobs number and Trump actually follows through on even half those trade deals, global growth optimism will find fresh legs—and that’s a recipe for further dollar selling. The dollar may have already lost altitude, but it's still coasting on residual flows. That lift disappears quickly once the market sees synchronised policy easing, improving risk appetite, and a Fed ready to play catch-up.

Meanwhile, the loonie is fighting its own demons. Crude oil’s sharp drop has taken the wind out of CAD’s sails, leaving it adrift even as the USD weakens broadly. And with Canadian CPI cooling, employment weakening, and Trump turning up the heat on trade, the BoC has cover to lean dovish. If oil stays heavy, CAD stays vulnerable.

As for the pound, it's been punching above its weight—but the cracks are starting to show. UK data is rolling over, and the risks of back-to-back MPC cuts are rising. If that materializes, sterling’s recent shine could fade fast—especially against non-dollar pairs where policy divergence still matters.

Bottom line: the path of least resistance for the dollar remains down, but not all currencies are equally poised to capitalize. Momentum may favor EUR and safe-haven catch-up plays like JPY, while energy-linked FX and politically exposed currencies like CAD remain at the mercy of external shocks. This is still a dollar sell-off—but it’s becoming more selective by the day.

Europe Has One Less Grenade to Dodge

Europe's geopolitical chessboard has been cluttered with mines lately—Ukraine’s still smoldering, the energy reshuffle is far from done, and Washington’s been sending more mixed signals than a broken Morse code machine. Until recently, the biggest concern wasn’t even coming from Moscow, but from across the Atlantic: a resurgent Trump, sabre-rattling over NATO and waving a tariff stick the size of a telephone pole. But this week, at least one pressure point eased off the map.

The NATO Summit delivered a rare win. In a move that looked more coordinated than expected, 31 of 32 member states agreed to crank up defense spending to 5% of GDP over the next decade—up from the long-ignored 2% target. Europe had pleaded for runway, and it got it: a seven-year glidepath instead of a cold plunge. Even more unexpected was Trump’s tone. Rather than his usual “you’re on your own” rhetoric, he pledged support “all the way.” For a continent bracing for a transatlantic divorce, that line landed like a sigh of relief in a soundproof room.

Germany’s already loading the fiscal ammo. Its €500 billion infrastructure and defense fund just cleared the cabinet, giving Berlin the green light to finally act like the economic heavyweight it is. Meanwhile, the EU’s €150 billion loan-to-weapons facility is unlocked and ready to be deployed—as long as most of the components come from EU-aligned suppliers. Brussels is building an arsenal not just of arms, but of autonomy.

But not everyone got the memo. Spain refused to sign up for the 5% commitment, insisting its 2.1% spend still gets the job done. That earned it the diplomatic version of a side-eye from allies—and a fresh Trump tariff threat for good measure. Madrid now sits awkwardly at the kids’ table.

Which brings us to the real ticking time bomb: trade. The July 9 deadline looms, and the tone between the U.S. and EU remains frosty. Trump is threatening a blanket 50% tariff on European exports if there’s no deal—carving a trade crater big enough to swallow Berlin’s surplus whole. Germany’s Chancellor Merz wants exemptions for auto exports, following the UK’s path, but Brussels isn’t thrilled. “Delusional,” muttered one official. Macron isn’t playing nice either, but even the French resistance knows the score: this deal gets done, or Europe eats tariffs.

The likely landing zone? A 10% baseline tariff Europe will grudgingly swallow, possibly sugar-coated with export quotas to dull the sting. Brussels doesn’t have the upper hand—it barely has a pair to play. The U.S. holds the cards, the clock, and the leverage.

For now, Europe has crossed one grenade off the checklist. But the trade war fuse is lit, and the blast radius is still being measured.

Chart Of The Week

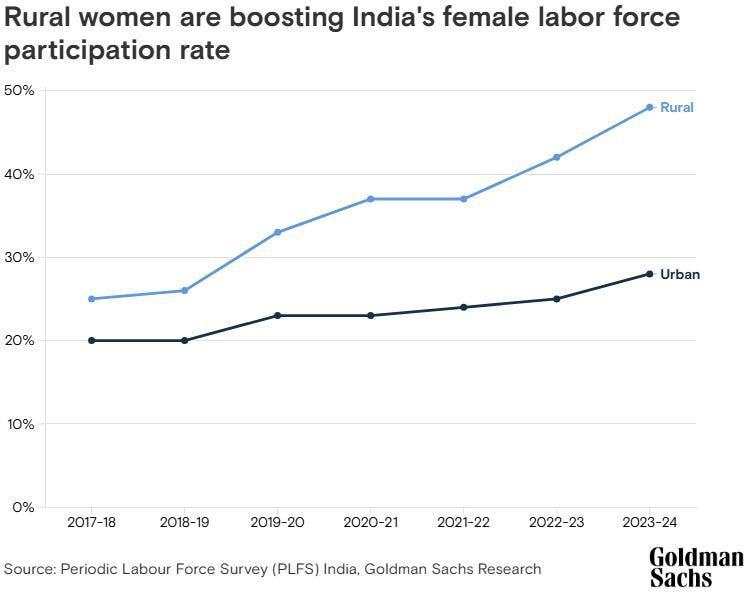

The Economic Opportunity of India's Women Workers

Among major economies, India stands out with a once-in-a-generation demographic dividend. A massive cohort is entering working age, and its age-dependency ratio is set to be one of the lowest globally—fewer mouths to feed per working pair of hands. That’s a structural tailwind most countries would kill for.

But unlocking the full upside hinges on a critical piece still missing from the engine: female participation. As Goldman’s Chaitra Purushotham points out, even a return to previous peak labor force participation could tack on a full percentage point to India’s potential growth. In a world starved for productivity, that’s not just a marginal gain—it’s a macro game-changer. The 20-year window is open, but it won’t stay that way forever. Now comes the hard part: policy, inclusion, and clearing the runway for half the population to get to work.

On the bright side, the status of Indian women is gradually turning a corner, buoyed by gains in education, healthcare access, and basic infrastructure. According to Purushotham, this progress is now showing up in labor market data—with female labor force participation seeing a meaningful uptick in recent years. The real driver? Rural India, where more women are stepping into self-employment, especially in agriculture.

This shift isn’t happening in a vacuum. It’s being propelled by a cocktail of supportive policies: financial inclusion schemes, digitization, targeted skills development, and better infrastructure. In short, the scaffolding is being built—and women are climbing it.

Goldman’s own 10,000 Women program sheds light on what’s powering these entrepreneurial journeys. Nearly two-thirds of respondents cited training and mentorship as critical to their growth. But while skills are being sharpened, capital remains elusive—access to funding is still the biggest stumbling block. It's a familiar story: the ambition is there, the infrastructure is rising, but the financial pipeline remains clogged. Unleashing the full potential of India’s women entrepreneurs will take more than inspiration—it’ll take investment.

Running Update

One of the toughest parts of running—beyond the early alarms and the occasional niggles—is simply staying consistent. And the only way that happens, at least for me, is if running feels fun. Not every run will be a runner’s high, of course—some days are a straight-up slog. But even those days need to be reframed as part of the fun, or else it all becomes a grind.

We live in an era of Garmin worship and social media-fueled data obsession, where every split, HRV trend, and zone breakdown gets dissected like a race report. But the truth is, there’s no one-size-fits-all method. I’ve been tweaking my approach in six-month cycles for the past three years, chasing that 2022 groove—those months when I was cruising through 200-250km like it was second nature after just two years back in the sport.

This week, I brought the focus back to fun. Yes, I’m still staying within my LT1 / upper zone 2 range—but I’m not sweating it if the heart rate drifts a few beats over. Today was a perfect example: the plan was 15km, but when my heart rate spiked early, I cut it short. Not out of laziness, but because I’m trying to stay in the consistency and fun zone, not push myself into a drudge march over the final stretch. This phase is about listening to the body, not punishing it. The miles matter—but so does the mindset.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()