As FX traders sharpen their focus, all eyes are on today’s June US jobs report. The release could be the catalyst that determines whether Fed Chair Jerome Powell holds firm on resisting rate cuts, or if a July cut becomes inevitable.

What to expect from the jobs report

Market consensus expects:

- Nonfarm Payrolls (NFP): +110,000 (down from +139k in May)

- Unemployment Rate: 4.3% (up slightly)

- Wage Growth: +0.3% MoM (~3.9% YoY)

However, several downside risks loom:

- ADP Report this week showed a surprising drop of 33,000 private-sector jobs.

- Goldman Sachs projects an even weaker print of +85,000, citing factors like federal layoffs and immigration shifts.

This leaves markets on edge.

Why it matters for the Fed and the Dollar

Powell has maintained a cautious stance—signaling rate cuts are possible, but not imminent. Today’s data will challenge that view:

- If jobs meet consensus: Powell may continue deferring cuts, keeping USD supported.

- If jobs miss significantly: A weak print could force the Fed’s hand in July, accelerating USD downside.

- If jobs beat expectations: The Fed stays on hold longer, giving the dollar a short-term boost.

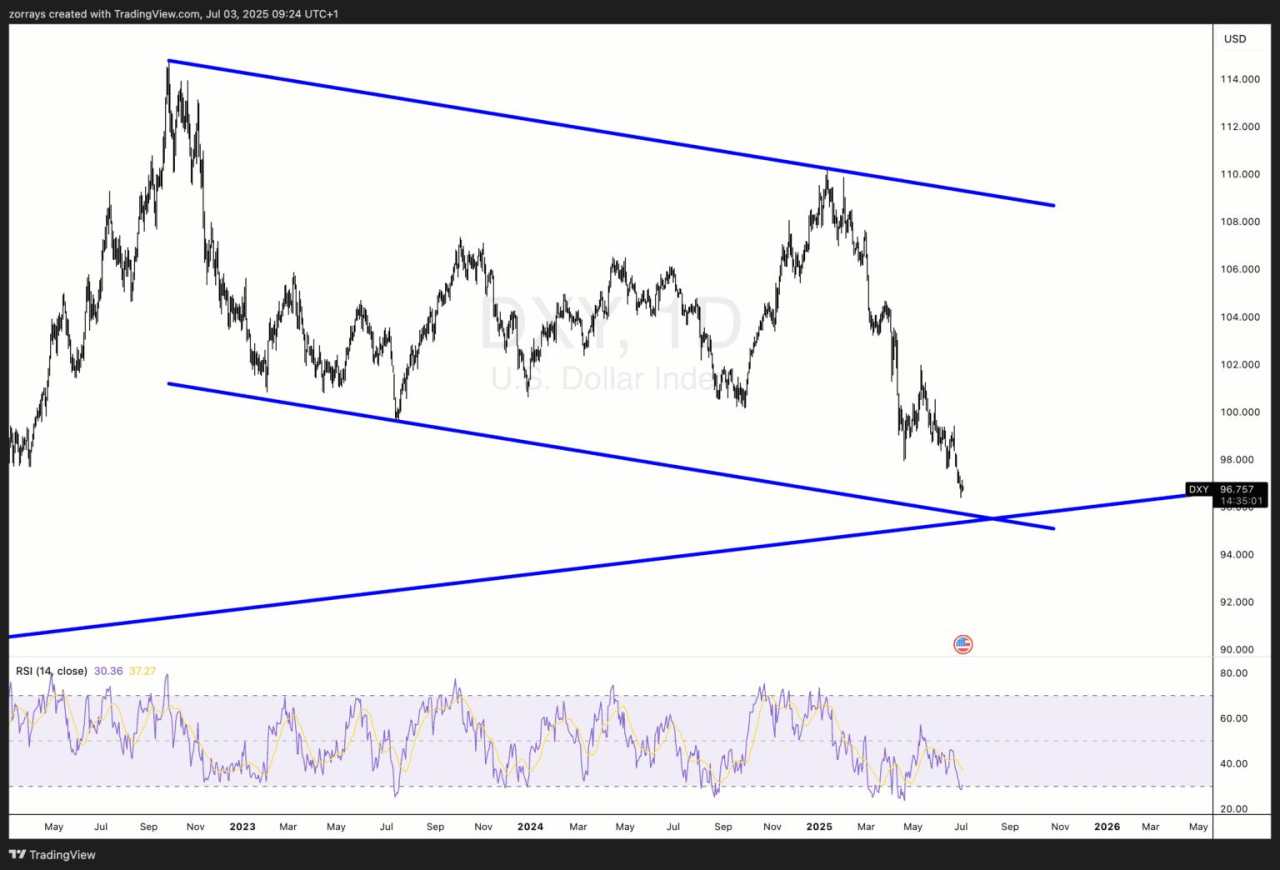

Technical picture: DXY approaches long-term support

The Dollar Index (DXY) is heading into a technically critical area, aligning perfectly with the fundamental setup.

Weekly chart: Multi-year trendline

- DXY is testing a trendline dating back to 2008.

- This would mark the fifth touch—typically a high-probability reversal zone.

- Despite current bearish momentum, the long-term structure still holds.

Daily chart: Channel breakdown in motion

- On the daily chart, DXY is making its way toward the lower boundary of a clear descending channel.

- This lower bound overlaps with long-term trendline support, increasing the odds of a technical reaction zone.

- Momentum indicators like RSI are oversold, which may suggest a pause or relief bounce—if NFP doesn’t spark further panic.

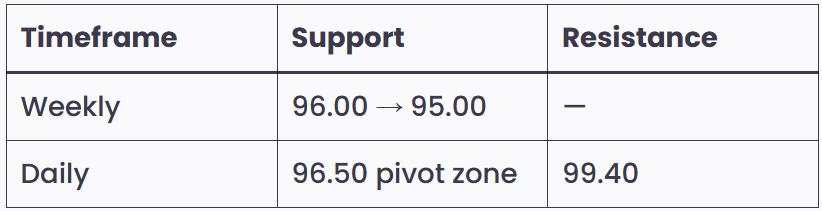

Key levels for traders

Summary: A make-or-break moment for the USD

Today’s NFP isn’t just another print—it could shape the Fed’s July decision and mark a turning point for the dollar.

- Fed flexibility hinges on whether labor market weakness is soft or severe.

- DXY has more room to fall—but it’s nearing strong, multi-year support.

- Traders should prepare for sharp USD moves post-NFP, with eyes on trendline reaction.

Whether this marks the beginning of a broader dollar collapse—or just a breather before stabilization—depends on how the next few hours unfold.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()