Summary

The June CPI report is likely to show inflation beginning to strengthen again, albeit not enough to alarm Fed officials at this juncture. We expect the headline CPI to rise 0.25% in June, which would nudge the year-ago rate up to 2.6%. Excluding food and energy, we anticipate the core CPI to increase 0.24% and view the risks skewed more to an upside surprise of 0.3% versus another downside surprise of 0.1%. If our forecast is realized, the 3-month and 12-month annualized rates of core CPI would strengthen to 2.4% and 2.9%, respectively.

The next three months will mark a key stretch of inflation data. While inventory front-running has mitigated the need to raise goods prices, it will become increasingly difficult for businesses to absorb higher import duties as pre-tariff stockpiles dwindle. We expect core goods prices to pick up further in the second half of the year as a result, but look for the pass-through to be limited by growing consumer fatigue. Amid a softer labor market and services inflation dissipating a bit more, the pickup in core inflation stemming from tariffs is likely to look more like a bump than a spike.

Pickup in June inflation won't be enough to rock the boat

The next three months will mark a key stretch of inflation data. FOMC Chair Powell has made clear that he will be watching price reports over the summer to discern if tariffs are reversing the disinflationary trend that has been underway the past three years. The past two CPI reports have shown some signs of tariffs within the goods sector, but not enough to spring the overall trend in inflation higher. We expect the June CPI report to show inflation beginning to strengthen again, albeit not enough to alarm Fed officials at this juncture.

We estimate headline CPI rose 0.25% in June, a bit stronger than its average pace since the start of the year (0.19%) and enough to nudge the year-ago rate up to 2.6%. Gasoline prices were up in June on a seasonally-adjusted basis, but continue to decline year-over-year to give consumers some breathing room. Another drop in egg prices and prior easing in food-related commodity prices point to a smaller monthly advance in food inflation.

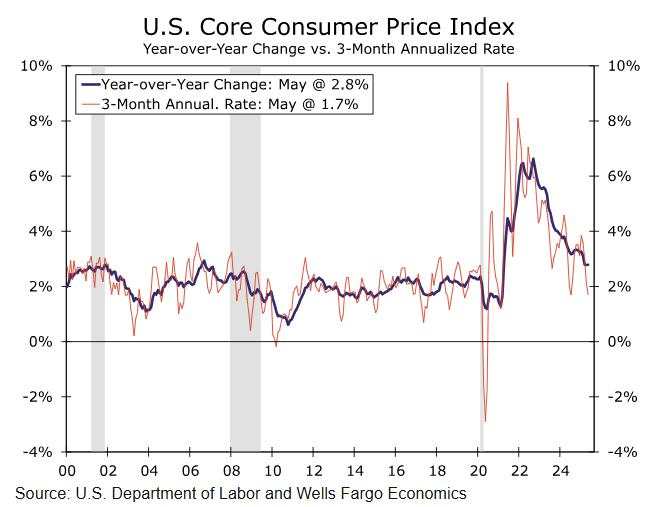

Excluding food and energy, core inflation looks to have picked up in June. We anticipate a 0.24% increase, and see the risks skewed more to an upside surprise of 0.3% versus another downside surprise of 0.1%. If our forecast is realized, the 3-month and 12-month annualized rates of core CPI would strengthen to 2.4% and 2.9%, respectively—a bit stronger than the pace the past few months but still relatively mild in the context of the past four years (chart).

Download The Full Special Commentary

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()