Dólar Americano

Yesterday I wrote about how I think the USD could bottom out for a bit and a few people asked me why I am not going long USD in the Current Views. It’s a tricky one as the seasonality isn’t great for the dollar over the next few weeks, there is no huge catalyst on the horizon until next week’s CPI, and I don’t love long vol right now so options don’t look particularly attractive. In other words, it’s a good time to exit short USD trades, but I am not sure it’s a great time to buy vol or go long USD.

As today marks another tariff “deadline” come and gone, the odds of a September Fed cut should drift lower as there is a large contingent on Team Zero Dots that believes there is no point cutting rates into a possible tariff-induced inflationary surge. Their ability to determine what is going on in the real economy post-tariffs has now been delayed another month.

If you are in the camp that fears an upward shift in inflationary psychology brought on by a possible one-time price level change due to tariffs, you want to see at least the August and September inflation data post-tariffs before cutting interest rates. And you won’t get that until October. Waller and Bowman have some heavy lifting to do if they want to get more players on Team Two Dots after a 4.1% UR just printed and tariffs are delayed another month.

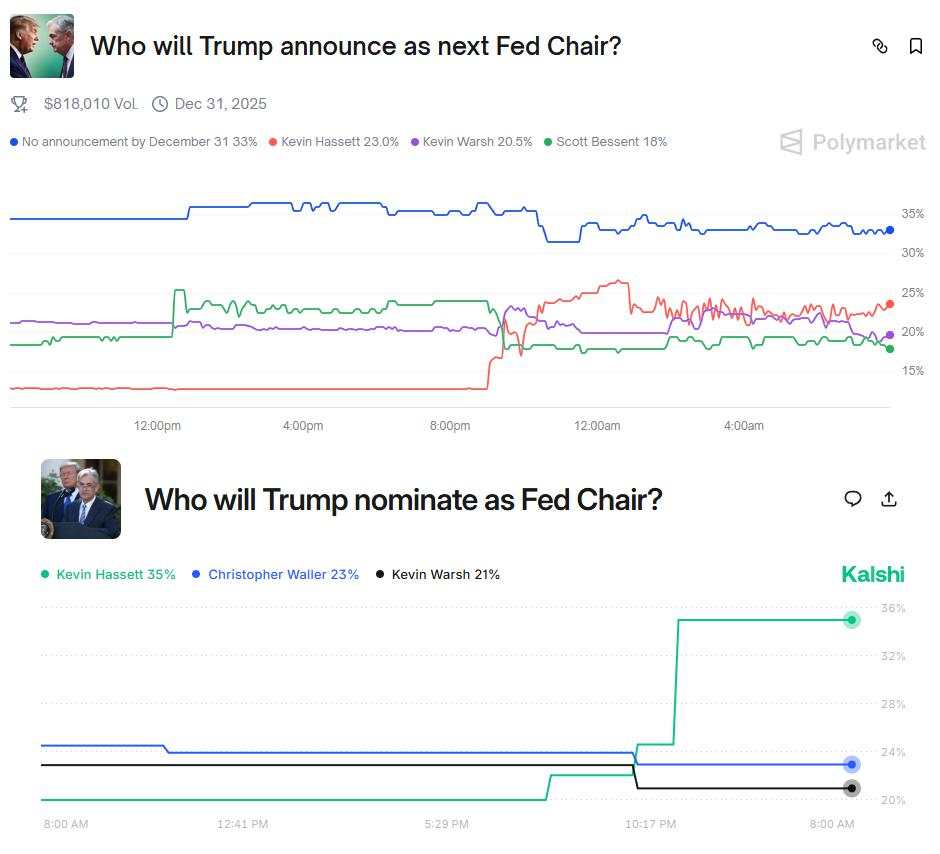

Meanwhile, the Fed Chair sweepstakes took a small turn overnight as the WSJ touted Hassett as a favored name.

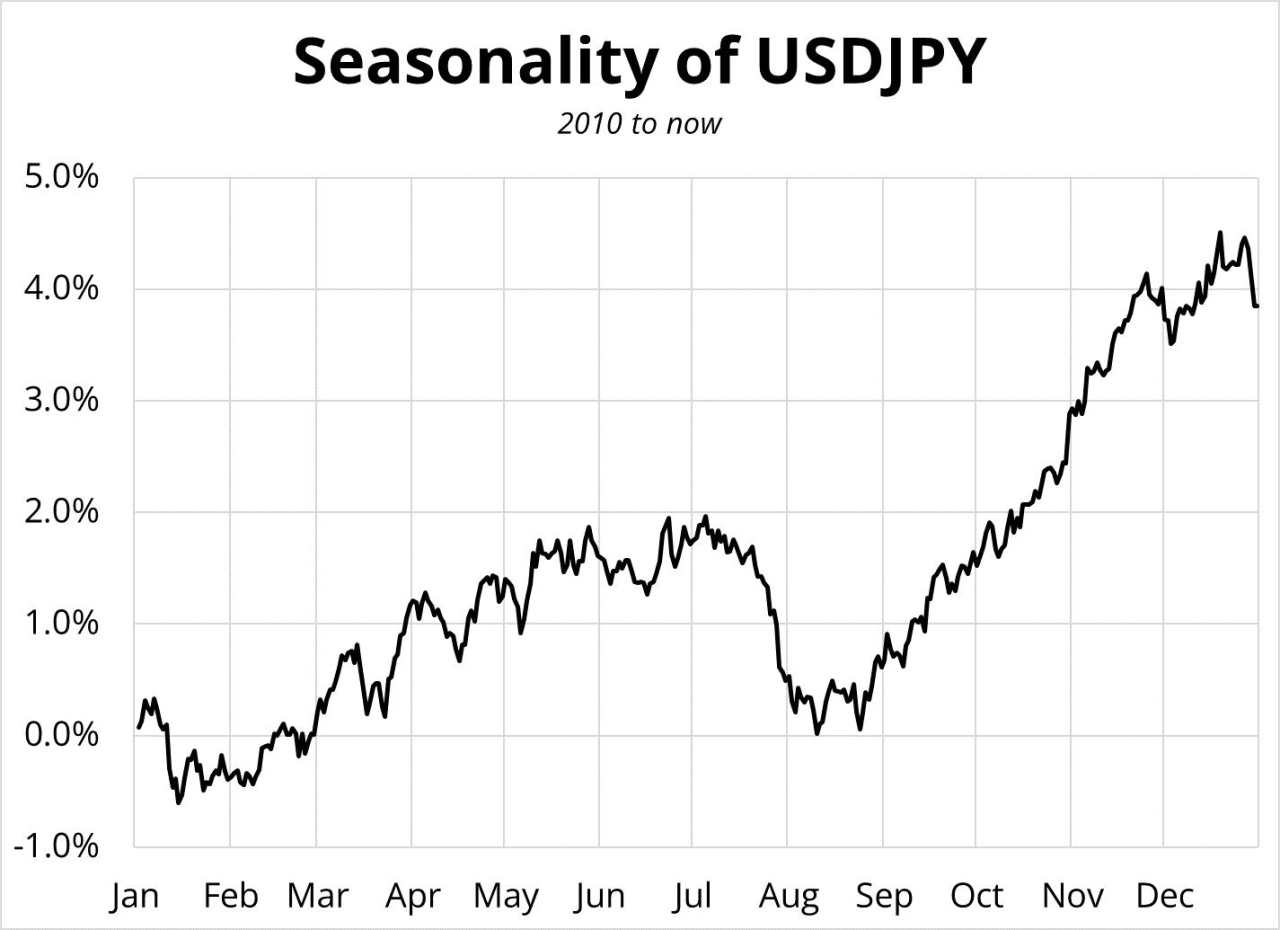

I mentioned seasonality above and we are approaching a big turning point for USD seasonality as most dollar pairs show seasonal dollar weakness into mid/late July and then USD strength in August and September. I showed USDBRL yesterday, and here’s USDJPY.

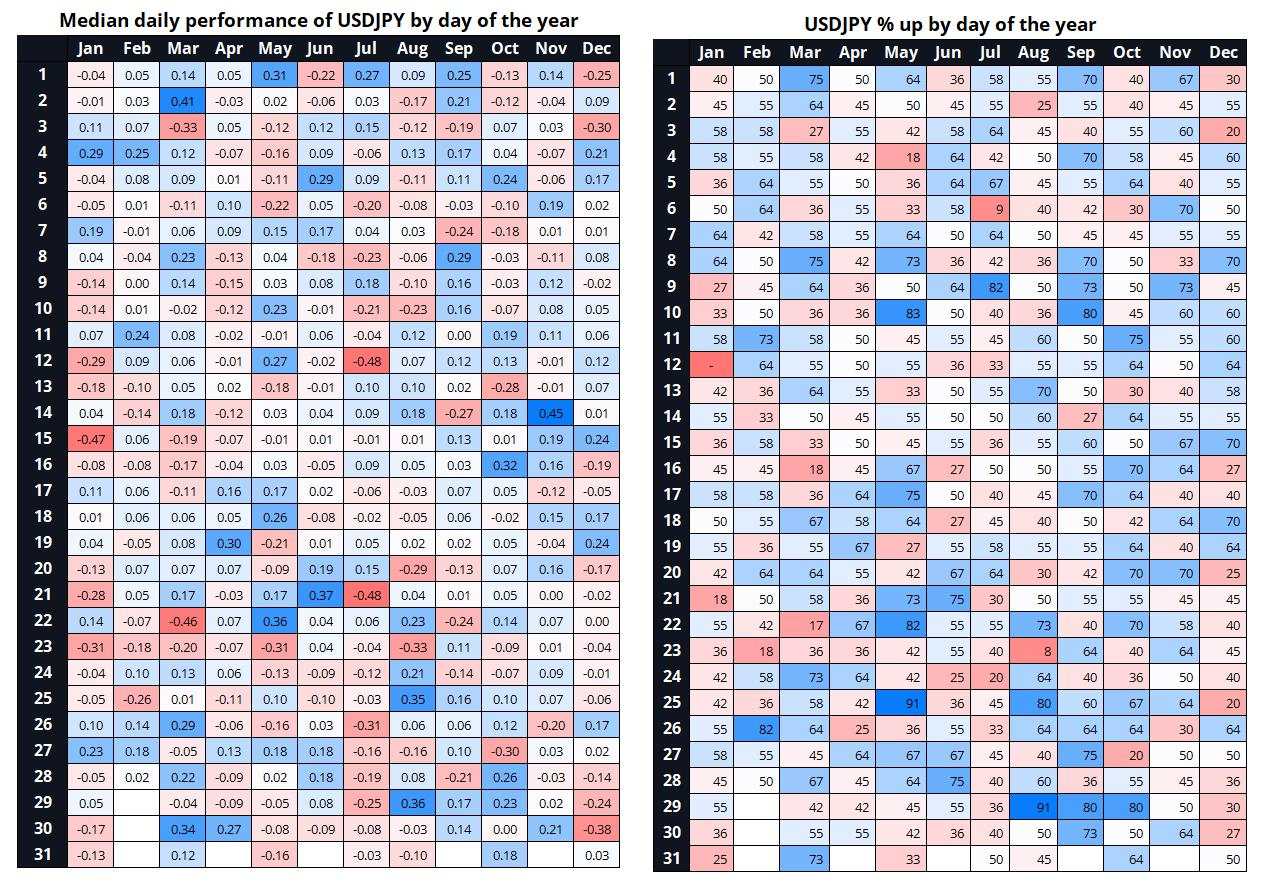

Looking at the daily data using Justin’s awesome xls output below, you can see the remarkable magnitude and consistency of USDJPY weakness in the second half of July.

If it were not for this seasonal, I would be going long USDJPY and short GBPUSD here, but I will just focus on CPI and Japan elections as possible catalysts and avoid entering the trade for now. Look at that bottom half of July in USDJPY. Hmm.

There is often a financial markets / macro regime change into August as the bullish equity seasonal expires, markets get nervous about September equity market weakness, and sentiment, weird news, and various random factors always seem to kick in as Fall approaches in the Northern Hemisphere.

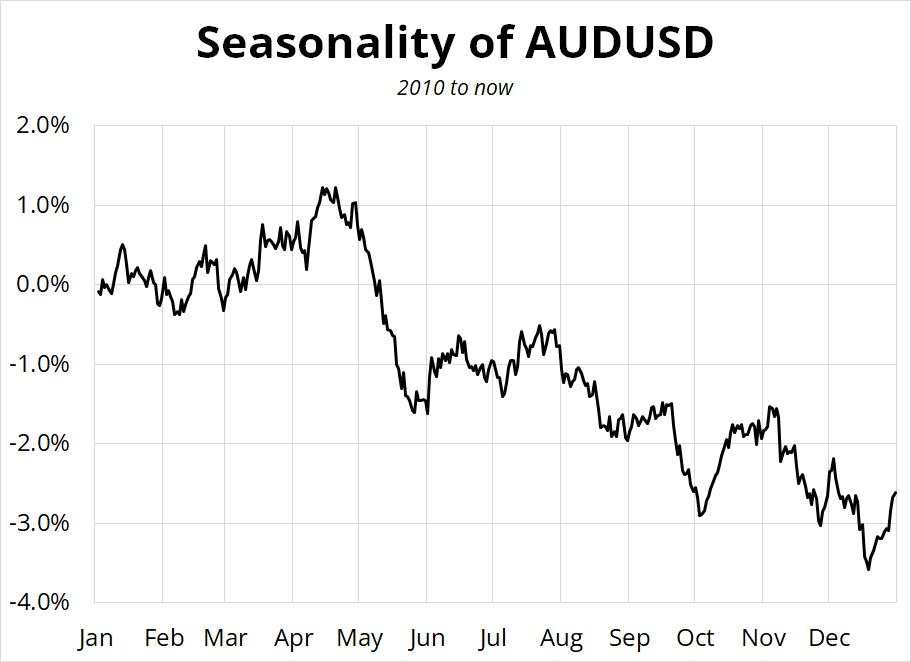

Here’s AUD/USD

A good trade idea would be to sell a 1-month 0.6611 one touch in AUDUSD for around 62%. AIt feels like AUD above 0.68 would require something Herculean at this point. The next chart shows seasonality of FX vol. While I would normally scorn the use of percentage of a percentage charts, this chart of CVIX seasonality is still useful as a guide to general direction of FX vol over the course of the year. August and September are tough months to be long carry, short vol, or long risky assets.

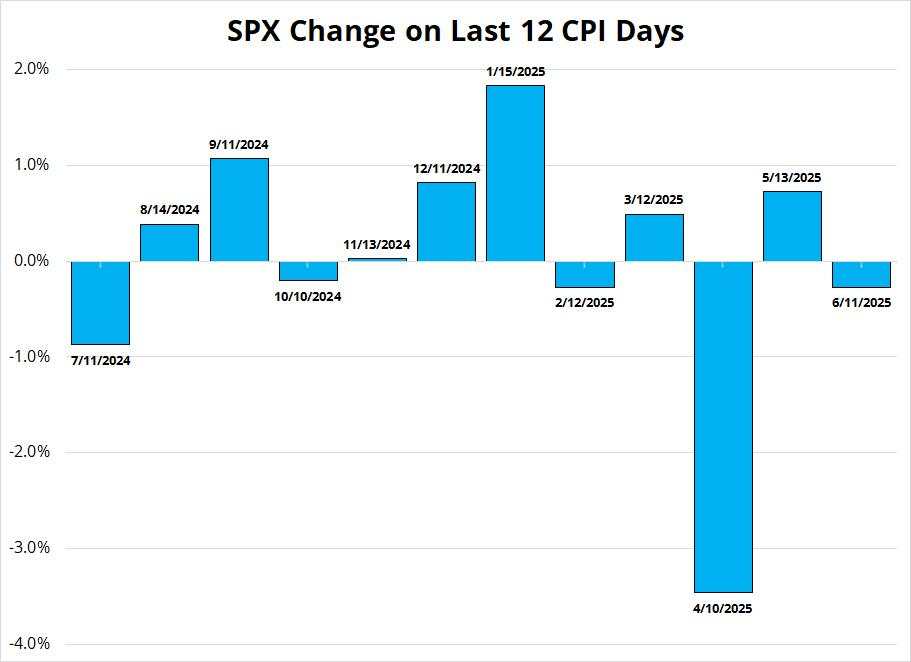

If you are looking for a regime change from low vol to higher vol and bullish stocks to less bullish stocks, you could do worse than guessing it might happen around late July. A 0.5% CPI print on July 14 could be the catalyst this year, perhaps? (!)

I think there is too much complacency on inflation here as it’s completely ridiculous to say that tariffs don’t cause inflation after one month of data. Anyone sounding the all clear is probably propagandizing in an effort to convince the public that policy is working even though the policy has barely been implemented, it keeps changing, and economic data come out with a 4-8 week delay.

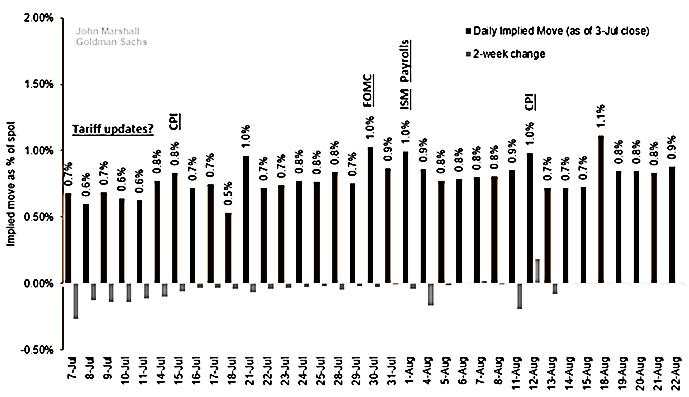

The GS chart of event weights in SPX options at right makes me think people are too blasé.

Context:

Final thoughts

Who do you think is the best EM strategist? Someone who writes timely, tradeable, actionable stuff, not super big picture macroeconomics. I need more EM reading.

Alpha Trader is super cheap for Prime Week. Normally $36, currently $23.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Nội dung trên chỉ đại diện cho quan điểm của tác giả hoặc khách mời. Nó không đại diện cho quan điểm hoặc lập trường của FOLLOWME và không có nghĩa là FOLLOWME đồng ý với tuyên bố hoặc mô tả của họ, cũng không cấu thành bất kỳ lời khuyên đầu tư nào. Đối với tất cả các hành động do khách truy cập thực hiện dựa trên thông tin do cộng đồng FOLLOWME cung cấp, cộng đồng không chịu bất kỳ hình thức trách nhiệm nào trừ khi có cam kết rõ ràng bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()