The FOMC agreed to keep interest rates on hold at the 4.25-4.50% range during their June 17-18 meeting, but the minutes of their discussions revealed divisions regarding the appropriate easing pace moving forward.

The minutes highlighted the central bank’s ongoing struggle to balance competing economic pressures. While officials acknowledged that tariff-induced inflation pressures may prove temporary or modest, they expressed caution about acting prematurely given the economy’s continued strength.

Key Takeaways

- Most participants assessed that some reduction in the federal funds rate this year would likely be appropriate, citing potentially temporary tariff-induced inflation pressures and signs of labor market softening

- A couple of participants indicated openness to considering a rate cut as soon as the July 29-30 meeting if data evolves as expected

- Some participants believed no rate reductions this year would be appropriate, expressing concerns about inflation still above the 2% target

- Staff continued to view inflation risks as skewed to the upside, with projected rises potentially more persistent than baseline assumptions

Recall that the Fed’s updated projections suggested expectations for two rate cuts this year, followed by three additional reductions over the subsequent years. However, the “dot plot” of individual members’ outlooks reflected considerable disagreement about the extent and timing of future cuts.

Link to official FOMC Meeting Minutes (June 2025)

The minutes also revealed ongoing discussions about enhancing the Fed’s communication tools, including potential changes to the Summary of Economic Projections and broader use of alternative scenarios. These improvements aim to better convey the uncertainty surrounding monetary policy decisions.

Market Reaction:

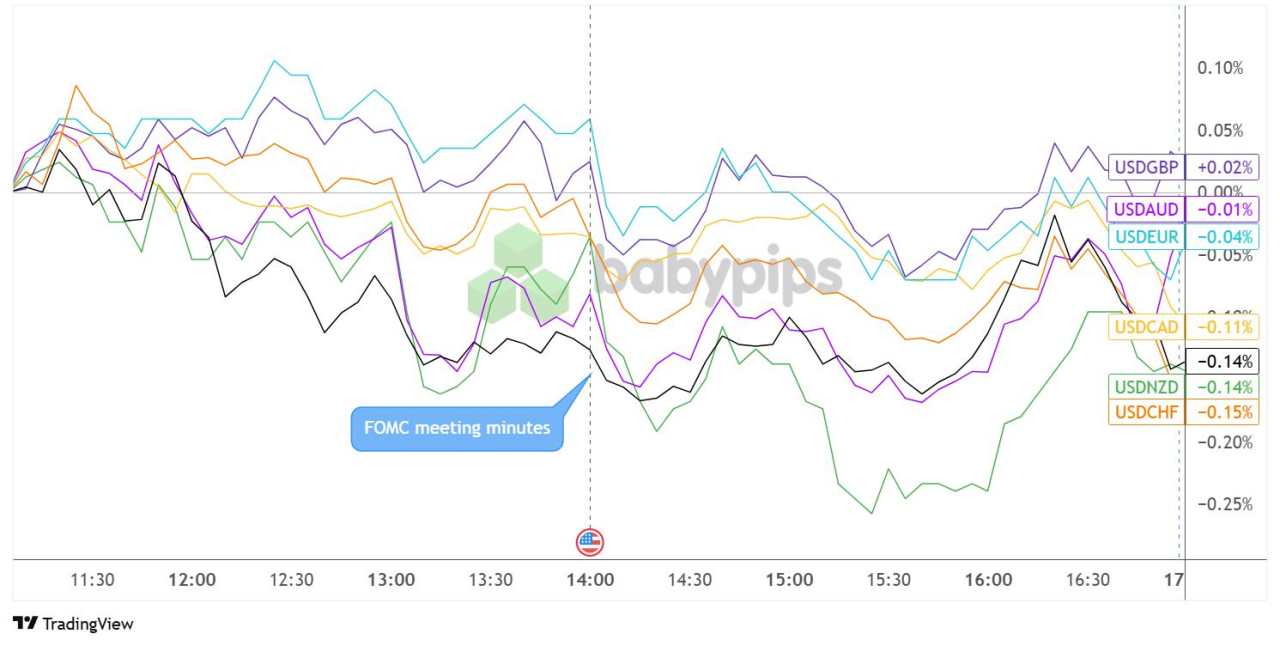

U.S. Dollar vs. Major Currencies: 5-min

Overlay of USD vs. Major Currencies Chart by TradingView

The Greenback, which had been cruising mostly lower in the hours leading up to the release of the June FOMC meeting minutes, saw another bearish wave after the numbers were printed.

After a brief round of profit-taking, the dollar carried on with its decline to test intraday lows then hovered in negative territory against majority of its peers until the end of the U.S. session.

The U.S. currency saw weakness against commodity currencies, dropping 0.11% versus the Canadian dollar and declining 0.14% against the New Zealand dollar. USD also tumbled against European currencies, falling 0.15% versus CHF and 0.04% against EUR but managed to end up with a meager 0.02% gain versus GBP.

Tải thất bại ()