Summary

Tariff threats have injected new volatility into Brazilian financial markets, but while we do not believe levies will have a material impact on Brazil's economy, tariffs could give President Lula a new platform to rally support ahead of presidential elections next year. In our view, Lula still has a tough road to re-election but the combination of aggressive populist-style policies, nationalism and patriotic pride, and plausible deniability of negative economic and market consequences, may give Lula more than just a fighting chance to win a fourth term. With Lula potentially on the rise and the U.S. administration demonstrating explicit support for Bolsonaro, Brazil's election is now more complicated. Political developments are now more uncertain; however, we have become more confident in our view that the Brazilian real will come under sharp pressure over the medium-term as fiscal support is deployed, and political risk rises in the lead up to the election.

Brazil's 2026 presidential election just got more complex

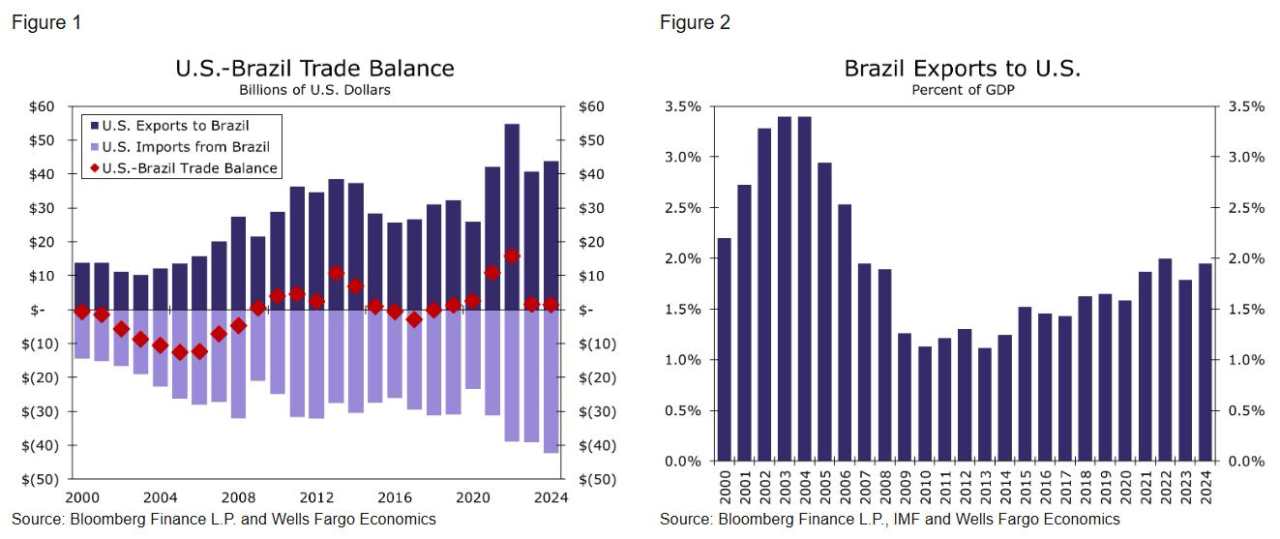

President Trump's 50% tariff threat on Brazil is interesting for a few reasons. First, the U.S. runs a trade surplus with Brazil. While the U.S. did have persistent trade deficits with Brazil from the early 2000s until 2008, and again briefly from 2016-2018, those trade imbalances have been eliminated over the past few years (Figure 1). Typically, but not always, the Trump administration has imposed tariffs due to trade deficits and highlighted a preference for rebalancing trade back in favor of the United States. Running a trade surplus currently with Brazil would, on the surface, seem inconsistent with the underlying motivation for "Liberation Day" tariffs and "Letter Day" tariffs. Second, President Trump made clear that the decision to impose tariffs was not, at least primarily, trade related but rather politically motivated. President Trump's letter to Brazil explicitly stated his objections to the judicial proceedings against Brazil's former president Jair Bolsonaro. President Trump's letter also indicated his preference for Bolsonaro's ban from local politics to be lifted, and that Bolsonaro be allowed to participate as a candidate in Brazil's presidential election next year. In addition, President Trump and President Lula have volleyed contentious rhetoric around BRICS nations considering alternatives to the U.S. dollar, which is a movement Lula seems to be leading the charge on. While difficult to know for sure, and not something Trump explicitly expressed frustration with in his letter, rhetoric around shifting away from the U.S. dollar likely played a role in the tariff threat. As far as the economic impact of a 50% tariff, if that levy is indeed imposed in full come early August, we believe tariffs would not have significant direct effects on Brazil's economy. Brazil is a relatively closed economy that is not dependent on trade, and not on trade with the United States (Figure 2). As of now, we forecast Brazil's economy to grow a little over 2% in 2025. A 50% tariff perhaps shaves up to a half percentage point off of our GDP forecast when we update our forecasts, but U.S. imposed tariffs are not material enough to push Brazil's economy into recession.

Download The Full International Commentary

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()