- Gold respects key demand at $3,350, buoyed by trade war fears and record central bank accumulation.

- Bullish scenario plays out, with price reacting to the Bullish Fair Value Gap and eyeing breakout above $3,370.

- Technical forecast leans bullish.

- $3,400–$3,450 in sight if $3,340 support holds; invalidation below FVG risks $3,310–$3,260 pullback.

Gold renews strength, gears up for another run

Over the past week, gold has tightened its grip as a safe-haven asset, buoyed by increasing global economic uncertainty and trade tensions. U.S. threats of hefty tariffs on the EU and Mexico have driven prices to a three-week peak around $3,354-$3,370 level. Meanwhile, central banks have been accumulating gold at record pace purchasing over 1,000 tons annually, with 43% planning more acquisitions in the next year. This institutional demand underpins gold’s long-term strength.

Tariff threats + bank accumulation

US – EU/Mexico tariff threats

President Trump's proposal of a 30% tariff on EU and Mexican imports triggered safe-haven flows into gold, lifting spot prices to $3,355-3,370.

Central bank accumulation

World Gold Council data shows central banks buying more gold annually than in the previous decade, driving gold to its record high of $3,500 in April.

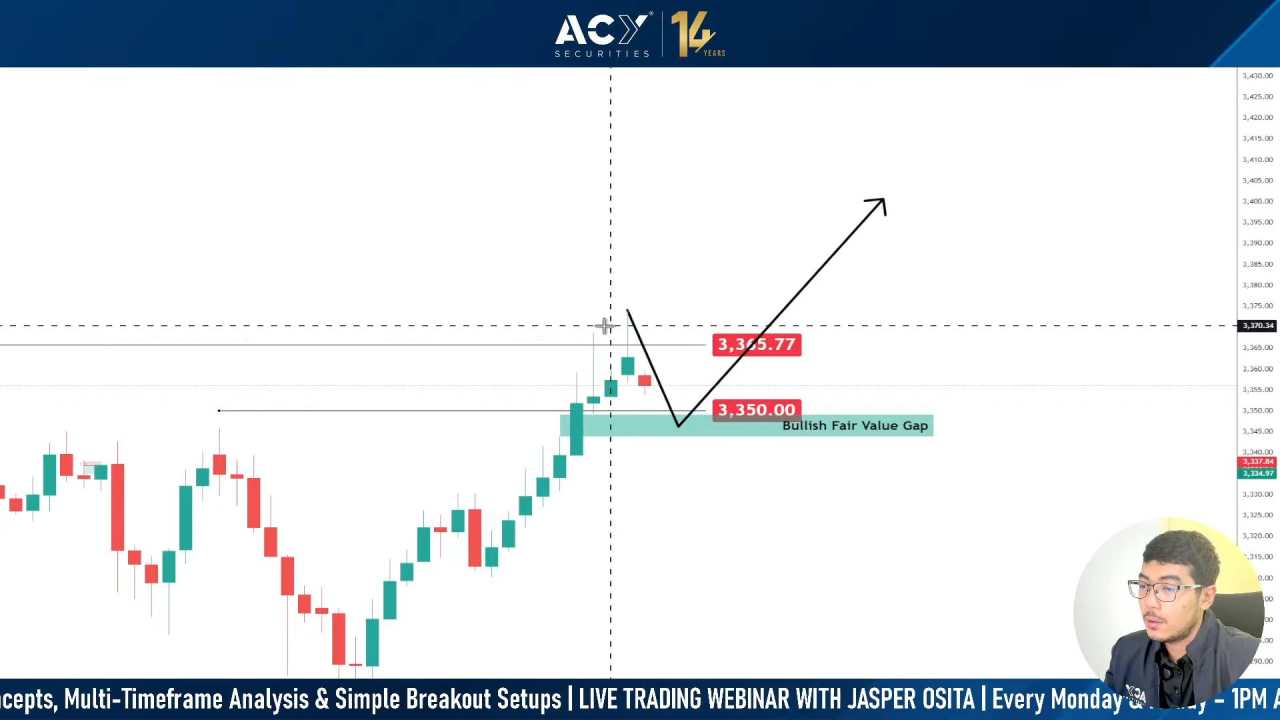

Bullish scenario unfolding from fair value gap

Previous Analysis: Bitcoin Breaks Out, Gold Eyes $3,400, Nasdaq Powers Up, USD up next? – What’s Next for this week?

Gold's current price behavior aligns precisely with what we outlined in yesterday’s live trading session: a pullback into the $3,350 Bullish Fair Value Gap, followed by an anticipated continuation.

Current

This clean structure showcases:

- A bullish FVG marked between $3,340-$3,350, acting as support.

- Price dipped slightly after failing to break $3,370, yet held above $3,350, respecting the bullish order flow.

- Our projection was for price to reject the FVG, re-accumulate, and then push up to the $3,370 high with $3,400-$3,420 set as targets.

Bullish validation

- We are still bullish unless price breaks below $3,340 (invalidating the FVG).

- If $3,370 breaks cleanly, the next upside targets are $3,400 and $3,450.

- This zone was emphasized as a "must-hold level" for gold bulls to maintain momentum.

Technical outlook

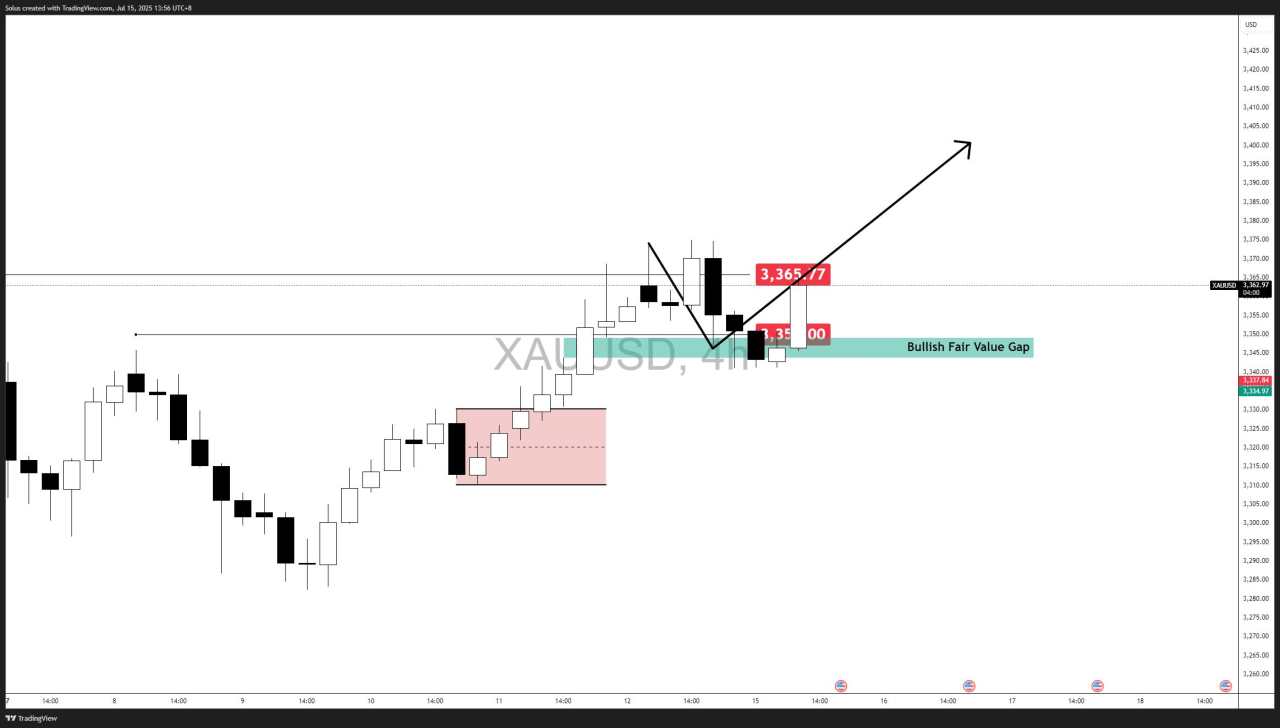

Bullish scenario: FVG rejection and breakout toward new highs

Gold is showing signs of bullish continuation after successfully retesting the $3,350 Bullish Fair Value Gap (FVG). The recent higher low formed above this level confirms that buyers are stepping in aggressively to defend and hold the line.

Bullish Confirmation:

- Price rejected from the FVG and formed a bullish engulfing candle with follow-through

- Price now eyes the $3,365.77 minor resistance for a breakout.

Invalidation: Break and close below $3,340.

Upside Targets:

- $3,400 – Key psychological and structural target.

- $3,450 – All-time high level target.

This scenario aligns with our current bias bulls remain in control as long as the FVG holds and price continues printing higher lows.

Bearish scenario: FVG breakdown signals deeper pullback

If price fails to break and hold above $3,365.77 and closes below the $3,350-$3,340 Bullish FVG, this could trigger a deeper sell-off.

Bearish Trigger:

- Rejection from $3,365.77.

- Breakdown below $3,340.

Invalidation: Bullish breakout above $3,370.

Downside Targets:

- $3,310 – Liquidity zone.

- $3,285 – Previous support.

- $3,260 – Swing demand area.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()