China's second-quarter GDP beat forecasts again with a 5.2% year-on-year growth, driven by strong trade and industrial production. Yet sharper-than-expected slowdowns in fixed-asset investment and retail sales and falling property prices are a concern. China remains on track to hit this year's growth target, though a slowdown could be on the way.

Solid 2Q GDP growth keeps growth on track in 1H25

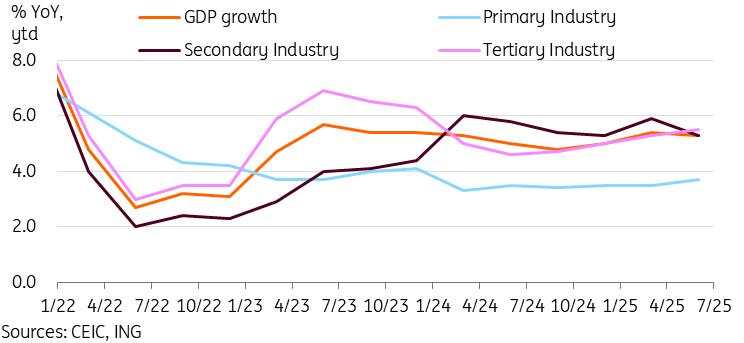

China's GDP growth moderated slightly to 5.2% year on year in the second quarter, down from 5.4% in the first quarter. Even after forecasters generally revised forecasts higher since May, 2Q growth once again outperformed the consensus. Through the first half of 2025, GDP has expanded by 5.3% YoY, keeping China on track to achieve this year's "around 5%" growth target.

By industry, the overall moderation of GDP growth can be attributed to a slowdown in the secondary industry, which moderated to 5.3% YoY in 2Q, down from 5.9%. Despite this moderation, manufacturing has thus far remained resilient in the year-to-date, defying expectations for a slowdown. In contrast, both the primary industry and tertiary industry accelerated 0.2pp from 1Q, reaching 3.7% YoY and 5.5% respectively in 2Q. After falling behind the secondary industry for the past five quarters, the tertiary industry has finally regained its spot as the fastest-growing area of China's economy amid supportive policies to boost the services sector.

Through the second quarter, we've generally seen trade beat expectations, while hard data has been more mixed. Retail sales outperformed in earlier months, while industrial production beat forecasts in June. Fixed-asset investment has been disappointing throughout. The main factors are China's policy support as well as tariff developments.

Tertiary industry led the way as 2Q growth beat forecasts

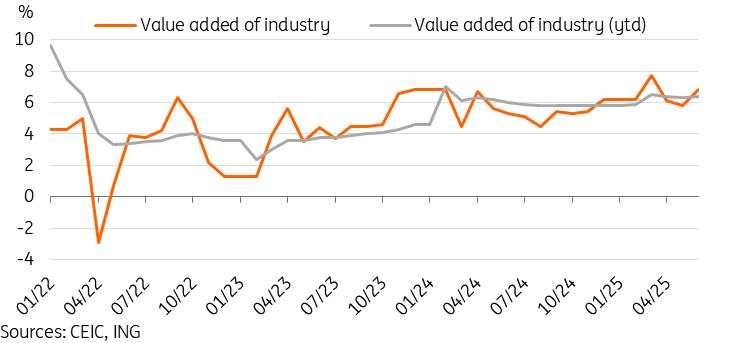

Value added of industry unexpectedly bounces back strongly in June

The biggest beat in June monthly data was in the value added of industry, which surprisingly bounced back to a three-month high of 6.8% YoY, up from 5.8% in May, bucking expectations for a further slowdown.

June industrial production benefited from a pickup of manufacturing (7.4%), in particular hi-tech manufacturing (9.7%), which has been an outperformer amid China's transition up the value-added ladder.

By industry, the standouts from earlier months continued to outperform. Autos (11.4%), railway, shipbuilding, and aeroplanes (10.1%), electrical machinery and equipment (11.4%) continued to outperform headline growth handily. Semiconductor manufacturing also continued to grow at a rapid pace of 15.8% YoY amid a push for greater tech self-sufficiency. These categories have helped offset softness in industries such as textiles (2.5%) and pharmaceuticals (2.7%).

Through the first half of the year, value added of industry has grown 6.4% YoY, faster than the 5.8% pace seen in 2024.

Value added of industry beat expectations in June

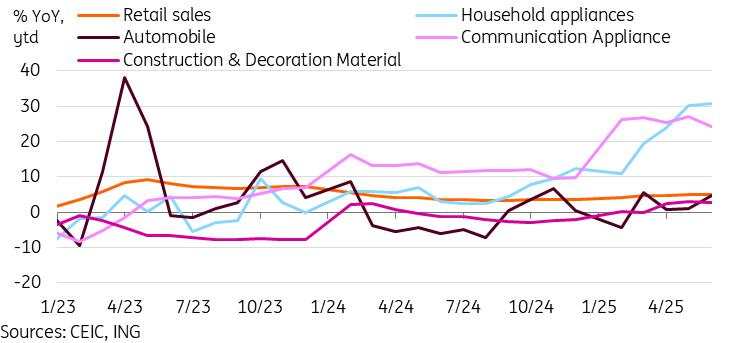

Retail Sales data slumped as the peak of the trade-in policy impact may be near

Retail sales growth slowed to 4.8% YoY in June, down from 6.4% in May. This growth came in lower than forecasts, after several months of outperformance. Nonetheless, retail sales have grown by 5.0% YoY year to date through the first half of the year, broadly on track with expectations.

Previous months’ data showed a clear impact of China's trade-in policy on supporting consumption. While the beneficiary categories of household appliances (32.4%) and communication equipment (13.9%) continue to outpace headline growth, we could soon be nearing the peak of this policy-driven boost.

The household appliances segment will likely see growth moderate in the second half of 2025, as last year's trade-in policies began to boost sales notably starting in September 2024. We can see the auto sector, which has already gone through several waves of supportive policy, is a relative underperformer with growth of 4.6% YoY in June and just 0.8% YoY ytd despite continued incentives available through trade-in programmes.

It's certainly possible we could see further expansions of the trade-in policy. Reports are that much of this year's quota has already been used. Assuming we don’t get a further expansion, a less supportive base effect as well as a smaller quota in the second half of 2025 could lead to less support for segments that outperformed recently.

The question then turns to whether the rest of the consumer market is strong enough to keep consumption growth solid. There are mixed signs on this front. While we see some positive signs in categories such as cultural and office supplies (24.4%), furniture (28.7%), these tend to be smaller categories. We are continuing to see a notable drag from petroleum sales (-7.3%) amid the EV transition, while the outperformer "eat, drink, and play" categories such as catering (0.9%) as well as alcohol and tobacco (-0.7%) from the past few years, have softened. They are dragging on growth this year.

Overall, weak consumer confidence remains an overhang. While consumers are responding to price incentives in the form of the trade-in policy, there remains an overall sense of caution in expanding discretionary consumption. Stabilising asset prices and restoring wage growth remain important milestones for a more sustainable recovery of confidence.

Consumption growth continues to be supported by the trade-in policy but this boost could wane in 2H25

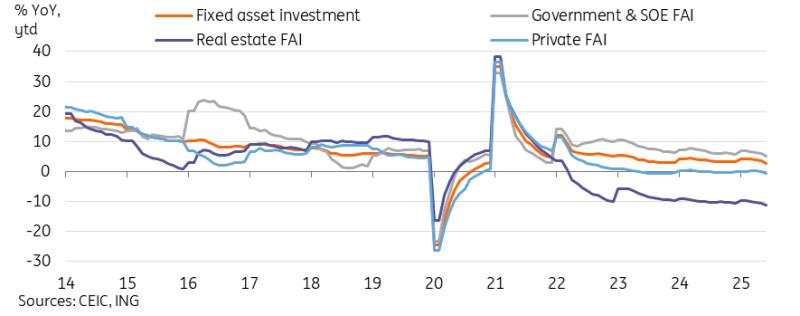

Heightened caution led to sharper-than-expected decline in fixed-asset investment

In the first half, FAI slumped to 2.8% YoY, down from 3.7% YoY ytd in May. This marked the lowest growth rate since the pandemic-impacted 2020. This slowdown was also significantly steeper than the slight downtick markets had been expecting. Note that FAI data is given in year-to-date terms, indicating June's slowdown was even more significant.

Public-led FAI continued to outperform with a 5.0% YoY ytd growth, while private investment fell by -0.6% YoY ytd, moving into contraction for the first time this year and hitting the lowest level since 2023. Foreign investment continued to shrink, down -13.6% YoY year-to-date.

By sector, manufacturing FAI maintained the highest growth rate at 7.5% YoY ytd, led by investments in auto (22.2%) and rail, ship, and aeroplane manufacturing (27.3%). Notably, rail, ship, and aeroplane manufacturing was one of the few segments to see an acceleration in June, up from 26.1% YoY in the first five months of 2025.

Uncertainty surrounding tariffs and geopolitical developments continues to weigh on FAI, as companies hold off on making new investments until there’s more clarity. This can also be seen in the sluggish new loans and corporate bond issuance data so far this year. With further tariff-related uncertainty likely in August, we could see this sort of weak investment appetite persist in the coming months.

Fixed asset investment slumped sharply in June as private investment returned to negative growth

Property price slump continued to worsen in June

China's 70-city sample of property prices showed further signs of deterioration in June. Overall, new home prices fell by -0.27% month on month, while used home prices fell by -0.61% MoM. Both saw steeper declines for the third consecutive month.

The breakdown of the city-level data doesn’t inspire much optimism. New home prices rose in 14 cities, the lowest count since October 2024. Shanghai and Changsha led the way with 0.4% MoM upticks, while other cities saw gains of 0.3% MoM or lower. Used home prices fared even worse, with only one city (Xining) seeing a tiny price uptick of 0.1%. The 69 other cities all saw price declines on the month, with Beijing seeing the steepest decline of 1.0% MoM.

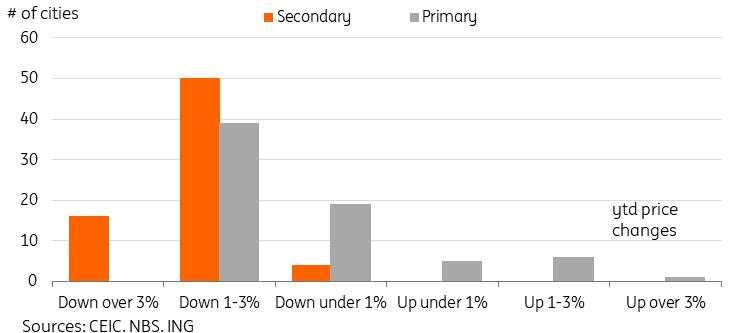

Through the first half of the year, new home prices have been outperforming used home prices, likely due to the dropoff in new supply coming onto the market. Twelve cities have seen new home prices recover year-to-date. Used home prices are down across the board, with 16 cities seeing declines of over 3% year-to-date. This is not good news in terms of sentiment, as the secondary market represents the assets held by households.

We continue to view stabilisation of the housing market as one of the most important priorities in turning around the economy. Given the prominent position of real estate in household balance sheets, it would be difficult to expect a turnaround in confidence as long as households' biggest asset depreciates every month.

With prices continuing to show signs of deterioration, there is a growing possibility we’ll see more support measures roll out in the coming weeks or months.

Underperforming used home prices continue to drag confidence

Second half could prove to be more challenging but growth target looks achievable

The strength of the economy through the first half of the year is certainly encouraging compared to the very downbeat expectations at the start of the year. Trade data benefited from frontloading in the first quarter, but generally held up better than expected in the first half as a whole. As a result, industrial production has outperformed. A recovery in retail sales is in line with expectations after this year's stronger policy support. Investment has slumped by more than expected amid the heightened uncertainty.

Nonetheless, the second half of the year could prove to be more challenging. The tariff uncertainty will remain an overhang, with the next key deadlines coming up soon in August. Though we don't expect a return to the April peak tariffs, we wouldn’t rule out further escalations. This uncertainty will likely continue to cap investment growth and could weigh on overall confidence. Domestically, it’s also possible that some of the momentum from trade-in policies could peak and begin to moderate. That is, unless we see further expansion in the coming months, and though there will be long-term benefits from a potential push to address the excessive price competition issue, what China calls "involution," this could come with short-term costs as well.

As such, we're expecting momentum could moderate in the second half of the year. However, the strength of the first half should nonetheless keep China on track to achieve its full year target of "around 5%" growth, and risks to our 4.7% YoY full year GDP forecasts look balanced to the upside.

Read the original analysis: China’s first-half growth remains on track, though activity data signals caution

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()