After a shallow pullback, the U.S. dollar chalked up another day in the red while trade jitters lingered ahead of the August 1 tariffs deadline.

It didn’t help that President Trump talked up the possibility of rate cuts since Powell “will be out soon.”

Here are headlines you may have missed in the last trading sessions!

Headlines:

- New Zealand trade surplus narrowed from 1,082M NZD to 142M NZD in June (1,020M NZD expected)

- RBA Meeting Minutes: Further rate cuts are warranted over time, debating on timing and extent of easing

- U.S. President Trump warned that they would strike Iran again if necessary, citing evidence of nuclear activity

- BOE Governor Bailey: Steeper U.K. yield curve reflects greater uncertainty on trade policy

- Limited trade deal between the U.S. and India reportedly ruled out, 26% tariffs loom by August 1

- U.K. Public Sector Net Borrowing Ex Banks for June 2025: -20.68B (-16.2B forecast; -17.69B previous)

- Fed Chair Powell reiterated that the central bank is a dynamic institution, open to feedback on how to improve capital framework but stopped short of discussing policy or economy

- U.S. Richmond Fed Manufacturing Index for July 2025: -20.0 (-2.0 forecast; -7.0 previous)

- U.S. Richmond Fed Manufacturing Shipments Index for July 2025: -18.0 (-1.0 forecast; -3.0 previous)

- U.S. Richmond Fed Services Revenues Index for July 2025: 2.0 (1.0 forecast; -4.0 previous)

- Fed official Bowman highlighted central bank’s independence with respect to monetary policy

- Trump mentioned that Powell “will be out soon” and that rates should be at 1%

- Bessent added that they called for an internal investigation of the Fed

Broad Market Price Action:

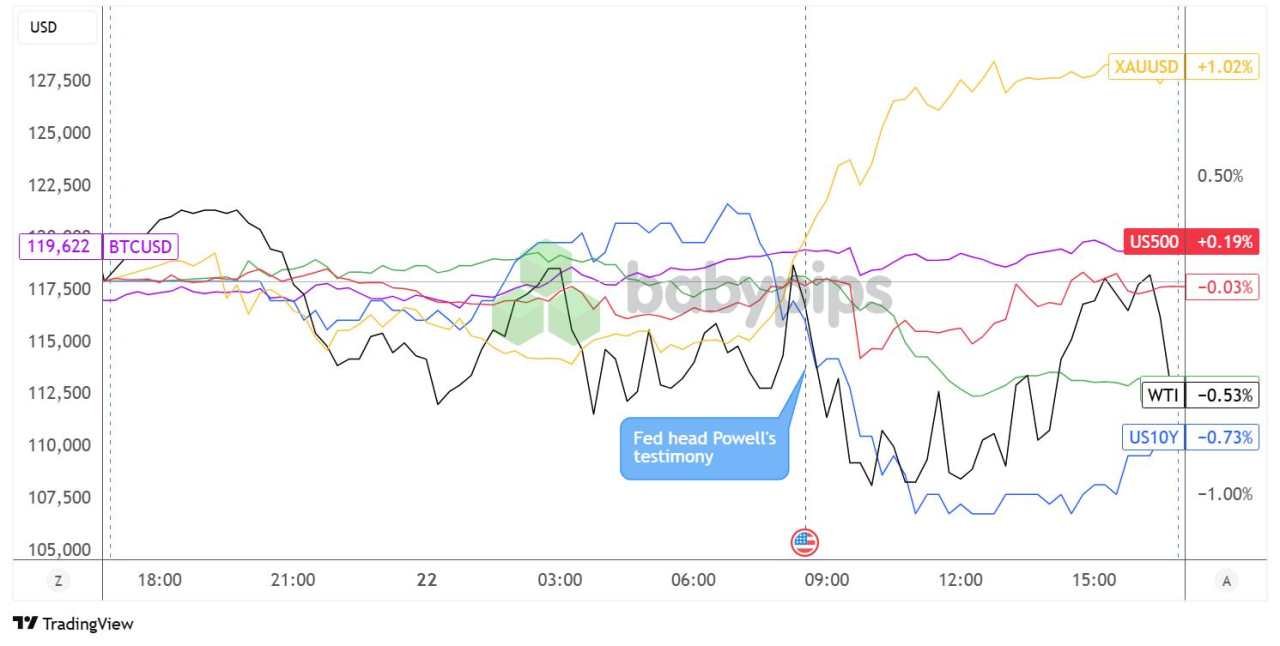

Dollar Index, Gold, S&P 500, Oil, U.S. 10-yr Yield, Bitcoin Overlay Chart by TradingView

Market volatility was elevated from the get-go, with asset classes seemingly responding to individual catalysts more than overall risk sentiment.

Crude oil got a boost early on, likely driven by renewed global supply concerns after Trump warned that the U.S. could strike Iran again if necessary, as there has been evidence of nuclear activity. However, the energy commodity soon unwound its gains while investors remained anxious about trade developments leading up to the August 1 tariffs deadline.

Gold, which had been on the back foot during the Asian session, regained its footing during the latter part of the London session as safe-haven flows ticked higher on reports that the limited trade deal between the U.S. and India has been ruled out.

Equities were also on wobbly ground while trade-related jitters lingered, with the Nasdaq snapping its six-day winning streak to close 0.39% lower while the S&P 500 index raked in a meager 0.06% gain. Treasury yields took a nasty tumble around the time Trump spoke of Fed head Powell being “out soon” and that interest rates should be much lower.

FX Market Behavior: U.S. Dollar vs. Majors:

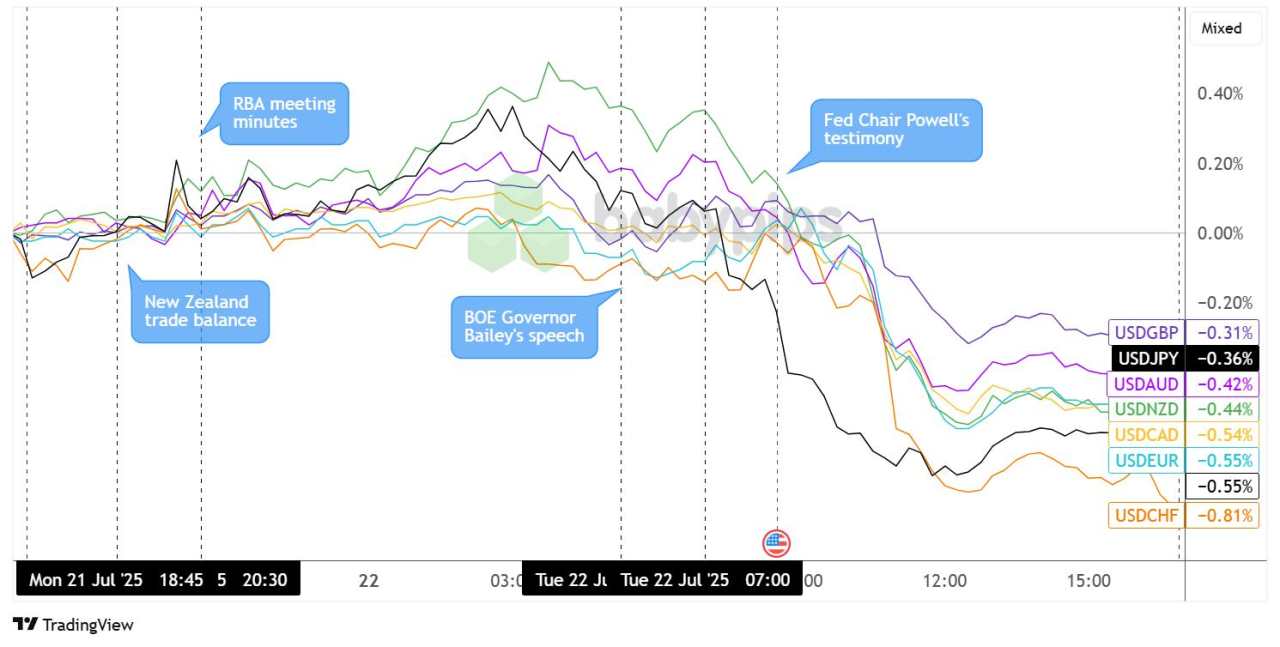

Overlay of USD vs. Majors Chart by TradingView

The Greenback, which was in continuous selloff mode the previous day, managed a shallow pullback during Asian market hours. NZD chalked up additional losses on account of a downbeat trade balance while AUD also dipped when the RBA meeting minutes revealed that further easing is likely.

Dollar rallies hit a ceiling right around the time European markets opened, with BOE Governor Bailey highlighting that short USD is the “most crowded trade in the market” and that rising U.K. yields are reflective of trade policy uncertainty.

Further dollar declines were seen as the U.S. Richmond manufacturing index fell short of estimates, followed by commentary from Trump on how borrowing costs should be at 1%. This was underscored by Treasury Secretary Bessent’s speech emphasizing that they have called for an internal investigation of the Fed.

By session’s end, USD closed lower across the board for another day so far this week, as the “Sell America” sentiment appeared to be building up while the August 1 tariffs deadline looms and the pressure is on the Fed to lower interest rates.

Upcoming Potential Catalysts on the Economic Calendar

- U.S. MBA Mortgage Applications at 11:00 am GMT

- Canada New Housing Price Index at 12:30 pm GMT

- Euro area Consumer Confidence Flash at 2:00 pm GMT

- U.S. Existing Home Sales at 2:00 pm GMT

- U.S. EIA Crude Oil Stocks Change at 2:30 pm GMT

- Australia S&P Global Services PMI Flash at 11:00 pm GMT

- Australia S&P Global Manufacturing PMI Flash at 11:00 pm GMT

There’s not much in the way of top-tier data releases in today’s schedule, which leaves traders more space to focus on tariffs-related headlines and U.S. trade deals. Look out for more signs of progress in trade talks that could keep risk-taking in play, as well as any setbacks that could keep investors anxious.

As always, stay nimble and don’t forget to check out our Forex Correlation Calculator when taking any trades!

Tải thất bại ()