I want to celebrate this milestone, as it has come with sweat, tears, and tennis elbow. Don’t ever underestimate how painful it is; I have new respect for tennis players.

3000 doesn’t feel like a lot compared to some of the newsletters with hundreds of thousands; some have millions of subscribers. I realised a long time ago I am not the most popular kid on the playground, and I am ok with that. As you grow older, the playground becomes Substack, Beehiiv, or whatever grown-up substitute you want to replace the playground with. Life is constant struggle to find where you fit in.

I have one mission and one mission only, and that is to provide ideas, thoughts, commentary, research, and humour that provides genuine value-add to traders and investors. I do this to the best of my ability, knowing that I don’t have all the answers and that I am going to make mistakes. I am unapologetic and say it as I see it, striving for truth.

For me quality over quantity has been one of my life principles. I am so happy that many of the people who are reading this letter are from the most well-respected financial institutions in the world. Companies most of us would dream about working for. Others are professors, doctors, lawyers, housewives, househusbands, and the unemployed—but all people with brains and curious minds.

To the 3000+ quality readers who have taken the time to read what I have had to say over the last 18 months, thank you, as I love what I do, and I value every single one of you.

I mentioned a week or so ago about me building Mini Me using LLMs embedded in my Python-based research background. That is one of the two main projects I am working on; now is probably a good time to share the other project.

I am focused on building a quantitative framework for backtesting and trade execution for serious traders who are keen to take their trading to a new level. I am sure some of you are saying, “Not another backtester.”

I have been in this space for more than 25 years, and I am constantly learning. I am surprised how many get it wrong. I am yet to see the ideal platform the way I have it envisaged in my mind. So I have taken the decision to build it myself. I have to say that it has become a bit all-consuming, and I am working too many hours a day, which is unhealthy. I am going to try and be a bit more balanced, but this is a massive project that requires my time. AI isn’t going to build it for me, but it will help.

Stay tuned; you will all be beneficiaries of my effort, and forgive me if I miss the odd letter.

S2N Spotlight

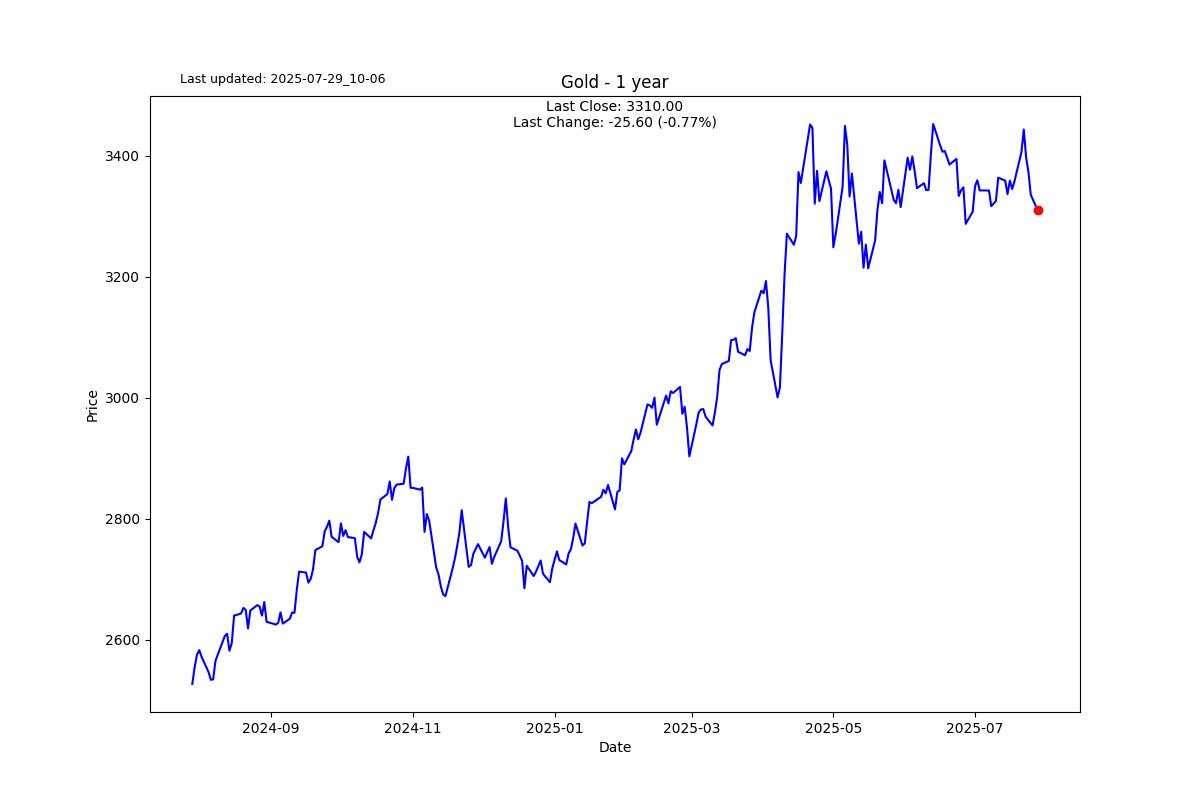

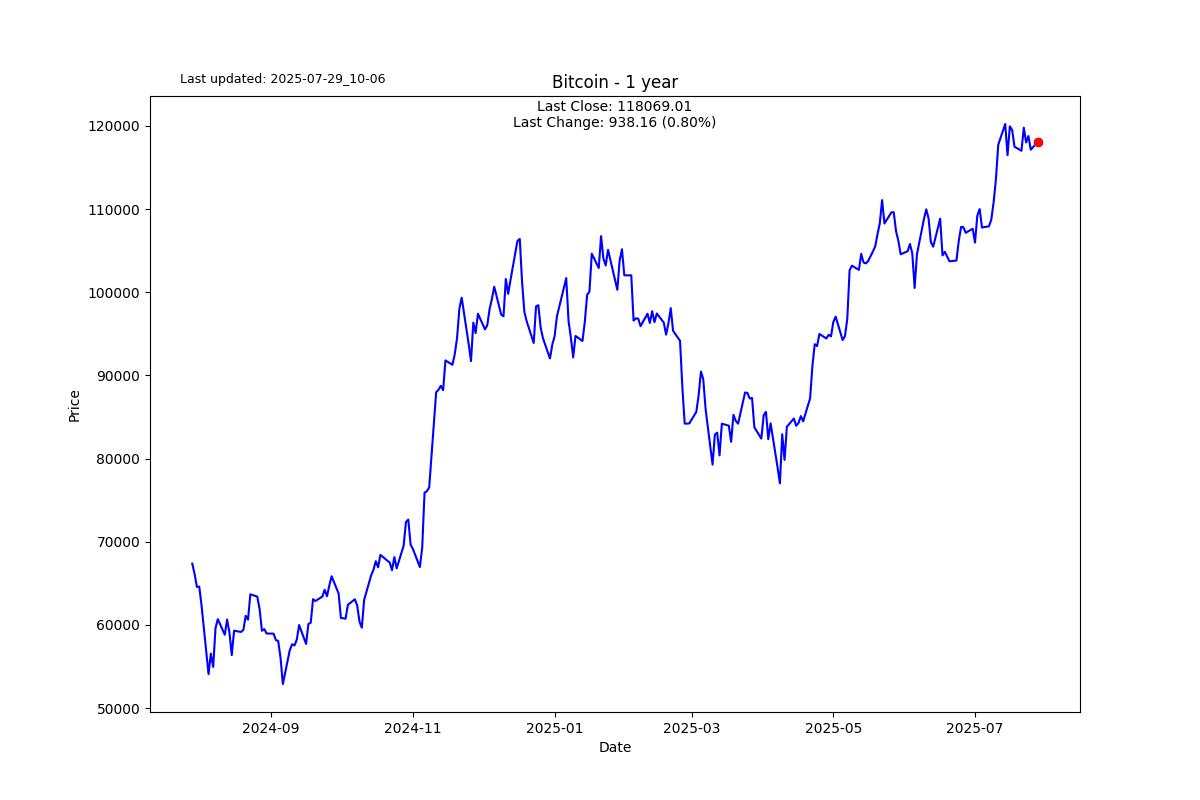

A subscriber wrote to me the other day and asked if he should invest in Bitcoin now given that it is at or near all-time highs.

I said that I believe you should have Bitcoin in your portfolio, ranging from 1 to 5% depending on your level of conviction and risk appetite. Once you have decided on the percent, you should commit to investing in Bitcoin irrespective of the price in tranches over a period of a few months.

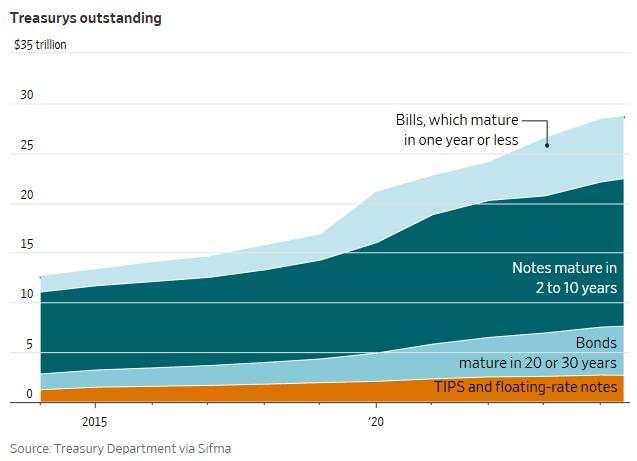

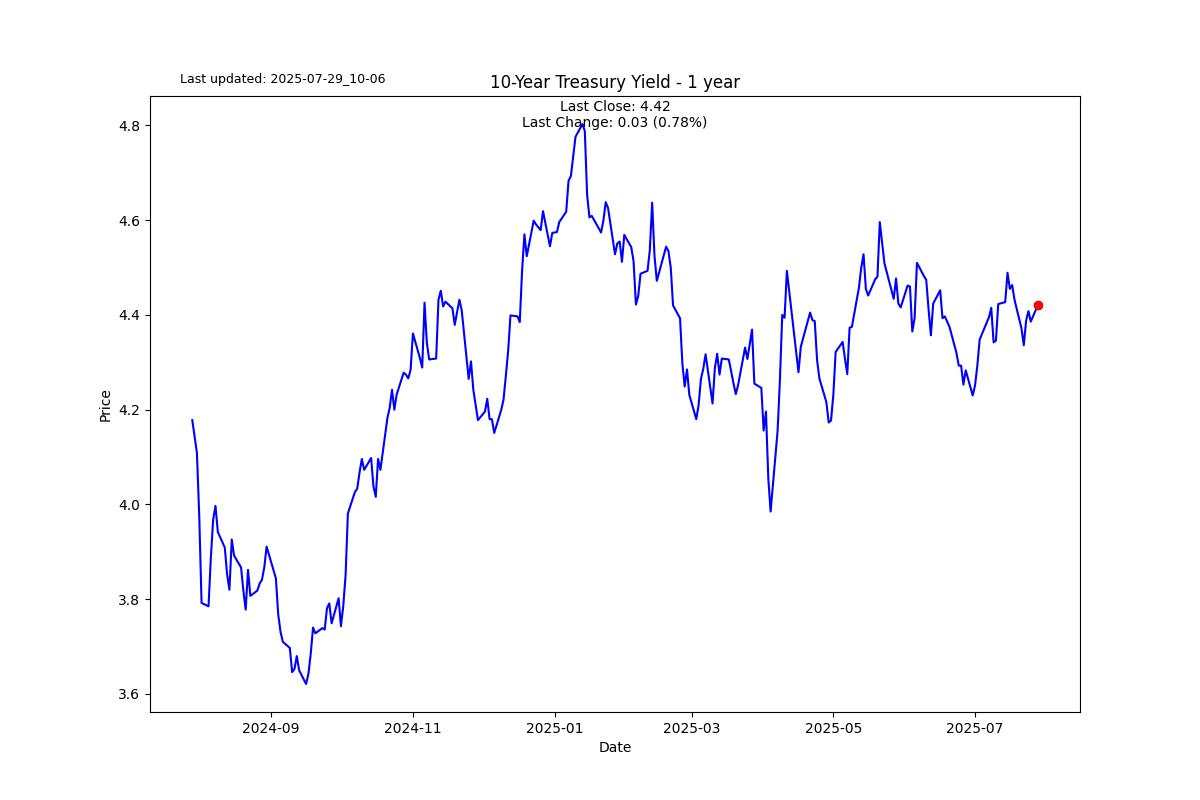

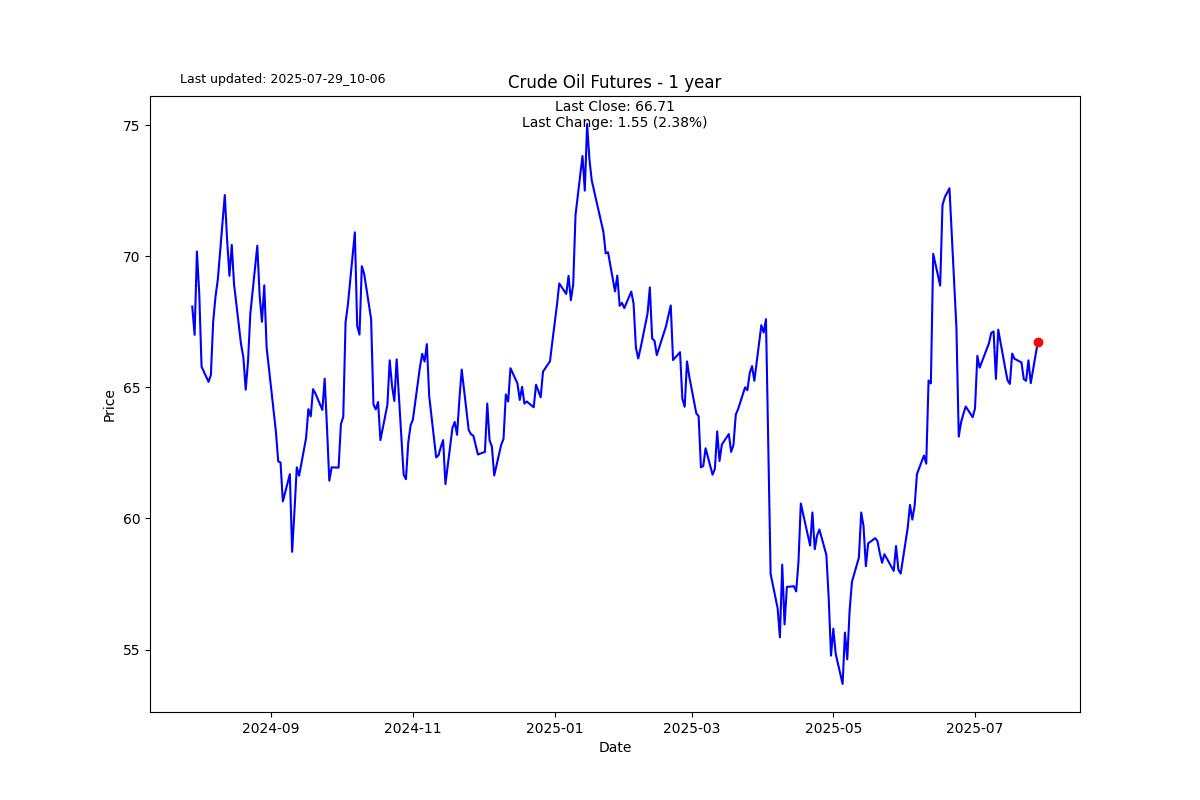

The US Treasury, under the guidance of Trump and Bessent in that order, is changing the profile of the Treasury auctions in favour of shorter-term debt issuance for 2 reasons. The one reason is that they don’t want to take out long-term debt at the current “high” interest rates. They want the Fed to lower interest rates and, in turn, lower the whole yield curve, at which point they will issue long-term debt. The other benefit of reducing the supply of the 10-year and longer maturities is that it influences demand, which in turn drives prices up and yields down.

This is risky business, and we are talking about unprecedented levels. Be careful trying to time the market. Get it wrong and there will be another Trump Chapter 11 on the cards.

President Trump is calling for a reduction in the Fed Funds Rate down from 4.25% to 1%. He is saying this when inflation is close to 3%, and he is saying that this is the strongest economy in history. He claims the Fed chair is the easiest job in the world. He is also the one who claimed that Janet Yellen was keeping interest rates too low for political reasons during his 2016 presidential campaign.

If I lived in the USA, I would have voted for Trump before you accuse me of Trump bashing. I also called his 2016 victory and was ridiculed at dinners when I raised the subject. I ask myself, how the hell does this guy get away with the constant hypocrisy? How does his popularity grow? Why do I mostly find myself loving his shtick even though it makes me cringe?

I'm feeling wordy today, so apologies. I like to psychoanalyse Trump from a Jungian lens. Here is an insight to try and answer the questions I just posed to myself. By the way, this dialectic form of writing is so Jungian.

Trump embodies the Trickster, one of Jung’s primordial archetypes. The Trickster is amoral, contradictory, and often mocks conventional values. He breaks rules, speaks in half-truths, and disrupts order—but in doing so, he reveals hidden truths and exposes the hypocrisies of others. People don't expect consistency from the Trickster; they expect disruption. His followers often see his hypocrisy not as deceit but as cleverness, even authenticity, because he says things others wouldn’t dare say.

That insight is coming from our collective unconscious. [one day I am going to have to explain the typology of the psyche so that you understand my musings better.]

Now for something a little more personal, which I hadn’t consciously integrated properly.

Jung believed that individuals project parts of their Shadow—the rejected, unconscious aspects of the self—onto others. Trump gives voice to repressed aggression, envy, fear, and narcissism that many people feel but are socially conditioned to hide.

If any of you feel this affinity like I do, you probably need more therapy to get in touch with your repressed Shadow. I just booked an appointment with my local Jungian analyst.

S2N Observations

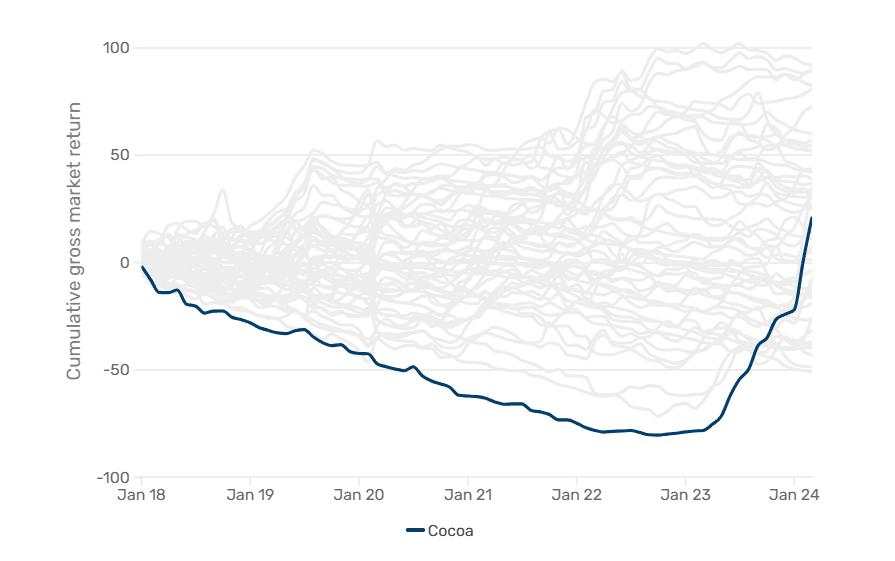

I was mentioning the backtesting framework project I am working on earlier in today's letter. The chart below shows the cumulative return of 50 different assets using a trend-following strategy. The time series in blue is cocoa. The chart illustrates how when trading a multi-asset trend-following system, there is no way to predict which of the assets are going to make a contribution to the overall return of the portfolio.

I will be speaking about it at the Australian Technical Analyst Society annual symposium in October (details to follow). This is the gap my framework attempts to fill: filter as much bias out of the process as possible and embrace emergence.

S2N Screener Alert

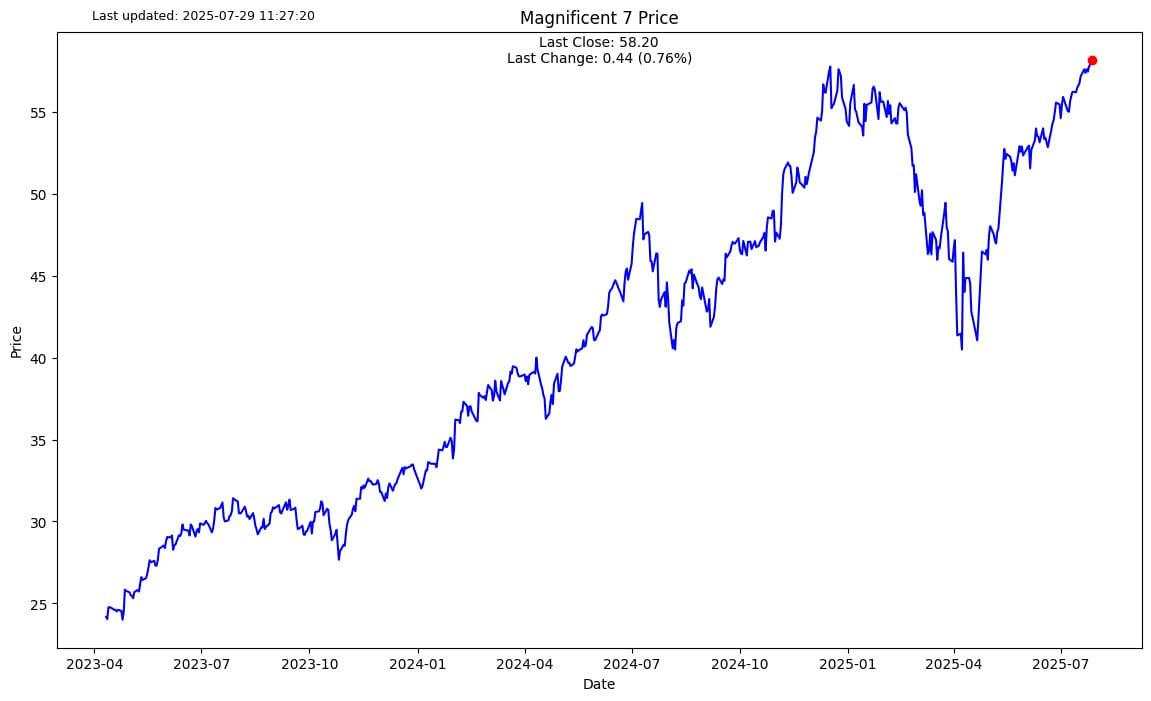

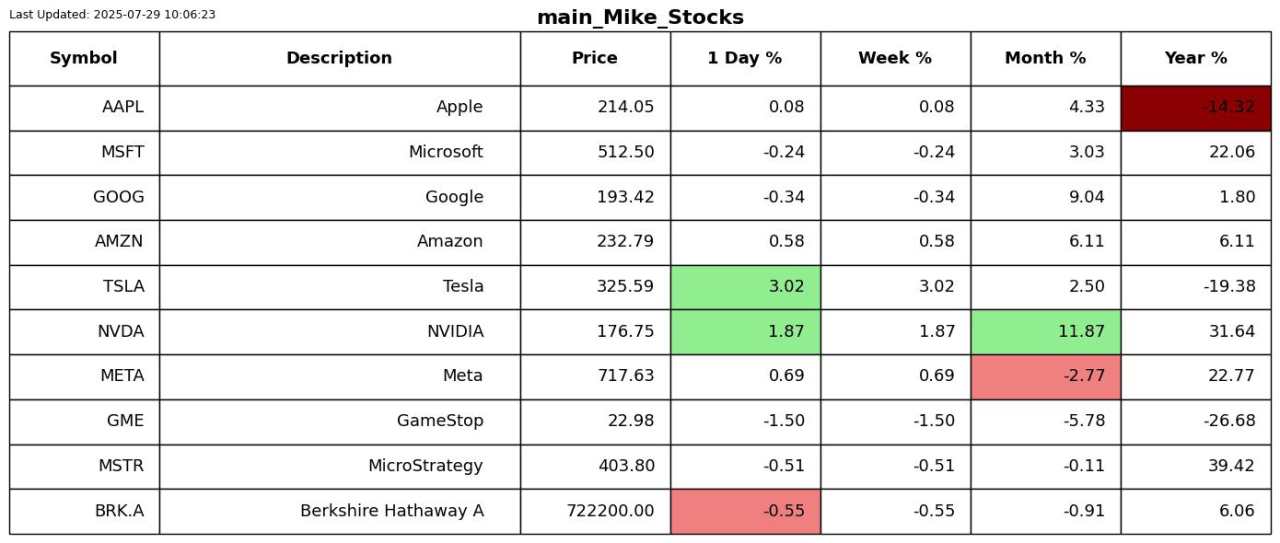

The Magnificent 7 made a new ATH.

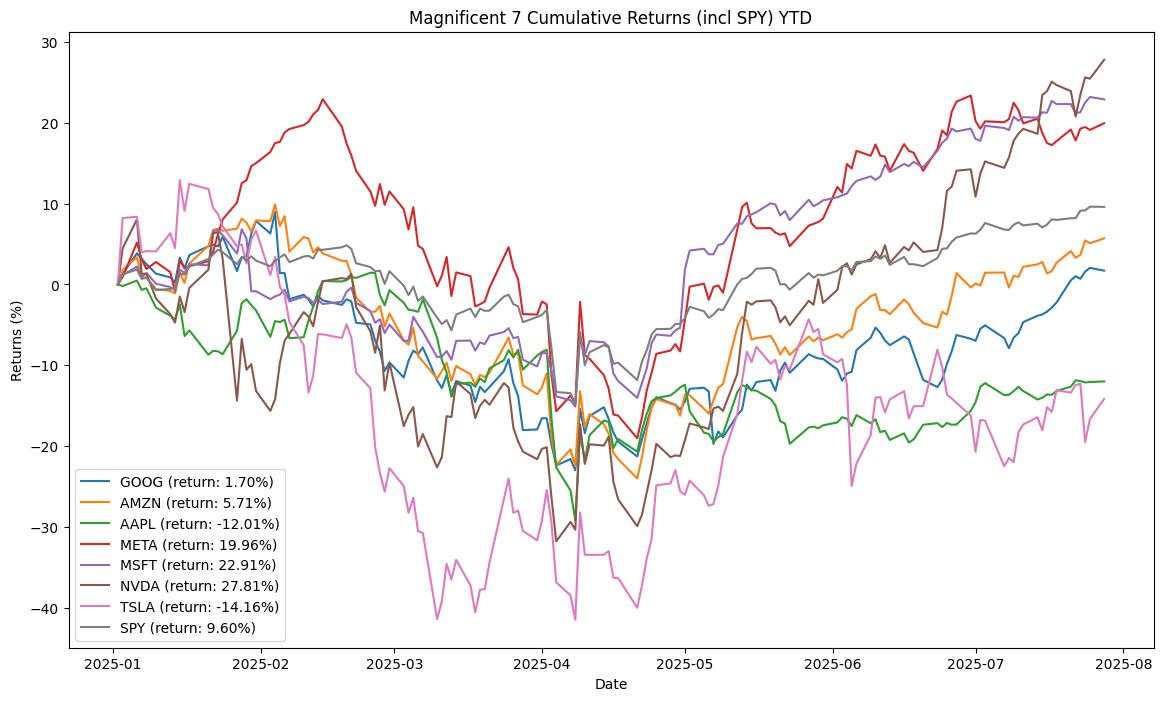

Here is a look at the YTD performance of the individual stocks.

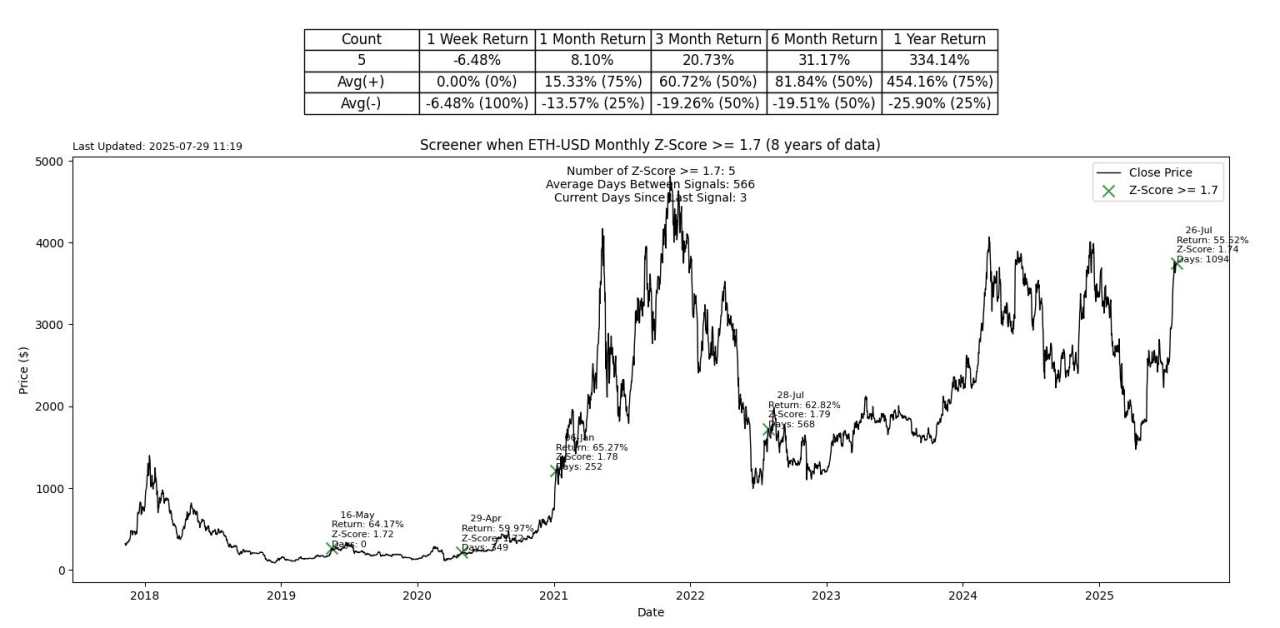

You might be surprised to see that a 55% increase in the month for Ethereum only produced a 1.74 Z-score. That gives you an idea of how volatile this asset is.

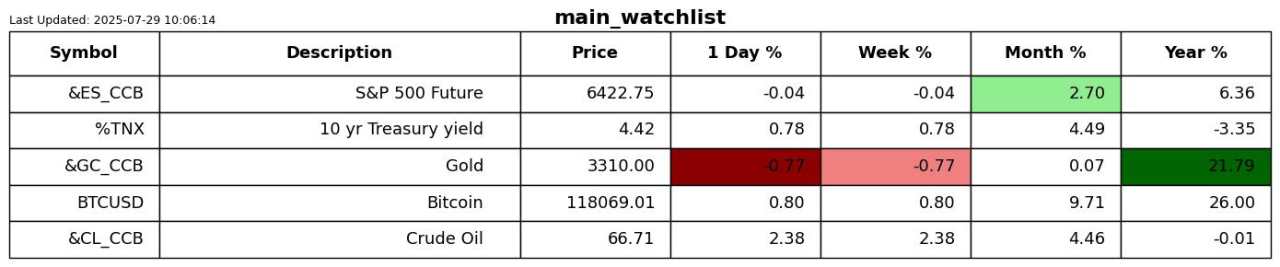

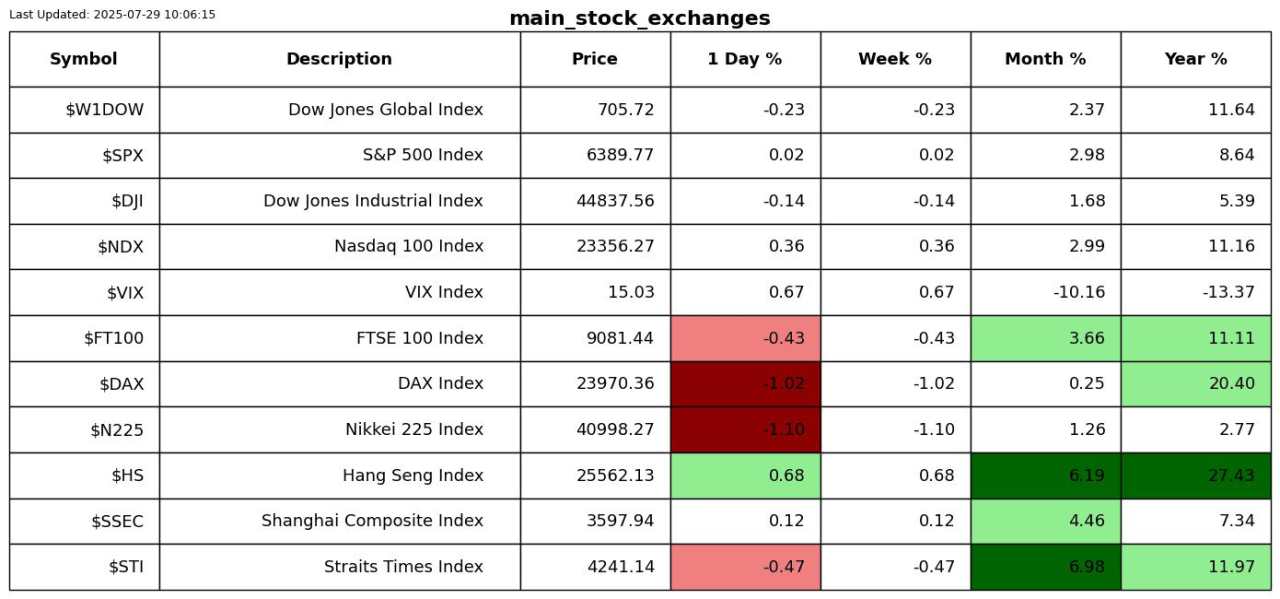

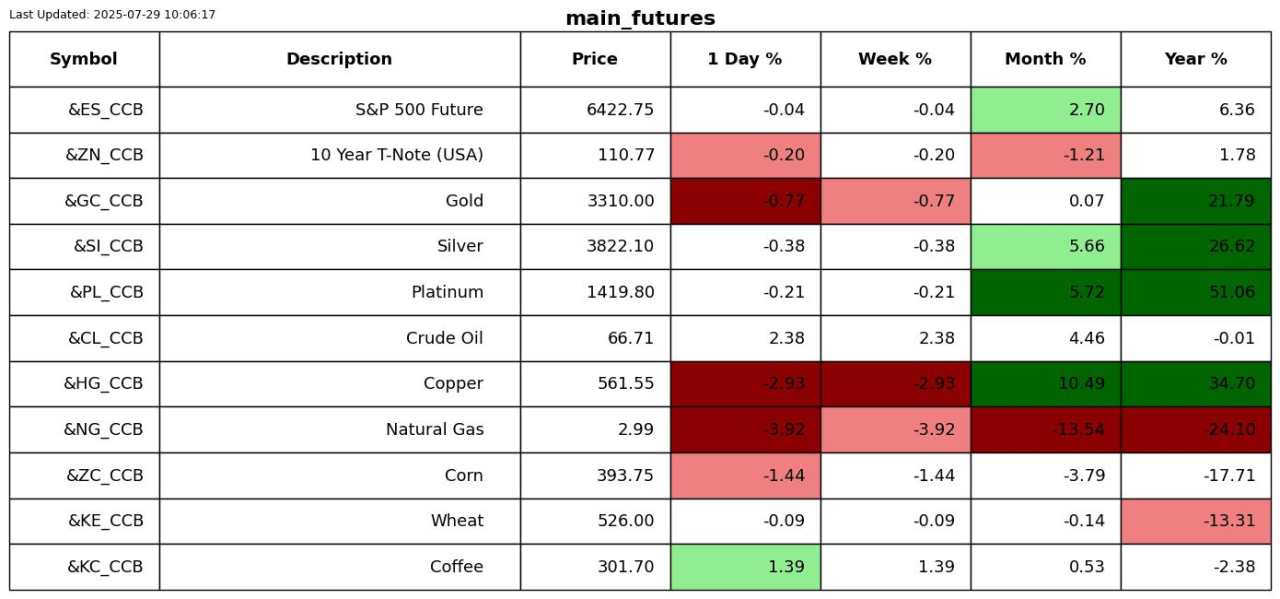

S2N performance review

S2N chart gallery

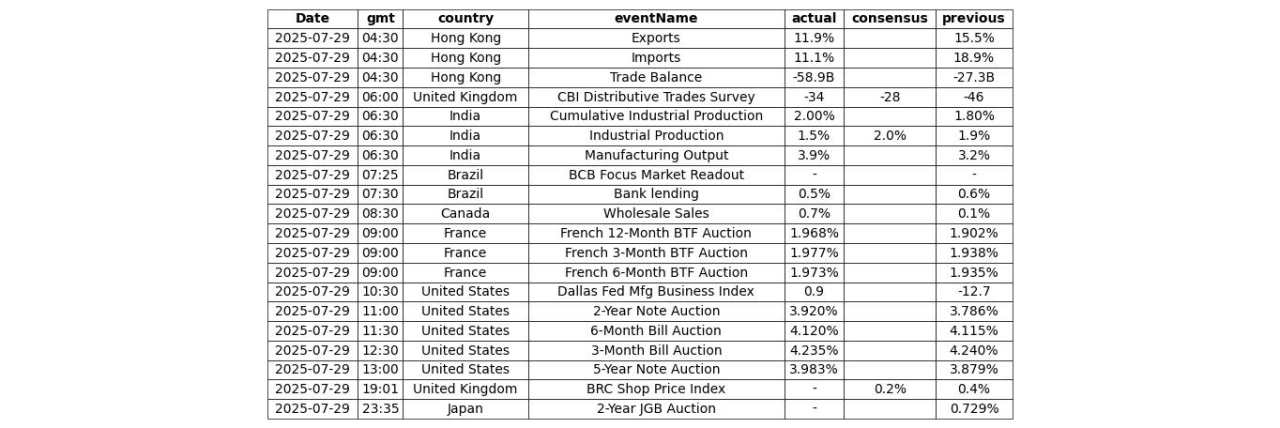

S2N news today

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()