Australia’s headline inflation rate fell to its lowest point in over four years during the second quarter, strengthening RBA rate cut expectations for the month.

The Consumer Price Index rose 2.1% year-over-year in the June 2025 quarter, down from 2.4% in the previous period and below the 2.2% consensus forecast. On a quarterly basis, inflation slowed to 0.7%, undershooting the 0.8% expectation and marking a deceleration from the 0.9% recorded in Q1 2025.

Key Takeaways

- Headline inflation at 2.1% annually – lowest reading since March 2021 and within the RBA’s 2-3% target range

- Quarterly inflation of 0.7% – below the 0.8% economist consensus

- Housing sector leads price gains – up 1.2% for the quarter, representing the largest contributor

- Food and health costs rise – food and non-alcoholic beverages increased 1.0%, health services up 1.5%

- Transport provides offset – declined 0.7% during the quarter, partially moderating overall price pressures

Housing costs, which contributed the most to quarterly price increases at 1.2%, remain a key focus for policymakers given their substantial weighting in the CPI basket and their sensitivity to interest rate changes.

While food and health services also recorded notable gains during the quarter, the decline in transport costs helped moderate the overall inflation outcome.

Link to ABS Australian CPI Report (June 2025 Quarter)

The latest inflation reading places Australia’s price pressures near the bottom of the RBA’s 2-3% target band, providing policymakers with additional flexibility to support economic growth through lower interest rates.

RBA Governor Michelle Bullock had previously indicated in late July remarks that she expected inflation “to be in the lower half of our 2%-3% target range” for the June quarter.

Market Reactions

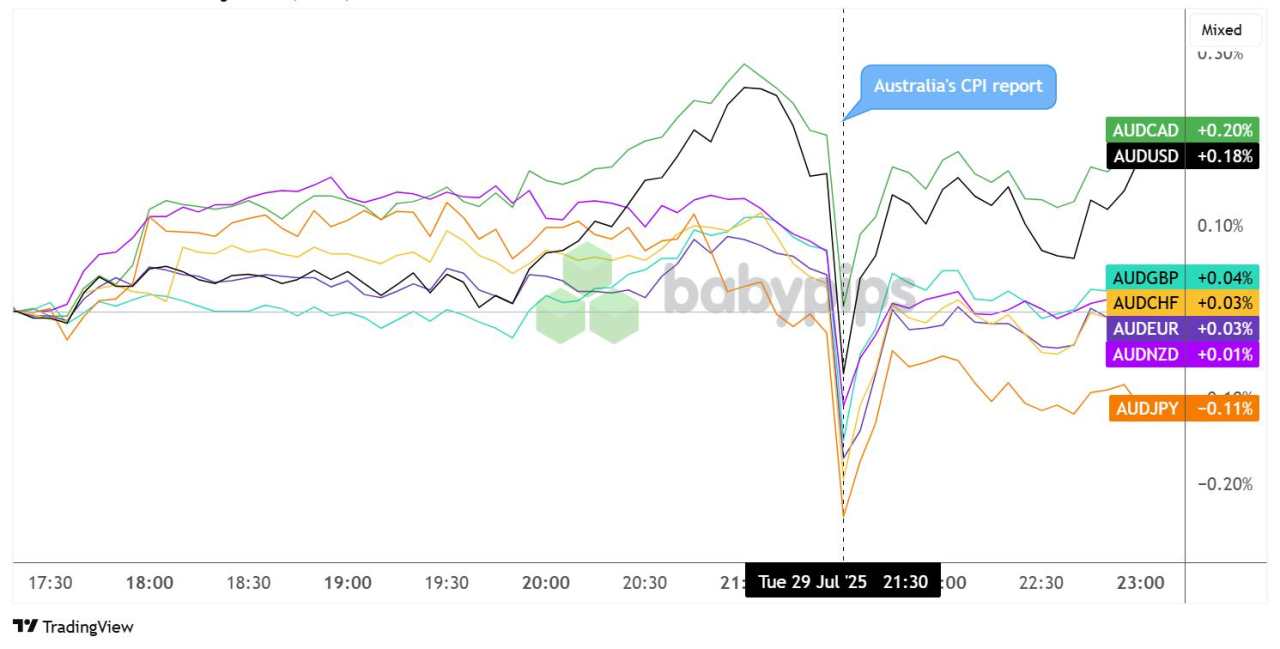

Australian Dollar vs. Major Currencies: 5-min

Overlay of AUD vs. Major Currencies Chart by TradingView

Softer-than-expected inflation data triggered a sharp selloff for the Australian dollar against most major currencies, with investors likely positioning for expectations that the RBA will deliver another rate cut in their next meeting.

However, the Aussie managed to recoup most of its post-CPI losses against CAD (+0.20%) and USD (+0.18) a few hours after the release while holding on to losses against JPY (-0.11%) and holding steady against NZD.

Tải thất bại ()