Summary

While the headline GDP print of 3.0% exceeded expectations, underlying growth in the economy as measured by private domestic final purchases slowed for the third consecutive quarter to come in at just a 1.2% pace. The largest boost on record from trade offset a drag from inventories.

Trade: From zero to hero for now

The U.S. economy grew at a 3.0% annualized clip in the first quarter, much faster than the 2.6% that had been expected by the Bloomberg Consensus. But just as the Q1 contraction in GDP understated the health of the economy, today's barn-burner of a headline overstates it.

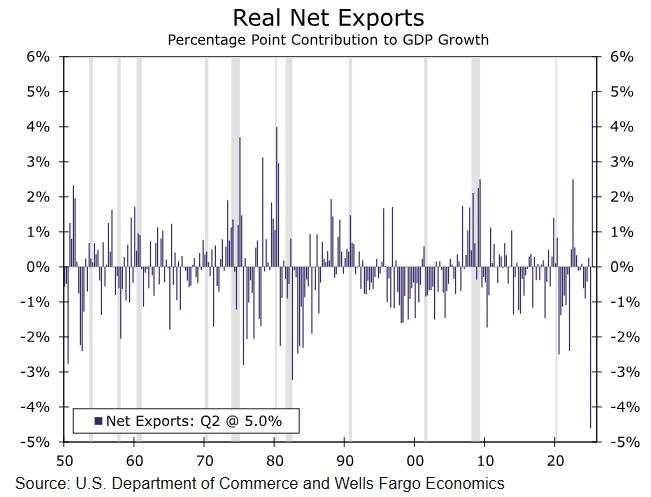

At a time when financial markets are trying to weigh the impact of tariffs on the economy, you need to be careful how you look at the GDP report. At the risk of stating the obvious, the D in GDP stands for "domestic" which is why exports boost growth, while imports weigh on it. That is a useful insight anytime, but it becomes the primary lens through which to view growth amid a trade war. After net exports exerted the biggest drag on headline growth in more than 75 years in the first quarter, it offered the biggest boost on record in the second, a whopping 5.0 percentage points (chart).

Headline GDP growth ultimately continues to be whipsawed by tariff-induced behavioral effects. The 30.3% annualized collapse in Q2 imports simply reflects an air pocket after businesses pulled forward demand for foreign product in the first quarter ahead of tariffs going into effect. This boost from net exports was somewhat offset by a drag from inventories as firms didn't stockpile product nearly as much as they did in Q1 with warehouses and stock-rooms full. Like trade, we saw some unwinding of those effects in the second quarter with the inventory drawdown subtracting 3.2 percentage points from the headline.

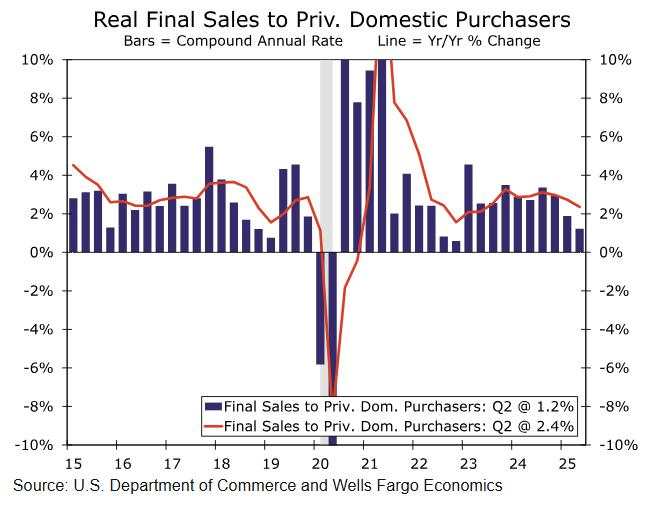

With over a full percent (~1.8pp) of headline growth therefore stemming from a reversal in imports and drawdown in inventories, we look to a better measure of underlying demand—real final sales to private domestic purchasers. While that's a mouthful, it's actually a fairly simple measure. It strips away the volatile components from GDP like trade and inventories to get at underlying private demand, or consumer and business capex spending.

You can expect Chair Powell to reference this measure when he recaps the state of the economy at the post-meeting press conference later today. The Fed keeps a close eye on this measure, often referring to it as a simpler PDFP (private domestic final purchases). PDFP rose at a 1.2% annualized clip in Q2, a marked slowdown from the ~3% average clip at which it ran at last year (chart). Consumer spending bounced back in the second quarter, up at a 1.4% annualized rate, though this now marks the slowest first half of the year for consumption since the depths of the pandemic. Business fixed investment spending was a touch weak, mostly stemming from a pullback in structures investment specifically. Equipment investment rose at nearly a 5% annualized clip, which is impressive after the Q1 +20% surge.

One added point of caution—pay extra attention to upcoming revisions. This PDFP measure got revised down across the three Q1 GDP prints from 3.0% in the advance print to a 1.9% annualized clip. Even despite remaining much stronger than the -0.5% GDP print, that marks the slowest pace of domestic demand in two years and signals growth is slowing even if headline rates suggest otherwise.

Even with upcoming changes to tariffs on August 1 bringing some potential clarity to businesses, trade policy remains fluid and uncertain. The U.S.-China trade truce may be extended further and there are only few details readily available around potential sector-level tariffs like those on Copper and Pharmaceuticals. The growth hampering effects of all this uncertainty may be taking some time to broadly materialize, but we still expect they're coming and for growth to slow more meaningfully in the second half of the year.

Download The Full Economic Indicator

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Website Cộng đồng Giao Dịch FOLLOWME: www.followme.asia

Tải thất bại ()