Softer growth and inflation data for the second quarter are likely to convince the Reserve Bank of Australia to cut rates, following its cautious stance in July. Markets are fully pricing in this August cut and another one by year-end (which we also expect), meaning downside risks for AUD are limited. We have revised our AUD/USD forecast higher.

Weaker data, following RBA’s cautious stance, should give way to a rate cut

We expect the Reserve Bank of Australia (RBA) to cut the cash rate by 25 basis points to 3.6% at its upcoming policy meeting on 12 August. Recent data on growth and inflation have come in softer than expected, reinforcing the case for easing.

In a surprise move last month, the RBA held the cash rate steady at 3.85%, defying both market consensus and our own expectations. The decision reflected the central bank’s desire for more evidence that inflation is tracking sustainably toward its 2.5% target. Since then, both the second-quarter inflation report and June employment data have undershot expectations, suggesting that the RBA’s cautious stance in July may now give way to a rate cut.

Data points on both growth and inflation support a rate cut

Headline CPI inflation continued to ease in June, coming in at 1.9% year-on-year, while trimmed mean CPI fell to 2.1%. On a quarterly basis, headline inflation moderated to 2.1% in the second quarter, down from 2.4% in the first quarter. The slowdown was largely driven by softer services inflation, particularly in financial and insurance services, as well as lower transport prices.

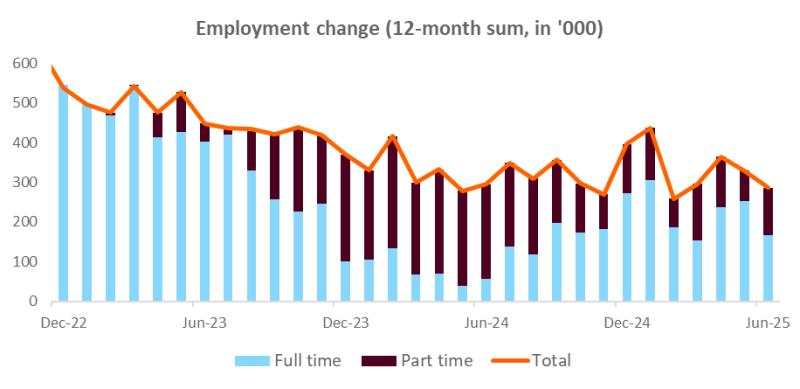

Labour market data also disappointed. Employment rose by just 2,000 in June, well below the consensus expectation of 20,000, while the unemployment rate edged up to 4.3% from 4.1% in May. Full-time employment contracted by 38,000, offset by a 40,000 increase in part-time jobs, which tend to be less stable and lower paying. Hours worked fell 0.9% month-on-month in June, also suggesting a weaker labour market.

Employment growth has been trending downwards

The market angle: Pricing still leaning dovish

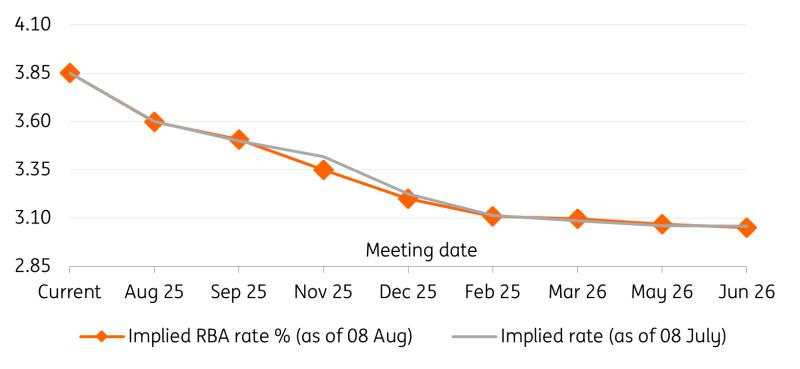

Markets were fully pricing in a rate cut at the August meeting within hours of July’s surprise hold. As discussed, recent data has largely validated short-term rate cut bets but has failed to shift expectations for future easing. The AUD OIS curve (chart below) remains largely unchanged since the day after the July meeting, with approximately 62 basis points priced in for year-end and a terminal rate around 3.00–3.10%.

We remain sceptical that the RBA will provide sufficiently strong guidance to push markets toward fully pricing in or out an additional 25 basis point cut in December (currently at 40%) or to bring forward the next move from November to September. The RBA appears as uncertain as markets regarding the disinflation path, while trade uncertainty remains elevated ahead of US pharmaceutical tariff announcements, which could impact Australian exports.

Our call remains for only one additional cut by year-end following the expected August reduction, making us slightly more hawkish than market pricing. This supports our bullish view on AUD/USD, although the USD leg remains dominant. We have revised our AUD/USD forecast higher, now targeting 0.67 by year-end.

RBA cash rate pricing unchanged in the past month

Source: ING, Refinitiv

Read the original analysis: RBA preview: Data supports a rate cut next week

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()