By the time the clock hits 8:30 a.m. in New York on Tuesday, the Bureau of Labor Statistics will drop July’s CPI — and while it’s just one line of data in the grand market scroll, traders are treating it like the final booby trap before September’s FOMC. A new BLS head is waiting in the wings, someone who’s already trashed the status quo, so there’s even a tinge of paranoia that the numbers may be presented with a little less gloss and a little more bite.

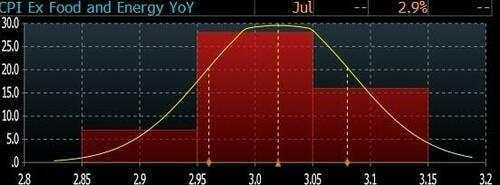

The street’s leaning hard — 89% probability priced — toward a 25bp September rate cut. But that’s conditional on one thing: the print doesn’t come in smoking hot. The market’s tolerance band is tight. Core CPI above 0.40% MoM isn’t just “hot,” it’s hot enough to torch the carefully constructed dove narrative and put a hawkish floor back under the Fed.

The consensus script — And where it’s prone to blow

- Headline CPI: +0.2% MoM (from +0.3%), Y/Y ticking to 2.8% from 2.7%.

- Core CPI: +0.3% MoM (from +0.2%), Y/Y to 3.0% from 2.9%.

- Forecast distribution is top-heavy — more than twice as many desks see 3.1% as 2.9%.

That skew tells you where the risk is — upside. And in a market that’s been spoon-fed softer prints four months in a row, an upside break won’t just sting, it’ll change the conversation.

The tariff transmission test

This print isn’t just a temperature check on rents and airfares — it’s the first big read on whether Trump’s latest tariff volleys are finally hitting US consumers. For months, the impact’s been absorbed upstream by foreign producers. Now, the pass-through baton is moving into US store shelves.

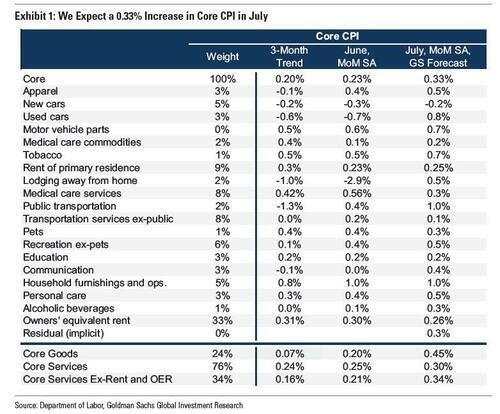

- Core goods — the stuff you can touch and ship — are catching a bid: furniture, appliances, electronics.

- Used cars: Goldman sees +0.75%, driven by auction prices heating up.

- New cars: –0.2% thanks to fatter dealer incentives.

- Airfares: +2% as seasonal headwinds battle underlying demand.

- Household goods & rec/comm gear: +0.12pp from tariffs; autos add +0.02pp.

If that basket delivers, you’re looking at a clean 0.3%–0.4% core print for the next several months. Goldman pegs half of that as tariff-driven noise, the other half as the dying embers of residual inflation. Strip tariffs, and their models take core PCE toward 2.5% in 2026 — textbook Fed “mission accomplished.” But with tariffs, the optics get ugly.

The Fed’s tightrope — And who’s ready to jump

The labour market’s wobbling just enough to give the doves confidence: NFP’s 3-month trend is cooling, unemployment steady at 4.2%. Hawks keep hammering that inflation’s above target, but the argument’s losing teeth when the job side of the mandate looks less bulletproof.

- Kashkari: Would rather cut now and reverse later than sit on his hands — essentially telling markets the Fed’s ready to play offense even without total clarity.

- Daly: Says the Fed “can’t wait forever” — code for September’s already penciled in.

- Musalem: “We’re missing on inflation, not jobs” — the line that lets doves keep pressing for easing.

Bottom line: If tonight’s print is anything shy of “hot-hot,” the cut remains locked. A tariff spike in goods? The Fed can call it transitory. A broad-based surge with services inflation on the boil? That’s where the hawks dig in.

Market plumbing and positioning

Complacency is the flavour of the week.

- VIX: 15.8 — lowest since December.

- SPX options: pricing a 0.70% absolute move post-print, biggest since May.

- Street positions: long front-end rates, steepeners, equities, short USD.

The pain trade is obvious: a hot print smokes all of them at once.

JPM’s CPI reaction grid:

- Core > 0.40%: SPX –2% to –2.75%.

- 0.35%–0.40%: –0.75% to +0.25%.

- 0.30%–0.35%: flat to +0.75%.

- 0.25%–0.30%: +0.75% to +1.2%.

<0.25%: +1.5% to +2%.

What’s really at stake

This CPI isn’t just about September’s cut — that’s likely coming unless the print is nuclear. It’s about how the Fed frames the move:

- Is it cutting because inflation’s back under control and tariffs are noise?

- Or is it cutting with inflation still sticky, admitting growth fears outweigh price risks?

The market narrative shifts depending on that framing. One makes it an “insurance cut” in a still-healthy economy; the other plants seeds for a longer, deeper cutting cycle.

My Trader Read:

- Core ≥0.4% and services hot → fade SPX, dump steepeners, USD squeeze likely.

- Core 0.3%–0.35%, goods-driven → buy the dip in equities, hold steepeners, short USD.

- Core <0.3% → risk party continues, VIX sinks, cyclicals and small caps rip.

Tonight’s number is the gatekeeper to the next Fed pivot. And in a market where traders are acting like volatility’s been deported for the summer, this one print could be the postcard that says it’s coming back — with luggage.

Views from Goldman Sachs trading

Brian Bingham (short-term rates trading)

In light of last Friday’s seismic payrolls report, risks for front-end rates are skewed to the downside and barring a substantial beat – 40bp unrounded or higher – a September cut is all but certain. The market entered NFP long and has increased length in both duration (long sfrm6) and steepener exposure (5s30s tsy) over the past week, while the predominant view has coalesced around the thesis that an in-line CPI report is all that’s needed to green light the resumption of the cutting cycle. But with 23bps priced for Sep and 60bps cumulatively through December, long z5 is an expensive option…particularly considering that the pain trade for virtually every consensus position (long duration, steepeners, long risk, short $) comes via a hot print. Given four consecutive misses relative to consensus forecast (16bp realized vs 27bp consensus, post Liberation Day) we continue to see value in optionalized longs and money market steepeners over the event, but see little value in playing for 50bp in Sep and strongly disagree with the sentiment that FFV5 longs are a free option.

Shawn Tuteja (ETF/basket vol trading)

The market into the end of this week has run with the narrative that CPI is slowly becoming unimportant, as the consensus is building that anything sub 0.44% core MoM doesn't discredit the Fed looking past tariffs as a one-time tax and re-starting a cutting cycle in September. Conversations have shifted much more to being focused on labor market data going forward and the pace and magnitude of weakness in the overall economy. What's interesting is even during the few days of market weakness, we've seen more clients look to play offense rather than hedge. One risk we see into CPI is the market unwinding some of the gross risk it has -- a month ago, we saw a quant de-grossing episode with highly shorted names squeezing, whereas the L/S community performance seemed relatively unscathed by that. What worries us is a rotation that could happen in the "market bullish" scenario of a benign CPI. One way to hedge against that is buying cyclical (RTY, etc.) calls but another way in our view given levels and overall asymmetry could be to strike some semis / AI hedges. While overall index volatility has stopped performing, single name options continue to carry well as the market has traded fairly anti-correlated.

Vickie Chang (Global macro research)

The clearer weakening in the labor market recently has led the market to push towards pricing more Fed easing. Our frameworks also show that the market has priced a “dovish policy shock” since payrolls—that has helped support both bonds and equities over the last week, and the market is now pricing a high chance of a September cut. CPI this week will be important in the near term to either interrupting or extending that narrative. The risks around the CPI print are now likely two-sided. A CPI print in-line or below consensus clears the way somewhat for the market to continue to push on pricing a dovish Fed pivot between now and September, with the growth pricing that accompanies that to be determined by the activity data. Our CPI forecasts have that flavor. A very benign print would probably start to encourage the pricing of the possibility of a 50bp cut in September. A high-side print (say, a 0.4% core print or worse) might now lead the market to scale back expectations for a September cut, and could weigh on risk and put a brake on the move lower in US rates. With Jackson Hole and the next payrolls release ahead, we think a sell-off could be short-lived, but this release clearly poses some risk to the recent prevailing trends. Our bias is still to be long US rates, short USD, and to be long risk with protection into event risks. We think that for investors with those views it makes sense either to look at short-term protection (downside in US equities, or US rate shorts), or to consider holding more of the core position through options (our Rates team recommends an ATMF 1m2y receiver). The goal is to maintain some convexity and the capacity to add on any sell-off. USD calls against G10 currencies may also be protective.

Ryan Hammond (US portfolio strategy)

With the S&P 500 at an all-time high, our tools suggest the market is pricing a friendly combination of a resilient economic growth outlook and dovish Fed policy. A soft CPI print would likely reinforce this view and support continued S&P 500 upside. A hot CPI print would likely push back on this pricing, but the composition of inflation (e.g. tariff vs. non-tariff categories) will be an important distinction. We think the CPI print will also be an important driver of rotations within the market. Investors continue to assign a high valuation premium to the perceived safety of large-cap companies with “quality” attributes. A blended Quality factor trades at a 57% premium, ranking in the 94th percentile vs. history. Our economists’ forecast for below-trend growth and above-target inflation in the near-term will likely make it challenging for low-quality stocks to outperform on a consistent basis. However, given the asymmetry indicated by current valuations, we think investors should protect themselves against the potential for a sharp rotation toward low quality stocks. Investors should keep in mind the potential convexity of low-quality stocks to the upside in a scenario where the macroeconomic outlook is more positive than feared, such as a soft CPI print.

Được in lại từ FXStreet, bản quyền được giữ lại bởi tác giả gốc.

Tuyên bố miễn trừ trách nhiệm: Quan điểm được trình bày hoàn toàn là của tác giả và không đại diện cho quan điểm chính thức của Followme. Followme không chịu trách nhiệm về tính chính xác, đầy đủ hoặc độ tin cậy của thông tin được cung cấp và không chịu trách nhiệm cho bất kỳ hành động nào được thực hiện dựa trên nội dung, trừ khi được nêu rõ bằng văn bản.

Tải thất bại ()